Global Walking Assist Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

5.81 Billion

2025

2033

USD

4.10 Billion

USD

5.81 Billion

2025

2033

| 2026 –2033 | |

| USD 4.10 Billion | |

| USD 5.81 Billion | |

|

|

|

|

Walking Assist Devices Market Size

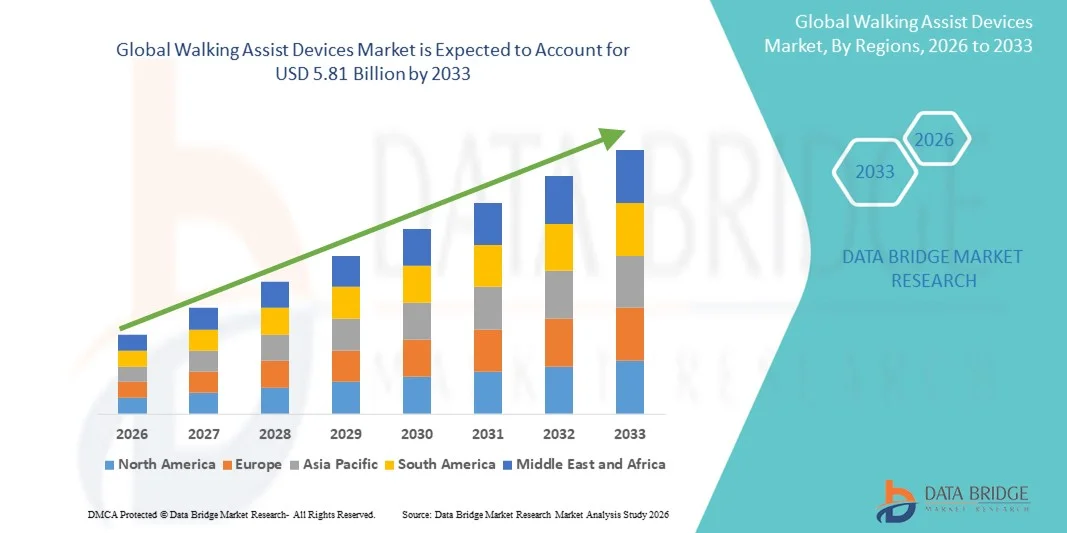

- The global walking assist devices market size was valued at USD 4.10 billion in 2025 and is expected to reach USD 5.81 billion by 2033, at a CAGR of 4.45% during the forecast period

- The market growth is primarily driven by the rising prevalence of mobility impairments, aging populations, and increasing cases of neurological and orthopedic conditions, which necessitate supportive devices for daily mobility

- Moreover, advancements in design, lightweight materials, and smart sensor integration are enhancing usability, comfort, and safety, making walking assist devices more accessible and efficient for both patients and caregivers. These combined factors are propelling market adoption, thereby significantly accelerating industry growth

Walking Assist Devices Market Analysis

- Walking assist devices, including walkers, canes, crutches, and rollators, are increasingly essential in supporting mobility and enhancing independence for individuals with movement impairments across both healthcare and home care settings due to their ergonomic design, stability, and user-friendly feature

- The rising demand for walking assist devices is primarily driven by the growing elderly population, increasing prevalence of musculoskeletal and neurological disorders, and a heightened focus on patient rehabilitation and fall prevention

- North America dominated the walking assist devices market with the largest revenue share of 39% in 2025, supported by a robust geriatric population, well-established healthcare infrastructure, and strong adoption of advanced mobility solutions, with the U.S. witnessing significant uptake in both clinical and home care environments due to innovations in lightweight materials and smart sensor-integrated devices

- Asia-Pacific is expected to be the fastest-growing region in the walking assist devices market during the forecast period due to rapid urbanization, rising awareness of mobility aids, and increasing healthcare expenditure

- Walker segment dominated the walking assist devices market with a market share of 42.4% in 2025, driven by its versatility, stability, and effectiveness in supporting patients during rehabilitation and daily mobility activities

Report Scope and Walking Assist Devices Market Segmentation

|

Attributes |

Walking Assist Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Walking Assist Devices Market Trends

Integration of Smart Sensors and IoT for Mobility Monitoring

- A significant and accelerating trend in the global walking assist devices market is the incorporation of smart sensors and IoT connectivity, enabling real-time monitoring of user movement, posture, and fall risk to enhance safety and rehabilitation outcomes

- For instance, the Smart Walker by Motus Health features integrated sensors that track gait patterns and provide feedback to both users and caregivers through a connected app, facilitating personalized mobility support

- IoT-enabled walking aids allow caregivers and healthcare professionals to remotely monitor patient activity, detect irregular movement patterns, and provide timely interventions, improving recovery and independence

- Advanced devices also integrate alerts and notifications for potential falls, battery status, and device malfunctions, ensuring continuous safety and usability for patients in home and clinical settings

- This trend toward intelligent, connected mobility aids is redefining user expectations, prompting companies such as iWALK to develop IoT-enabled walkers with adaptive support and remote monitoring capabilities

- The demand for walking assist devices with smart connectivity is rising across both rehabilitation centers and home care markets, as users increasingly seek safer, data-driven, and interactive mobility solutions

- Wearable integration with walking assist devices is gaining traction, allowing seamless tracking of physical activity, rehabilitation progress, and vital signs for holistic health monitoring

- Personalized adaptive features, such as adjustable resistance and support levels based on user strength and gait, are emerging as a key trend to enhance comfort and usability for diverse patient groups

Walking Assist Devices Market Dynamics

Driver

Increasing Geriatric Population and Prevalence of Mobility Disorders

- The rising number of elderly individuals and growing prevalence of musculoskeletal and neurological disorders are major drivers for the adoption of walking assist devices

- For instance, in March 2025, Drive Medical launched a new line of ergonomic rollators aimed at seniors with balance issues, designed to improve stability and reduce fall risks

- Walking assist devices offer enhanced support, reduce strain during mobility, and aid in rehabilitation, making them indispensable for patients with temporary or chronic mobility challenges

- Furthermore, rising awareness about preventive care and fall prevention programs is boosting the adoption of these devices in both clinical and home care environments

- The convenience of lightweight, adjustable, and user-friendly designs, coupled with increasing affordability, is further driving the uptake of walking assist devices across different age groups and healthcare settings

- Increasing government initiatives and insurance reimbursements for mobility aids are supporting market growth by making devices more accessible to patients

- Rising adoption of home-based rehabilitation programs due to post-surgery or chronic condition care is creating additional demand for walking assist devices outside traditional clinical setting

Restraint/Challenge

High Cost and Limited Awareness in Emerging Markets

- The relatively high price of advanced walking assist devices, particularly those with smart or ergonomic features, can limit adoption in cost-sensitive regions

- For instance, sophisticated models from Rehabtronics or iWALK equipped with sensors and IoT connectivity are priced significantly higher than traditional walkers or canes, restricting access for lower-income users

- Limited awareness about the benefits of mobility aids and rehabilitation devices in emerging markets further hampers growth, as potential users often rely on conventional solutions

- Addressing these challenges through the development of affordable, durable, and low-maintenance devices, along with educational initiatives on the importance of mobility aids, is crucial for broader market penetration

- Companies investing in cost-effective manufacturing and strategic partnerships with healthcare providers are expected to gradually overcome these adoption barriers

- Maintenance and durability concerns for advanced devices can deter adoption, especially in regions lacking proper service infrastructure

- Variability in regulatory standards across countries can delay product approvals and limit the global rollout of innovative walking assist devices

Walking Assist Devices Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the walking assist devices market is segmented into gait belts & lift vests, canes, crutches, walkers, wheelchairs, and power scooters. The walker segment dominated the market with the largest revenue share of 42.4% in 2025, driven by its versatility, stability, and wide adoption across rehabilitation centers, elderly care facilities, and home care settings. Walkers provide balanced support for patients recovering from surgeries, injuries, or neurological disorders and are often recommended by healthcare professionals for fall prevention. The market also sees strong demand for walkers due to innovations such as foldable frames, lightweight materials, and adjustable height options, which enhance usability and portability. Furthermore, smart walkers equipped with sensors and connectivity features are increasingly preferred, offering real-time feedback and monitoring for caregivers and therapists. Their multi-functional design allows for customization with baskets, seats, or trays, making them suitable for both daily living and therapeutic purposes. The familiarity and reliability of traditional walkers also contribute to their sustained dominance in the market.

The power scooters segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing urbanization and a rising elderly population seeking enhanced mobility and independence. Power scooters offer extended mobility range and convenience, especially for users with limited stamina or strength, and are increasingly being integrated with ergonomic designs and lightweight materials. The growing awareness of mobility aids in developed and emerging markets, coupled with technological advancements such as foldable and portable designs, is accelerating adoption. In addition, the aesthetic appeal and customizable features of power scooters contribute to their rising preference among users seeking both functionality and style. Rising healthcare initiatives promoting independence and improved quality of life for seniors further support the segment’s rapid growth trajectory.

- By Distribution Channel

On the basis of distribution channel, the walking assist devices market is segmented into online and offline channels. The offline segment held the largest revenue share in 2025, driven by the widespread presence of medical equipment suppliers, rehabilitation centers, and healthcare stores where consumers can physically test and select devices. Offline sales provide users with professional guidance, fitting services, and demonstrations, which are particularly important for first-time users or those requiring specialized support. Moreover, many insurance providers reimburse purchases made through certified medical supply stores, further boosting offline sales. The trust and credibility associated with established brick-and-mortar outlets make them a preferred choice for hospitals, clinics, and home care providers. Regular maintenance and after-sales support are more accessible through offline channels, enhancing customer satisfaction and loyalty. The offline distribution network’s extensive reach ensures availability across urban and semi-urban regions, sustaining its dominance in the market.

The online segment is expected to witness the fastest growth from 2026 to 2033, fueled by the convenience of home delivery, wider product selection, and growing e-commerce adoption. Online platforms enable users to compare multiple device options, read reviews, and access detailed product specifications, enhancing informed purchasing decisions. The COVID-19 pandemic and subsequent rise in digital healthcare solutions have accelerated online adoption, particularly for mobility aids. E-commerce marketplaces also support flexible pricing, discounts, and bundled offers, attracting cost-sensitive consumers. In addition, online channels allow manufacturers to directly engage with end-users and introduce advanced, smart, and customized walking assist devices efficiently. Rising smartphone penetration and digital literacy further support the rapid growth of online distribution in both developed and emerging markets.

Walking Assist Devices Market Regional Analysis

- North America dominated the walking assist devices market with the largest revenue share of 39% in 2025, supported by a robust geriatric population, well-established healthcare infrastructure, and strong adoption of advanced mobility solutions

- Consumers and healthcare providers in the region highly value the reliability, advanced safety features, and ergonomic design offered by modern walking assist devices, which enhance mobility and independence for elderly and disabled individuals

- This widespread adoption is further supported by high healthcare expenditure, insurance reimbursements, and growing awareness of rehabilitation and fall-prevention programs, establishing walking assist devices as a preferred mobility solution in both home care and clinical settings

U.S. Walking Assist Devices Market Insight

The U.S. walking assist devices market captured the largest revenue share of 82% in 2025 within North America, fueled by the growing elderly population and increasing prevalence of mobility-related disorders. Consumers and healthcare providers are prioritizing advanced mobility solutions that offer safety, independence, and ease of use. The rising adoption of home-based rehabilitation programs, coupled with strong demand for ergonomic, lightweight, and smart-enabled devices, further propels the market. Moreover, increasing insurance reimbursements and government initiatives supporting mobility aids are significantly contributing to market expansion.

Europe Walking Assist Devices Market Insight

The Europe walking assist devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising aging population and the increasing incidence of musculoskeletal and neurological disorders. Urbanization, coupled with improved healthcare infrastructure, is fostering the adoption of walking assist devices. European consumers and care facilities are drawn to devices that offer convenience, durability, and rehabilitation support. The region is witnessing significant growth across hospitals, rehabilitation centers, and home care applications, with walking assist devices being integrated into both new and ongoing healthcare programs.

U.K. Walking Assist Devices Market Insight

The U.K. walking assist devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for mobility support among the elderly and post-surgery patients. Rising awareness about fall prevention and rehabilitation programs is encouraging adoption in both homes and healthcare facilities. In addition, the U.K.’s robust healthcare infrastructure, combined with strong retail and online distribution channels, is expected to continue stimulating market growth. The availability of advanced devices with ergonomic designs and smart features further supports consumer preference for walking assist solutions.

Germany Walking Assist Devices Market Insight

The Germany walking assist devices market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare standards and increasing awareness about mobility aids. Germany’s well-developed infrastructure and emphasis on innovation promote the adoption of advanced walking assist devices, particularly in clinical and home care settings. The integration of smart features, ergonomic design, and durable construction is gaining popularity among healthcare providers and consumers. Government initiatives supporting elderly care and rehabilitation programs further enhance market penetration and growth potential.

Asia-Pacific Walking Assist Devices Market Insight

The Asia-Pacific walking assist devices market is poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and growing geriatric populations in countries such as China, Japan, and India. The region’s growing awareness about mobility aids and rehabilitation programs is driving adoption. In addition, advancements in affordable and lightweight walking assist devices, supported by domestic manufacturers, are making these solutions accessible to a wider population. The expansion of healthcare facilities and home care services in APAC is further boosting market growth.

Japan Walking Assist Devices Market Insight

The Japan walking assist devices market is gaining momentum due to the country’s rapidly aging population and high emphasis on elderly care. Japanese consumers and healthcare providers are increasingly adopting ergonomic and smart-enabled mobility aids to support rehabilitation and daily activities. Integration with home-based monitoring systems and rehabilitation programs is fueling demand. The preference for technologically advanced, reliable, and easy-to-use devices ensures steady market growth across residential, clinical, and institutional applications.

India Walking Assist Devices Market Insight

The India walking assist devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the growing elderly population, rising awareness about mobility aids, and expanding healthcare infrastructure. India represents a rapidly growing market for both affordable and advanced walking assist devices. Government initiatives supporting healthcare and rehabilitation, along with increasing penetration of e-commerce platforms for medical devices, are key factors driving adoption. The presence of domestic manufacturers offering cost-effective solutions further supports the market’s expansion.

Walking Assist Devices Market Share

The Walking Assist Devices industry is primarily led by well-established companies, including:

- Invacare Corporation (U.S.)

- Medical Depot, Inc. (U.S.)

- Sunrise Medical (U.S.)

- GF Health Products, Inc. (U.S.)

- Pride Mobility Products Corp (U.S.)

- Honda Motor Co., Ltd. (Japan)

- Ottobock (Germany)

- Ekso Bionics (U.S.)

- ReWalk Robotics (U.S.)

- Medline Industries, Inc. (U.S.)

- Karma Medical (India)

- Yuwell Group (China)

- Topro Industrie AS (Norway)

- LifeWalker Mobility (U.S.)

- Besco Medical (U.S.)

- Human Care (Sweden)

- Ossenberg GmbH (Germany)

- Benmor Medical (U.S.)

- Mabis Healthcare, Inc. (U.S.)

- Nova Products, Inc. (U.S.)

What are the Recent Developments in Global Walking Assist Devices Market?

- In July 2025, Indian Institute of Technology Madras (IIT M) announced the launch of YD One, billed as “India’s lightest active wheelchair”. It weighs just 9 kg and is customised for each user in terms of body, posture and mobility needs; built using aerospace grade materials and precision engineering to match international benchmarks

- In April 2024, IIT M (via press coverage) revealed the launch of NeoStand, an indigenously developed, customisable electric standing wheelchair. NeoStand allows users to transition from sitting to standing, which aids in circulation, reduces risk of pressure sores, and improves social participation by facilitating eye level interaction

- In March 2023, Toyota Motor Corporation announced the launch of the C+walk S, a three wheeled pedestrian mobility assistance vehicle designed for users who can walk but struggle with longer distances. The C+walk S travels at walking speed (~6 km/h) and is built for sidewalk use, equipped with obstacle detection safety functions and a removable lithium ion battery

- In November 2022, Drive Medical (a division of Drive DeVilbiss Healthcare) launched the Nitro Sprint Rollator, a next generation rollator walker offering advanced safety and design features. The Nitro Sprint features a redesigned Euro style frame, a 350 lb (≈160 kg) weight capacity, and a patented “slowdown brake” to provide extra control on declines or uneven terrain

- In August 2021, IIT M announced the development of NeoBolt, India’s first indigenous motorised wheelchair vehicle capable of outdoor use on uneven terrain. NeoBolt has a max speed of 25 km/h and range up to 25 km per charge; it converts wheelchair mobility into a more vehicle such as outdoor capability for users with locomotor disability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.