Global Wood Chipper Machines Market

Market Size in USD Million

CAGR :

%

USD

434.04 Million

USD

520.64 Million

2024

2032

USD

434.04 Million

USD

520.64 Million

2024

2032

| 2025 –2032 | |

| USD 434.04 Million | |

| USD 520.64 Million | |

|

|

|

|

Wood Chipper Machines Market Size

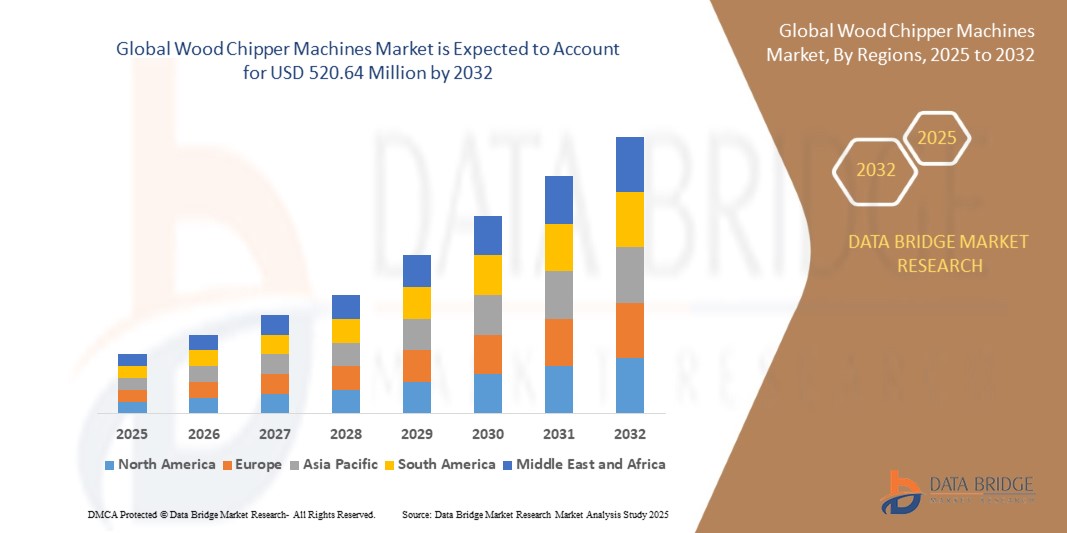

- The global wood chipper machines market size was valued at USD 434.04 million in 2024 and is expected to reach USD 520.64 million by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fueled by increasing demand for efficient biomass processing and sustainable forestry operations, driven by the global emphasis on renewable energy and eco-friendly waste management

- Furthermore, rising investments in forestry mechanization and growing adoption of high-performance chipping solutions across sectors such as timber, construction, and landscaping are accelerating the deployment of wood chipper machines, thereby significantly boosting the industry's growth

Wood Chipper Machines Market Analysis

- Wood chipper machines are mechanized equipment used to convert wood logs, branches, and waste into small chips or mulch, playing a critical role in biomass energy production, landscaping, pulp and paper, and construction waste management

- The expanding use of wood chippers is primarily fueled by the need for sustainable resource utilization, increasing adoption of biomass as an alternative energy source, and the operational efficiency these machines offer in large-scale and remote forestry applications

- Europe dominated the wood chipper machines market with a share of 30.1% in 2024, due to stringent environmental regulations, a strong focus on sustainable forestry practices, and growing investments in biomass-based energy solutions

- Asia-Pacific is expected to be the fastest growing region in the wood chipper machines market during the forecast period due to expanding infrastructure projects, growing urbanization, and mechanization in agriculture and forestry

- Drum Chipper segment dominated the market with a market share of 43.7% in 2024, due to its high efficiency in processing large volumes of wood with uniform chip sizes. Widely used in industrial applications such as sawmills and biomass plants, drum chippers offer high throughput, strong cutting capability, and are preferred for their consistent performance in continuous operations

Report Scope and Wood Chipper Machines Market Segmentation

|

Attributes |

Wood Chipper Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wood Chipper Machines Market Trends

“Increasing Demand for Sustainable Landscaping”

- The drive for eco-friendly landscaping and green waste management practices is significantly boosting the adoption of wood chipper machines in both municipal and private sectors. Sustainable landscaping trends—such as mulching, composting, and biomass production—encourage recycling of organic matter over landfill disposal, making wood chippers essential for waste minimization and soil health

- For instance, manufacturers such as Cresswood Shredding Machinery have introduced high-efficiency models such as the XR620 Industrial Shredder, designed to handle heavy-duty materials with enhanced throughput, directly addressing the needs of recycling, landscaping, and timber processing industries

- The rising use of wood chips as a biomass solid fuel is further propelling demand, aligning with renewable energy incentives and global efforts to reduce dependence on fossil fuels

- Urbanization and rapid infrastructure development are generating large amounts of wood debris, necessitating efficient machines for land clearing and green space management

- Electric-powered and low-emission chipper models are gaining traction as sustainability concerns lead both buyers and policymakers to favor environmentally friendly equipment over traditional gasoline-powered options

- Smart technology and automation, including improved safety features, advanced controls, and telematics, are being integrated into new models, enhancing operational efficiency and reducing the need for manual intervention

Wood Chipper Machines Market Dynamics

Driver

“Growth in Forestry and Timber Industry”

- Expansion in forestry, timber, paper, and furniture industries is driving up demand for wood chipper machines, as efficient processing of wood waste and raw materials becomes increasingly critical to these sectors

- For instance, investment in modern wood chippers is rising in regions such as North America and the Asia-Pacific, where robust forestry management, timber production, and sawmill operations support large-scale procurement and utilization of advanced equipment by industry leaders

- The need to prepare wood for further processing—such as pulp for paper manufacturing and wood chips for biomass—cements the wood chipper’s central role in maintaining productivity and resource optimization

- The adoption of wood chippers is further supported by government policies promoting sustainable forestry practices and bioenergy use, creating a favorable environment for market growth

- Rising demand for compact and portable machines is broadening the market’s reach among smaller forestry operations, landscape contractors, and municipal utility providers who require on-site wood waste management

Restraint/Challenge

“High Initial Cost”

- The significant upfront investment required for industrial-grade wood chipper machines—especially advanced, high-capacity, or automated models—remains a major challenge for many potential buyers, including small businesses and municipalities

- For instance, entry costs can be prohibitive for smaller operators, prompting some to delay purchasing, opt for used or rental units, or select less capable machines, which may affect efficiency and scalability in the long term

- Maintenance, repair, and operational costs, combined with the specialized training needed to safely operate modern wood chippers, add to the total cost of ownership and can impact long-term adoption rates

- In regions with limited access to financing or inconsistent demand, the payback period for new equipment can be long, further discouraging investment in high-end machines

- The price barrier particularly affects the uptake of chippers equipped with smart tech, automation, or environmentally friendly powertrains, as these models often carry a substantial premium over their basic counterparts

- Manufacturers are addressing this challenge by introducing flexible financing options, leasing programs, and entry-level models aimed at broadening accessibility and meeting the needs of diverse customer segments

Wood Chipper Machines Market Scope

The market is segmented on the basis of power source, product type, and end use.

• By Power Source

On the basis of power source, the wood chipper machines market is segmented into gasoline engine, PTO driven, diesel engine, and electric driven. The gasoline engine segment dominated the largest market revenue share in 2024, owing to its portability, high power output, and widespread availability across forestry and landscaping applications. These machines are preferred in remote and off-grid locations due to their self-contained fuel systems and robust performance, making them ideal for heavy-duty operations in outdoor environments. The convenience of not relying on external power supplies and their proven durability further strengthen their market presence.

The electric driven segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing environmental regulations and a global push toward low-emission machinery. Electric wood chippers are gaining traction among urban landscaping professionals and small-scale operations due to their quiet operation, low maintenance needs, and suitability for indoor or residential use. The growing integration of electric chippers into green landscaping fleets is contributing to their rapid adoption.

• By Product Type

On the basis of product type, the market is segmented into high-torque roller, disc chipper, drum chipper, and screw chipper. The drum chipper segment accounted for the largest market revenue share of 43.7% in 2024, primarily due to its high efficiency in processing large volumes of wood with uniform chip sizes. Widely used in industrial applications such as sawmills and biomass plants, drum chippers offer high throughput, strong cutting capability, and are preferred for their consistent performance in continuous operations.

The high-torque roller segment is expected to register the fastest CAGR from 2025 to 2032, attributed to its energy-efficient operation, safety features, and ability to handle wet or fibrous material without frequent jamming. These chippers are increasingly favored for residential and light commercial use due to their low-noise, low-speed mechanism, making them suitable for regions with noise ordinances and safety compliance concerns.

• By End Use

On the basis of end use, the wood chipper machines market is segmented into forestry and biomass, paper and pulp, timber factories and sawmills, construction, and others. The forestry and biomass segment led the market with the highest revenue share in 2024, supported by the growing demand for biomass-based energy production and sustainable forest management practices. These machines play a vital role in converting forest residues into usable chips for renewable fuel and mulch, aligning with government initiatives focused on circular economies and bioenergy.

The construction segment is anticipated to grow at the fastest pace from 2025 to 2032, driven by rising demand for on-site wood waste processing in infrastructure and housing developments. With increasing emphasis on minimizing construction waste and optimizing job site efficiency, wood chippers are being integrated into construction workflows to manage debris, recycle wood, and reduce haul-off costs, thereby enhancing operational sustainability and productivity.

Wood Chipper Machines Market Regional Analysis

- Europe dominated the wood chipper machines market with the largest revenue share of 30.1% in 2024, driven by stringent environmental regulations, a strong focus on sustainable forestry practices, and growing investments in biomass-based energy solutions

- European markets are witnessing high demand for advanced chipping equipment across forestry, pulp and paper, and renewable energy sectors, particularly due to the region’s commitment to carbon neutrality and waste reduction

- The availability of modern forestry infrastructure, government support for bioenergy initiatives, and widespread use of eco-friendly technologies further strengthen Europe’s leadership in the global market

Germany Wood Chipper Machines Market Insight

The Germany wood chipper machines market accounted for the largest revenue share in Europe in 2024, fueled by the country’s strong emphasis on sustainable forest management, advanced industrial capabilities, and growing biomass energy demand. German manufacturers continue to lead in innovation and efficiency, making the country a hub for high-performance chipping machinery across commercial and industrial applications.

U.K. Wood Chipper Machines Market Insight

The U.K. wood chipper machines market is projected to grow at a robust CAGR over the forecast period, driven by increased government focus on decarbonization and sustainable construction. Growing urban tree management and landscaping activities, alongside rising use of compact electric chippers for municipal and residential purposes, are contributing to market expansion in the region.

North America Wood Chipper Machines Market Insight

The North America wood chipper machines market is experiencing steady growth, supported by strong demand in forestry operations, landscaping services, and agricultural residue processing. Increasing biomass energy production and the trend toward sustainable land management are fueling equipment adoption across the U.S. and Canada.

U.S. Wood Chipper Machines Market Insight

The U.S. market held the largest share within North America in 2024, driven by extensive use of gasoline and PTO-driven chippers in forestry, municipal services, and rural land maintenance. The growing preference for mechanized solutions, especially in landscaping and construction waste handling, is propelling the market forward.

Asia-Pacific Wood Chipper Machines Market Insight

The Asia-Pacific market is expected to grow at the fastest CAGR of 6.6% during the forecast period of 2025 to 2032, driven by expanding infrastructure projects, growing urbanization, and mechanization in agriculture and forestry. Government efforts to promote renewable energy and sustainable wood utilization are supporting the demand for high-capacity chippers.

India Wood Chipper Machines Market Insight

India is projected to register the highest growth rate in the region, backed by increasing afforestation initiatives, demand for agricultural waste processing, and the rising need for cost-effective biomass generation equipment. Expanding rural electrification and small-scale forestry operations are further boosting equipment penetration.

China Wood Chipper Machines Market Insight

China held the largest revenue share in Asia-Pacific in 2024 due to its massive forestry industry, large-scale timber processing, and biomass energy development. With strong domestic production capabilities and growing investments in renewable energy, the demand for drum and disc chippers continues to expand in commercial and industrial sectors.

Wood Chipper Machines Market Share

The wood chipper machines industry is primarily led by well-established companies, including:

- Redwood Global (U.S.)

- Continental Biomass Industrie (U.S.)

- Wallenstein Equipment Inc. (Canada)

- MORBARK, LLC (U.S.)

- Bandit Industries, Inc. (U.S.)

- Vermeer Corporation (U.S.)

- MTD Products Inc. (U.S.)

- Astec Industries, Inc. (U.S.)

- J.P. Carlton Company (U.S.)

- Crary Industries, Inc. (U.S.)

- PATRIOT PRODUCTS INC. (U.S.)

- Siwertell (Sweden)

- Zenoah (Japan)

- Avant Tecno Oy (Finland)

- Trelan Manufacturing (U.S.)

- UNTHA shredding technology GmbH (Austria)

- Salsco, Inc. (U.S.)

Latest Developments in Global Wood Chipper Machines Market

- In November 2024, Terex strengthened its position in the wood chipper machines market by showcasing its latest environmental solutions at IFAT 2024, featuring brands such as Terex Ecotec, CBI, Terex Recycling Systems, ZenRobotics, and Green-Tec. The introduction of advanced machines such as the TDS 815 slow-speed shredder and the CBI Magnum Force 5400B horizontal grinder demonstrated the company's commitment to innovation in wood processing and recycling. This move is expected to enhance Terex’s market competitiveness by promoting high-efficiency equipment aligned with global sustainability goals

- In November 2023, Bandit Industries expanded its product portfolio with the launch of the HM6420 hammermill horizontal grinder, a high-performance solution designed for heavy-duty grinding applications involving contaminants. Equipped with a 1,200-horsepower Caterpillar engine and a 50” hammermill, the machine significantly improves material throughput and durability. This development is poised to strengthen Bandit's market share by addressing demand for powerful, efficient wood chipping machinery with enhanced productivity and ease of maintenance

- In December 2021, Bandit Industries, a Michigan-based manufacturer of wood waste and arboriculture equipment, acquired Trelan Co., a producer of tree chippers. This purchase, which includes all assets and properties from the Schumacher family, expands Bandit’s product line, enhancing its offerings for forestry and logging clients

- In September 2022, Timberwolf introduced the RW 280HB hybrid wood chipper, reflecting the industry's shift towards more sustainable equipment. This new model emphasizes eco-friendly practices while delivering high-performance chipping capabilities, catering to growing demand for environmentally conscious solutions in wood processing

- In September 2020, Vermeer EMEA launched the BC200 brush chipper, marking its first machine developed entirely in the Netherlands. This innovative chipper combines advanced engineering with local expertise, providing a robust solution for efficient brush chipping, and underlining Vermeer’s commitment to regional development and technological advancement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wood Chipper Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wood Chipper Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wood Chipper Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.