Global Vitamin Nutrition For Swine Market

Market Size in USD Million

CAGR :

%

USD

273.26 Million

USD

320.17 Million

2025

2033

USD

273.26 Million

USD

320.17 Million

2025

2033

| 2026 –2033 | |

| USD 273.26 Million | |

| USD 320.17 Million | |

|

|

|

|

Vitamin Nutrition for Swine Market Size

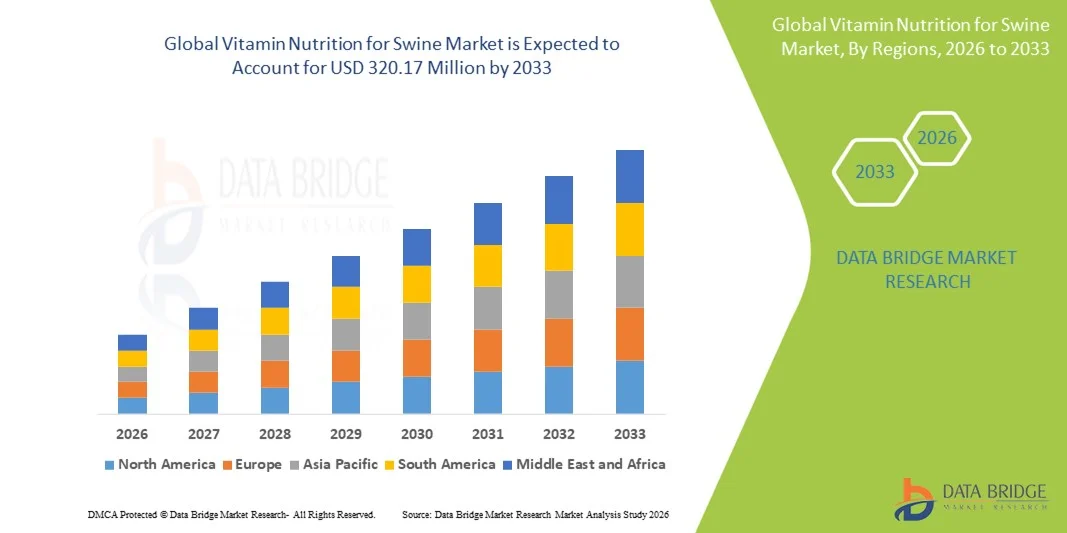

- The global vitamin nutrition for swine market size was valued at USD 273.26 million in 2025 and is expected to reach USD 320.17 million by 2033, at a CAGR of 2.00% during the forecast period

- The market growth is largely driven by the increasing emphasis on animal health, productivity, and feed efficiency in commercial swine farming, leading to higher adoption of vitamin-enriched feed formulations across intensive production systems

- Furthermore, rising demand for high-quality pork, growing awareness of nutritional deficiencies, and the need to improve immunity and reproductive performance in swine are reinforcing the importance of vitamin nutrition. These converging factors are accelerating the adoption of vitamin supplementation programs, thereby significantly supporting market growth

Vitamin Nutrition for Swine Market Analysis

- Vitamin nutrition solutions, including essential fat- and water-soluble vitamins, have become integral components of modern swine feed formulations due to their critical role in supporting growth, immunity, reproduction, and overall herd performance in both small- and large-scale farming operations

- The increasing demand for vitamin nutrition for swine is primarily fueled by the expansion of commercial pig farming, heightened focus on animal welfare and disease prevention, and the growing need to optimize feed conversion ratios and production efficiency across the swine industry

- North America dominated the vitamin nutrition for swine market in 2025, due to a well-established commercial swine industry, high adoption of advanced feed solutions, and increasing awareness of animal health and productivity

- Asia-Pacific is expected to be the fastest growing region in the vitamin nutrition for swine market during the forecast period due to rising pork consumption, rapid urbanization, and growing commercial swine farming in countries such as China, Japan, and India

- Vitamin E segment dominated the market with a market share of 39% in 2025, due to its crucial role in enhancing reproductive performance, immunity, and overall growth in swine. Farmers often prioritize Vitamin E supplementation due to its antioxidant properties, which protect pigs from oxidative stress and improve meat quality

Report Scope and Vitamin Nutrition for Swine Market Segmentation

|

Attributes |

Vitamin Nutrition for Swine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vitamin Nutrition for Swine Market Trends

Growing Use of Vitamin-Fortified Swine Feed

- A key trend in the vitamin nutrition for swine market is the growing use of vitamin-fortified feed formulations to improve animal health, growth efficiency, and overall herd productivity across commercial swine operations. Producers are increasingly incorporating balanced vitamin blends into feed to support immunity, reproduction, and metabolic performance under intensive farming conditions

- For instance, DSM-Firmenich provides customized vitamin premixes for swine nutrition that are widely adopted by large-scale pig producers to enhance feed efficiency and support consistent weight gain. These fortified solutions help reduce nutrient deficiencies and improve overall production outcomes in modern swine farming systems

- The adoption of vitamin-enriched swine feed is rising as producers seek to reduce disease incidence and reliance on therapeutic interventions through preventive nutrition strategies. Vitamins such as A, D, E, and B-complex play a critical role in supporting immune response and stress tolerance in pigs

- Feed manufacturers are focusing on precision nutrition approaches where vitamin inclusion levels are optimized based on growth stage and production goals. This is encouraging wider use of advanced vitamin formulations tailored for piglets, growers, and breeding sows

- The trend is further supported by increasing awareness of the link between balanced micronutrient intake and meat quality parameters such as carcass yield and fat composition. Improved nutritional management through vitamin fortification is becoming a standard practice in competitive pork production

- Overall, the growing use of vitamin-fortified swine feed is strengthening productivity, animal welfare, and economic efficiency across the swine industry. This trend is reinforcing the role of vitamins as essential components of modern, performance-driven swine nutrition programs

Vitamin Nutrition for Swine Market Dynamics

Driver

Rising Focus on Swine Health And Productivity

- The rising focus on swine health and productivity is a major driver of the vitamin nutrition for swine market as producers prioritize nutritional strategies that support robust growth and reduce mortality rates. Vitamins are increasingly recognized as critical inputs for maintaining physiological balance and enhancing feed conversion efficiency

- For instance, Cargill offers comprehensive swine nutrition solutions that include vitamin-enriched feed programs designed to improve animal performance and reproductive outcomes. These solutions are widely used by commercial pig farms aiming to optimize productivity while maintaining herd health

- Improved swine health through adequate vitamin intake supports stronger immune systems, which is particularly important in intensive farming environments with higher disease exposure risks. This focus is encouraging consistent investment in high-quality vitamin supplements across production cycles

- Productivity-driven farming models are pushing producers to adopt nutrition plans that minimize growth variability and improve uniformity across herds. Vitamins contribute to stable metabolic function, which supports predictable performance and efficient resource utilization

- The growing emphasis on sustainable and efficient pork production is further amplifying the importance of nutritional optimization. This sustained focus on health and productivity continues to drive demand for specialized vitamin nutrition solutions within the swine industry

Restraint/Challenge

Fluctuating Vitamin Raw Material Costs

- Fluctuating vitamin raw material costs present a significant challenge for the vitamin nutrition for swine market as many vitamins rely on complex chemical synthesis and globally sourced inputs. Price volatility can impact manufacturing margins and create uncertainty for feed producers and livestock farmers

- For instance, BASF, a major supplier of feed-grade vitamins, has highlighted the sensitivity of vitamin pricing to disruptions in raw material availability and energy costs. Such fluctuations can affect supply stability and influence pricing strategies across the feed value chain

- Variability in raw material costs makes it difficult for manufacturers to maintain consistent pricing for vitamin premixes and supplements. This can limit long-term contract planning between feed suppliers and swine producers

- Rising production costs may lead some farmers to reduce supplementation levels, potentially affecting animal performance and health outcomes. Cost pressures can therefore create trade-offs between nutritional quality and economic feasibility

- The challenge of managing raw material price volatility continues to place pressure on vitamin suppliers to improve sourcing strategies and operational efficiency. Addressing cost instability remains essential for ensuring sustained adoption of vitamin nutrition solutions in swine production systems

Vitamin Nutrition for Swine Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the Vitamin Nutrition for Swine market is segmented into Vitamin A, Vitamin B3, Vitamin B5, Vitamin D3, Vitamin E, Vitamin C, and Others. The Vitamin E segment dominated the market with the largest market revenue share of 39% in 2025, driven by its crucial role in enhancing reproductive performance, immunity, and overall growth in swine. Farmers often prioritize Vitamin E supplementation due to its antioxidant properties, which protect pigs from oxidative stress and improve meat quality. The high demand is also supported by its compatibility with various feed formulations and ease of inclusion in premixes, making it a staple in swine nutrition programs. Vitamin E’s effectiveness in improving reproductive efficiency and supporting piglet vitality further strengthens its dominant position in the market.

The Vitamin D3 segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of its role in bone development and calcium-phosphorus metabolism in pigs. For instance, companies such as DSM have been innovating with enhanced Vitamin D3 formulations that improve skeletal health and reduce leg deformities in swine. Increasing adoption in commercial pig farming, combined with regulatory encouragement for optimized vitamin supplementation, is driving rapid growth. The growing focus on animal welfare and performance efficiency is contributing to higher demand for Vitamin D3-enriched feed additives.

- By Application

On the basis of application, the Vitamin Nutrition for Swine market is segmented into Feed Additives and Pharmaceuticals. The feed additives segment dominated the market in 2025, supported by its widespread use in commercial swine production for growth promotion, immunity enhancement, and improved feed conversion ratios. Swine producers often rely on feed additive solutions for consistent vitamin intake across large herds, ensuring uniform growth and health outcomes. The dominance is also reinforced by the ability of feed additives to integrate multiple vitamins into premixes, reducing handling complexity and cost for farmers. In addition, feed additives provide an effective, scalable solution for both sows and piglets, further solidifying their leading position.

The pharmaceuticals segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for targeted vitamin therapy to address deficiencies and specific health conditions in swine. For instance, companies such as Evonik are focusing on vitamin-enriched veterinary formulations to prevent diseases and improve recovery rates in pigs. Rising adoption of pharmaceutical-grade vitamin solutions in intensive pig farming systems is fueling market expansion. The segment benefits from growing awareness among veterinarians and farmers regarding optimized vitamin interventions to enhance productivity and animal health outcomes.

Vitamin Nutrition for Swine Market Regional Analysis

- North America dominated the vitamin nutrition for swine market with the largest revenue share in 2025, driven by a well-established commercial swine industry, high adoption of advanced feed solutions, and increasing awareness of animal health and productivity

- Producers in the region prioritize nutrient-rich feed formulations, high-quality vitamin supplementation, and optimized growth performance to meet consumer demand for quality pork products

- This widespread adoption is further supported by advanced farming practices, government initiatives promoting animal nutrition, and high investment capacity among commercial swine farms, establishing vitamin nutrition solutions as a standard in both large-scale and medium-scale operations

U.S. Vitamin Nutrition for Swine Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by widespread adoption of fortified feed additives and advanced vitamin premixes. Swine farmers increasingly focus on improving growth rates, immunity, and reproductive performance through scientifically formulated vitamin nutrition. The presence of leading feed additive companies, strong veterinary advisory networks, and growing awareness of cost-effective feed supplementation further supports market expansion. In addition, initiatives promoting sustainable farming practices and improved animal welfare are encouraging the use of high-quality vitamin solutions across swine operations.

Europe Vitamin Nutrition for Swine Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent animal health regulations and the growing demand for high-quality pork products. Increasing urbanization, consumer preference for safer meat, and technological advancements in feed formulations are fostering adoption. European producers are focusing on comprehensive vitamin supplementation to improve swine immunity, growth, and reproductive efficiency. The market is experiencing growth across both conventional and organic swine farms, with fortified feed additives and pharmaceutical-grade vitamins becoming integral to nutrition programs.

U.K. Vitamin Nutrition for Swine Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness regarding swine health and enhanced productivity. Concerns about animal welfare and product quality are encouraging swine farmers to adopt scientifically optimized vitamin nutrition solutions. The presence of established feed additive manufacturers, combined with growing demand for fortified feed formulations, is expected to continue stimulating market growth.

Germany Vitamin Nutrition for Swine Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced swine nutrition practices and regulatory compliance requirements. Producers are emphasizing vitamin supplementation to enhance growth, reproductive health, and overall immunity in swine herds. Germany’s focus on sustainable farming and technological adoption supports the integration of vitamin nutrition solutions into modern feed systems. Strong veterinary networks and farm advisory services further enhance the uptake of premium vitamin products.

Asia-Pacific Vitamin Nutrition for Swine Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising pork consumption, rapid urbanization, and growing commercial swine farming in countries such as China, Japan, and India. Increasing awareness of animal health and productivity, coupled with government initiatives promoting advanced feed technologies, is driving adoption. APAC is emerging as both a major consumer and manufacturer of feed additives and vitamin premixes, improving accessibility and affordability for swine farmers across the region.

Japan Vitamin Nutrition for Swine Market Insight

The Japan market is gaining momentum due to the country’s advanced livestock practices, high demand for pork quality, and focus on swine health management. Farmers are increasingly incorporating vitamin-enriched feed solutions to enhance growth, immunity, and reproductive outcomes. Integration of nutrition strategies with modern farming technologies, including precision feeding and automated feed delivery, is fueling market growth. The aging farming population is also encouraging the adoption of easier-to-use, high-efficacy vitamin premixes in commercial operations.

China Vitamin Nutrition for Swine Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by a large commercial swine industry, rising pork demand, and increasing adoption of fortified feed solutions. The country’s rapid urbanization, growing middle class, and technological integration in farms are key growth factors. Push towards modernized livestock management, government support for animal health programs, and expansion of domestic feed additive manufacturers are further propelling the market.

Vitamin Nutrition for Swine Market Share

The vitamin nutrition for swine industry is primarily led by well-established companies, including:

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- BASF SE (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Archer Daniels Midland Company (U.S.)

- Cargill, Incorporated (U.S.)

- Associated British Foods plc (U.K.)

- Alltech (U.S.)

- Charoen Pokphand Group (Thailand)

- Land O'Lakes, Inc. (U.S.)

- ForFarmers (Netherlands)

- Kyodo Shiryo Co Ltd (Japan)

- Sodrugestvo Group of Companies (Lithuania)

- Ballance Agri-Nutrients Ltd. (New Zealand)

- J. D. HEISKELL & CO. (U.S.)

- Nutreco NV (Netherlands)

Latest Developments in Global Vitamin Nutrition for Swine Market

- In February 2026, the Akralos Animal Nutrition joint venture officially launched as a new combined animal feed and nutrition company formed by Alltech and Archer‑Daniels‑Midland (ADM), creating one of the largest feed networks in North America with over 40 feed mills. This development enhances the competitive landscape for swine nutrition by uniting the scientific expertise, manufacturing scale, and product portfolios of two major feed companies, which is expected to accelerate innovation and broader distribution of vitamin‑enriched premixes and feed solutions for swine producers across the U.S. and Canada, improving market reach and customer service in the region

- In September 2025, ADM and Alltech signed a definitive agreement to form a North American animal feed joint venture, combining extensive feed mill operations and nutrition capabilities under shared governance, set to start operations in early 2026. This partnership signals a strategic shift in the swine nutrition market toward consolidated feed production and stronger R&D support, with anticipated improvements in product quality, supply consistency, and custom nutrition solutions that include vitamin fortification, enhancing competitiveness against standalone providers

- In August 2025, DSM‑Firmenich announced plans to expand its feed additives manufacturing in Asia with a new facility in India focused on mycotoxin binders and complementary animal nutrition products. While the primary focus is mycotoxin control, this expansion also strengthens the regional production infrastructure for feed vitamins and other nutrition products, facilitating better local supply, reduced import dependency, and more tailored vitamin formulations for swine producers in South and Southeast Asian markets

- In July 2025, Cargill made a binding offer to acquire 100% of Mig‑Plus, a Brazilian animal nutrition company specializing in premixes and feed concentrates, including those used in swine feed, with the transaction aimed at deepening its presence in Brazil’s livestock feed sector. This acquisition, once regulatory approvals are complete, is expected to strengthen Cargill’s product portfolio and technical capabilities in vitamin‑enriched feed solutions, allowing the company to provide more integrated and localized nutrition systems to swine producers in one of the world’s most important pork production regions

- In March 2024, South Korea’s EASY BIO completed the acquisition of Devenish Nutrition LLC, a North American feed additives and premix specialist, significantly enhancing EASY BIO’s presence in the U.S., Canada, and Mexico. This move broadened the company’s access to established research facilities and manufacturing assets for swine nutrition, enabling more robust deployment of vitamin‑enhanced products and strengthening competitive positioning in the North American market by combining global R&D resources with localized feed vitamin solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.