Global Whipping Cream Powder Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

1.57 Billion

2025

2033

USD

1.01 Billion

USD

1.57 Billion

2025

2033

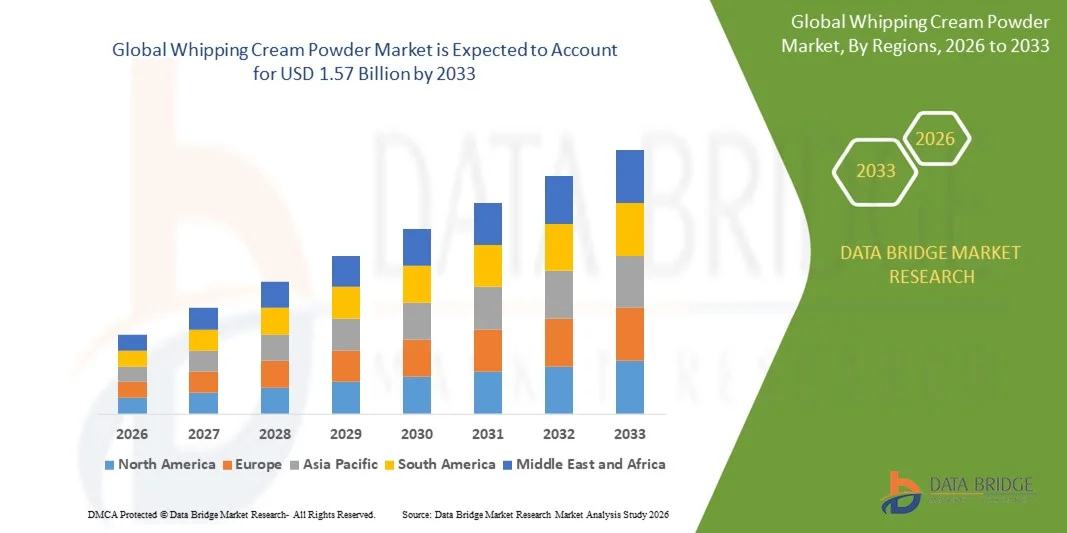

| 2026 –2033 | |

| USD 1.01 Billion | |

| USD 1.57 Billion | |

|

|

|

|

Global Whipping Cream Powder Market Size

- The global Whipping Cream Powder Market size was valued at USD 1.01 billion in 2025 and is expected to reach USD 1.57 billion by 2033, at a CAGR of 5.62% during the forecast period.

- The market growth is largely fueled by increasing consumer preference for convenient, long-shelf-life dairy products and the rising trend of premium desserts, bakery, and confectionery consumption across residential and commercial segments.

- Furthermore, expanding applications of whipping cream powder in cafes, restaurants, and food service industries, along with innovations in flavor, formulation, and packaging, are driving higher adoption. These converging factors are accelerating the demand for whipping cream powder solutions, thereby significantly boosting the industry's growth.

Global Whipping Cream Powder Market Analysis

- Whipping cream powder, used as a convenient and long-shelf-life alternative to fresh cream, is increasingly essential in modern food preparation and bakery applications in both residential and commercial settings due to its versatility, ease of storage, and consistent quality.

- The escalating demand for whipping cream powder is primarily fueled by the growing bakery and confectionery industry, rising consumer preference for ready-to-use and premium dairy ingredients, and expanding applications in cafes, restaurants, and packaged desserts.

- North America dominated the Global Whipping Cream Powder Market with the largest revenue share of 35.3% in 2025, characterized by high consumer awareness of premium dairy products, established bakery and food service industries, and a strong presence of key manufacturers, with the U.S. witnessing substantial growth in whipping cream powder usage in both home baking and commercial food production, driven by product innovations and diversified flavor offerings.

- Asia-Pacific is expected to be the fastest-growing region in the Global Whipping Cream Powder Market during the forecast period due to rising disposable incomes, expanding urban populations, and increasing demand for processed and convenience foods.

- The dairy segment dominated the market with the largest revenue share of 65.4% in 2025, driven by consumer preference for natural milk-based ingredients in baking, desserts, and beverages.

Report Scope and Global Whipping Cream Powder Market Segmentation

|

Attributes |

Whipping Cream Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Nestlé (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Whipping Cream Powder Market Trends

Enhanced Convenience Through Ready-to-Use and Flavor-Infused Formulations

- A significant and accelerating trend in the global Whipping Cream Powder Market is the development of ready-to-use and flavor-enhanced formulations, which are simplifying preparation and enhancing culinary versatility for both home cooks and professional chefs.

- For instance, some premium whipping cream powders now come pre-flavored with vanilla, chocolate, or fruit essences, allowing users to create desserts, beverages, and bakery products quickly without additional ingredients. Similarly, instant reconstitution powders can be whisked or blended in minutes, reducing preparation time and ensuring consistent results.

- Advances in formulation technology also allow whipping cream powders to maintain texture, creaminess, and stability under various storage and cooking conditions, making them suitable for a wide range of applications, from cakes and pastries to coffee beverages and frozen desserts.

- The convenience of these innovations supports centralized kitchen operations in cafes, restaurants, and catering businesses, allowing chefs to prepare consistent-quality products efficiently while minimizing waste and storage constraints.

- This trend toward more convenient, ready-to-use, and multifunctional whipping cream powders is fundamentally reshaping consumer expectations in both residential and commercial food preparation. Consequently, companies such as Nestlé, Fonterra, and Arla Foods are developing innovative powders with enhanced solubility, flavor profiles, and application versatility.

- The demand for whipping cream powders that combine convenience, quality, and flavor innovation is growing rapidly across both domestic and professional sectors, as consumers increasingly seek time-saving, high-quality ingredients that elevate their culinary experiences.

Global Whipping Cream Powder Market Dynamics

Driver

Growing Need Due to Rising Demand for Convenience and Premium Dairy Ingredients

- The increasing preference for convenient, long-shelf-life dairy products, coupled with the rising consumption of premium desserts, bakery items, and beverages, is a significant driver for the heightened demand for whipping cream powder.

- For instance, in 2025, Nestlé launched a range of flavored and instant whipping cream powders targeting home bakers and foodservice providers, offering easy-to-use solutions that reduce preparation time while maintaining product quality. Such strategies by key companies are expected to drive the whipping cream powder market growth in the forecast period.

- As consumers increasingly seek high-quality ingredients that enhance culinary outcomes, whipping cream powders provide consistent texture, creaminess, and flavor, making them a preferred alternative to fresh cream for both residential and commercial applications.

- Furthermore, the growing popularity of cafes, bakeries, and packaged desserts, along with the expansion of ready-to-drink beverages, is making whipping cream powder an essential component in modern kitchens, offering versatility across multiple recipes and applications.

- The convenience of instant preparation, long shelf life, and ease of storage are key factors propelling the adoption of whipping cream powders in both household and professional settings. The trend towards ready-to-use, multifunctional dairy products and the increasing availability of innovative formulations further contribute to market growth.

Restraint/Challenge

Concerns Regarding Shelf Stability, Storage, and Pricing

- Concerns surrounding product shelf life, storage conditions, and proper reconstitution pose challenges to broader market adoption. As whipping cream powders require specific storage conditions to maintain quality, improper handling can affect texture, taste, and performance.

- For instance, fluctuations in temperature and humidity during storage or transportation can compromise powder quality, making some consumers and small foodservice providers hesitant to rely solely on these products.

- Addressing these concerns through improved packaging, better moisture-resistant formulations, and clear usage instructions is crucial for building consumer trust. Companies such as Fonterra and Arla Foods emphasize their advanced processing and packaging technologies to ensure stability and consistency. Additionally, the relatively higher cost of premium whipping cream powders compared to traditional fresh cream can be a barrier for price-sensitive consumers or small-scale food businesses. While some brands have introduced competitively priced options, specialty powders with enhanced flavors or instant reconstitution capabilities often come at a premium.

- While prices are gradually becoming more accessible, the perception of higher costs can still hinder widespread adoption, especially in developing regions or among budget-conscious consumers.

- Overcoming these challenges through innovative packaging, education on proper storage and usage, and the development of more affordable and versatile powder options will be vital for sustained market growth.

Global Whipping Cream Powder Market Scope

The market is segmented on the basis product, application, distribution channel, container, and fat content.

- By Product

On the basis of product, the Global Whipping Cream Powder Market is segmented into dairy and non-dairy variants. The dairy segment dominated the market with the largest revenue share of 65.4% in 2025, driven by consumer preference for natural milk-based ingredients in baking, desserts, and beverages. Dairy whipping cream powders are widely used in commercial kitchens and home baking due to their authentic flavor, rich texture, and superior whipping properties.

The non-dairy segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by increasing lactose intolerance awareness, veganism, and demand for plant-based alternatives. Non-dairy powders made from coconut, soy, or almond milk provide flexibility in formulation while catering to health-conscious and specialty-diet consumers. Both segments benefit from innovations in instant solubility, flavor enhancement, and longer shelf life, but the shift toward plant-based diets is expected to significantly accelerate non-dairy adoption globally.

- By Application

On the basis of application, the Global Whipping Cream Powder Market is segmented into B2B (business-to-business) and B2C (business-to-consumer). The B2C segment accounted for the largest market revenue share of 58.7% in 2025, driven by the rising trend of home baking, premium dessert preparation, and growing consumer interest in convenience products. Increasing urbanization and exposure to Western-style desserts and coffee beverages are fueling home consumption of whipping cream powders.

The B2B segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, supported by rapid growth in cafes, restaurants, bakeries, hotels, and packaged food industries. Commercial users prefer bulk packaging and premium variants that ensure consistency in taste, texture, and performance. The expansion of foodservice chains and industrial-scale dessert manufacturing further boosts B2B adoption, while B2C continues to dominate through retail-ready packages and convenient home-use formats.

- By Distribution Channel

On the basis of distribution channel, the Global Whipping Cream Powder Market is segmented into warehouse clubs, variety stores, department stores, online retail, convenience stores, supermarkets and hypermarkets, specialist retailers, and others. The supermarkets and hypermarkets segment dominated the market with a revenue share of 42.6% in 2025, driven by widespread accessibility, promotional offers, and the presence of multiple brands under one roof.

Online retail is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by e-commerce growth, convenience of doorstep delivery, and increasing consumer trust in online grocery purchases. Specialty retailers and warehouse clubs cater to niche markets and bulk buyers, while convenience stores and department stores provide regional penetration. The overall growth of the distribution network is reinforced by digital ordering platforms, subscription models, and expanding retail footprints, allowing consumers and businesses to access a variety of dairy and non-dairy whipping cream powders efficiently.

- By Container

On the basis of container, the Global Whipping Cream Powder Market is segmented into metal cans, plastic tubs, Tetra Pak, and other packaging formats. The metal can segment dominated the market with the largest revenue share of 46.8% in 2025, owing to its superior protection against moisture, air, and light, ensuring extended shelf life and product stability.

Tetra Pak packaging is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by rising demand for lightweight, eco-friendly, and easy-to-store solutions. Plastic tubs are widely used in both retail and foodservice channels for their reusability and convenience, while specialty packaging formats cater to premium or ready-to-use products. Innovation in resealable designs, portion-controlled containers, and sustainable materials is expected to influence container choices, balancing protection, convenience, and environmental sustainability across both commercial and residential applications.

- By Fat Content

On the basis of fat content, the Global Whipping Cream Powder Market is segmented into regular (30–36%), light (25–29%), ultra-light (15–19%), and non-fat (0%) variants. The regular fat segment dominated the market with a revenue share of 51.3% in 2025, driven by its ability to provide rich texture, superior whipping properties, and authentic cream flavor preferred in bakery, confectionery, and beverage applications.

The ultra-light segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, fueled by growing health consciousness, demand for low-calorie diets, and increasing popularity of light desserts and beverages. Light and non-fat variants are gaining traction in fitness-focused and weight management consumer segments. Innovations in stabilizers and emulsifiers allow reduced-fat powders to perform comparably to full-fat products, further expanding adoption in both residential and commercial settings.

Global Whipping Cream Powder Market Regional Analysis

- North America dominated the Global Whipping Cream Powder Market with the largest revenue share of 35.3% in 2025, driven by growing consumer preference for convenient, long-shelf-life dairy products and the increasing popularity of premium desserts, bakery items, and beverages.

- Consumers in the region highly value the consistent quality, rich flavor, and versatility offered by whipping cream powders for both home baking and commercial food preparation.

- This widespread adoption is further supported by high disposable incomes, well-established foodservice and bakery industries, and increasing awareness of convenient and ready-to-use dairy solutions, establishing whipping cream powder as a preferred ingredient across residential kitchens and commercial establishments.

U.S. Whipping Cream Powder Market Insight

The U.S. whipping cream powder market captured the largest revenue share of 81% in 2025 within North America, fueled by the increasing adoption of convenient, ready-to-use dairy products and the growing trend of home baking and premium dessert consumption. Consumers are increasingly prioritizing high-quality ingredients that offer consistency, rich texture, and enhanced culinary results. The rising popularity of cafes, bakeries, and packaged beverages further propels the whipping cream powder industry. Moreover, product innovations such as flavored and instant-reconstitution powders, alongside the availability of both dairy and non-dairy variants, are significantly contributing to market expansion.

Europe Whipping Cream Powder Market Insight

The Europe whipping cream powder market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing demand for bakery and confectionery products and growing awareness of convenience-focused dairy solutions. Rising urbanization, coupled with a growing café culture and the demand for premium desserts, is fostering the adoption of whipping cream powders. European consumers are also drawn to consistent product quality, long shelf life, and multifunctional usage across residential and commercial kitchens.

U.K. Whipping Cream Powder Market Insight

The U.K. whipping cream powder market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising popularity of home baking, dessert preparation, and ready-to-use dairy ingredients. Additionally, increasing demand from cafes, restaurants, and catering services is encouraging both household and commercial adoption. The U.K.’s strong retail and e-commerce infrastructure further supports market expansion, making whipping cream powders widely accessible for both B2C and B2B consumers.

Germany Whipping Cream Powder Market Insight

The Germany whipping cream powder market is expected to expand at a considerable CAGR during the forecast period, fueled by growing consumer preference for high-quality, premium dairy ingredients and increasing use in commercial kitchens and bakeries. Germany’s well-developed foodservice sector, combined with high awareness of convenience products, promotes the adoption of whipping cream powders. Product innovations that improve solubility, shelf life, and flavor consistency are further enhancing market growth.

Asia-Pacific Whipping Cream Powder Market Insight

The Asia-Pacific whipping cream powder market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and the expansion of cafés, bakeries, and packaged food industries in countries such as China, Japan, and India. The growing popularity of convenience foods and premium desserts, supported by evolving consumer lifestyles, is driving adoption. Additionally, Asia-Pacific is emerging as a hub for dairy processing and powder production, improving affordability and accessibility across the region.

Japan Whipping Cream Powder Market Insight

The Japan whipping cream powder market is gaining momentum due to the country’s strong baking culture, urbanization, and demand for convenience in both household and commercial kitchens. Japanese consumers prioritize high-quality ingredients, consistent texture, and multifunctional applications. The integration of whipping cream powders into desserts, beverages, and bakery products is fueling growth. Moreover, the aging population is likely to spur demand for easy-to-use, ready-to-mix dairy solutions in both residential and professional foodservice sectors.

China Whipping Cream Powder Market Insight

The China whipping cream powder market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and increasing preference for premium and convenient food products. China is one of the largest markets for bakery, confectionery, and café-based consumption, with whipping cream powders becoming increasingly popular in residential and commercial kitchens. Government support for food processing industries, growing awareness of high-quality ingredients, and the availability of both dairy and plant-based powders are key factors propelling market growth in China.

Global Whipping Cream Powder Market Share

The Whipping Cream Powder industry is primarily led by well-established companies, including:

• Nestlé (Switzerland)

• Fonterra (New Zealand)

• Arla Foods (Denmark)

• Lactalis Group (France)

• FrieslandCampina (Netherlands)

• Yili Group (China)

• Mengniu Dairy (China)

• DMK Group (Germany)

• Parmalat (Italy)

• Meiji Holdings (Japan)

• Valio (Finland)

• Milcobel (Belgium)

• Amul (India)

• Anchor (New Zealand)

• Groupe Sodiaal (France)

• Glanbia (Ireland)

• Cabot Creamery (U.S.)

• Alta Dena (U.S.)

• Mori-Nu (Japan)

• Milk Specialties Global (U.S.)

What are the Recent Developments in Global Whipping Cream Powder Market?

- In April 2024, Nestlé, a global leader in dairy and food products, launched a strategic initiative in South Africa aimed at expanding its whipping cream powder offerings for both residential and commercial markets. This initiative underscores the company’s dedication to delivering high-quality, convenient dairy solutions tailored to local culinary preferences. By leveraging its global expertise and innovative formulations, Nestlé is addressing regional demand while strengthening its presence in the rapidly growing global Whipping Cream Powder Market.

- In March 2024, Fonterra Co-operative Group introduced a new line of flavored and instant whipping cream powders specifically designed for cafes, bakeries, and dessert manufacturers. The innovative products provide ease of use, consistent texture, and enhanced flavor profiles, highlighting Fonterra’s commitment to developing versatile dairy solutions that meet professional and consumer needs.

- In March 2024, Arla Foods successfully launched its premium whipping cream powder range in India, targeting the growing foodservice and bakery sectors. This initiative leverages advanced processing technologies to deliver high-quality products with long shelf life and stable performance, reinforcing Arla’s focus on supporting urban culinary trends and expanding its market share.

- In February 2024, FrieslandCampina, a leading dairy cooperative, announced a strategic partnership with major café chains in Europe to supply specialty whipping cream powders for beverages and desserts. This collaboration aims to enhance product consistency, reduce preparation time, and support innovative menu offerings, demonstrating FrieslandCampina’s commitment to catering to both commercial and residential segments.

- In January 2024, Lactalis Group unveiled its new ultra-light whipping cream powder at the International Dairy Expo 2024. Designed for health-conscious consumers and low-fat culinary applications, the product highlights Lactalis’ focus on innovation, convenience, and quality, providing versatile solutions for bakeries, beverage producers, and home kitchens alike.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Whipping Cream Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Whipping Cream Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Whipping Cream Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.