Global Wi Fi As A Service Market

Market Size in USD Billion

CAGR :

%

USD

7.82 Billion

USD

50.98 Billion

2024

2032

USD

7.82 Billion

USD

50.98 Billion

2024

2032

| 2025 –2032 | |

| USD 7.82 Billion | |

| USD 50.98 Billion | |

|

|

|

|

Wi-Fi as a Service Market Size

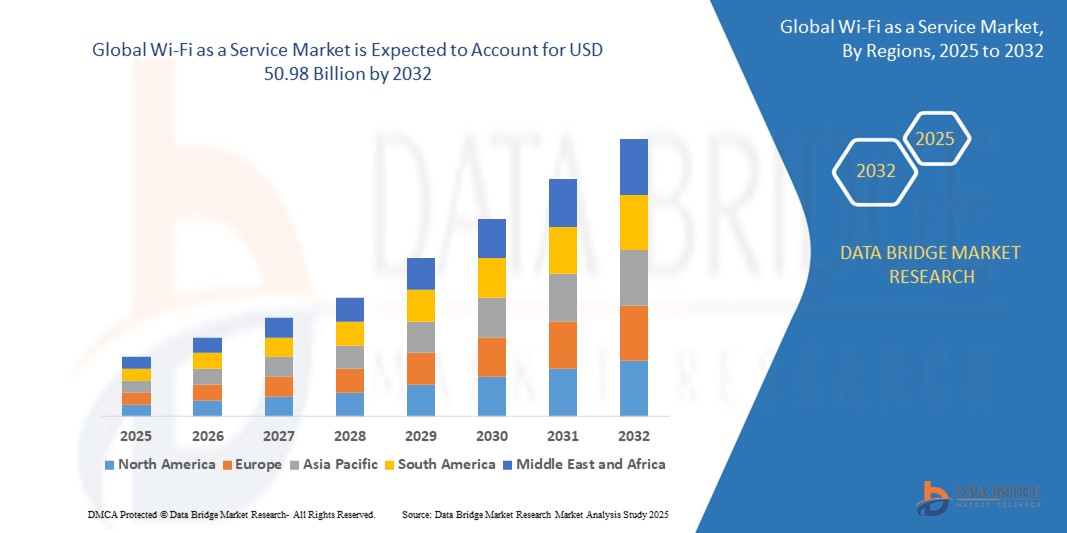

- The global wi-fi as a service market size was valued at USD 7.82 billion in 2024 and is expected to reach USD 50.98 billion by 2032, at a CAGR of 26.40% during the forecast period

- The market growth is primarily driven by the increasing adoption of cloud-based solutions, the proliferation of connected devices, and the growing demand for seamless, scalable, and cost-effective wireless connectivity solutions across various industries

- The rising need for high-speed, reliable, and secure Wi-Fi networks to support digital transformation initiatives in enterprises and public sectors is further accelerating the adoption of Wi-Fi as a Service, positioning it as a preferred connectivity solution

Wi-Fi as a Service Market Analysis

- Wi-Fi as a Service (WaaS) provides managed wireless connectivity solutions, offering businesses and organizations scalable, secure, and efficient network access without the need for significant upfront infrastructure investments

- The demand for wi-fi as a service is fueled by the rapid expansion of IoT devices, the growing reliance on cloud-based applications, and the need for flexible, subscription-based connectivity models that reduce operational complexity

- North America dominated the Wi-Fi as a Service market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced networking technologies, high enterprise spending on IT infrastructure, and the presence of major market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, increasing digitalization, and rising investments in IT infrastructure in countries such as China, India, and Japan

- The infrastructure segment dominated the largest market revenue share of 45% in 2024, driven by the critical role of hardware such as Wi-Fi routers, access points, and network switches in enabling seamless connectivity for both consumer and enterprise environments. The adoption of advanced technologies such as Wi-Fi 6 and Wi-Fi 7 further supports the dominance of this segment

Report Scope and Wi-Fi as a Service Market Segmentation

|

Attributes |

Wi-Fi as a Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Wi-Fi as a Service Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Global Wi-Fi as a Service (WaaS) market is experiencing a notable trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into network performance, user behavior, and predictive maintenance needs

- AI-powered wi-fi as a service solutions facilitate proactive problem-solving, identifying potential network issues before they lead to downtime or degraded performance

- For instances, several companies are developing AI-driven platforms that analyze user connectivity patterns to optimize network performance or offer personalized service plans based on real-time usage and environmental conditions

- This trend enhances the value proposition of wi-fi as a service , making it more appealing to both individual users and enterprise clients

- AI algorithms can analyze a wide range of user behaviors, including peak usage times, bandwidth demands, connection drops, and device preferences, improving network efficiency

Wi-Fi as a Service Market Dynamics

Driver

“Rising Demand for Seamless Connectivity and Advanced Network Features”

- The growing consumer and enterprise demand for seamless, high-speed connectivity, such as real-time data access, cloud-based applications, and IoT integration, is a major driver for the wi-fi as a service market

- wi-fi as a service solutions enhance network reliability by providing features such as automatic network optimization, real-time diagnostics, and enhanced security protocols

- Government initiatives, particularly in North America, which dominates the market, are promoting the adoption of advanced wireless technologies to support smart city projects and digital transformation

- The proliferation of IoT and the rollout of 5G technology are further enabling the expansion of wi-fi as a service applications, offering faster data transmission and lower latency for sophisticated network services

- Service providers are increasingly offering scalable wi-fi as a service solutions tailored for small and medium enterprises (SMEs) and large enterprises across various verticals, including Education, Retail, Travel and Hospitality, Healthcare, and IT and Telecom, to meet rising expectations

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The significant initial investment required for infrastructure, software, and integration of wi-fi as a service solutions can be a barrier to adoption, particularly for small and medium enterprises and in emerging markets within the Asia-Pacific region, which is the fastest-growing market

- Deploying and managing wi-fi as a service infrastructure, especially for outdoor or large-scale indoor environments, can be complex and costly

- Data security and privacy concerns are a major challenge, as wi-fi as a service systems collect and transmit vast amounts of sensitive user and network data, raising concerns about potential breaches, misuse of information, and compliance with data protection regulations

- The fragmented regulatory landscape across different countries regarding data collection, storage, and usage complicates operations for global service providers

- These factors can deter potential adopters and limit market expansion, particularly in regions with high data privacy awareness or cost sensitivity

Wi-Fi as a Service market Scope

The market is segmented on the basis of component, user location, organization size, and vertical.

- By Component

On the basis of component, the Wi-Fi as a Service market is segmented into infrastructure, software, and services. The infrastructure segment dominated the largest market revenue share of 45% in 2024, driven by the critical role of hardware such as Wi-Fi routers, access points, and network switches in enabling seamless connectivity for both consumer and enterprise environments. The adoption of advanced technologies such as Wi-Fi 6 and Wi-Fi 7 further supports the dominance of this segment.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for managed and professional services, including installation, configuration, monitoring, and troubleshooting. These services allow businesses to outsource network management, reducing operational complexities and costs while ensuring reliable and secure connectivity.

- By User Location

On the basis of user location, the Wi-Fi as a Service market is segmented into indoor and outdoor. The indoor segment dominated the market with a revenue share of 69% in 2024, driven by the widespread need for high-speed, reliable Wi-Fi in homes, offices, shopping malls, hospitals, and educational institutions. The demand for seamless connectivity in these environments supports the segment's leadership.

The outdoor segment is anticipated to experience robust growth from 2025 to 2032, fueled by the rising deployment of public Wi-Fi networks in parks, streets, stadiums, and transportation hubs. The expansion of smart city initiatives and the growing need for connectivity in high-density public areas are key drivers for this segment.

- By Organization Size

On the basis of organization size, the Wi-Fi as a Service market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment held the largest market revenue share of 60% in 2024, driven by their need for scalable and high-performance Wi-Fi networks to support large workforces, critical applications, and cloud-based services. Large enterprises also invest significantly in wi-fi as a service to address data security and privacy concerns.

The SMEs segment is expected to witness the fastest growth rate of approximately 22.8% from 2025 to 2032. The cost-efficiency, scalability, and short lifecycle of wi-fi as a service solutions make them highly attractive to SMEs across industries such as retail, healthcare, and hospitality, enabling enhanced productivity without the need for extensive infrastructure investments.

- By Vertical

On the basis of vertical, the Wi-Fi as a Service market is segmented into education, retail, travel and hospitality, healthcare and life sciences, manufacturing, banking, financial services, and insurance (BFSI), IT and telecom, transportation and logistics, government and public sector, and others. The BFSI segment held the largest market revenue share of 22% in 2024, driven by the increasing adoption of wi-fi as a service for secure, low-latency connectivity to support online transactions, fraud prevention, and data security.

The retail segment is anticipated to witness the fastest growth rate of approximately 23.4% from 2025 to 2032. The rising deployment of public Wi-Fi networks in retail environments, coupled with the need to analyze customer behavior, enhance e-commerce capabilities, and provide seamless connectivity for in-store experiences, drives the growth of this segment.

Wi-Fi as a Service Market Regional Analysis

- North America dominated the Wi-Fi as a Service market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced networking technologies, high enterprise spending on IT infrastructure, and the presence of major market players

- Enterprises and consumers prioritize wi-fi as a service for enhanced network performance, mobility, and cost-effective connectivity, particularly in urbanized regions with high digital adoption

- Growth is supported by advancements in cloud-based network management, 5G integration, and rising adoption across both small and medium enterprises (SMEs) and large enterprises in various verticals such as IT, telecom, and healthcare

U.S. Wi-Fi as a Service Market Insight

The U.S. wi-fi as a service market captured the largest revenue share of 83.7% in 2024 within North America, fueled by strong demand for managed Wi-Fi solutions and growing awareness of the benefits of cloud-based network scalability. The trend toward digital transformation and increasing reliance on IoT devices further boost market expansion. Enterprises’ adoption of wi-fi as a service for operational efficiency and the growing need for secure, high-speed connectivity complement both infrastructure and service-based offerings.

Europe Wi-Fi as a Service Market Insight

The Europe wi-fi as a service market is expected to witness significant growth, supported by regulatory emphasis on digital connectivity and data security. Enterprises seek scalable Wi-Fi solutions that enhance network reliability and user experience. Growth is prominent in both indoor and outdoor deployments, with countries such as Germany and France showing significant uptake due to rising smart city initiatives and digital infrastructure investments.

U.K. Wi-Fi as a Service Market Insight

The U.K. market for wi-fi as a service is expected to witness rapid growth, driven by demand for high-speed connectivity and seamless network management in urban and suburban settings. Increased focus on digital workplace solutions and rising awareness of cybersecurity benefits encourage adoption. Evolving regulations around data privacy and network reliability influence enterprise choices, balancing performance with compliance.

Germany Wi-Fi as a Service Market Insight

Germany is expected to witness rapid growth in the wi-fi as a service market, attributed to its advanced IT and manufacturing sectors and high focus on operational efficiency and digital transformation. German enterprises prefer cloud-managed Wi-Fi solutions that enhance network performance and reduce operational costs. The integration of wi-fi as a service in smart manufacturing and premium enterprise applications supports sustained market growth.

Asia-Pacific Wi-Fi as a Service Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding digital infrastructure and rising internet penetration in countries such as China, India, and Japan. Increasing awareness of cloud-based connectivity, mobility, and cost efficiency is boosting demand. Government initiatives promoting smart cities and digital economies further encourage the adoption of advanced wi-fi as a service solutions.

Japan Wi-Fi as a Service Market Insight

Japan’s wi-fi as a service market is expected to witness rapid growth due to strong consumer and enterprise preference for high-quality, scalable Wi-Fi solutions that enhance connectivity and operational efficiency. The presence of major technology providers and integration of wi-fi as a service in enterprise IT infrastructure accelerate market penetration. Rising interest in smart city applications and IoT-driven solutions also contributes to growth.

China Wi-Fi as a Service Market Insight

China holds the largest share of the Asia-Pacific wi-fi as a service market, propelled by rapid urbanization, rising enterprise digitalization, and increasing demand for seamless connectivity solutions. The country’s growing tech-savvy population and focus on smart city initiatives support the adoption of advanced wi-fi as a service offerings. Strong domestic technology providers and competitive pricing enhance market accessibility.

Wi-Fi as a Service Market Share

The wi-fi as a service industry is primarily led by well-established companies, including:

- FUJITSU (Japan)

- Superloop Limited (Australia)

- Cisco Systems (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Extreme Networks (U.S.)

- Arris International (U.S.)

- Singtel (Singapore)

- Rogers Communications (Canada)

- Telstra (Australia)

- ADTRAN Inc. (U.S.)

- Viasat, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Arista Networks, Inc. (U.S.)

- Ubiquiti Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Riverbed Technology (U.S.)

- 4ipnet, Inc. (Taiwan)

- Edgecore Networks Corporation (Taiwan)

- Juniper Networks, Inc. (U.S.)

- ALE International (France)

- Allied Telesis, Inc. (Japan)

- LANCOM Systems GmbH (Germany)

What are the Recent Developments in Global Wi-Fi as a Service Market?

- In December 2024, Alkira, a leader in network infrastructure-as-a-service, launched its cloud-based Zero Trust Network Access (ZTNA) service, aimed at transforming enterprise security and connectivity. Built on Alkira’s Cloud Exchange Points (CXPs), the platform delivers secure remote access, granular identity-based controls, and efficient traffic routing across user-to-app, app-to-app, and user-to-internet flows. It integrates seamlessly with existing identity providers and supports multi-factor authentication, offering a single-pane-of-glass dashboard for policy enforcement and network visibility. This scalable, on-demand solution eliminates the need for hardware installations, simplifying security management in multi-cloud environments

- In November 2024, BSNL rolled out a national Wi-Fi roaming service for its Fiber-to-the-Home (FTTH) subscribers across India. This initiative enables users to enjoy high-speed internet at any BSNL Wi-Fi hotspot nationwide, without incurring extra charges. Once registered, customers can seamlessly connect to the “BSNLWiFi_Roaming” network using their FTTH credentials, ensuring uninterrupted connectivity even while traveling. The service is especially beneficial for users in rural and remote areas, bridging the digital divide and enhancing broadband accessibility. It reflects BSNL’s commitment to expanding its footprint and delivering cost-effective connectivity solutions

- In October 2024, Sparklight Business introduced Business Wi-Fi Plus, a cutting-edge mesh Wi-Fi solution tailored for small-to-medium-sized businesses. Developed in partnership with eero, an Amazon company, the service leverages Wi-Fi 6 technology and the eero Pro6E system to deliver seamless, high-speed coverage across entire office spaces. Featuring TrueMesh routing, multiple SSIDs, and advanced security protocols, Business Wi-Fi Plus ensures reliable connectivity for up to 100 devices. Managed via an intuitive mobile app, the solution offers enhanced control, performance, and protection—ideal for modern business environments seeking robust wireless infrastructure

- In September 2024, Huawei unveiled its upgraded Fiber to the Office (FTTO) 2.0 solution, optimized for Wi-Fi 7 technology, during HUAWEI CONNECT 2024. Designed to modernize campus networks across sectors such as education, healthcare, and hospitality, FTTO 2.0 simplifies architecture by reducing network layers from three to two, transitioning from active to passive setups. It also cuts energy consumption by 30% and cabling by 80%, while supporting speeds up to 25Gbps. Leveraging XGS-PON Pro and hard slicing, the solution enables ultra-broadband, intelligent, and eco-friendly connectivity tailored to diverse campus scenarios

- In May 2024, Bharti Airtel and Google Cloud entered a long-term strategic collaboration to deliver advanced cloud solutions to businesses across India. The partnership aims to accelerate cloud adoption, modernization, and the deployment of generative AI technologies for Airtel’s extensive customer base, including over 2,000 large enterprises and one million emerging businesses. Airtel will integrate Google Cloud’s AI capabilities into its offerings—mobile, broadband, and digital TV—while also enhancing internal operations. A dedicated managed services center in Pune will support this initiative, reflecting both companies’ commitment to driving India’s digital transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.