Global Water Detection Sensors Market Segmentation, By Sensor Type (Chlorine Residual Sensor, pH Sensor, TOC Sensor, ORP Sensor, Conductivity Sensor, and Others), Size (Less than 38 mm and More than 38 mm), Weight (Less than 60 gms and More than 60 gms), Device Range (Less than 250 ft and More than 250 ft), Voltage Range (Less than 15 VDC, 15 VDC TO 25 VDC, and More than 25 VDC), Purpose (Constitute in Water (Chemical Concentrations, Solids) and Measuring Surrogates), Connectivity (Wireless and Wired), End Use (Industrial, Drinking Water, Ground Water, Aquaculture, Wastewater, and Others) – Industry Trends and Forecast to 2032

Water Detection Sensors Market Analysis

The water detection sensors market is witnessing significant growth due to increasing concerns over water leakage, conservation, and efficient monitoring systems. These sensors are widely used across residential, commercial, and industrial applications to detect leaks, prevent water damage, and optimize water usage. Technological advancements, such as IoT-enabled smart sensors, real-time monitoring, and automated alerts, are driving market expansion. Growing regulatory emphasis on water conservation and rising demand for smart infrastructure further fuel adoption. Recent developments include the integration of AI-driven analytics for predictive maintenance and enhanced sensor accuracy. Companies are focusing on innovations in wireless connectivity, battery efficiency, and multi-parameter sensing to improve reliability. The market is also benefiting from the rise in smart home adoption and stringent water management policies worldwide. As industries and households strive for efficient water management, the demand for advanced water detection sensors is expected to surge, positioning the market for continued growth.

Water Detection Sensors Market Size

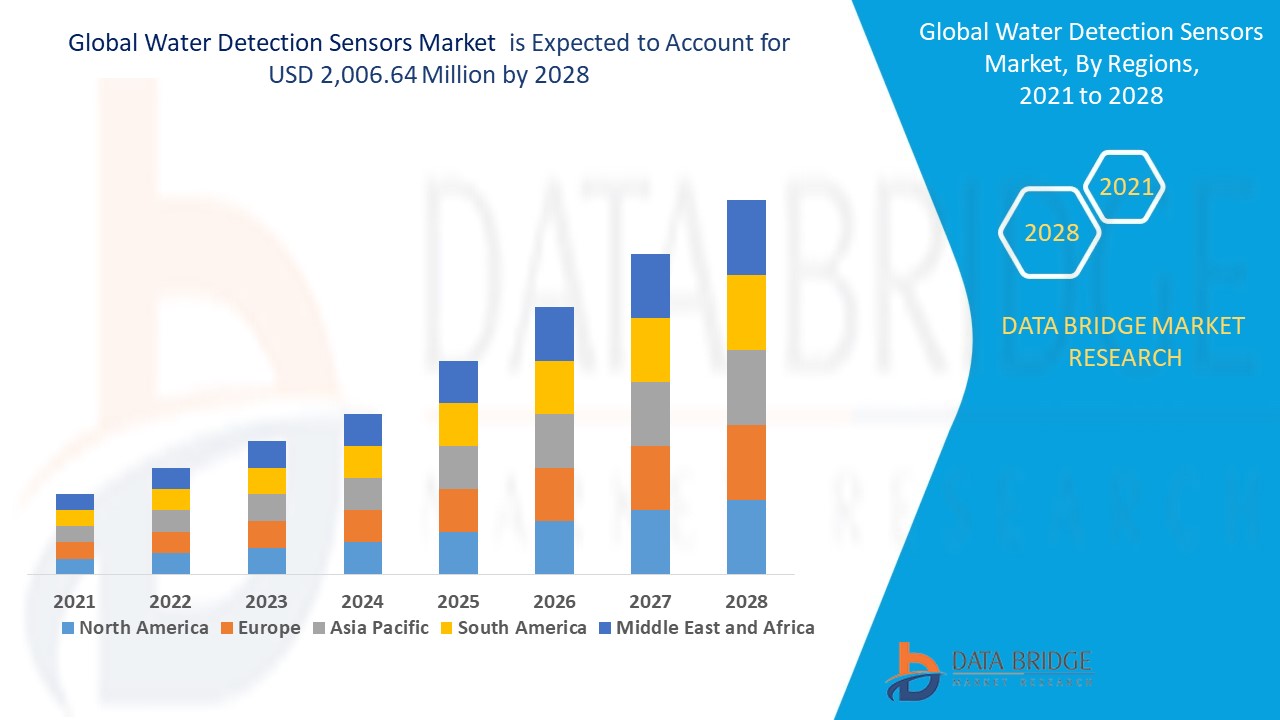

The global water detection sensors market size was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.61 billion by 2032, with a CAGR of 6.90% during the forecast period of 2025 to 2032 In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Water Detection Sensors Market Trends

“Adoption of IoT-Enabled Sensors for Real-Time Water Monitoring”

The integration of Internet of Things (IoT) technology in water detection sensors is revolutionizing real-time water leakage and quality monitoring. Smart sensors equipped with wireless connectivity, cloud integration, and AI-powered analytics enable instant detection of leaks, contamination, and abnormal water usage patterns. These sensors provide continuous data transmission, allowing predictive maintenance and reducing water wastage. Industries, municipalities, and residential sectors are increasingly adopting these solutions to enhance efficiency, comply with environmental regulations, and minimize operational costs. The rise of smart infrastructure and digital water management systems is further accelerating the deployment of connected water sensors, ensuring proactive responses to potential water-related issues and optimizing resource utilization across various applications.

Report Scope and Water Detection Sensors Market Segmentation

|

Attributes

|

Water Detection Sensors Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

The Detection Group, Inc. (U.S.), Dwyer Instruments, LLC. (U.S.), Campbell Scientific, Inc. (U.S.), TTK - Leak Detection System (France), Emerson Electric Co. (U.S.), HORIBA Group (Japan), CMR Electrical (U.K.), Endress+Hauser Group Services AG (Switzerland), Insteon (U.S.), Nice - Polska Sp. z o.o. (Poland), Fortive (U.S.), Hermann Sewerin GmbH (Germany), RIKO Float Technology Co., Ltd. (Taiwan), Danaher (U.S.), Libelium Comunicaciones Distribuidas S.L. (Spain), TE Connectivity (Switzerland), Ijinus (France), Waxman Energy (U.K.), Infineon Technologies AG (Germany), Sontay Ltd. (U.K.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Water Detection Sensors Market Definition

Water detection sensors are electronic devices designed to identify the presence of water or moisture in a specific area. They operate by detecting changes in conductivity, capacitance, or other physical properties of water. These sensors are commonly used in leak detection, flood prevention, water quality monitoring, and industrial applications. They can be standalone units or integrated with Internet of Things (IoT) systems for real-time alerts and data analysis. Water detection sensors play a crucial role in preventing water damage, conserving resources, and ensuring compliance with environmental regulations across residential, commercial, and industrial sectors.

Water Detection Sensors Market Dynamics

Drivers

- Rising Industrial Applications

Industries such as manufacturing, oil & gas, and pharmaceuticals are increasingly deploying water detection sensors to enhance operational efficiency and prevent costly damages. These sensors play a critical role in detecting leaks, monitoring water usage, and ensuring compliance with stringent environmental and safety regulations. In manufacturing, they help optimize production processes by preventing equipment damage caused by water leaks. The oil & gas sector relies on advanced sensors for pipeline monitoring and spill prevention, while pharmaceutical companies use them to maintain strict hygiene and water purity standards. The growing emphasis on process optimization and regulatory compliance is fueling market growth.

- Increasing Water Conservation Efforts

Rising global concerns over water scarcity and wastage are significantly driving the adoption of water detection sensors across various industries and residential sectors. With freshwater resources depleting and climate change intensifying water shortages, efficient monitoring and management have become critical. Water detection sensors help prevent leaks, optimize water distribution, and reduce unnecessary consumption. Governments and organizations are increasingly investing in smart water management systems, integrating real-time monitoring technologies to ensure sustainable usage. As conservation efforts gain momentum, the demand for advanced water detection sensors continues to grow, supporting proactive water management and resource efficiency across multiple applications.

Opportunities

- Advancements in Smart Sensor Technology

Innovations in wireless connectivity, AI-driven analytics, and miniaturized sensor technology are creating significant growth opportunities in the water detection sensors market. Wireless sensors eliminate the need for complex wiring, enabling easy installation and remote monitoring in residential, industrial, and commercial settings. AI-powered analytics enhance predictive maintenance by identifying leaks, contamination, and abnormal water usage patterns in real time. In addition, miniaturized sensors allow for seamless integration into compact and portable devices, expanding their applications across various industries. As demand for smart water management solutions rises, these technological advancements are driving greater adoption, improving efficiency, and opening new market opportunities.

- Increased Awareness and Disaster Prevention

Growing awareness of flood risks and water-related damages is creating a strong market opportunity for water detection sensors in residential, commercial, and industrial spaces. With climate change increasing the frequency of extreme weather events, property owners and businesses are prioritizing proactive water damage prevention. Water detection sensors provide early warnings of leaks, pipe bursts, and flooding, minimizing costly repairs and operational disruptions. Insurance companies are also encouraging sensor adoption to reduce claim losses. As urbanization accelerates and smart building technologies advance, the demand for reliable water monitoring solutions continues to grow, driving expansion in the water detection sensors market.

Restraints/Challenges

- Sensor Accuracy & False Alarms

One of the key challenges in the water detection sensors market is inconsistent sensor performance, leading to false positives or missed detections. False alarms can cause unnecessary maintenance costs and operational disruptions, while failure to detect water leaks or contamination in time can result in severe property damage and financial losses. Variability in sensor sensitivity, environmental factors such as humidity, and interference from external sources can affect accuracy. These reliability concerns impact user trust and slow adoption, particularly in critical applications such as industrial facilities and smart buildings. Improving sensor precision and developing advanced calibration techniques remain crucial for market growth.

- High Initial Costs

The high cost of advanced water detection sensors, particularly those integrated with IoT and AI technologies, poses a significant barrier to market adoption in cost-sensitive regions. These sensors require sophisticated components, wireless connectivity, and cloud-based data processing, all of which contribute to elevated pricing. Small businesses, residential users, and developing economies often find these solutions financially challenging, slowing widespread deployment. In addition, the need for periodic maintenance, software updates, and network infrastructure further adds to operational expenses. To overcome this restraint, manufacturers must focus on cost-effective production, affordable sensor models, and scalable solutions tailored for budget-conscious markets.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Water Detection Sensors Market Scope

The market is segmented on the basis of sensor type, size, weight, device range, voltage range, purpose, connectivity, and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Sensor Type

- Chlorine Residual Sensor

- pH Sensor

- TOC Sensor

- ORP Sensor

- Conductivity Sensor

- Others

Size

- Less than 38 mm

- More than 38 mm

Weight

- Less than 60 gms

- More than 60 gms

Device Range

- Less than 250 ft

- More than 250 ft

Voltage Range

- Less than 15 VDC

- 15 VDC to 25 VDC

- More than 25 VDC

Purpose

- Constitute in Water (Chemical Concentrations, Solids)

- Measuring Surrogates

Connectivity

- Wireless

- Wired

End Use

- Industrial

- Drinking Water

- Ground Water

- Aquaculture

- Wastewater

- Others

Water Detection Sensors Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, sensor type, size, weight, device range, voltage range, purpose, connectivity, and end use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The Asia Pacific region is set to dominate the water detection sensors market, driven by rapid industrialization and urbanization. Increasing government investments in water management and stricter environmental regulations are accelerating adoption. Rising concerns over water pollution further fuel demand across industries and municipalities.

North America is expected to be the fastest-growing region in the water detection sensors market. The rise in residential swimming pools and the increasing adoption of automatic pool cleaners equipped with water quality sensors are key growth drivers. Growing awareness of water safety and advanced smart home technologies further accelerate market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Water Detection Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Water Detection Sensors Market Leaders Operating in the Market Are:

- The Detection Group, Inc. (U.S.)

- Dwyer Instruments, LLC. (U.S.)

- Campbell Scientific, Inc. (U.S.)

- TTK - Leak Detection System (France)

- Emerson Electric Co. (U.S.)

- HORIBA Group (Japan)

- CMR Electrical (U.K.)

- Endress+Hauser Group Services AG (Switzerland)

- Insteon (U.S.)

- Nice - Polska Sp. z o.o. (Poland)

- Fortive (U.S.)

- Hermann Sewerin GmbH (Germany)

- RIKO Float Technology co.,ltd (Taiwan)

- Danaher (U.S.)

- Libelium Comunicaciones Distribuidas S.L. (Spain)

- TE Connectivity (Switzerland)

- Ijinus (France)

- Waxman Energy (U.K.)

- Infineon Technologies AG (Germany)

- Sontay Ltd. (U.K.)

Latest Developments in Water Detection Sensors Market

- In 2022, Indian startup RefillBot launched an advanced Remote Monitoring and Management (RMM) solution using IoT and sensor technology for real-time water quality monitoring. Deployed across 100 Karnataka villages in four months, it aims to improve clean water access

- In 2022, ANB Sensors introduced a calibration-free pH monitoring solution for water quality assessment. Designed for accuracy and low maintenance, it offers real-time monitoring and seamless integration with data networks, enhancing cost-effective water analysis

SKU-