Global Vision Positioning System Market

Market Size in USD Billion

CAGR :

%

USD

6.20 Billion

USD

13.40 Billion

2024

2032

USD

6.20 Billion

USD

13.40 Billion

2024

2032

| 2025 –2032 | |

| USD 6.20 Billion | |

| USD 13.40 Billion | |

|

|

|

|

Vision Positioning System Market Size

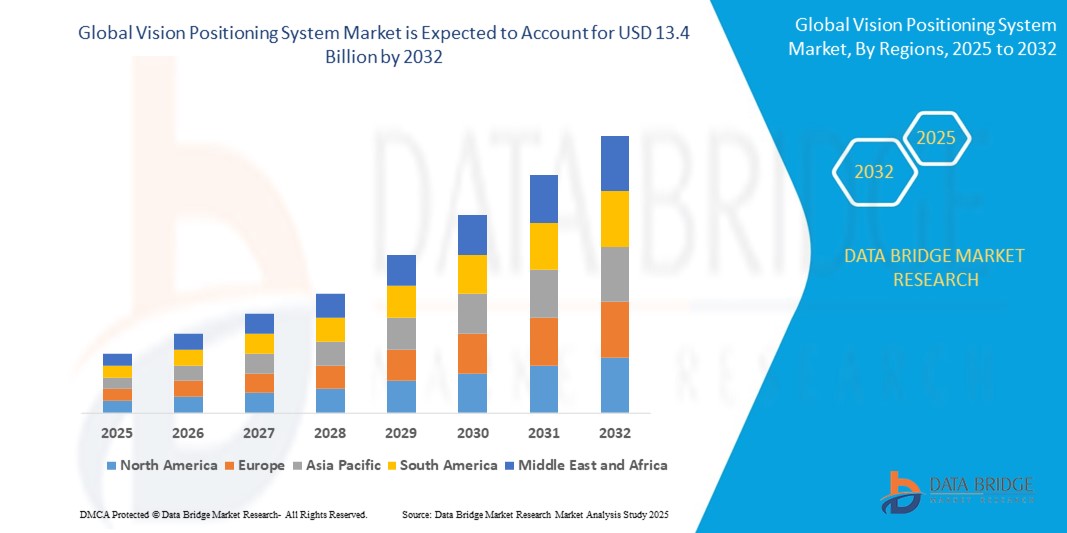

- The Global Vision Positioning System Market size was valued at USD 6.2 billion in 2024 and is expected to reach USD 13.4 billion by 2032, at a CAGR of 11.6% during the forecast period

- The need for enhanced efficiency and quality control in manufacturing and industrial processes is fueling the adoption of vision positioning systems. These systems enable automation by integrating robots, smart cameras, and sensors, which help streamline operations and reduce human error.

- Governments and municipalities are investing in smart city projects that require precise navigation and positioning for public safety, traffic management, and urban planning. Vision positioning systems provide critical data for these applications, supporting the development of smarter urban environments.

Vision Positioning System Market Analysis

- Artificial Intelligence (AI) is increasingly integrated into GPS technologies, enhancing functionalities such as route optimization and predictive maintenance. For instance, TomTom, in collaboration with Microsoft, has introduced a generative AI-based driving assistant aimed at providing personalized navigation experiences. Additionally, the convergence of GPS with Internet of Things (IoT) and 5G technologies is expanding applications across various sectors, including autonomous vehicles, smart cities, and precision agriculture.

- In response to concerns over GPS vulnerabilities, alternative systems are being explored. The U.S. Federal Communications Commission (FCC) is investigating complementary positioning, navigation, and timing (PNT) technologies to bolster national security and infrastructure resilience. One such alternative is the Broadcast Positioning System (BPS), which utilizes digital TV signals to provide location data, offering a potential backup in case of satellite disruptions.

- North America dominates the Vision Positioning System Market with the largest revenue share of 39.01% in 2024, characterized by the high adoption of UAVs, AGVs, industrial robots and space vehicles and presence of prominent players in the region.

- Asia-Pacific is expected to be the fastest growing region in the Vision Positioning System Market during the forecast period due to the rapid development and deployment of autonomous vehicles, including self-driving cars and drones, rely heavily on vision positioning systems for accurate navigation and obstacle avoidance. This trend is a significant driver in both commercial and defense sectors.

- Sensor’s segment dominates the Vision Positioning System Market with a market share of 31.2% in 2024, driven by Advancements in computer vision and AI algorithms.

Report Scope and Vision Positioning System Market Segmentation

|

Attributes |

Vision Positioning System Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vision Positioning System Market Trends

“Enhanced Security, Automation, and Cloud Integration”

- A major and accelerating trend in the Global Vision Positioning System (VPS) Market is the deepening integration with artificial intelligence (AI) and advanced sensor fusion technologies, including LiDAR, ultrasonic, and GPS. This convergence is significantly enhancing the precision, reliability, and automation capabilities of VPS solutions across industries.

- For instance, modern VPS platforms for drones and autonomous vehicles now combine computer vision with AI-driven data processing, allowing real-time mapping, obstacle detection, and navigation even in GPS-denied environments. Leading products seamlessly integrate with AI-powered analytics, enabling dynamic route optimization and adaptive decision-making for industrial robots, delivery drones, and automated guided vehicles.

- The integration of VPS with broader IoT and automation platforms is facilitating centralized control and monitoring of assets across large facilities and urban environments. Users can manage fleets of robots, drones, or vehicles through unified dashboards, optimizing operations alongside other smart infrastructure components such as surveillance, inventory management, and environmental controls.

- This trend toward more intelligent, interconnected, and autonomous positioning systems is fundamentally reshaping user expectations for automation and operational efficiency. Companies are now developing VPS solutions with features such as real-time 3D mapping, AI-based anomaly detection, and compatibility with major industrial automation ecosystems.

- The demand for VPS solutions offering seamless AI integration and multi-sensor fusion is growing rapidly across sectors including logistics, manufacturing, agriculture, and smart cities, as organizations increasingly prioritize precision, automation, and comprehensive operational oversight.

- Asia Pacific is emerging as the fastest-growing region due to rapid technological advancements and growing investments in automation and smart city initiatives in countries like China, Japan, and South Korea.

Vision Positioning System Market Dynamics

Driver

“Growing Demand for Precision Navigation in Robotics and Drones”

- The increasing deployment of autonomous systems in sectors like agriculture, logistics, defense, and smart manufacturing is driving the demand for accurate, real-time navigation technologies such as vision positioning systems.

- For instance, in February 2024, DJI launched the updated VPS module in its enterprise drone lineup, enhancing centimeter-level accuracy in indoor and GPS-denied environments. These systems use downward-facing cameras and ultrasonic sensors to detect ground textures and distances, enabling stable flight and obstacle avoidance.

- Vision positioning systems offer an advantage over traditional GPS by operating effectively indoors and in complex terrains where satellite signals are weak or unavailable.

- Government-backed urban development initiatives are creating demand for real-time asset tracking and mobility solutions enabled by VPS.

Restraint/Challenge

“Complex Calibration and Environmental Limitations”

- VPS performance can be severely affected by poor lighting, reflective surfaces, and featureless environments, leading to degraded positional accuracy or system failures.

- For instance, in 2025, Amazon Robotics noted that VPS modules in their warehouse robots required frequent recalibration when transitioning between different lighting zones and floor types.

- The calibration process itself involves aligning camera sensors with inertial and depth-measurement units, often requiring manual intervention and high computational resources.

- These limitations hinder widespread adoption, particularly in environments with changing visual textures, and impose additional burdens on system integrators to customize solutions for specific use cases.

Vision Positioning System Market Scope

The market is segmented on the basis of component, Location, Type, Solution, Platform, Application, End-User.

- By component

On the basis of component, the Vision Positioning System Market is segmented into Sensors, Camera Systems, Markers, Others. The Sensors segment dominates the largest market revenue share of 51.2% in 2024, driven by Rising Demand for Industrial Automation.

The Markers segment is anticipated to witness the fastest growth rate of 23.7% from 2025 to 2032, fueled by Increasing Use of Automated Guided Vehicles (AGVs).

- By Location

On the basis of Location, the Vision Positioning System Market is segmented into Indoor Positioning System, Outdoor Positioning System. The Indoor Positioning System segment held the largest market revenue share in 2024 driven by Proliferation of Smartphones and Internet Connectivity.

The Outdoor Positioning System segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Technological Developments and Industrialization.

- By Type

On the basis of Type, the Vision Positioning System Market is segmented into 1D, 2D, 3D. The 3D segment held the largest market revenue share in 2024, driven by Advancements in Artificial Intelligence (AI) and Machine Vision.

The 3D is expected to witness the fastest CAGR from 2025 to 2032, driven by Continuous improvements in AI, machine learning, and computer vision technologies are enhancing the capabilities of vision positioning systems.

Vision Positioning System Market Regional Analysis

- North America dominates the Vision Positioning System Market with the largest revenue share of 39.01% in 2024, driven by UAVs, or drones, are increasingly used in industries such as agriculture, logistics, and surveillance. Vision positioning systems are essential for precise flight control and navigation, boosting their adoption in this fast-growing market segment.

- The global Vision Positioning System market is gaining momentum due to a combination of technological advancements and rising demand across sectors. Key drivers include the proliferation of autonomous vehicles and drones, which require precise navigation, as well as significant progress in AI and computer vision technologies.

- The increasing need for accurate indoor navigation, particularly in retail spaces, hospitals, and warehouses, further accelerates adoption. VPS is also becoming integral to AR applications and smart city developments, adding to its relevance in modern infrastructure.

U.S. Vision Positioning System Market Insight

The U.S. Vision Positioning System Market captured the largest revenue share of 78% in 2024 within North America, fueled by the need for enhanced efficiency and quality control in manufacturing and industrial processes is fueling the adoption of vision positioning systems. These systems enable automation by integrating robots, smart cameras, and sensors, which help streamline operations and reduce human error.

Europe Vision Positioning System Market Insight

Governments and municipalities are investing in smart city projects that require precise navigation and positioning for public safety, traffic management, and urban planning. Vision positioning systems provide critical data for these applications, supporting the development of smarter urban environments.

U.K. Vision Positioning System Market Insight

The U.K. Vision Positioning System Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rapid development and deployment of autonomous vehicles, including self-driving cars and drones, rely heavily on vision positioning systems for accurate navigation and obstacle avoidance. This trend is a significant driver in both commercial and defense sectors.

Germany Vision Positioning System Market Insight

The Germany Vision Positioning System Market is expected to expand at a considerable CAGR during the forecast period, fueled by UAVs, or drones, are increasingly used in industries such as agriculture, logistics, and surveillance. Vision positioning systems are essential for precise flight control and navigation, boosting their adoption in this fast-growing market segment.

Asia-Pacific Vision Positioning System Market Insight

The Asia-Pacific Vision Positioning System Market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by Continuous improvements in AI, machine learning, and computer vision technologies are enhancing the capabilities of vision positioning systems. These advancements enable more accurate object recognition, localization, and mapping.

Japan Vision Positioning System Market Insight

The Japan Vision Positioning System Market is gaining momentum due to AGVs are widely used in warehouses, manufacturing plants, and logistics centers for material handling and transportation. Vision positioning systems help AGVs navigate complex environments safely and efficiently.

China Vision Positioning System Market Insight

The China Vision Positioning System Market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the global trend toward urbanization increases the demand for technologies that can manage densely populated environments. Vision positioning systems support efficient transportation, infrastructure management, and public safety in urban settings.

Vision Positioning System Market Share

The Vision Positioning System Market is primarily led by well-established companies, including:

- ABB

- ADTECH (SHENZHEN) TECHNOLOGY CO., LTD.

- Quest Solution Inc.

- Pepperl+Fuchs

- Cognex Corporation

- Parrot Drones SAS

- FANUC CORPORATION

- Senion

- SICK AG

- Seegrid Corporation

- DJI

- infsoft GmbH

- LOCATA CORPORATION PTY. LIMITED

- Navigine

- HTS

- Scape Technologies Ltd

- OMRON Corporation

- Maxar Technologies Ltd.

Latest Developments in Global Vision Positioning System Market

- In September 2023, Cognex launched the In-Sight SnAPP vision sensor, enhancing industrial automation with improved accuracy and user-friendly features.

- In August 2023, ABB invested in Pratexo, an edge-to-cloud platform, to bolster its capabilities in smart manufacturing and vision positioning technologies.

- In March 2024, DJI introduced drones equipped with advanced vision positioning systems, enhancing obstacle detection and navigation for various applications.

- In February 2024, Seegrid unveiled the Palion Lift CR1, an autonomous lift truck designed to improve material handling in warehouses through advanced vision positioning.

- In January 2024, OMRON launched the K7DD-PQ Series, a device for monitoring motor conditions, aligning with its smart maintenance philosophy by utilizing real-time data analysis.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vision Positioning System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vision Positioning System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vision Positioning System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.