Global Video Laryngoscope Market

Market Size in USD Million

CAGR :

%

USD

436.65 Million

USD

1,326.47 Million

2024

2032

USD

436.65 Million

USD

1,326.47 Million

2024

2032

| 2025 –2032 | |

| USD 436.65 Million | |

| USD 1,326.47 Million | |

|

|

|

|

Video Laryngoscope Market Size

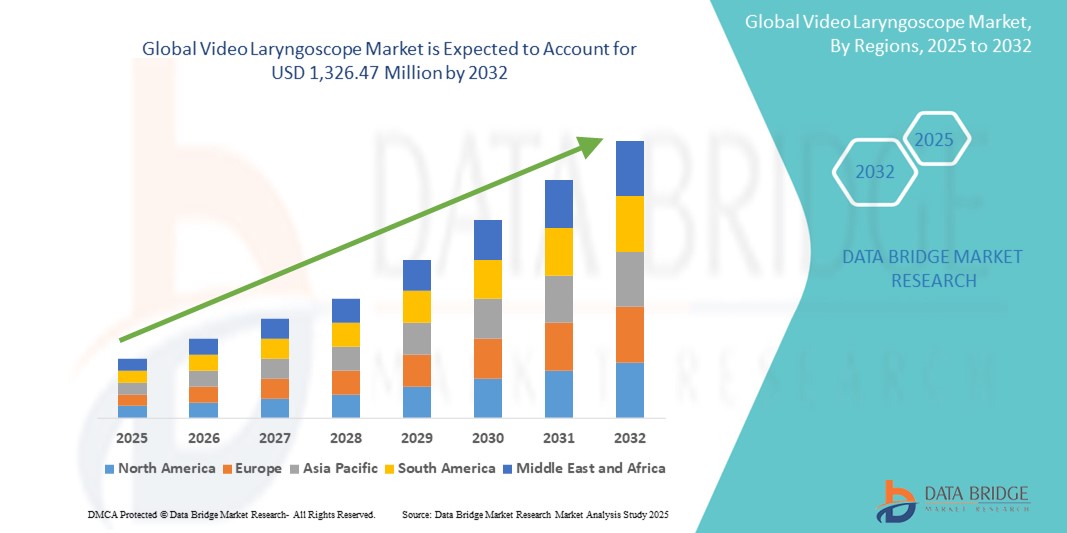

- The global video laryngoscope market size was valued at USD 436.65 million in 2024 and is expected to reach USD 1,326.47 million by 2032, at a CAGR of 14.90% during the forecast period

- The market growth is primarily driven by increasing demand for advanced airway management tools, especially in emergency and critical care settings where visualization and precision are vital

- In addition, a rising geriatric population, growing surgical procedures globally, and the push for minimally invasive and safer intubation techniques are accelerating the adoption of video laryngoscopes, significantly propelling market expansion

Video Laryngoscope Market Analysis

- Video laryngoscopes, which enable real-time visualization of the airway during intubation, are becoming indispensable tools in modern anesthesiology and emergency medicine due to their ability to improve first-attempt success rates and reduce complications compared to traditional methods

- The growing demand for video laryngoscopes is primarily driven by an increase in elective and emergency surgical procedures, rising incidences of respiratory diseases, and the critical need for enhanced airway management across intensive care units and pre-hospital environments

- North America dominated the video laryngoscope market with the largest revenue share of 39.5% in 2024, supported by advanced healthcare infrastructure, frequent adoption of innovative medical devices, and strong presence of leading market players, particularly in the U.S. where clinical guidelines increasingly favor video-assisted intubation

- Asia-Pacific is projected to be the fastest growing region in the video laryngoscope market during the forecast period, fueled by expanding healthcare access, increasing investments in hospital infrastructure, and rising medical tourism

- The reusable segment dominated the video laryngoscope market with a market share of 46.8% in 2024, attributed to its cost-effectiveness over time and growing preference among hospitals for durable, high-performance devices with integrated sterilization protocols

Report Scope and Video Laryngoscope Market Segmentation

|

Attributes |

Video Laryngoscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Video Laryngoscope Market Trends

“AI-Driven Visualization and Real-Time Decision Support”

- A prominent and evolving trend in the global video laryngoscope market is the integration of artificial intelligence (AI) and advanced imaging technologies to enhance visualization, accuracy, and clinical decision-making during intubation procedures. These innovations are transforming video laryngoscopes into intelligent diagnostic and procedural tools beyond traditional airway visualization

- For instance, companies such as Ambu A/S and Verathon are advancing their product lines with AI-powered video processing that provides automated landmark identification and guidance, improving first-pass success rates in difficult airway scenarios. Similarly, the GlideScope Go by Verathon offers a compact, portable solution with real-time video assistance, ideal for use in both hospital and pre-hospital environments

- AI algorithms are increasingly being used to detect anomalies, recommend optimal tube placement angles, and provide decision support during high-risk or emergency intubations. This trend enhances procedural safety and supports less experienced healthcare providers through guided visual cues, making advanced airway management more accessible and standardized

- The integration of video laryngoscopes into broader hospital IT systems and training platforms is also gaining traction, enabling real-time data capture, performance analytics, and integration into simulation-based medical education

- As AI capabilities evolve and demand for evidence-based clinical practices grows, the development of AI-assisted, network-connected video laryngoscopes is setting new standards in airway management. This shift is driving medical device manufacturers to innovate with compact, wireless, and cloud-integrated models designed to meet the diverse needs of hospitals, emergency services, and military settings

- The rising demand for precision, safety, and enhanced training tools is fueling the global shift toward intelligent, AI-enhanced video laryngoscope systems across both developed and emerging healthcare markets

Video Laryngoscope Market Dynamics

Driver

“Rising Surgical Volume and Need for Improved Airway Management”

- The increasing number of surgeries and emergency care procedures globally, along with the need for more reliable airway management tools, is a key driver fueling demand for video laryngoscopes

- Their ability to improve visualization and increase first-pass intubation success rates makes them indispensable in modern operating rooms, ICUs, and emergency departments.

- For instance, in 2024, Medtronic plc expanded the availability of its McGRATH MAC video laryngoscope in emerging markets, targeting improved patient outcomes in resource-limited settings. Such initiatives by major players reflect the growing role of video laryngoscopes in critical care and anesthesia practices

- The rising global prevalence of respiratory conditions, such as chronic obstructive pulmonary disease (COPD) and COVID-19-related complications, is further amplifying the need for advanced airway tools in both routine and emergency procedures

- In addition, the shift toward minimally invasive procedures and the emphasis on patient safety are encouraging healthcare providers to adopt video laryngoscopes for routine intubation practices, particularly in high-risk or obese patients, where direct laryngoscopy may be challenging

Restraint/Challenge

“High Cost and Limited Access in Low-Resource Settings”

- One of the primary restraints in the widespread adoption of video laryngoscopes is the high cost of acquisition and maintenance, especially for advanced models with built-in displays, wireless capabilities, and reusable components. This poses a challenge for healthcare facilities in low-income or underfunded regions.

- For instance, hospitals in rural parts of Africa, Southeast Asia, and Latin America often lack the capital resources to invest in modern video-assisted equipment, relying instead on traditional laryngoscopes. This limits the market’s penetration in these areas despite growing demand.

- In addition, some clinicians may require additional training to effectively use video laryngoscopes, and the learning curve can be a barrier in fast-paced or understaffed environments

- Delays in regulatory approvals or varying compliance standards across countries can also slow down product launches and adoption.

- To overcome these challenges, manufacturers are increasingly focusing on developing cost-effective, portable, and disposable options

- Strategic partnerships with non-profits and public health initiatives are also helping to expand access and drive adoption in resource-constrained regions

Video Laryngoscope Market Scope

The market is segmented on the basis of type, usage, model, device type, channel type, patient type, end user, and distribution channel.

- By Type

On the basis of type, the video laryngoscope market is segmented into rigid and flexible. The rigid segment dominated the market with the largest market revenue share in 2024, attributed to its high image clarity, reliability, and extensive use in operating rooms and emergency care settings. Rigid video laryngoscopes are preferred for their durable construction and ability to provide consistent visualization of the vocal cords, making them a standard tool in many healthcare facilities.

The flexible segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its applicability in difficult airway cases and scenarios requiring greater maneuverability. Flexible models are gaining popularity in anesthesiology and critical care due to their ability to navigate complex airway anatomies, particularly in trauma and intensive care units.

- By Usage

On the basis of usage, the video laryngoscope market is segmented into reusable and disposable. The reusable segment held the largest market revenue share of 46.8% in 2024, driven by its cost-effectiveness and long-term usability in high-volume healthcare environments. Hospitals and surgical centers frequently opt for reusable models due to established sterilization infrastructure and frequent need for intubation procedures.

The disposable segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing demand for single-use devices in infection control, especially post-COVID-19. These are increasingly favored in emergency settings, field hospitals, and for immunocompromised patients due to their sterile, ready-to-use design.

- By Model

On the basis of model, the video laryngoscope market is segmented into integrated display and standard. The integrated display segment dominated the market with the largest market revenue share in 2024, owing to its all-in-one functionality, compact design, and ease of use in various care environments. These models enhance visualization and reduce the need for external monitors, improving workflow efficiency in critical care situations.

The standard segment is anticipated to grow at a steady rate from 2025 to 2032, supported by its modular nature, which allows flexibility in component upgrades and replacements. Standard video laryngoscopes are preferred in institutions seeking cost-effective scalability across departments.

- By Device Type

On the basis of device type, the video laryngoscope market is segmented into handheld and cart-based. The handheld segment dominated the market with the largest market revenue share in 2024, driven by increasing demand for portability, especially in pre-hospital and point-of-care settings. Handheld video laryngoscopes are compact, battery-operated, and ideal for emergency responders and mobile medical teams.

The cart-based segment is expected to witness moderate growth from 2025 to 2032, fueled by use in academic and large hospital environments where multi-user access, video recording, and data sharing capabilities are essential. Cart-based models offer advanced functionalities for teaching and documentation.

- By Channel Type

On the basis of channel type, the video laryngoscope market is segmented into channeled and non-channeled. The non-channeled segment held the largest market revenue share in 2024, attributed to its simplicity and compatibility with conventional intubation techniques. These models are widely used in general surgery and emergency intubations due to their lower cost and ease of training.

The channeled segment is projected to grow at the fastest rate during the forecast period, driven by its built-in guidance pathway for endotracheal tubes, which enhances precision and reduces the need for additional tools. Channeled video laryngoscopes are particularly useful in difficult airway cases and among less experienced practitioners.

- By Patient Type

On the basis of patient type, the video laryngoscope market is segmented into neonate, pediatric, and adult. The adult segment dominated the market with the largest revenue share in 2024, driven by the high incidence of adult surgical and emergency intubation procedures globally.

The pediatric segment is expected to grow at a substantial pace during forecast period, due to increasing awareness of pediatric airway management and the need for child-specific devices. The neonate segment is also gaining attention, with demand rising for miniature, high-precision tools in neonatal intensive care units.

- By End User

On the basis of end user, the video laryngoscope market is segmented into in-hospital, pre-hospital, and others. The in-hospital segment held the largest market revenue share in 2024, owing to widespread use in operating rooms, intensive care units, and emergency departments. These settings demand reliable airway visualization tools to support critical procedures.

The pre-hospital segment is projected to register the fastest growth rate, fueled by rising use in ambulances, military, and remote care environments. Paramedics and emergency responders increasingly rely on portable video laryngoscopes to improve outcomes during field intubation.

- By Distribution Channel

On the basis of distribution channel, the video laryngoscope market is segmented into direct tender, retail sales, and online sales. The direct tender segment dominated the market with the largest market revenue share in 2024, driven by bulk purchases by hospitals and government healthcare programs. Direct procurement through tenders ensures standardized supply to public hospitals and large institutions.

The online sales segment is expected to witness the fastest growth from 2025 to 2032, as digital platforms expand the accessibility of video laryngoscopes to smaller clinics, private practitioners, and emerging healthcare markets. Online channels enable quick comparison, bulk ordering, and direct-to-facility shipments.

Video Laryngoscope Market Regional Analysis

- North America dominated the video laryngoscope market with the largest revenue share of 39.5% in 2024, supported by advanced healthcare infrastructure, frequent adoption of innovative medical devices, and strong presence of leading market players

- Healthcare providers in the region prioritize patient safety and procedural efficiency, leading to widespread use of video laryngoscopes across operating rooms, intensive care units, and emergency departments for both routine and complex airway management

- The strong presence of leading medical device manufacturers, favorable reimbursement frameworks, and increasing emphasis on clinical training and simulation are further supporting the demand, establishing video laryngoscopes as a standard tool in airway management across the U.S. and Canada

U.S. Video Laryngoscope Market Insight

The U.S. video laryngoscope market captured the largest revenue share of 79% in 2024 within North America, fueled by the country’s advanced healthcare infrastructure, high procedural volume, and strong emphasis on patient safety. The growing demand for efficient airway management tools in emergency and critical care settings is a primary driver. Increased adoption of technologically advanced, AI-integrated devices in hospitals and pre-hospital care, alongside favorable reimbursement policies and clinical guidelines promoting video-assisted intubation, continue to support the market’s expansion.

Europe Video Laryngoscope Market Insight

The Europe video laryngoscope market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing burden of respiratory diseases, aging population, and high surgical case volumes. The region benefits from robust public healthcare systems and rising awareness of the advantages of video-assisted intubation. Medical institutions across Europe are investing in portable and reusable video laryngoscopes to standardize airway management and improve clinical outcomes. Demand is growing across both acute care and outpatient facilities, with ongoing innovation and cross-border collaborations further accelerating market growth.

U.K. Video Laryngoscope Market Insight

The U.K. video laryngoscope market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the increasing focus on safe intubation practices and enhanced training in airway management. Hospitals and emergency services are adopting video laryngoscopes as standard tools due to regulatory emphasis on reducing complications in anesthesia and critical care. In addition, government investment in healthcare modernization and training programs for clinicians is fostering the use of advanced visualization tools in both public and private healthcare sectors.

Germany Video Laryngoscope Market Insight

The Germany video laryngoscope market is expected to expand at a considerable CAGR during the forecast period, propelled by the country’s strong healthcare infrastructure, innovation-led medical device industry, and demand for precision-driven diagnostic tools. German hospitals are increasingly adopting AI-supported and reusable video laryngoscopes to improve procedural accuracy and efficiency in operating rooms and ICUs. The push for medical digitization and infection control protocols is also influencing the transition from traditional to video-assisted intubation methods.

Asia-Pacific Video Laryngoscope Market Insight

The Asia-Pacific video laryngoscope market is poised to grow at the fastest CAGR of 26% during the forecast period of 2025 to 2032, driven by rapid improvements in healthcare infrastructure, growing awareness of airway management safety, and the rising number of surgeries. Countries such as China, India, and Japan are witnessing increased adoption of video laryngoscopes in both government and private hospitals, supported by initiatives to modernize healthcare delivery. The affordability of compact, portable models is also contributing to widespread adoption in urban and rural settings.

Japan Video Laryngoscope Market Insight

The Japan video laryngoscope market is gaining momentum due to the country’s aging population, high rate of surgical procedures, and demand for advanced medical technologies. Japanese hospitals are integrating video laryngoscopes into anesthetic protocols to enhance patient safety and reduce complications. The healthcare system’s focus on minimally invasive procedures and clinical training is further supporting the adoption of compact, AI-enhanced laryngoscope systems that align with the country’s standards for precision and reliability.

India Video Laryngoscope Market Insight

The India video laryngoscope market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding hospital infrastructure, increasing focus on emergency care, and growing availability of cost-effective devices. India’s large surgical volume, especially in government-run tertiary hospitals and medical colleges, is driving demand for affordable and reusable video laryngoscopes. The rise of local manufacturers, coupled with training programs and telemedicine integration, is propelling adoption in both urban and semi-urban regions across the country.

Video Laryngoscope Market Share

The Video Laryngoscope industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Verathon Inc. (U.S.)

- Ambu A/S (Denmark)

- Karl Storz SE & Co. KG (Germany)

- Pentax Medical Company (Japan)

- Olympus Corporation (Japan)

- Prodol Meditec S.A. (Spain)

- Vygon SA (France)

- Teleflex Incorporated (U.S.)

- Smiths Medical ASD, Inc. (U.S.)

- UE Medical Devices (China)

- Acutronic Medical Systems AG (Switzerland)

- Truphatek International Ltd. (Israel)

- BD (U.S.)

- Intersurgical Ltd. (U.K.)

- Henan Tuoren Medical Device Co., Ltd. (China)

- Cogentix Medical, Inc. (U.S.)

- Heine Optotechnik GmbH & Co. KG (Germany)

- Dilon Technologies, Inc. (U.S.)

- Zhejiang UE Medical Corp. (China)

What are the Recent Developments in Global Video Laryngoscope Market?

- In April 2024, Medtronic plc, a global leader in medical technology, expanded the reach of its McGRATH MAC video laryngoscope into several emerging markets across Southeast Asia and Latin America. This strategic move aims to improve access to advanced airway management tools in under-resourced regions. By leveraging its established brand and distribution networks, Medtronic is addressing the global need for safer, more efficient intubation procedures, particularly in settings with limited clinical support

- In March 2024, Verathon Inc. announced the release of the next-generation GlideScope Core system, a high-performance video laryngoscope platform offering enhanced video resolution, integrated suction, and expanded data integration capabilities. This innovation is designed to meet growing clinical demand for multi-functional airway visualization tools. The system’s AI-compatible architecture enables real-time feedback, making it a vital tool in complex surgical and emergency settings, and reinforcing Verathon’s commitment to cutting-edge clinical solutions

- In February 2024, Ambu A/S, a Denmark-based medical device manufacturer, launched the Ambu aView 2 Advance Monitor to complement its single-use video laryngoscope offerings. The device enhances display clarity and connectivity while supporting infection control through compatibility with disposable scopes. This advancement highlights Ambu’s dedication to improving patient safety, particularly in intensive care units and during pandemic-related procedures where cross-contamination risks are high

- In January 2024, Karl Storz SE & Co. KG, a prominent name in endoscopy and surgical technologies, unveiled a portable, battery-powered video laryngoscope with real-time recording and wireless data transfer features. Developed for pre-hospital and field use, the device is tailored for emergency responders and military applications. This innovation showcases Karl Storz’s continued focus on portability, functionality, and data-driven clinical practice, meeting the growing demand for mobile solutions in critical care environments

- In December 2023, UE Medical Devices, a key player in China’s medical technology space, received CE certification for its UED Video Laryngoscope, enabling expanded market entry across Europe. The device is designed with anti-fog optics, a high-resolution display, and ergonomic design, aimed at delivering reliable performance across diverse clinical settings. This milestone underscores the company’s international growth strategy and reflects the rising global competitiveness of Chinese medical device manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.