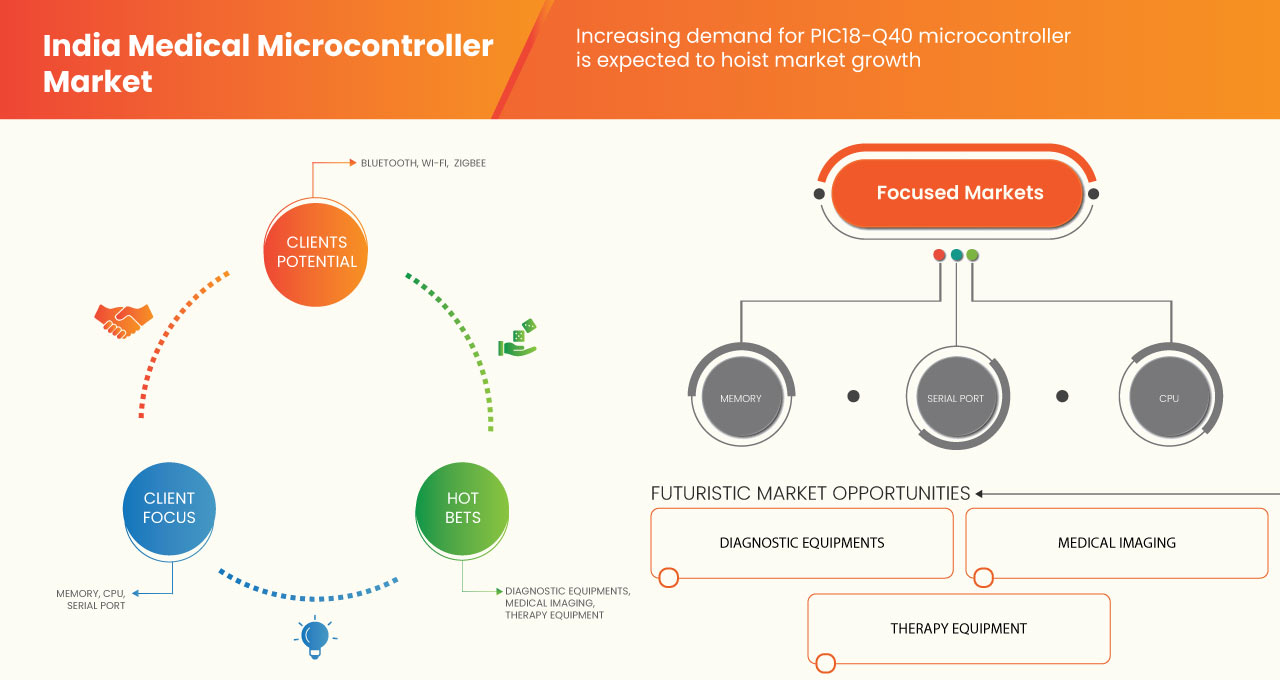

India Medical Microcontroller Market Analysis and Insights

Medical microcontrollers offer numerous advantages over the normally used microcontroller in electronic devices. The features of medical microcontrollers are low time commitment required for operation, simple to use, troubleshooting, and keeping up-to-date. Many chores can be completed in the same amount of time as humans can, reducing the overall environmental impact. The processor chip is quite small, and it can be customized. The system has a lower price and is smaller in size, and microcontrollers can't be reprogrammed once they've been set up. These prime factors have increased the adoption of microcontrollers in the medical industry in the recent past. Therefore, these benefits are expected to boost India medical microcontroller market growth over the forecast period. This feature allows a microcontroller to work independently and develop the efficiency of medical devices, which depends on technology for medical usage services and the entrance of new market players in the region. It is expected that the India medical microcontroller market is going to boom in the future.

In current times, the importance of medical microcontroller construction has grown drastically and the growth of microcontroller connectivity across India. In addition, there is a growing market demand for medically advanced medical devices. Data Bridge Market Research analyses that the India medical microcontroller market is expected to reach a value of USD 833.39 million by 2029 and will grow at a CAGR of 8.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in Million, Volumes in Million Units, Pricing in USD |

|

Segments Covered |

By Type (8-Bit Microcontrollers, 16-Bit Microcontrollers, 32-Bit Microcontrollers, And 64-Bit Microcontrollers), Memory (Embedded Memory Microcontroller And External Memory Microcontroller), Number Of Pins (Less Than 20 Pin, 20 Pins To 40 Pins, And More Than 40 Pins), Connectivity (Bluetooth, Wi-Fi, Zigbee, And Others), Components (Memory, CPU, Serial Port, And Others), Application (Diagnostic Equipment, Medical Imaging, Therapy Equipment, And Others) |

|

Country Covered |

India |

|

Market Players Covered |

Renesas Electronics Corporation. (Japan) General Electric Company (U.S.), Nuvoton Technology Corporation (China), STMicroelectronics (US), Mouser Electronics, Inc. (U.S.), Microchip Technology Inc. (U.S.), TMI Systems. (India), ROHM CO., LTD. (Japan), NXP Semiconductors. (US) TOSHIBA CORPORATION (China), Analog Devices, Inc. (U.S.), Integral Medical Instrumentation. (India), Infineon Technologies AG (Germany), Semiconductor Components Industries, LLC (U.S.), Zilog. Inc (U.S.), Panasonic Corporation of North America (U.S.), Integrated Silicon Solution Inc. (U.S.), Texas Instruments Incorporated (U.S.), Digi-Key Electronics. (U.S.), FUJITSU SEMICONDUCTOR LIMITED (Japan), Bhairav Electronics (India), Cosmic Devices (India), Skrip Electronics (India) |

Market Definition

The microcontroller can be defined as a microchip, microcomputer, or integrated circuit containing programmable input/output peripherals, processors, and memory. There are various microcontrollers, among which microcontroller 8051 is used frequently. Microcontrollers are intended for embedded devices, compared to the microprocessors used in PCs or other all-purpose devices. Microcontrollers are employed in automatically managed inventions and appliances such as power tools, implantable medical devices, automobile engine control systems, and offices. The application of microcontroller 8051 in medical applications made revolutionary changes in the medical field. The patient health monitoring system with location details by GPS over GSM is an electronic project based on a microcontroller application. This project is designed to track the patient's location, enabling the facility to reach the patient location quickly in an emergency. With this project, the patient's body temperature can be monitored wirelessly using GPS, and a message can be sent to the concerned/authorized person using GSM.

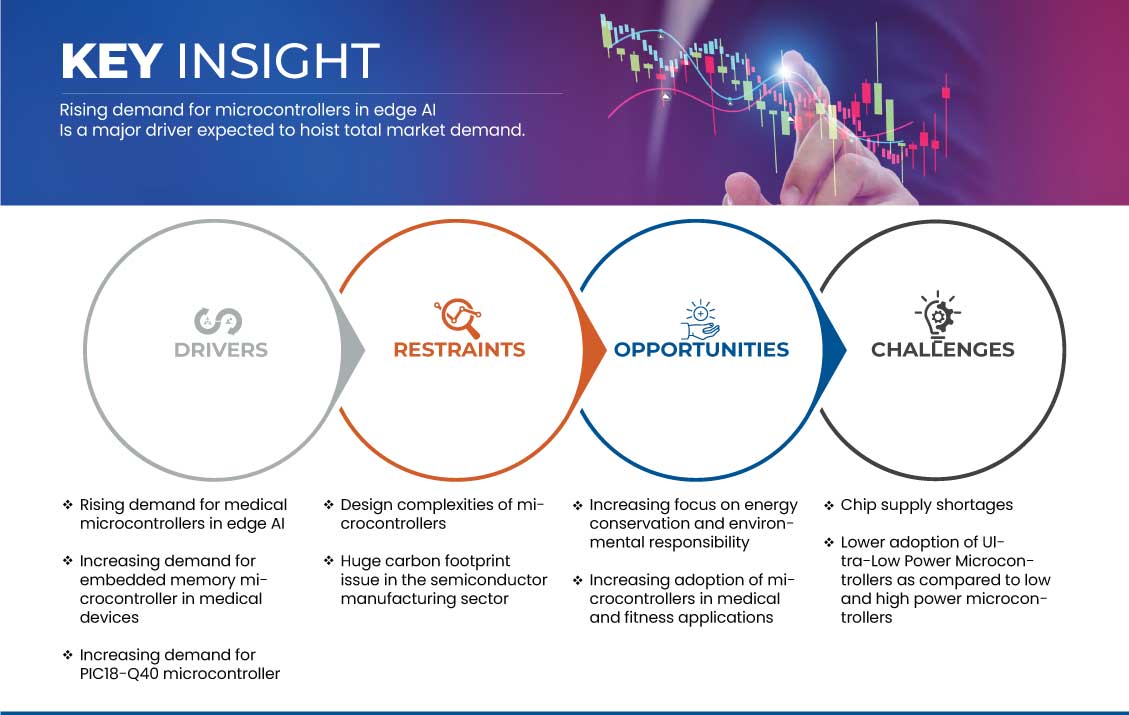

India Medical Microcontroller Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in the demand for microcontrollers in edge AI

Advancements in power electronics have left behind the understanding that high-end hardware is required to perform machine learning and deep learning tasks. Gateways, edge servers, or data centers execute training and inference at the edge. In an increasing number of cases, the latest microcontrollers, some with embedded ML accelerators, were able to bring ML to edge devices.

IoT product designers see the tremendous potential of AI and machine learning to bring even greater intelligence to edge applications like home security systems, wearable medical monitors, sensors monitoring commercial facilities and industrial equipment, and more. Those considering deploying AI or machine learning at the edge are faced with steep performance and energy use penalties that may outweigh the benefits.

- Increase in the demand for embedded memory microcontrollers in medical devices

The market for personal wellness and medical wearable applications is growing fast. New technological advancements and changing lifestyles have led to increased adoption of smart devices throughout the globe. The number of wearable device users around the globe is increasing, directly impacting the demand for sophisticated electronics used for developing these technologies.

Embedded systems are used in MRI and CT scanners, which use radio frequency pulses and x-rays to produce a picture of the parts of the body and the structure of the human body. Devices must also have high accuracy, low noise, and extremely low power dissipation in various operational modes to ensure sufficient operating life on a single charge. This has led to new complex demands being placed on the internal electronic components of devices. Sonography machines are also inbuilt with embedded systems called ultrasound imaging which uses high-frequency sound waves.

- Increase in the demand for PIC18-q40 microcontroller

The world is becoming more connected than ever, and with the rapid rise of the Internet of Things (IoT), home appliances are part of smart home automation networks. They result in quieter and more energy-efficient medical appliance designs driven by intuitive sensor-based operation. Products can now be linked seamlessly together, forming widespread digital networks with intelligence and communication built-in. This trend delivers higher levels of functionality, making life more convenient for tech-savvy consumers.

The PIC18-Q40 microcontrollers make the system work easier by allowing customization for India's next space constraint design. These microcontrollers are built with a high level of sophistication into a small 14 to 20 pins package. This microcontroller contains highly configurable core-independent peripherals with advanced interconnection capabilities. These microcontrollers are well suited for remote medical care devices, wearables, consumer, automotive, industrial, and the internet of things.

Opportunities

- Increase in the adoption of microcontrollers in medical and fitness applications

The fitness and medical devices use technologies have been evolving at a larger pace with increasing developments in connectivity. There has been a growing emphasis worldwide on increasing the production and adoption of fitness devices for reducing the burden on doctor for regular check-ups.

This progress can be attributed to the technological developments in medical devices that consume low power and need high voltage and current with the latest design and compact size. This has created tremendous opportunities in power electronics components such as ultra-low power microcontrollers.

- Increase in the focus on energy conservation and environmental responsibility

Electrical power is the foundation for sustaining our perpetually humming modern society. Electrical power consumption has risen in recent years, despite the calls for energy conservation. The rapid proliferation of IT devices is catalyzing this trend considerably. Against this background, power electronics is drawing renewed attention today as one of the key technologies for alleviating environmental and energy problems.

- Restraint/ Challenge

Increasing macroeconomic conditions

Increasing macroeconomic conditions will pose a major challenge to the microcontroller market growth. Intense competition among 16-bit, 32-bit, and other microcontroller systems will further dampen the microcontroller market growth rate. Lack of standardization and security and privacy concerns will also hamper the microcontroller market growth rate.

Covid-19 Impact on India Medical Microcontroller Market

COVID-19 has positively affected India medical microcontroller market. As data production was unaffected by the lockdowns, businesses and institutions were constantly working on these data to enhance their products. The demand for more electric vehicles has also been seen in that phase, but the construction of electric charging stations was impacted, which has caught the required phase post-pandemic. There is no denying that the data center construction market has progressed positively during and after COVID-19.

Recent Developments

- In December 2020, NXP Semiconductors announced the partnership with Foxconn Industrial Internet Ltd., a subsidy company of the Foxconn group, to transform the car into the ultimate edge device. NXP provided FII with its comprehensive portfolio of automotive technologies. The initial phase of the joint project focused on the development of a full digital cockpit solution that includes digital clusters and a head-up display (HUD) system, which will enable leading global automotive OEMs and Tier Ones to deliver vivid in-vehicle experiences for their customers

- In July 2020, Future Electronics, a leading global distributor of electronic components, is featuring the STMicroelectronics STM32L5 Series of Microcontrollers (MCU) in the latest issue of The Edge. The series is the solution to increasing focus on security for developers of embedded and IoT applications. These microcontrollers are mainly used in medical devices because it's low on cost and offers more features

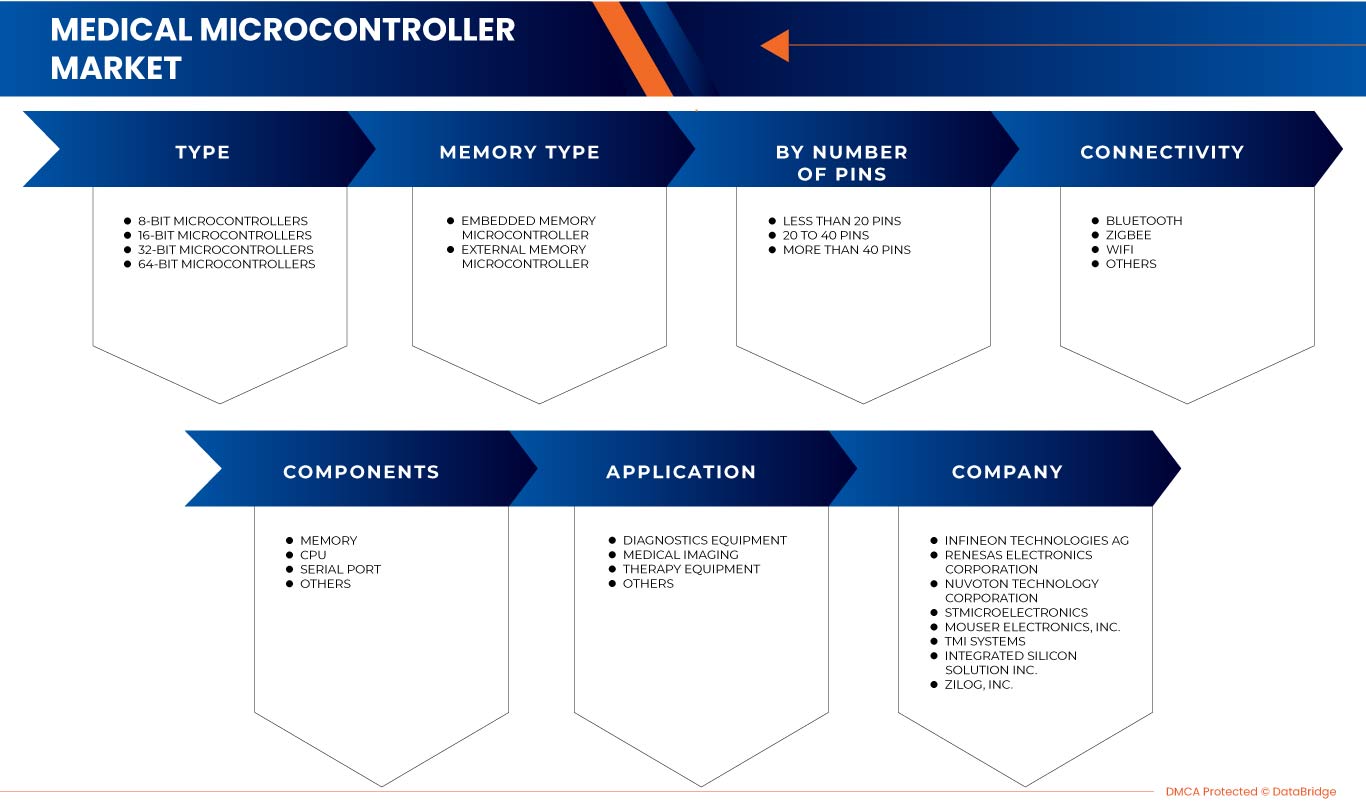

India Medical Microcontroller Market Scope

India medical microcontroller market is segmented based on the type, memory, number of pins, connectivity, components, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- 8-Bit Microcontrollers

- 16-Bit Microcontrollers

- 32-Bit Microcontrollers

- 64-Bit Microcontrollers

On the basis of the type, India medical microcontroller market is segmented into 8-bit microcontrollers, 16-bit microcontrollers, 32-bit microcontrollers, and 64-bit microcontrollers.

Memory

- Embedded Memory Microcontroller

- External Memory Microcontroller

On the basis of memory, India medical microcontroller market is segmented into embedded memory microcontroller and external memory microcontroller.

Number of Pins

- Less than 20 Pin

- 20 Pins to 40 Pins

- More than 40 Pins

On the basis of number of pins, India medical microcontroller market is segmented into less than 20 pin, 20 pins to 40 pins, and more than 40 pins.

Connectivity

- Bluetooth

- Wi-Fi

- ZigBee

- Others

On the basis of connectivity, India medical microcontroller market is segmented into bluetooth, wi-fi, zigbee, and others.

Components

- Memory

- CPU

- Serial Port

- Others

On the basis of components, India medical microcontroller market is segmented into memory, CPU, serial port, and others

Application

- Diagnostic equipment,

- Medical imaging

- Therapy equipment

- Others

On the basis of application, India medical microcontroller market is segmented into diagnostic equipment, medical imaging, therapy equipment, and others.

India Medical Microcontroller Market Regional Analysis/Insights

The India medical microcontroller market is analyzed, and market size insights and trends are provided for type, memory, number of pins, connectivity, components, and application referenced above.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and India Medical Microcontroller Market Share Analysis

The data medical microcontroller market competitive landscape provides details of a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on India medical microcontroller market.

Some of the major players operating in the India medical microcontrollers market are Infineon Technologies AG, Renesas Electronics Corporation, Nuvoton Technology Corporation, STMicroelectronics, Mouser Electronics, Inc., TMI Systems, Integrated Silicon Solution Inc., Zilog, Inc., Analog Devices, Inc., Microchip Technology Inc., ROHM CO., LTD., Digi-Key Electronics, Texas Instruments Incorporated, FUJITSU SEMICONDUCTOR MEMORY SOLUTION, General Electric Company, Integral Medical Instrumentation, Semiconductor Components Industries, LLC, NXP Semiconductors, Toshiba Corporation, Panasonic Corporation of North America, Bhairav Electronics, Cosmic Devices, Skrip Electronics and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA MEDICAL MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.2 PRICING ANALYSIS

4.3 PRICING ANALYSIS REPORT FOR INDIA MEDICAL MICROCONTROLLER MARKET BASED ON APPLICATION SEGMENT (PRICE PER MICRONTROLLER IN USD)

4.4 CASE STUDIES

4.5 TECHNOLOGICAL TRENDS

4.5.1 INTERNET OF THINGS (IOT) TARGETED MICROCONTROLLERS

4.5.2 USE OF TYPE-C CONNECTORS

4.6 VALUE CHAIN FOR INDIA MEDICAL MICROCONTROLLER MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR MEDICAL MICROCONTROLLERS IN EDGE AI

5.1.2 INCREASING DEMAND FOR EMBEDDED MEMORY MICROCONTROLLERS IN MEDICAL DEVICES

5.1.3 INCREASING DEMAND FOR PIC18-Q40 MICROCONTROLLER

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES OF MICROCONTROLLERS

5.2.2 HUGE CARBON FOOTPRINT ISSUE IN THE SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF MICROCONTROLLERS IN MEDICAL AND FITNESS APPLICATIONS

5.3.2 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LESS ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE

6.1 OVERVIEW

6.2 8-BIT MICROCONTROLLERS

6.3 16-BIT MICROCONTROLLERS

6.4 32-BIT MICROCONTROLLERS

6.5 64-BIT MICROCONTROLLERS

7 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE

7.1 OVERVIEW

7.2 EMBEDDED MEMORY MICROCONTROLLER

7.3 EXTERNAL MEMORY MICROCONTROLLER

8 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS

8.1 OVERVIEW

8.2 MORE THAN 40 PINS

8.3 20 PINS TO 40 PINS

8.4 LESS THAN 20 PINS

9 INDIA MEDICAL MICROCONTROLLER MARKET, BY CONNECTIVITY

9.1 OVERVIEW

9.2 BLUETOOTH

9.3 WI-FI

9.4 ZIGBEE

9.5 OTHERS

10 INDIA MEDICAL MICROCONTROLLER MARKET, BY COMPONENTS

10.1 OVERVIEW

10.2 MEMORY

10.3 CPU

10.4 SERIAL PORT

10.5 OTHERS

11 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC EQUIPMENT

11.2.1 PULSE OXIMETER

11.2.2 BLOOD GLUCOSE METER

11.2.3 IR CONTACTLESS THERMOMETER

11.2.4 ELECTROCARDIOLOGY

11.2.5 MEDICAL PATCH

11.2.6 HANDHELD ULTRASOUND SCANNER

11.2.7 BLOOD GLUCOSE MONITOR

11.2.8 ELECTRONIC THERMOMETER

11.2.9 SMART CONNECTED PULSE OXIMETER

11.2.10 OTHERS

11.3 MEDICAL IMAGING

11.3.1 BLOOD GLUCOSE MONITOR MAGNETIC RESONANCE IMAGING

11.3.2 ULTRASOUND IMAGING

11.3.3 X-RAY & COMPUTER TOMOGRAPHY

11.3.4 OTHERS

11.4 THERAPY EQUIPMENT

11.4.1 CPAP & RESPIRATORS

11.4.2 DIALYSIS MACHINES

11.4.3 POWERED PATIENT BEDS

11.4.4 OTHERS

11.5 OTHERS

12 INDIA MEDICAL MICROCONTROLLER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: INDIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NXP SEMICONDUCTORS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ROHM CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 FUJITSU SEMICONDUCTOR MEMORY SOLUTION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 NUVOTON TECHNOLOGY CORPORATION

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 STMICROELECTRONICS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ANALOG DEVICES, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DIGI-KEY ELECTRONICS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GENERAL ELECTRIC COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 INFINEON TECHNOLOGIES AG

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 INTEGRAL MEDICAL INSTRUMENTATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INTEGRATED SILICON SOLUTION INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MICROCHIP TECHNOLOGY INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 MOUSER ELECTRONICS, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 PANASONIC CORPORATION OF NORTH AMERICA

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 RENESAS ELECTRONICS CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 TEXAS INSTRUMENTS INCORPORATED

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 TMI SYSTEMS

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 TOSHIBA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 ZILOG, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 BHAIRAV ELECTRONICS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 COSMIC DEVICES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 SKRIP ELECTRONICS

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 2 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE

TABLE 3 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

TABLE 4 PRICING OF INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION

TABLE 5 PRICING OF INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 6 PRICING OF INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 7 PRICING OF INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE

TABLE 8 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 INDIA MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 10 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE, 2020-2029 (USD MILLION)

TABLE 11 INDIA MEDICAL MICROCONTROLLER MARKET, BY MEMORY TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS, 2020-2029 (USD MILLION)

TABLE 13 INDIA MEDICAL MICROCONTROLLER MARKET, BY NUMBER OF PINS, 2020-2029 (MILLION UNITS)

TABLE 14 INDIA MEDICAL MICROCONTROLLER MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 15 INDIA MEDICAL MICROCONTROLLER MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 16 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 INDIA MEDICAL MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 18 INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 INDIA DIAGNOSTIC EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 20 INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 INDIA MEDICAL IMAGING IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 22 INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 INDIA THERAPY EQUIPMENT IN MEDICAL MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 INDIA MEDICAL MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 INDIA MEDICAL MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 INDIA MEDICAL MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 INDIA MEDICAL MICROCONTROLLER MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA MEDICAL MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA MEDICAL MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA MEDICAL MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA MEDICAL MICROCONTROLLER MARKET: MULTIVARIATE MODELING

FIGURE 9 INDIA MEDICAL MICROCONTROLLER MARKET: MARKET TYPE TIMELINE CURVE

FIGURE 10 INDIA MEDICAL MICROCONTROLLER MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDIA MEDICAL MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND BY MEDICAL INDUSTRY IS EXPECTED TO DRIVE THE INDIA MEDICAL MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA MEDICAL MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF INDIA MEDICAL MICROCONTROLLER MARKET

FIGURE 15 INDIA MEDICAL MICROCONTROLLER MARKET: BY TYPE, 2021

FIGURE 16 INDIA MEDICAL MICROCONTROLLER MARKET: BY MEMORY TYPE, 2021

FIGURE 17 INDIA MEDICAL MICROCONTROLLER MARKET: BY NUMBER OF PINS, 2021

FIGURE 18 INDIA MEDICAL MICROCONTROLLER MARKET: BY CONNECTIVITY, 2021

FIGURE 19 INDIA MEDICAL MICROCONTROLLER MARKET: BY COMPONENTS, 2021

FIGURE 20 INDIA MEDICAL MICROCONTROLLER MARKET: BY APPLICATION, 2021

FIGURE 21 INDIA MEDICAL MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

India Medical Microcontroller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Medical Microcontroller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Medical Microcontroller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.