Global Workwear And Uniforms Market

Market Size in USD Billion

CAGR :

%

USD

26.54 Billion

USD

38.04 Billion

2024

2032

USD

26.54 Billion

USD

38.04 Billion

2024

2032

| 2025 –2032 | |

| USD 26.54 Billion | |

| USD 38.04 Billion | |

|

|

|

|

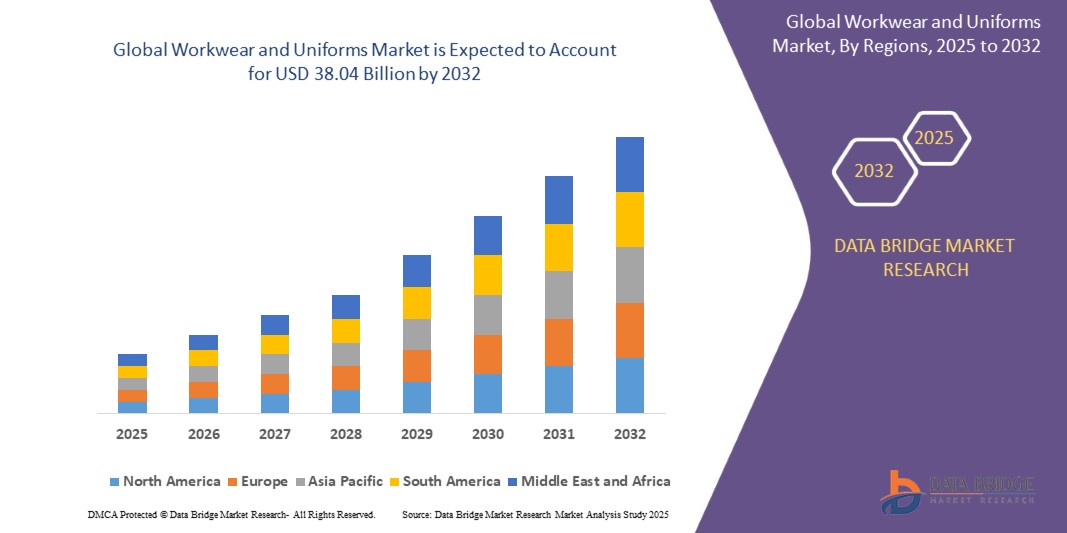

Global Workwear and Uniforms Market Size

- The global workwear and uniforms market was valued at USD 26.54 billion in 2024 and is expected to reach USD 38.04 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 4.60%, primarily driven by the increasing demand for functional and safety-enhancing apparel across various industries

- This growth is driven by factors such as the rising emphasis on employee protection, branding, and workplace professionalism

Global Workwear and Uniforms Market Analysis

- The current workwear and uniforms market is witnessing a clear shift toward multifunctional apparel that merges safety features with comfort and modern design aesthetics

- Companies are increasingly opting for uniforms that not only adhere to industry standards but also reflect their brand identity through colors logos and tailored fits

- Innovations in fabrics such as moisture-wicking breathable and stretchable textiles have made workwear more practical for long hours of use especially in physically demanding professions

- The integration of smart textiles and wearable technologies like sensor-embedded uniforms is also gaining attention as industries explore ways to improve worker safety and monitor health parameters in real time

- Customization has become a key focus with businesses placing bulk orders for uniforms tailored to specific job roles ensuring both utility and employee satisfaction

- For instance, many logistics and delivery companies have started using lightweight uniforms made from temperature-regulating fabrics to help staff cope with varying weather conditions while on duty

- In conclusion, this growing preference for functional and brand-aligned workwear is reshaping the market landscape with manufacturers expanding offerings to meet the rising demand for personalized practical and tech-enabled clothing across industries

Report Scope and Global Workwear and Uniforms Market Segmentation

|

Attributes |

Global Workwear and Uniforms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Workwear and Uniforms Market Trends

“Rise of Smart Fabrics in Workwear and Uniforms”

- The current workwear and uniforms market is experiencing a significant shift towards the integration of smart textiles, which incorporate technology directly into the fabric to enhance functionality and user experience

- These smart textiles are designed to monitor various health metrics, such as heart rate and body temperature, providing real-time data that can be crucial for employee safety and well-being

- Industries such as manufacturing and construction are adopting smart uniforms that can detect improper postures or exposure to hazardous conditions, thereby preventing workplace injuries

- The development of garments with embedded sensors and connectivity features allows for seamless communication and data collection, facilitating better decision-making and efficiency in operations

- For instance, a company has introduced a heated wool jacket powered by a battery, featuring a flexible, wire-free circuit board that integrates heating, lighting, touch-sensing, and data-transmitting capabilities into the garment

- In conclusion, this trend towards smart textiles in workwear is redefining the standards for employee safety and operational efficiency, marking a new era in the industry

Global Workwear and Uniforms Market Dynamics

Driver

“Growing Focus on Workplace Safety and Compliance”

- Employers across industries like construction healthcare and manufacturing are mandated to provide protective uniforms that comply with safety regulations to minimize workplace hazards

- High-visibility flame-resistant and antimicrobial uniforms are being used increasingly for jobs with physical risks such as road maintenance electrical works and hospital environments

- Real-time example includes the growing use of antimicrobial scrubs in hospitals during and after the pandemic to ensure hygiene and safety for medical staff

- Companies are using compliant uniforms as part of brand identity and employee care enhancing both their corporate image and internal safety standards

- Reflective jackets steel-toe boots and other certified gear are now standard for factory workers as seen in logistics and infrastructure sectors where safety gear is a daily requirement

- This ongoing alignment with safety and legal standards is not only improving workplace conditions but also ensuring a steady demand for regulated workwear across sectors

Opportunity

“Rising Demand for Customizable and Branded Uniforms”

- Companies are increasingly treating uniforms as tools for brand expression especially in hospitality aviation and retail where visual identity is crucial

- Customized uniforms featuring logos brand colors and specific designs help reinforce brand recognition and create a consistent experience for customers

- Digital printing and on-demand manufacturing technologies enable suppliers to offer flexible and cost-effective customization options that meet varied client needs

- For instance, boutique hotels and upscale restaurants often request uniforms that align with their décor and theme enhancing their overall brand presentation

- Customizable uniforms also contribute to employee morale by offering a better fit and a sense of belonging which is essential in service-driven industries

- As more businesses aim to differentiate themselves visually branded and customizable uniforms present a scalable opportunity for workwear providers across sectors

Restraint/Challenge

“High Cost and Maintenance of Specialized Workwear”

- Specialized workwear required in sectors like oil and gas pharmaceuticals and manufacturing involves advanced materials that meet strict safety standards increasing the overall cost

- Maintaining these uniforms requires specific laundering processes regular inspections and replacements which adds continuous operational expenses especially for small businesses

- Managing large-scale uniform programs across multiple locations demands additional resources for inventory tracking sizing consistency and quality control

- For instance, a manufacturing unit opting for flame-resistant uniforms made from recycled materials may face both sourcing limitations and elevated costs due to the sustainable element

- Eco-friendly options while aligning with corporate sustainability goals further intensify the challenge by raising procurement and maintenance expenses

- In conclusion, cost and upkeep continue to be significant challenges in the widespread adoption of high-performance workwear especially for budget-conscious organizations looking to balance safety compliance and sustainability

Global Workwear and Uniforms Market Scope

The market is segmented on the basis of type, distribution channel, purpose, demography, and end- user industry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Distribution Channel |

|

|

By Purpose |

|

|

By Demography

|

|

|

By End-User Industry |

|

Global Workwear and Uniforms Market Regional Analysis

“North America is the Dominant Region in the Global Workwear and Uniforms Market”

- North America continues to lead the global workwear and uniforms market due to strong industrial presence and strict adherence to safety standards

- The U.S. plays a key role, supported by large-scale demand in construction, manufacturing, and healthcare sectors

- The healthcare industry in particular sees consistent demand for protective clothing and hygienic uniforms

- Businesses in the region prioritize compliance with occupational safety norms which fuels steady demand for specialized workwear

- Companies benefit from advanced production facilities and established distribution networks across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific is emerging as the fastest growing region in the global workwear and uniforms market

- Countries like China and India are major contributors due to increasing industrialization and expanding workforce across key sectors

- The region is witnessing greater emphasis on workplace safety and uniform standards in industries such as manufacturing and construction

- Businesses are actively investing in modern workwear solutions to meet both functional and branding needs

- Growing demand for comfortable, functional, and compliant uniforms is driving continuous market expansion across Asia Pacific

Global Workwear and Uniforms Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dickies (U.S.)

- Carhartt (U.S.)

- Red Kap (U.S.)

- Alsico Group (Belgium)

- Delta Plus Group (France)

- Williamson-Dickie Manufacturing Company (U.S.)

- VF Corporation (U.S.)

- Fristads Kansas Group (Sweden)

- Engelbert Strauss GmbH & Co. KG (Germany)

- Alsico NV (Belgium)

- Adolphe Lafont (France)

- Mascot International A/S (Denmark)

- Portwest (Ireland)

- Yoko International Ltd. (U.K.)

- China Garments Co., Ltd. (China)

- Aramark Corporation (U.S.)

- Würth MODYF (Germany)

- Simon Jersey (U.K.)

- Uniforms Australia (Australia)

- Nokian Footwear (Finland)

Latest Developments in Global Workwear and Uniforms Market

- In July 2023, Workwear Uniform Group (WWUGL) was established through the merger of Direct Corporate Clothing and Incorporatewear, aiming to provide comprehensive workwear solutions across the entire product lifecycle. The group is investing heavily in infrastructure, including a state-of-the-art automated warehouse and unified digital systems, to enhance service quality and operational efficiency

- In April 2024, renowned streetwear brand Les Benjamins collaborated with acclaimed hip-hop artist Kabus Kerim to launch a new collection inspired by workwear

- In March 2024, Snickers Workwear, Solid Gear Footwear, and EripioWear became the first workwear and safety shoe brands to partner with Carbonfact, marking a significant step towards more sustainable workwear and safety shoes

- In February 2024, the Ampersand Group, a network of business owners in the promotional products and related industries, completed the acquisition of Trogo Sales. Trogo Sales, based in Akron, OH, specializes in selling branded uniforms and corporate apparel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.