Global Wearable Devices Market

Market Size in USD Billion

CAGR :

%

USD

193.91 Billion

USD

764.22 Billion

2024

2032

USD

193.91 Billion

USD

764.22 Billion

2024

2032

| 2025 –2032 | |

| USD 193.91 Billion | |

| USD 764.22 Billion | |

|

|

|

|

Wearable Devices Market Size

Wearable Devices Market Size

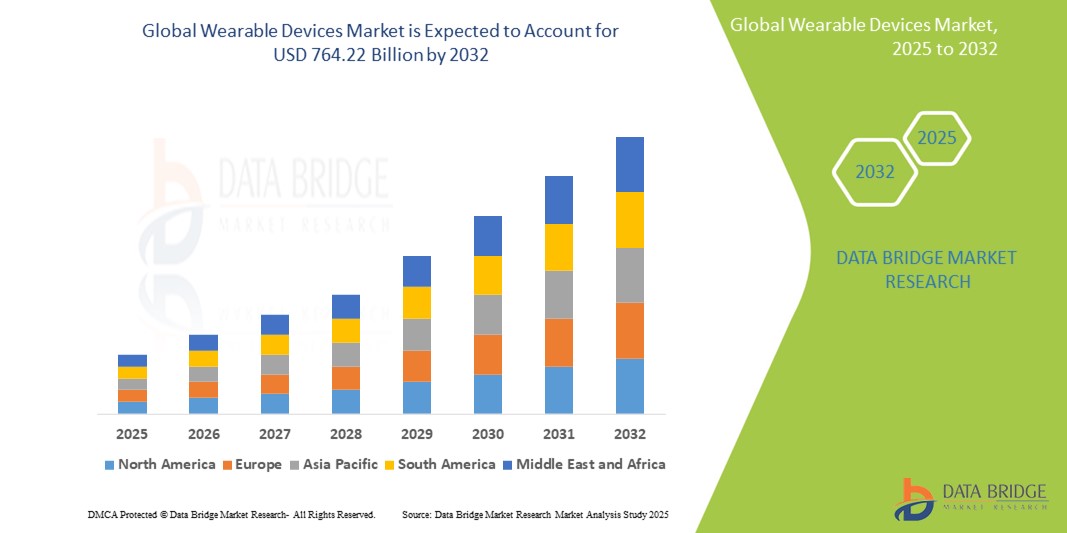

- The global wearable devices market was valued at USD 193.91 billion in 2024 and is expected to reach USD 764.22 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 18.7%, primarily driven by the rising health and fitness awareness

- This growth is driven by factors such as the expansion of healthcare applications and advancement in technology

Wearable Devices Market Analysis

- Wearable devices are increasingly vital tools in modern health monitoring and personal wellness, offering real-time tracking of physiological metrics such as heart rate, activity levels, sleep patterns, and blood oxygen saturation. These devices are widely used in fitness management, chronic disease monitoring, and preventive healthcare

- The demand for wearable devices is largely fueled by rising health consciousness, technological advancements, and the growing prevalence of chronic lifestyle-related diseases such as diabetes, hypertension, and cardiovascular conditions. A significant portion of global demand is attributed to fitness and wellness applications, while medical-grade wearables are gaining traction in clinical settings

- North America stands out as one of the dominant regions for wearable devices, driven by high consumer awareness, strong digital infrastructure, and a robust ecosystem of health-tech innovation

- For instance, the U.S. market has seen a continuous surge in the adoption of smartwatches and fitness trackers, not only for recreational use but also for health monitoring. Major tech companies and startups based in North America are leading the development and integration of AI-powered features in wearable technologies

- Globally, wearable devices rank among the top three digital health tools used by consumers and healthcare providers such as, following mobile health apps and telemedicine platforms. These devices play a critical role in promoting proactive health management, enabling early intervention, and supporting the transition to value-based care

Report Scope and Wearable Devices Market Segmentation

|

Attributes |

Wearable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wearable Devices Market Trends

“Increasing Adoption of AI Integration and Health Data Analytics”

- One prominent trend in the global wearable device market is the growing adoption of AI integration and health data analytics

- These advanced features enhance the functionality and effectiveness of wearable devices by providing users with personalized insights and predictive health monitoring

- For instance, AI-powered wearables can analyze real-time data from sensors (such as heart rate, oxygen levels, and sleep patterns) to predict potential health issues, such as heart disease or sleep apnea, before symptoms become critical. This is especially valuable for individuals managing chronic conditions such as diabetes or hypertension

- Health data analytics also allows for the aggregation of data from multiple devices or sources, offering a comprehensive overview of a user’s health. This trend facilitates better decision-making, proactive healthcare, and personalized wellness plans

- This trend is revolutionizing personal health management, enabling users to take a more active role in their health. As a result, there is increasing demand for wearables that not only track physical activity but also provide predictive analytics and actionable health insights, driving market growth in both consumer and medical-grade wearable devices

Wearable Devices Market Dynamics

Driver

“Growing Need Due to Rising Health Consciousness and Chronic Diseases”

- The increasing prevalence of chronic diseases such as diabetes, hypertension, cardiovascular diseases, and obesity is significantly driving the demand for wearable devices.

- As the global population becomes more health-conscious and lifestyle-related diseases continue to rise, individuals are increasingly turning to wearables for health tracking, fitness management, and preventive care

- Wearable devices, such as smartwatches and fitness trackers, are becoming essential tools for monitoring heart rate, activity levels, sleep patterns, and blood glucose levels. This helps individuals track their health and take early actions to prevent or manage chronic conditions.

- The adoption of wearable devices is especially prominent in developed regions, where high healthcare awareness and access to advanced technologies facilitate growth

For instance,

- In January 2023, according to a report published by the World Health Organization (WHO), the rising incidence of diabetes and cardiovascular diseases, particularly among adults aged 45 and older, highlights the growing need for preventive health tools. This trend acts as a key driver for the global wearable device market, as consumers seek to manage these conditions through continuous health monitoring.

- In March 2022, a study published by CDC indicated that nearly 47% of U.S. adults have one or more chronic diseases, creating a significant market opportunity for wearables to support long-term health management

- The rising prevalence of chronic diseases such as diabetes, hypertension, and obesity is driving the demand for wearable devices, as individuals seek health tracking and preventive care solutions

Opportunity

“Advancement in AI and Machine Learning for Personalized Health Insights”

- The integration of AI and machine learning into wearable devices is revolutionizing the way users track and manage their health by providing personalized, real-time insights

- AI algorithms embedded in wearables can analyze data from sensors (such as heart rate, body temperature, and blood oxygen levels) and deliver actionable feedback to users. These insights can help individuals better understand their health trends, track progress, and identify potential health risks before they become critical

- AI-powered wearables also enable predictive health monitoring, where the device can provide early warnings for conditions such as arrhythmias, irregular sleep patterns, or elevated stress levels, enhancing proactive health management

For instance,

- In January 2025, a study published in JAMA Cardiology highlighted that AI-powered wearables could detect early signs of atrial fibrillation with over 95% accuracy, enabling early intervention and significantly reducing the risk of stroke

- In November 2023, Harvard Medical School published an article showing how AI in wearables can help optimize fitness regimens by analyzing individual data patterns and providing tailored workout recommendations that improve health outcomes

- The integration of AI and machine learning in wearable devices enhances personalized health tracking, provides early warnings for health risks, and improves proactive health management through predictive insights and tailored recommendations

Restraint/Challenge

“High Costs and Limited Affordability for Mass Adoption”

- The high cost of advanced wearable devices remains a significant barrier to mass adoption, particularly in developing regions and among budget-conscious consumers

- Premium wearable devices with advanced features, such as medical-grade sensors, AI integration, and advanced health monitoring, can cost hundreds of dollars, which may deter widespread use in lower-income populations

- In addition, the price of wearables with long battery life, durability, and health data integration with smartphones or healthcare systems can be prohibitively expensive for many consumers, especially in emerging markets

For instance,

- In June 2024, according to a report by Gartner, the high price of smartwatches with health-monitoring capabilities is a major concern in emerging markets such as Southeast Asia, where the affordability of these devices remains a key barrier to adoption

- In July 2023, a study published by Nielsen revealed that 40% of potential wearable device buyers in Africa cited cost as the primary factor preventing them from purchasing health-focused wearables

- The high cost of advanced wearable devices, particularly in emerging markets, remains a major barrier to mass adoption, limiting accessibility for budget-conscious consumers

Wearable Devices Market Scope

The market is segmented on the basis of product, type, technology, and industry.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Industry

|

|

|

By End User |

|

Wearable Devices Market Regional Analysis

“North America is the Dominant Region in the Wearable Devices Market”

- North America dominates the wearable devices market, driven by a combination of advanced healthcare infrastructure, high consumer awareness, and widespread adoption of smart technologies

- U.S. holds the largest market share, fueled by rising demand for continuous health monitoring, the growing prevalence of lifestyle-related diseases such as obesity and cardiovascular conditions, and the integration of wearables into clinical care and corporate wellness programs

- The region benefits from strong support for digital health innovation, favorable reimbursement policies for certain medical-grade wearables, and the presence of major tech and health companies such as Apple, Fitbit (Google), and Garmin, which continue to launch AI-powered and feature-rich devices

- In addition, the growing use of wearables in remote patient monitoring (RPM) and telehealth services, especially post-COVID-19, has significantly contributed to market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the wearable devices market, driven by rapidly improving healthcare infrastructure, rising smartphone penetration, and increasing consumer interest in health and fitness

- Countries such as China, India, Japan, and South Korea are emerging as key markets due to growing middle-class populations, increasing disposable income, and heightened awareness of the importance of preventive health care

- Japan continues to lead in the adoption of advanced wearable technologies for elder care and chronic disease management, while China and India are seeing explosive growth in consumer wearables for fitness, wellness, and mobile health tracking

- The presence of local manufacturers offering cost-effective smart wearables, combined with increased government initiatives promoting digital health and foreign investments in the health-tech sector, further fuels the regional market’s rapid expansion

Wearable Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SAMSUNG (South Korea)

- Garmin Ltd. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Apple Inc. (U.S.)

- Sony Group Corporation (Japan)

- HTC Corporation (Taiwan)

- Google (U.S.)

- Xiaomi (China)

- ADIDAS AG (Germany)

- Nike, Inc. (U.S.)

- LG Electronics (South Korea)

- Motorola Solutions, Inc. (U.S.)

- Fossil Group (U.S.)

- Polar Electro (Finland)

- Withings (France)

- Michael Kors (U.S.)

- CASIO COMPUTER CO., LTD. (Japan)

- TomTom International BV (Netherlands)

- ASUSTeK Computer Inc. (Taiwan)

Latest Developments in Global Wearable Devices Market

- In February 2025, Apple Inc. unveiled its latest wearable innovation, the Apple Watch Series 10, featuring enhanced AI-driven health insights, non-invasive blood glucose monitoring, and mental wellness tracking through mood detection algorithms. The device also integrates seamlessly with the Apple Health ecosystem, offering new personalized workout plans and medication adherence reminders, further bridging the gap between consumer wellness and clinical health applications

- In January 2025, Garmin Ltd. introduced its next-gen smartwatch, the Garmin Venu 3X, targeting endurance athletes and health-focused users. The watch incorporates advanced biometric sensors, including skin temperature, hydration tracking, and recovery metrics. The device also features enhanced sleep coaching powered by AI, making it a valuable tool for users seeking detailed wellness analysis and lifestyle optimization

- In December 2024, Huawei Technologies launched the Huawei Watch D2, expanding its lineup of medically certified wearables in select European and Asian markets. The Watch D2 includes clinical-grade ECG, continuous blood pressure monitoring, and early arrhythmia detection. It also received CE certification for medical-grade accuracy, reflecting Huawei’s growing role in blending consumer tech with regulated health tools

- In November 2024, Google LLC officially rolled out a major update to its Wear OS platform, introducing new AI-powered health insights, expanded third-party medical device integration, and a streamlined interface for fitness tracking and remote health monitoring. The update is designed to support broader compatibility with devices from Fitbit, Fossil, and other leading Wear OS brands, enhancing the platform's relevance in both fitness and digital health sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.