Global Wireless Lan Controller Market

Market Size in USD Billion

CAGR :

%

USD

8.47 Billion

USD

45.70 Billion

2024

2032

USD

8.47 Billion

USD

45.70 Billion

2024

2032

| 2025 –2032 | |

| USD 8.47 Billion | |

| USD 45.70 Billion | |

|

|

|

|

Wireless LAN Controller Market Size – Global

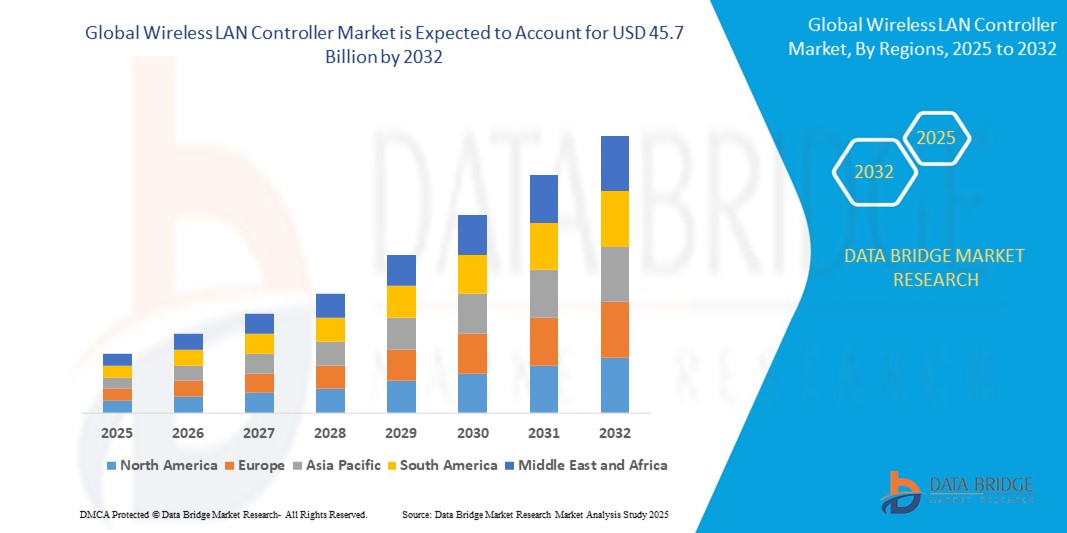

- The Global Wireless LAN Controller Market was valued at USD 8.47 billion in 2024 and is projected to reach USD 45.7 billion by 2032, growing at a CAGR of 27.22% during the forecast period.

- Market growth is being driven by increasing demand for centralized wireless network management, growing adoption of cloud-based WLAN solutions, and rising implementation of IoT and BYOD policies across enterprises and public infrastructure.

Global Wireless LAN Controller Market Analysis

- Wireless LAN controllers (WLCs) play a critical role in managing, securing, and optimizing Wi-Fi networks by centralizing control over access points (APs) and ensuring seamless wireless connectivity across distributed environments.

- The surge in remote working, digital transformation initiatives, and smart campus deployments has accelerated the need for reliable and scalable WLAN solutions that offer real-time monitoring, traffic prioritization, and security enforcement.

- With increasing numbers of connected devices in enterprise and public networks, cloud-based WLAN controllers are witnessing significant traction due to their cost-effectiveness, scalability, and ability to enable zero-touch provisioning and centralized firmware updates.

- Rapid growth in educational institutions, hospitals, retail stores, and government smart infrastructure is also contributing to the market expansion, as these sectors prioritize secure, high-performance wireless access for users and devices.

Report Scope and Global Wireless LAN Controller Market Segmentation

|

Attributes |

Global Wireless LAN Controller Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wireless LAN Controller Market Trends

“Cloud-Managed Platforms, AI Optimization, and Wi-Fi 6/6E Compatibility Redefine WLAN Control”

- A key trend reshaping the wireless LAN controller market is the rapid migration to cloud-managed platforms, enabling organizations to monitor, configure, and optimize their wireless networks from centralized dashboards. These solutions support zero-touch provisioning, multi-location orchestration, and remote firmware upgrades, enhancing IT agility and reducing overhead.

- The growing complexity of enterprise Wi-Fi environments has fueled demand for AI- and ML-powered WLAN controllers that can automatically detect network congestion, optimize access point channels, and proactively address performance bottlenecks. AI-enhanced troubleshooting and predictive analytics are becoming standard in enterprise WLAN deployments.

- The adoption of Wi-Fi 6 and 6E is accelerating controller upgrades. These new standards demand greater throughput, efficient spectrum usage, and high-density client management—features that are being incorporated into next-gen WLAN controllers.

- As cybersecurity becomes a boardroom priority, WLAN controllers are evolving to integrate Zero Trust Network Access (ZTNA), multi-factor authentication, and micro-segmentation, ensuring that network integrity is maintained even in large BYOD and IoT environments.

Wireless LAN Controller Market Dynamics

Driver

“Proliferation of Connected Devices and Shift Toward Centralized Wireless Network Management”

- The exponential increase in connected devices—from mobile phones to IoT sensors—is pushing organizations to adopt wireless LAN controllers that can efficiently manage traffic, reduce interference, and ensure seamless roaming across access points.

- Enterprises and institutions are seeking centralized WLAN control to standardize policy enforcement, enhance network visibility, and reduce configuration errors across multi-site operations.

- The rise of hybrid workforces, cloud applications, and smart campus deployments is further accelerating demand for WLAN controllers that offer scalability, security, and real-time diagnostics.

- Educational institutions, hospitals, and government buildings are prioritizing WLAN controller upgrades to support HD video conferencing, digital classrooms, and connected medical infrastructure, requiring robust and uninterrupted wireless networks.

Restraint/Challenge

“High Upfront Costs and Integration Challenges in Legacy Environments”

- Despite long-term savings, the initial capital expenditure for enterprise-grade WLAN controllers, especially those supporting Wi-Fi 6/6E, remains a barrier for small and medium-sized businesses.

- Legacy IT infrastructure often lacks compatibility with modern WLAN controller features, requiring costly network redesigns or phased migrations that delay full adoption.

- Ensuring secure integration with cloud platforms, SD-WAN, and NAC systems presents technical challenges, particularly for organizations without dedicated IT teams.

- Concerns over data privacy, vendor lock-in, and the management complexity of hybrid environments (cloud + on-premise) are also limiting adoption in regulated industries.

Wireless LAN Controller Market Scope

The market is segmented on the battery type, vehicle type, engine type, functions and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Deployment Mode |

|

|

By Application |

|

|

By End User |

|

Wireless LAN Controller Market Scope

The market is segmented by type, deployment mode, application size, and end user, reflecting the diversity of wireless LAN controller adoption across sectors.

- By Type

Segmented into standalone controllers and integrated controllers.

Standalone controllers dominate the market in 2025 due to their high performance, dedicated management capabilities, and large-scale enterprise use. Integrated controllers, embedded within routers or access points, are gaining traction in SME and branch office settings for their cost-effectiveness and simplified deployment.

- By Deployment Mode

Divided into on-premise and cloud-based deployments.

On-premise controllers remain dominant in sectors requiring high security, such as BFSI and government. However, cloud-based WLAN controllers are expected to grow at the fastest rate due to increasing adoption in multi-site enterprises, educational campuses, and retail chains, where centralized management and remote access are crucial.

- By Application

Segmented into small and medium enterprises (SMEs) and large enterprises.

Large enterprises accounted for the largest share in 2025 due to their extensive wireless infrastructure and stringent performance and security requirements. SMEs are expected to see rapid growth, driven by cloud-managed solutions that reduce IT complexity and offer scalability.

By End User

- Includes BFSI, healthcare, retail, education, government, IT & telecom, and others.

IT & telecom and education sectors lead in adoption due to the need for seamless and high-capacity wireless connectivity across campuses and corporate facilities. Healthcare is emerging as a key segment due to the rise in connected medical devices, telehealth, and EMR systems requiring secure and reliable WLAN.

Wireless LAN Controller Market Regional Analysis

- North America dominates the wireless LAN controller market in 2025, supported by widespread enterprise digitization, robust IT infrastructure, and rapid adoption of cloud-managed WLAN solutions. Major players like Cisco and HPE are headquartered in the U.S., further fueling innovation and adoption across corporate, educational, and healthcare sectors.

- Europe is a key growth region driven by increasing demand for secure, high-density Wi-Fi solutions in public institutions, smart buildings, and regulated industries. Countries like the U.K., Germany, and France are investing in controller-based WLAN systems to comply with GDPR and cybersecurity standards while improving performance.

- Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, driven by rapid urbanization, smart city development, and increasing deployment of cloud-based IT infrastructure. Countries like China, India, Japan, and South Korea are adopting WLAN controllers in education, manufacturing, and enterprise environments.

- Middle East and Africa (MEA) is experiencing steady growth due to government investments in e-governance, digital healthcare, and educational modernization. Countries like UAE, Saudi Arabia, and South Africa are integrating WLAN controllers into smart campuses, digital clinics, and smart retail networks.

- South America shows expanding adoption, especially in Brazil, Chile, and Colombia, where digital transformation efforts in telecom, retail, and public infrastructure are fueling demand for wireless LAN controllers capable of managing large and diverse networks.

United States Wireless LAN Controller Market Insights

The U.S. leads the wireless LAN controller market globally, backed by large-scale enterprise deployments, strong public sector investment, and the presence of top-tier vendors such as Cisco, Juniper, and HPE. Enterprises across sectors are deploying AI-powered WLAN controllers to support hybrid work, edge computing, and high-performance cloud applications.

Germany Wireless LAN Controller Market Insights

Germany’s growing focus on secure connectivity for Industry 4.0 applications is boosting demand for WLAN controllers in manufacturing, logistics, and public sectors. Companies are prioritizing low-latency, centralized control systems with GDPR-compliant data handling for business continuity and digital competitiveness.

India Wireless LAN Controller Market Insights

India is a fast-growing market, supported by smart city initiatives, digital education reforms, and affordable cloud-based IT solutions. SMEs, schools, and retail chains are rapidly deploying cloud-managed WLAN controllers to ensure secure, scalable Wi-Fi for customers and employees.

United Arab Emirates (UAE) Wireless LAN Controller Market Insights

UAE is witnessing increased deployment of wireless LAN controllers in smart government offices, digital healthcare projects, and luxury retail spaces. The country’s smart infrastructure push under Vision 2031 is accelerating demand for enterprise-grade Wi-Fi management tools.

Brazil Wireless LAN Controller Market Insights

Brazil’s wireless LAN controller market is expanding, driven by investments in digital banking, connected retail, and public internet infrastructure. Businesses are deploying WLAN controllers to optimize network traffic and maintain cybersecurity across large and distributed locations.

Wireless LAN Controller Market Share

The Wireless LAN Controller industry is primarily led by well-established companies, including:

- Cisco Systems Inc.

- Hewlett Packard Enterprise (Aruba Networks)

- Huawei Technologies Co. Ltd.

- Extreme Networks, Inc.

- Juniper Networks Inc. (Mist Systems)

- Fortinet Inc.

- Zyxel Communications Corp.

- TP-Link Technologies Co., Ltd.

- D-Link Corporation

- Netgear, Inc.

- Ubiquiti Inc.

- Sophos Group plc

Latest Developments in Global Wireless LAN Controller Market

- In April 2025, Cisco Systems launched its new Catalyst 9800X WLAN controller, supporting Wi-Fi 6E and 7-readiness with embedded AI-driven performance analytics and adaptive radio management for large enterprise deployments.

- In March 2025, Hewlett Packard Enterprise (Aruba) rolled out enhancements to its Aruba Central cloud platform, enabling AI-powered WLAN optimization and real-time threat detection across controller-based networks for healthcare and retail clients.

- In February 2025, Juniper Networks (Mist Systems) introduced Mist Edge Controller, a microservices-based WLAN solution for high-density environments, offering autonomous network operations and integrated anomaly detection.

- In January 2025, Huawei Technologies launched its Agile Controller-WLAN 2.0, designed to manage multi-site wireless networks using deep learning algorithms to improve roaming performance and reduce latency for mobile-first enterprises.

- In December 2024, Extreme Networks unveiled its Universal Platform Update, integrating centralized control for Wi-Fi, SD-WAN, and IoT access, enabling enterprises to manage multi-protocol environments from a unified controller interface.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wireless Lan Controller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wireless Lan Controller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wireless Lan Controller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.