Global Wine Market Segmentation, By Type (Still Wines, Sparkling Wines, Fortified Wines, and Others), Color (Red Wine, White Wine, Rose Wine, and Others), Product Type (Unflavored and Flavored), Packaging (Bottles, Can, and Others), Body Type (Full-Bodied, Light-Bodied and Medium-Bodied), Distribution Channel (Off Trade and On Trade) – Industry Trends and Forecast to 2031

Wine Market Analysis

The wine market has witnessed significant growth driven by evolving consumer preferences and a surge in global demand for premium and artisanal products. As consumers increasingly seek high-quality and unique offerings, the market has expanded to include a diverse range of wines, from traditional varietals to innovative blends. Recent developments, such as the rise of e-commerce platforms and direct-to-consumer sales, have transformed how consumers access and purchase wine, enhancing convenience and selection. Additionally, sustainability initiatives and organic wine production are gaining traction, appealing to environmentally conscious consumers. The market's expansion is further supported by increasing interest in wine tourism and education, fostering deeper connections with the product. Overall, the wine market is positioned for continued growth as it adapts to changing consumer behaviors and preferences, establishing itself as a dynamic segment within the global beverage industry.

Wine Market Size

The global wine market size was valued at USD 382.25 million in 2023 and is projected to reach USD 524.35 million by 2031, with a CAGR of 4.03% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Wine Market Trends

“Increasing Demand of Organic and Biodynamic Wines”

The wine market is evolving rapidly, driven by consumer demand for innovation and unique experiences. One notable trend is the growing popularity of organic and biodynamic wines, as consumers become more health-conscious and environmentally aware. This shift reflects a broader interest in sustainability and responsible sourcing, prompting wineries to adopt organic practices and emphasize transparency in their production processes. Additionally, advancements in technology, such as AI-driven wine recommendations and enhanced e-commerce platforms, are transforming the purchasing experience. As wineries embrace these trends, they cater to the evolving preferences of a diverse consumer base, ensuring that the wine market remains vibrant and competitive in an ever-changing landscape.

Report Scope and Wine Market Segmentation

|

Attributes

|

Wine Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Accolade Wines (Australia), The Wine Group (U.S.), Davide Campari-Milano N.V. (Italy), E. & J. Gallo Winery (U.S.), Constellation Brands, Inc. (U.S.), Castel Group (France), Compagnia del Vino srl (Italy), KOMMIGRAPHICS & LAB21 FOR AMVYX (U.S.), Bacardi (Bermuda), Pernod Ricard (France), Treasury Wine Estates Ltd (Australia), Gruppo Caviro (Italy), Miguel Torres S. A. (Spain), Concha y Toro (Chile), Sula Vineyards Limited (India), and Chapel Down (U.K.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

|

Wine Market Definition

Wine is an alcoholic beverage made from fermented grapes or other fruits. The fermentation process involves the conversion of sugars in the fruit into alcohol and carbon dioxide by yeast. Wine can be classified into various types, including red, white, rosé, sparkling, and fortified, depending on the grape variety, production methods, and region of origin. The flavor, aroma, and character of wine are influenced by several factors, including the grape variety, climate, soil, and winemaking techniques. Wine has a rich cultural significance and is often enjoyed in social settings, paired with food, or used in celebrations and rituals.

Wine Market Dynamics

Drivers

- Rising Consumer Demand

The growing interest in premium and artisanal wines among consumers has significantly boosted sales in the high-end segment of the wine market. As consumers become more discerning and seek unique, high-quality products, they are willing to invest in premium offerings that reflect craftsmanship and authenticity. This trend is driven by an increasing appreciation for terroir, vintage, and winemaking techniques, leading consumers to explore smaller, boutique wineries that prioritize quality over quantity. Additionally, social media and wine education initiatives have further fueled this interest, allowing consumers to discover and share their experiences with premium wines, thereby driving market growth in this lucrative segment.

- Innovation in Winemaking Techniques

Advancements in winemaking technology, such as precision viticulture and improved fermentation methods, are playing a crucial role in enhancing the quality and diversity of wine offerings. Precision viticulture utilizes data analytics and sensor technologies to monitor vineyard conditions, allowing winemakers to make informed decisions about irrigation, harvesting, and grape management. This results in better quality grapes and, ultimately, superior wines. Improved fermentation techniques, including temperature control and yeast selection, further refine flavor profiles and consistency. These innovations elevate the overall standard of wines produced and attract a broader consumer base, eager to explore high-quality and diverse wine selections, thereby driving growth in the market.

Opportunities

- Innovative Flavors and Product

Developing unique flavors, such as fruit-infused wines and limited-edition releases, presents a significant market opportunity for wine producers looking to attract adventurous consumers. As the palate of wine drinkers evolves, there is an increasing demand for innovative products that offer novel tasting experiences. By experimenting with unconventional ingredients and creative blends, wineries can create distinctive offerings that stand out in a crowded market. Limited-edition releases also generate excitement and urgency, encouraging consumers to try new products before they sell out. This approach caters to consumers’ desire for exploration and novelty and enhances brand loyalty and engagement, driving growth in the wine market.

- Digital and E-commerce Expansion

Leveraging e-commerce platforms and direct-to-consumer sales channels presents a significant opportunity for wine brands to enhance accessibility and convenience for consumers, ultimately driving sales growth. As online shopping continues to gain popularity, consumers increasingly prefer the ability to browse and purchase wines from the comfort of their homes. E-commerce allows brands to reach a broader audience, including those in regions with limited access to retail outlets. Additionally, direct-to-consumer sales enable wineries to establish a personal connection with customers, fostering loyalty and repeat purchases. By investing in robust online platforms and user-friendly purchasing experiences, wine producers can capitalize on this trend and tap into the growing demand for convenient shopping solutions.

Restraints/Challenges

- High Intense Competition

The wine market is characterized by intense competition, with a vast array of brands and products competing for consumer attention. This crowded landscape poses significant challenges for new entrants attempting to establish a foothold. Established brands often have strong recognition and loyalty, making it difficult for newcomers to differentiate themselves and capture market share. Additionally, consumers may be hesitant to try unfamiliar brands, favoring those they already know and trust. This situation necessitates that new wineries invest heavily in marketing, branding, and unique product offerings to carve out a niche in a market saturated with options, complicating their entry and growth strategies.

- High Initial Investment Costs and Scaling Challenges

The production of wine, especially premium and aged varieties, is associated with significant costs that can impose constraints on profit margins. High-quality raw materials, such as select grapes and specialized yeast strains, contribute to increased expenses. Additionally, the labor-intensive processes involved in vineyard management, harvesting, and winemaking require skilled workers, further driving up costs. The aging process, which is essential for developing complex flavors in premium wines, necessitates the use of barrels and storage facilities, adding to financial burdens. Moreover, adherence to stringent regulatory compliance related to production and labeling can incur additional costs, ultimately squeezing profit margins and posing a challenge for wineries striving to maintain profitability in a competitive market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Wine Market Scope

The market is segmented on the basis of type, color, product type, packaging, body type, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Still Wines

- Sparkling Wines

- Fortified Wines

- Others

Color

- Red Wine

- White Wine

- Rosé Wine

- Others

Product Type

- Unflavored

- Flavored

Packaging

- Bottles

- Cans

- Others

Body Type

- Full-Bodied

- Light-Bodied

- Medium-Bodied

Distribution Channel

- Off Trade

- On Trade

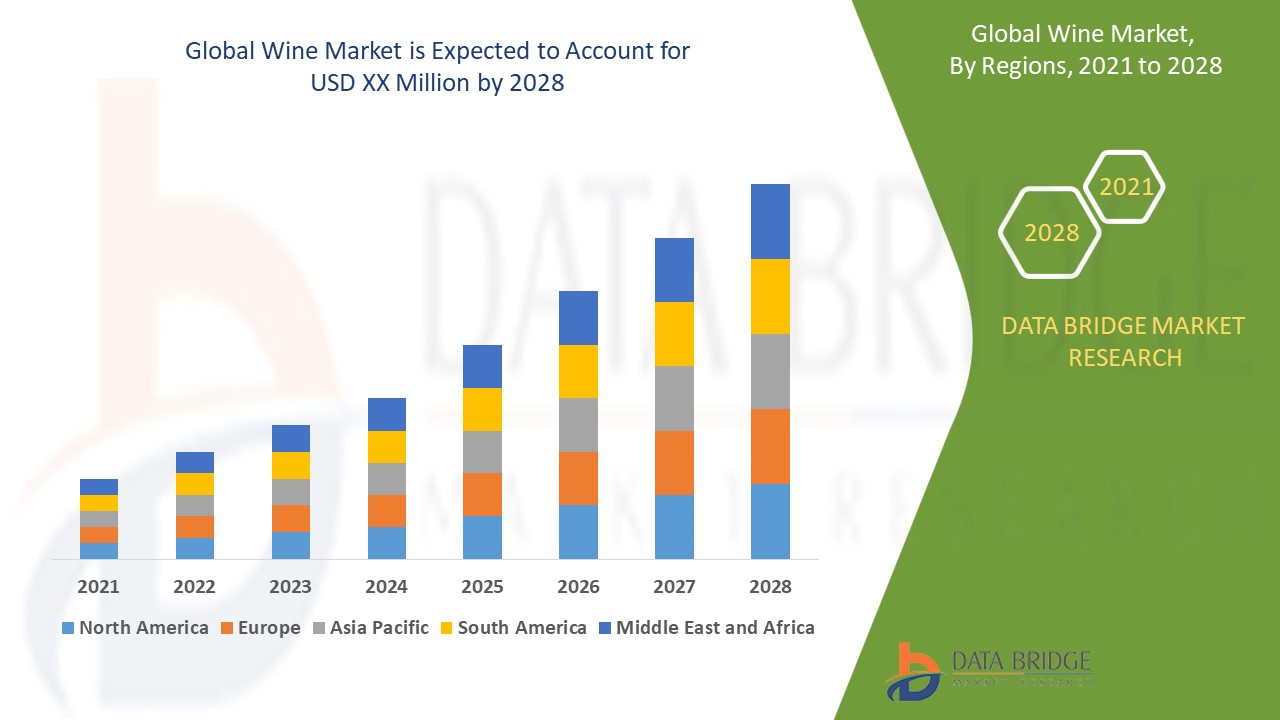

Wine Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, color, product type, packaging, body type, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

The European region currently leads the wine market and is expected to maintain this dominance throughout the forecast period, driven by robust demand for a diverse range of wine varieties. This strong consumer interest reflects the region's rich winemaking heritage and cultural appreciation for wine. As a result, Europe is well-positioned to sustain its significant market share in the global wine industry.

Asia-Pacific region is poised for significant growth and is expected to achieve the highest compound annual growth rate (CAGR) during this period, driven by the expansion of the food and beverage industry. This growth is fueled by increasing demand for alcoholic beverages, a rise in urbanization, and a notable increase in personal disposable income among consumers. Consequently, these factors are creating a favorable environment for the wine market to thrive in this dynamic region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Wine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Wine Market Leaders Operating in the Market Are:

- Accolade Wines (Australia)

- The Wine Group (U.S.)

- Davide Campari-Milano N.V. (Italy)

- E. & J. Gallo Winery (U.S.)

- Constellation Brands, Inc. (U.S.)

- Castel Group (France)

- Compagnia del Vino srl (Italy)

- KOMMIGRAPHICS & LAB21 FOR AMVYX (U.S.)

- Bacardi (Bermuda)

- Pernod Ricard (France)

- Treasury Wine Estates Ltd (Australia)

- Gruppo Caviro (Italy)

- Miguel Torres S. A. (Spain)

- Concha y Toro (Chile)

- Sula Vineyards Limited (India)

- Chapel Down (U.K.)

Latest Developments in Wine Market

- In May 2022, Accolade Wines introduced its zero-alcohol wine collection, branded as 'Called & Then.' This innovative range is crafted using the company's proprietary de-alcoholization process known as 'Zero Tech X technology.' With this launch, Accolade Wines aims to cater to the growing demand for non-alcoholic options, providing consumers with enjoyable and sophisticated wine alternatives that maintain flavor without the alcohol content

- In September 2021, Familia Torres unveiled the latest vintage of their prestigious Antología Miguel Torres wine collection. This flagship range reflects the winery's dedication to regenerative viticulture and sustainable practices aimed at combating climate change. The collection features five exceptional wines: Milmanda 2018, Mas La Plana 2017, Reserva Real 2017, Grans Muralles 2017, and Mas de la Rosa 2018, showcasing the winery's commitment to quality and environmental responsibility

- In July 2021, E. & J. Gallo Winery Group, a prominent leader in the global liquor and spirits market, announced the launch of a new wine collection called “The Language of Yes,” created in collaboration with the legendary winemaker and visionary Randall Grahm. This innovative collection is inspired by the deep-rooted history of winemaking in Southern France, capturing the essence and character of the region's rich viticultural heritage. With this release, Gallo aims to offer wine enthusiasts a unique experience that celebrates the artistry and tradition of Southern French wine culture

- In April 2021, Constellation Brands announced the establishment of a dedicated business unit focused on fine wine and craft spirits. This new venture includes a diverse portfolio of renowned brands, such as High West Whisky, Casa Noble Tequila, Mi Campo, Copper & Kings, Nelson's Green Brier Distillery, and The Real McCoy. Through this initiative, Constellation aims to enhance its presence in the premium beverage market, catering to consumers' growing appreciation for high-quality wines and artisanal spirits

- In April 2023, Provi, a leading online marketplace for beverage alcohol, unveiled a set of new product features designed to enhance the efficiency of the three-tier distribution system. These innovative features aim to streamline operations and improve the overall user experience for retailers, distributors, and suppliers within the beverage alcohol industry. By focusing on optimizing these processes, Provi seeks to strengthen its position as a vital resource in the evolving marketplace

SKU-