Global Vitamin Nutritional Analysis Market

Market Size in USD Billion

CAGR :

%

USD

40.70 Billion

USD

76.45 Billion

2025

2033

USD

40.70 Billion

USD

76.45 Billion

2025

2033

| 2026 –2033 | |

| USD 40.70 Billion | |

| USD 76.45 Billion | |

|

|

|

|

Vitamin Nutritional Analysis Market Size

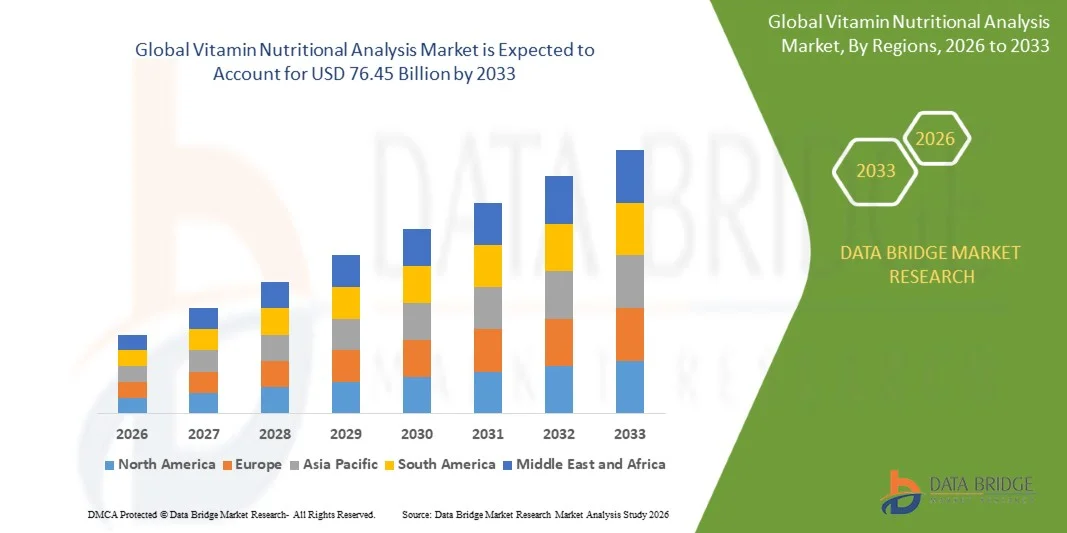

- The global vitamin nutritional analysis market size was valued at USD 40.7 billion in 2025 and is expected to reach USD 76.45 billion by 2033, at a CAGR of 8.20% during the forecast period

- The market growth is largely driven by increasing regulatory requirements for accurate nutrition labelling and the rising consumption of fortified and functional food and beverage products across global markets

- Furthermore, growing consumer awareness regarding health, immunity, and preventive nutrition is compelling manufacturers to invest in precise vitamin profiling, strengthening demand for vitamin nutritional analysis services and supporting sustained market expansion

Vitamin Nutritional Analysis Market Analysis

- Vitamin nutritional analysis involves the scientific measurement and verification of vitamin content in food, beverages, dietary supplements, and infant nutrition products to support labelling accuracy, quality control, and regulatory compliance

- The escalating demand for vitamin nutritional analysis is primarily fueled by strict food safety regulations, increased product innovation in fortified foods, and the growing emphasis on transparency and trust in nutritional claims among health-conscious consumers

- North America dominated the vitamin nutritional analysis market with a share of 37% in 2025, due to stringent food labelling regulations, a high consumption of fortified foods and beverages, and strong awareness regarding nutritional transparency

- Asia-Pacific is expected to be the fastest growing region in the vitamin nutritional analysis market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing consumption of packaged and fortified foods

- Beverages segment dominated the market with a market share of 34.5% in 2025, due to the high consumption of fortified drinks such as energy beverages, functional juices, and vitamin-enriched waters. Manufacturers in this segment rely heavily on vitamin nutritional analysis to validate fortification claims and ensure consistency across large production volumes. The rising focus on health-oriented beverages has further increased the need for precise vitamin profiling. Continuous product launches and reformulation activities in beverages sustain strong analytical demand across global markets

Report Scope and Vitamin Nutritional Analysis Market Segmentation

|

Attributes |

Vitamin Nutritional Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vitamin Nutritional Analysis Market Trends

Rising Demand for Fortified and Functional Food Products

- A key trend shaping the vitamin nutritional analysis market is the increasing demand for fortified and functional food and beverage products, driven by growing consumer focus on preventive healthcare and balanced nutrition. Food manufacturers are expanding the use of vitamins in beverages, dairy products, bakery items, and dietary supplements, which is increasing the need for precise vitamin profiling to support accurate nutritional claims

- For instance, Nestlé Health Science actively develops fortified nutrition solutions such as Resource Activ, which require detailed vitamin composition analysis to ensure formulation accuracy and regulatory alignment. Such developments highlight how leading food and nutrition companies rely on advanced analytical testing to validate nutrient levels and maintain product credibility

- The growing popularity of functional beverages enriched with vitamins A, C, D, and B-complex is further strengthening demand for vitamin nutritional analysis across large-scale production environments. These products require consistent testing to maintain uniform nutrient content across batches and markets

- The expansion of fortified baby food and infant nutrition products is also contributing to this trend, as manufacturers must meet strict nutritional standards and ensure precise vitamin delivery. This is reinforcing the role of vitamin analysis as a critical quality assurance step in sensitive nutrition categories

- Retail and private-label brands are increasingly launching health-focused products with clear vitamin claims, which is driving higher testing volumes to support transparency and consumer trust. This trend is accelerating adoption of standardized and advanced vitamin nutritional analysis services globally

- Overall, the rising integration of vitamins into everyday food products is strengthening the long-term demand for nutritional analysis, positioning it as a core requirement within modern food formulation and quality management strategies

Vitamin Nutritional Analysis Market Dynamics

Driver

Stringent Food Labelling and Regulatory Compliance Requirements

- Strict regulatory frameworks governing nutrition labelling are a major driver for the vitamin nutritional analysis market, as manufacturers are required to disclose accurate vitamin content on packaged foods and dietary supplements. Regulatory bodies across regions enforce compliance standards that mandate validated analytical data to support label declarations

- For instance, companies such as SGS SA and Eurofins Scientific provide accredited vitamin testing services to help food manufacturers comply with FDA and European Food Safety Authority labelling regulations. These services enable brands to meet compliance requirements while minimizing the risk of recalls or penalties

- The increasing harmonization of global food safety standards is compelling multinational manufacturers to adopt consistent vitamin analysis practices across different markets. This is driving continuous demand for reliable and repeatable analytical testing solutions

- The rise in reformulation activities to reduce sugar or fat content often requires adjustment of vitamin fortification levels, further increasing the need for accurate nutritional analysis. Manufacturers depend on testing services to validate reformulated products before market entry

- Retailers and regulators are intensifying scrutiny of nutritional claims, which is reinforcing the importance of validated vitamin data to maintain brand credibility. This sustained regulatory pressure continues to strengthen the role of vitamin nutritional analysis as a fundamental driver of market growth

Restraint/Challenge

High Cost and Complexity of Advanced Vitamin Analysis Techniques

- The vitamin nutritional analysis market faces challenges due to the high cost and technical complexity associated with advanced analytical techniques required for accurate vitamin measurement. Many vitamins are sensitive to light, heat, and oxidation, which necessitates specialized sample preparation and testing environments

- For instance, laboratories operated by Bureau Veritas and Mérieux NutriSciences utilize sophisticated instrumentation such as high-performance liquid chromatography systems to analyze fat- and water-soluble vitamins. These technologies require significant capital investment and skilled technical expertise, increasing overall testing costs

- Maintaining accuracy across diverse food matrices adds further complexity, as different products require tailored analytical methods. This increases operational burden for laboratories and can limit accessibility for smaller food manufacturers

- The need for frequent calibration, validation, and compliance with international testing standards extends analysis timelines and raises service pricing. These factors can act as barriers for cost-sensitive producers seeking routine vitamin testing

- Despite growing demand, the challenge of balancing analytical precision with affordability continues to influence market adoption. Addressing cost efficiency while maintaining accuracy remains a key constraint impacting the scalability of advanced vitamin nutritional analysis solutions

Vitamin Nutritional Analysis Market Scope

The market is segmented on the basis of type and objective.

- By Type

On the basis of type, the vitamin nutritional analysis market is segmented into beverages, bakery & confectionery, snacks, dairy & desserts, meat & poultry, sauces, dressings, condiments, fruits & vegetables, and baby food. The beverages segment dominated the largest market revenue share of 34.5% in 2025, driven by the high consumption of fortified drinks such as energy beverages, functional juices, and vitamin-enriched waters. Manufacturers in this segment rely heavily on vitamin nutritional analysis to validate fortification claims and ensure consistency across large production volumes. The rising focus on health-oriented beverages has further increased the need for precise vitamin profiling. Continuous product launches and reformulation activities in beverages sustain strong analytical demand across global markets.

The baby food segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by stringent nutritional standards and heightened parental awareness regarding infant health. Baby food producers require detailed vitamin analysis to meet regulatory requirements and ensure optimal nutrient delivery for early-stage development. Growing birth rates in emerging economies and increasing preference for packaged infant nutrition further accelerate this demand. The critical nature of accuracy in baby food formulations makes vitamin nutritional analysis an essential component of product development and quality assurance.

- By Objective

On the basis of objective, the vitamin nutritional analysis market is segmented into product labelling, new product development, and regulation compliance. Product labelling accounted for the largest market revenue share in 2025, driven by mandatory nutrition disclosure requirements across packaged food and beverage categories. Brands increasingly depend on accurate vitamin analysis to support label claims, avoid penalties, and build consumer trust. Frequent label updates due to reformulation and regional regulatory differences further strengthen the dominance of this segment. Transparent labelling practices also play a key role in influencing purchasing decisions among health-conscious consumers.

New product development is expected to register the fastest growth during the forecast period, as manufacturers focus on innovation in fortified and functional foods. Vitamin nutritional analysis supports R&D teams in optimizing formulations, validating nutrient stability, and differentiating products in competitive markets. The rising demand for personalized nutrition and functional ingredients accelerates analytical requirements during early development stages. As innovation cycles shorten, rapid and reliable vitamin analysis becomes critical for faster time-to-market and sustained product success.

Vitamin Nutritional Analysis Market Regional Analysis

- North America dominated the vitamin nutritional analysis market with the largest revenue share of 37% in 2025, driven by stringent food labelling regulations, a high consumption of fortified foods and beverages, and strong awareness regarding nutritional transparency

- Food and beverage manufacturers in the region place strong emphasis on accurate vitamin profiling to support health claims, meet regulatory standards, and maintain consumer trust

- This widespread adoption is further supported by an advanced food testing infrastructure, the presence of major analytical service providers, and rising demand for clean-label and functional food products across retail and foodservice channels

U.S. Vitamin Nutritional Analysis Market Insight

The U.S. vitamin nutritional analysis market captured the largest revenue share within North America in 2025, fueled by strict FDA labelling requirements and a mature packaged food and beverage industry. Manufacturers increasingly rely on vitamin analysis to validate nutrient content claims and ensure compliance across product categories. The growing popularity of fortified beverages, dietary supplements, and functional foods continues to reinforce sustained demand for analytical services. Moreover, strong consumer focus on preventive health and wellness further supports market expansion.

Europe Vitamin Nutritional Analysis Market Insight

The Europe vitamin nutritional analysis market is projected to expand at a substantial CAGR during the forecast period, driven by rigorous EU food safety regulations and increasing demand for standardized nutritional labelling. Rising consumption of fortified and organic food products across the region is encouraging manufacturers to invest in precise vitamin analysis. The focus on transparency, traceability, and quality assurance in food production further accelerates market growth. Expansion of private-label food brands is also contributing to higher testing volumes.

U.K. Vitamin Nutritional Analysis Market Insight

The U.K. vitamin nutritional analysis market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by growing health awareness and strong regulatory oversight of food labelling practices. Food producers are increasingly prioritizing accurate vitamin content disclosure to align with consumer expectations and government guidelines. The rise in demand for plant-based and fortified foods is further driving analytical requirements. The U.K.’s well-established retail and packaged food ecosystem continues to sustain steady market growth.

Germany Vitamin Nutritional Analysis Market Insight

The Germany vitamin nutritional analysis market is expected to expand at a considerable CAGR, fueled by a strong emphasis on food quality, safety, and regulatory compliance. German manufacturers place high importance on precise nutritional validation to support premium and health-focused product positioning. The growing consumption of functional dairy, bakery, and fortified food products is increasing demand for vitamin analysis. In addition, Germany’s advanced laboratory infrastructure supports high adoption of standardized testing solutions.

Asia-Pacific Vitamin Nutritional Analysis Market Insight

The Asia-Pacific vitamin nutritional analysis market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing consumption of packaged and fortified foods. Growing regulatory focus on food safety and nutrition labelling across emerging economies is accelerating demand for analytical services. Expanding food processing industries and increasing health awareness among consumers further support market growth. The region’s large population base amplifies overall testing volumes.

Japan Vitamin Nutritional Analysis Market Insight

The Japan vitamin nutritional analysis market is gaining momentum due to strong consumer focus on balanced nutrition, aging population needs, and high standards for food quality. Manufacturers emphasize vitamin accuracy to support functional food and beverage formulations tailored to specific health benefits. The popularity of fortified foods aimed at immunity, bone health, and energy is driving consistent analytical demand. Japan’s advanced testing capabilities further strengthen market adoption.

China Vitamin Nutritional Analysis Market Insight

The China vitamin nutritional analysis market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid growth in packaged food consumption and increasing regulatory scrutiny of nutrition claims. Expanding middle-class populations and rising health consciousness are driving demand for fortified foods and beverages. Domestic and international manufacturers increasingly invest in vitamin analysis to meet compliance standards and differentiate products. The expansion of China’s food processing sector continues to propel market growth.

Vitamin Nutritional Analysis Market Share

The vitamin nutritional analysis industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Intertek Group plc (U.K.)

- Eurofins Scientific (Luxembourg)

- Bureau Veritas (France)

- ALS Limited (Australia)

- Mérieux NutriSciences Corporation (France)

- Thermo Fisher Scientific Inc. (U.S.)

- AsureQuality Services (New Zealand)

- TÜV NORD GROUP (Germany)

- Dairy Technical Services Limited (U.K.)

- QIAGEN (Netherlands)

- Covance (U.S.)

- AWTA Ltd (Australia)

- Microbac Laboratories, Inc. (U.S.)

- Food Lab, Inc. (U.S.)

- NutriData (U.S.)

- MenuSano (U.S.)

- nettnutrition (U.S.)

- Nutritional Information Solutions (U.S.)

Latest Developments in Global Vitamin Nutritional Analysis Market

- In October 2025, BASF launched Lutavit A/D3 1000/200 NXT, a next-generation combined vitamin A and D3 formulation, strengthening its position in the vitamin and nutritional ingredients market by addressing growing demand for efficient, high-stability formulations in animal nutrition. This launch supports improved nutrient delivery and compliance with evolving quality standards, reinforcing BASF’s role in advancing fortified nutrition solutions across global feed and food value chains

- In July 2024, AvesLabs announced the launch of its Nutrient Composition Analysis service, positively impacting the vitamin nutritional analysis market by enhancing access to precise and comprehensive nutritional profiling. The service supports food manufacturers and regulatory bodies in meeting labelling requirements and compliance standards, while also enabling product innovation through accurate nutrient validation and improved transparency

- In February 2024, Nestlé Health Science launched Resource Activ, a new-edge nutritional solution targeted at active millennials, contributing to market growth by expanding demand for scientifically backed, functional nutrition products. The launch highlights the increasing need for detailed vitamin and nutrient analysis to support formulation accuracy, performance claims, and consumer trust in specialized nutrition segments

- In April 2022, Abbott launched Arachitol Gummies in India, driving expansion in the vitamin and dietary supplements market by increasing consumer adoption of convenient, fortified vitamin D products. The inclusion of additional micronutrients heightened the need for accurate vitamin analysis to support regulatory approval, quality assurance, and consistent nutrient delivery in health supplements

- In February 2021, Bayer launched The Nutrient Gap Initiative to expand global access to essential vitamins and minerals, positively influencing the broader vitamin nutrition ecosystem by increasing awareness and demand for fortified food and supplement solutions. The initiative underscored the importance of scalable vitamin production and reliable nutritional analysis to support large-scale public health and nutrition programs worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vitamin Nutritional Analysis Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vitamin Nutritional Analysis Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vitamin Nutritional Analysis Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.