Global Warehouse Robotics Market

Market Size in USD Billion

CAGR :

%

USD

10.10 Billion

USD

27.54 Billion

2024

2032

USD

10.10 Billion

USD

27.54 Billion

2024

2032

| 2025 –2032 | |

| USD 10.10 Billion | |

| USD 27.54 Billion | |

|

|

|

|

Warehouse Robotics Market Size

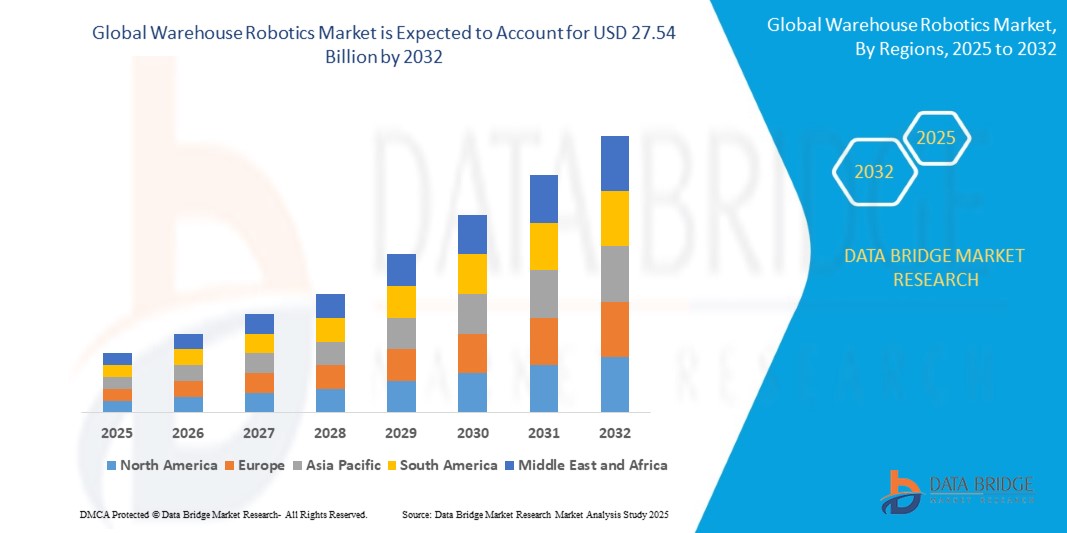

- The global warehouse robotics market was valued at USD 10.10 billion in 2024 and is expected to reach USD 27.54 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.36%, primarily driven by the increasing demand for automation and operational efficiency in warehousing and logistics

- This growth is driven by factors such as the rapid expansion of e-commerce, rising labor costs, technological advancements in robotics and AI, and the need for faster, error-free order fulfilment

Warehouse Robotics Market Analysis

- Innovations in artificial intelligence and machine learning are enhancing the capabilities of warehouse robots, enabling tasks such as real-time inventory management and adaptive decision-making

- The market comprises various robotic types, including autonomous mobile robots, automated guided vehicles, articulated robots, and collaborative robots, each serving specific functions such as picking, sorting, and transportation

- Key sectors adopting warehouse robotics include e-commerce, automotive, consumer electronics, and food and beverage industries, driven by the need for efficient logistics and supply chain operations

- Companies are increasingly investing in robotic solutions to enhance operational efficiency and reduce labor costs

Report Scope and Warehouse Robotics Market Segmentation

|

Attributes |

Warehouse Robotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Warehouse Robotics Market Trends

“Integration of Advanced Robotics and Artificial Intelligence”

- The warehouse robotics market is evolving towards the integration of advanced robotics and artificial intelligence, enabling robots to perform complex tasks with greater autonomy and efficiency

- Companies are investing in technologies such as machine learning and computer vision to enhance robots' decision-making capabilities, allowing them to adapt to dynamic warehouse environments

- For instance, Amazon has deployed over 750,000 mobile robots and tens of thousands of robotic arms in its fulfillment centers, utilizing AI to optimize sorting and inventory management processes

- This trend is leading to the development of "smart warehouses," where robots collaborate seamlessly with human workers to improve operational efficiency

- The adoption of AI-powered robots is not only streamlining warehouse operations but also reducing costs and improving delivery times, setting new standards for the logistics industry

Warehouse Robotics Market Dynamics

Driver

“Surge in E-Commerce and Demand for Faster Fulfillment”

- The rapid growth of e-commerce has significantly increased the demand for efficient and scalable warehouse operations

- Consumers' expectations for faster delivery times are pushing companies to adopt automation solutions to meet these demands

- For Instance, Amazon's investment in robotics-led warehouses aims to achieve a reduction in fulfillment costs and enhance delivery speed

- The need to handle large volumes of orders efficiently is driving the adoption of automated guided vehicles and autonomous mobile robots in warehouses

- This surge in e-commerce is a primary driver of the warehouse robotics market, prompting companies to invest heavily in automation technologies

Opportunity

“Expansion into Emerging Markets”

- Emerging markets present significant growth opportunities for the warehouse robotics industry due to rapid industrialization and increasing adoption of automation

- Countries such as India and Brazil are witnessing a surge in e-commerce activities, creating a demand for automated logistics solutions

- Companies are entering these markets to capitalize on the growing need for efficient warehouse operations

- This expansion into emerging markets allows companies to tap into new revenue streams and establish a strong presence in developing economies

Restraint/Challenge

“High Initial Investment Costs”

- The high initial investment required for implementing warehouse robotics systems remains a significant barrier for many companies

- The cost encompasses not only the robots themselves but also expenses related to system integration, software, and infrastructure modifications

- Small to medium-sized enterprises may find these upfront costs prohibitive, hindering their ability to adopt automation technologies

- For instance, the integration of robotics in warehouses often necessitates substantial changes to existing layouts and processes, leading to increased expenditures

- Overcoming this challenge involves developing cost-effective solutions and offering scalable automation options to make robotics accessible to a broader range of businesses

Warehouse Robotics Market Scope

The market is segmented on the basis product type, payload capacity, system type, components, software, function, and industry.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Payload Capacity |

|

|

By System Type |

|

|

By Components |

|

|

By Software |

|

|

By Function |

|

|

By Industry |

|

Warehouse Robotics Market Regional Analysis

“Asia- Pacific is the Dominant Region in the Warehouse Robotics Market”

- The rapid growth of e-commerce in countries such as China, India, and Japan has significantly increased the demand for efficient warehouse operations, driving the adoption of robotics solutions

- Asia-Pacific remains a global manufacturing powerhouse, with countries such as China and Japan leading in industrial automation and robotics integration

- Governments in the region are actively promoting automation through subsidies and tax incentives, facilitating the widespread adoption of warehouse robotics

- Rising labor costs in manufacturing and logistics sectors are prompting companies to invest in robotics to maintain competitiveness and operational efficiency

“Latin America is Projected to Register the Highest Growth Rate”

- Latin America is experiencing the highest compound annual growth rate (CAGR) in the warehouse robotics market, with projections indicating significant expansion through 2032

- The rapid expansion of e-commerce platforms in countries such as Brazil and Mexico is driving demand for automated logistics solutions to meet consumer expectations

- Ongoing investments in logistics infrastructure and supply chain modernization are creating opportunities for warehouse robotics adoption

- Companies such as Geek+ are forming collaborations with regional players to introduce robotics solutions tailored to the Latin American market, enhancing market penetration

- The region's emerging markets present untapped opportunities for warehouse robotics providers, with increasing industrialization and urbanization fueling growth

Warehouse Robotics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- KUKA AG (Germany)

- FANUC CORPORATION (Japan)

- YASKAWA ELECTRIC CORPORATION (Japan)

- KION GROUP AG (Germany)

- Geekplus Technology Co., Ltd. (China)

- Grey Orange Pte. Ltd. (U.S.)

- Murata Machinery, Ltd. (Japan)

- OMRON Corporation (Japan)

- ATS Corporation (Canada)

- Honeywell International Inc. (U.S.)

- Rockwell Automation Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- Mobile Industrial Robots (Denmark)

Latest Developments in Global Warehouse Robotics Market

- In April 2024, Geekplus and Toll Group launch an automated warehouse using warehouse robots for sorting operations. The warehouse utilizes over 60 warehouse robots to streamline sortation processes for e-commerce, retail, and omnichannel fulfillment

- In March 2024, Locus Robotics releases LocusHub, a business intelligence engine for warehouse robotics operations. LocusHub uses analytics, AI, and machine learning to provide insights and optimize autonomous mobile robot fleets in fulfillment warehouses

- In May 2023, KUKA (Germany) launched the KR CYBERTECH series Edition robot makes the perfect choice for cost-effective automation of handling and basic machining tasks. The multi-talented KR CYBERTECH feeds components into assembly processes, checks workpiece quality, and grinds and polishes metal parts. Its flexibility makes it particularly popular in a wide range of industries, including the dynamic metal and electronics industries

- In May 2023, FANUC Corp. (Japan), the world leader in CNCs, robotics, and ROBOMACHINEs introduced two new high-payload capacity collaborative robots, and demonstrate a wide range of automation solutions at Automate 2023. The CRX-25iA cobot will demonstrate its enhanced 30kg payload capacity by easily handling a 30kg kettlebell with full wrist articulation

- In February 2023, Honeywell International Inc. inaugurated a cutting-edge research and development facility aimed at advancing its technology, benefiting warehouse and logistics firms across Europe. The market is poised for growth with an uptick in such developments enhancing operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Warehouse Robotics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Warehouse Robotics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Warehouse Robotics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.