Global Wearable Injectors Market

Market Size in USD Billion

CAGR :

%

USD

8.00 Billion

USD

17.28 Billion

2024

2032

USD

8.00 Billion

USD

17.28 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 17.28 Billion | |

|

|

|

|

Wearable Injectors Market Analysis

The wearable injectors market is witnessing significant growth, driven by rising demand for efficient drug delivery solutions and the increasing prevalence of chronic diseases. These devices, designed for convenient self-administration of medication, are revolutionizing healthcare by offering patients autonomy and improving treatment adherence. Wearable injectors are particularly popular for the delivery of biologics, insulin, and other high-volume medications.

Technological advancements are playing a key role in the market's expansion, with innovations focused on improving device usability, comfort, and the accuracy of drug delivery. Features such as needle-free injection systems, longer battery life, and wireless connectivity are enhancing patient experience. For instance, Insulet Corporation’s Omnipod Insulin Management System has gained recognition for its ease of use and portability. Moreover, the integration of smart technologies, including sensors and remote monitoring capabilities, is driving the adoption of wearable injectors, making them more adaptable to personalized care regimens.

The market is also benefitting from regulatory approvals and advancements in drug formulations, which further enhance the scope for wearable injectors in various therapeutic areas. As healthcare systems continue to prioritize patient-centric solutions, the wearable injectors market is poised for substantial growth.

Wearable Injectors Market Size

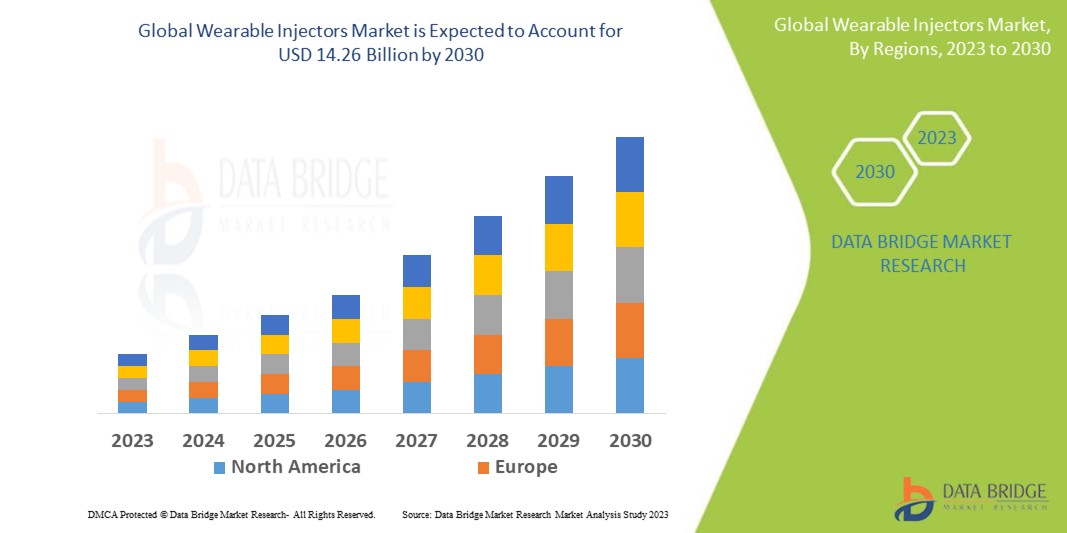

The global wearable injectors market size was valued at USD 8.00 billion in 2024 and is projected to reach USD 17.28 billion by 2032, with a CAGR of 10.10 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Wearable Injectors Market Trends

“Increasing Integration of Smart Technologies”

One key trend in the wearable injectors market is the integration of smart technologies, such as connectivity and remote monitoring capabilities, which enhance the patient experience and treatment management. These innovations allow for real-time tracking of drug delivery, ensuring precise administration and improving adherence to prescribed therapies. For instance, Insulet Corporation's Omnipod Insulin Management System integrates Bluetooth and a smartphone app to provide remote monitoring and dosage adjustments. This trend is particularly significant for chronic conditions such as diabetes, where patients require frequent insulin injections. The use of wearable injectors with built-in connectivity allows healthcare providers to monitor patient data remotely, improving the overall management of the condition. In addition, the ability to track injection history, measure dosage, and receive alerts for potential issues ensures better therapeutic outcomes. As technology continues to advance, the growing demand for these connected devices will likely drive further growth in the wearable injectors market, meeting the needs of both patients and healthcare professionals.

Report Scope and Wearable Injectors Market Segmentation

|

Attributes |

Wearable Injectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

BD (U.S.), Ypsomed AG (Switzerland), Amgen Inc. (U.S.), TJCC Aps (Denmark), ENABLE INJECTIONS (U.S.), Medtronic (Ireland), Insulet Corporation (U.S.), United Therapeutics Corporation (U.S.), CeQur Simplicity (Switzerland), Gerresheimer AG (Switzerland), West Pharmaceutical Services, Inc. (U.S.), Sonceboz (Switzerland), E3D (Israel), Recipharm AB. (U.K.), Stevanato Group (Italy), LTS Lohmann Therapie-Systeme AG (Israel), and Weibel CDS AG (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Wearable Injectors Market Definition

Wearable injectors are medical devices designed to deliver a pre-measured dose of medication, typically via subcutaneous injection, to patients in a convenient, portable, and discrete manner. These devices are worn on the body and can be used for self-administration of drugs, particularly for chronic conditions that require regular injections, such as diabetes, rheumatoid arthritis, and multiple sclerosis.

Wearable Injectors Market Dynamics

Drivers

- Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as diabetes, rheumatoid arthritis, and multiple sclerosis, significantly drives the wearable injectors market. For instance, according to the World Health Organization (WHO), over 422 million people worldwide have diabetes, a condition that often requires regular insulin injections. Similarly, the Centers for Disease Control and Prevention (CDC) reports that more than 54 million Americans are affected by arthritis, with a large portion requiring injectable treatments. These diseases necessitate continuous medication, and wearable injectors provide a practical solution by enabling patients to self-administer injections comfortably at home, enhancing their quality of life. This growing demand for efficient drug delivery methods is fueling the adoption of wearable injectors, as they offer an ideal solution for those with long-term treatment regimens. The convenience and ease of use offered by wearable injectors, especially for chronic disease management, position them as a key market driver, making them essential in meeting the needs of an expanding patient base worldwide.

- Growing Demand for Self-Administration

The growing demand for self-administration in healthcare is becoming a significant driver for the wearable injectors market. With the rising focus on empowering patients, especially those with chronic diseases such as diabetes, wearable injectors offer an accessible and efficient solution for home-based treatment. According to a report by the International Diabetes Federation, over 400 million people globally suffer from diabetes, many of whom require daily insulin injections. Wearable injectors enable these patients to administer their medication autonomously, enhancing their quality of life and reducing the burden on healthcare facilities. For instance, the Insulet Omnipod system, which is a popular wearable injector, allows insulin-dependent diabetic patients to manage their insulin delivery conveniently without the need for multiple daily injections or visits to healthcare centers. As patients increasingly prefer these devices for their convenience and ease of use, the growing demand for self-administered solutions is fueling the expansion of the wearable injectors market.

Opportunities

- Increasing Technological Advancements

Technological advancements are significantly driving the wearable injectors market by enhancing their efficiency, ease of use, and functionality. Innovations such as the integration of smart technologies, real-time monitoring, and automated drug administration are transforming how medications are delivered. For instance, the integration of Bluetooth connectivity in devices such as the BD Intevia injector allows patients to track their medication schedule, receive reminders, and share real-time data with healthcare providers, all through a smartphone application. This capability improves patient adherence to treatment and enhances the overall user experience by enabling seamless interactions between patients and healthcare professionals. In addition, automated systems ensure accurate, consistent dosing and reduce human error, increasing the reliability of the injectors. As these technologies continue to evolve, offering more personalized and connected experiences, wearable injectors present a significant market opportunity for companies to tap into the growing demand for more efficient, convenient, and patient-centered drug delivery solutions.

- Increasing Trend of Home Healthcare

The increasing trend of home healthcare is significantly driving the adoption of wearable injectors, as these devices enable patients to manage their treatments independently, reducing the need for frequent healthcare visits. This is especially important in regions with limited access to healthcare services, where patients may struggle to visit clinics or hospitals regularly for treatments. For instance, in rural areas or remote locations, patients with chronic conditions such as diabetes or rheumatoid arthritis can use wearable injectors to administer insulin or biologic treatments at home, improving their quality of life while avoiding long travel times. These devices enhance convenience and contribute to cost savings, as they reduce healthcare system burdens and improve patient outcomes. As home healthcare becomes more prevalent, wearable injectors offer a substantial market opportunity for companies to provide solutions that empower patients to manage their health effectively and autonomously, further expanding the market reach and demand for such devices.

Restraints/Challenges

- High Development Costs

High development costs present a significant market challenge for wearable injectors, as manufacturers must invest heavily in advanced technologies to ensure that these devices are safe, reliable, and effective. For instance, wearable injectors require sophisticated components such as microelectronics, sensors for accurate drug delivery, and durable materials to ensure patient safety and comfort. The research and development phase can involve extensive testing, clinical trials, and regulatory approvals, particularly when aiming for compliance with stringent standards set by health authorities such as the FDA. This process can take several years and involves substantial financial resources, which may be a barrier for smaller companies without access to significant capital. As a result, the high upfront investment can lead to higher production costs, which are often passed on to the end consumer. For instance, a wearable insulin injector designed for diabetes management may cost more than traditional insulin pens or syringes, making it less accessible to a broader population. This can limit market penetration, especially in developing countries or for patients who lack comprehensive insurance coverage. Thus, the high development costs restrict market entry for smaller players and hinder the widespread adoption of wearable injectors, making this a key challenge for the industry.

- Regulatory and Compliance Challenges

Regulatory and compliance challenges are a significant hurdle in the wearable injector market, as these devices must meet stringent requirements set by health authorities such as the FDA, EMA, and other global agencies. The approval process for wearable injectors is often time-consuming and expensive, involving extensive clinical trials, safety tests, and regulatory filings to demonstrate the device’s safety and efficacy. For instance, the process of getting a wearable injector for chronic conditions such as diabetes approved by the FDA requires numerous rounds of testing to ensure that the device delivers the correct dose of medication consistently and without adverse effects. These regulatory hurdles can delay product launches by several years, raising development costs and affecting manufacturers' ability to bring new innovations to market quickly. The lengthy approval process also means that companies face the challenge of navigating shifting regulatory standards, which can vary across different regions, further complicating international market expansion. Consequently, these delays and increased costs slow the adoption of new wearable injector technologies, limiting the speed at which improvements in drug delivery are made accessible to patients.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Wearable Injectors Market Scope

The market is segmented on the basis of type, therapy, technology, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- On-Body

- Off-Body

Therapy

- Immuno-Oncology

- Diabetes

- Cardiovascular Diseases

- Parkinson's Disease

- Thalassemia

- Primary Immunodeficiency Disease

Technology

- Spring-based

- Motor-driven

End-Use

- Hospitals

- Clinics

- Homecare

- Others

Wearable Injectors Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, therapy, technology, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market for antiparasitic drugs, driven by the rising prevalence of chronic diseases, such as diabetes and arthritis, which require frequent medication administration. The region's advanced healthcare infrastructure enables efficient distribution and use of these devices, with widespread access to large-volume injectors that cater to patients' needs. Moreover, the region benefits from technological advancements in wearable injectors, improving ease of use, patient comfort, and accuracy in drug delivery. This combination of factors is driving the widespread adoption of wearable injectors, contributing to the market's robust growth in North America.

Asia-Pacific is the fastest growing region in the wearable injectors market in the coming years, primarily due to the increasing awareness of ultra-large volume devices among both healthcare providers and patients. Governments in several countries within the region are also implementing favorable initiatives and policies to promote the adoption of medical devices, which directly benefits the growth of wearable injectors. These initiatives include subsidies, regulatory support, and efforts to improve healthcare accessibility, particularly in developing economies. In addition, the expanding healthcare infrastructure in countries such as China, India, and Japan is further accelerating the market's adoption, driving the widespread integration of wearable injectors in both clinical settings and home care solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Wearable Injectors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Wearable Injectors Market Leaders Operating in the Market Are:

- BD (U.S.)

- Ypsomed AG (Switzerland)

- Amgen Inc. (U.S.)

- TJCC Aps (Denmark)

- ENABLE INJECTIONS (U.S.)

- Medtronic (Ireland)

- Insulet Corporation (U.S.)

- United Therapeutics Corporation (U.S.)

- CeQur Simplicity (Switzerland)

- Gerresheimer AG (Switzerland)

- West Pharmaceutical Services, Inc. (U.S.)

- Sonceboz (Switzerland)

- E3D (Israel)

- Recipharm AB (U.K.)

- Stevanato Group (Italy)

- LTS Lohmann Therapie-Systeme AG (Israel)

- Weibel CDS AG (Switzerland)

Latest Developments in Wearable Injectors Market

- In May 2023, Enable Injections, Inc. entered into a partnership with Viridian Therapeutics, Inc., a biotech company based in the U.S., to expand their collaborative efforts in the field of drug delivery systems

- In January 2023, Tandem Diabetes Care, Inc. completed the acquisition of AMF Medical SA, the producer of the Sigi Patch Pump, enhancing its product portfolio for diabetes management solutions

- In June 2022, AbbVie received approval from the U.S. FDA for SKYRIZI, an interleukin-23 inhibitor, for the treatment of moderately to severely active Crohn’s disease. Administered through subcutaneous injection, it provides a self-administration option using the On-Body Injector

- In January 2022, Enable Injections secured USD 215 million in funding to further develop enFuse, a subcutaneous drug delivery system that includes a wearable delivery disc and a vessel transfer system, aimed at improving drug delivery efficiency

- In April 2020, Insulet Corporation, known for its Omnipod Insulin Management System, offered financial assistance to its U.S. customers affected by the pandemic, providing eligible individuals with up to a six-month supply of products free of charge to alleviate financial challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.