Global Veterinary Molecular Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

732.81 Million

USD

1,458.02 Million

2024

2032

USD

732.81 Million

USD

1,458.02 Million

2024

2032

| 2025 –2032 | |

| USD 732.81 Million | |

| USD 1,458.02 Million | |

|

|

|

|

Veterinary Molecular Diagnostics Market Size

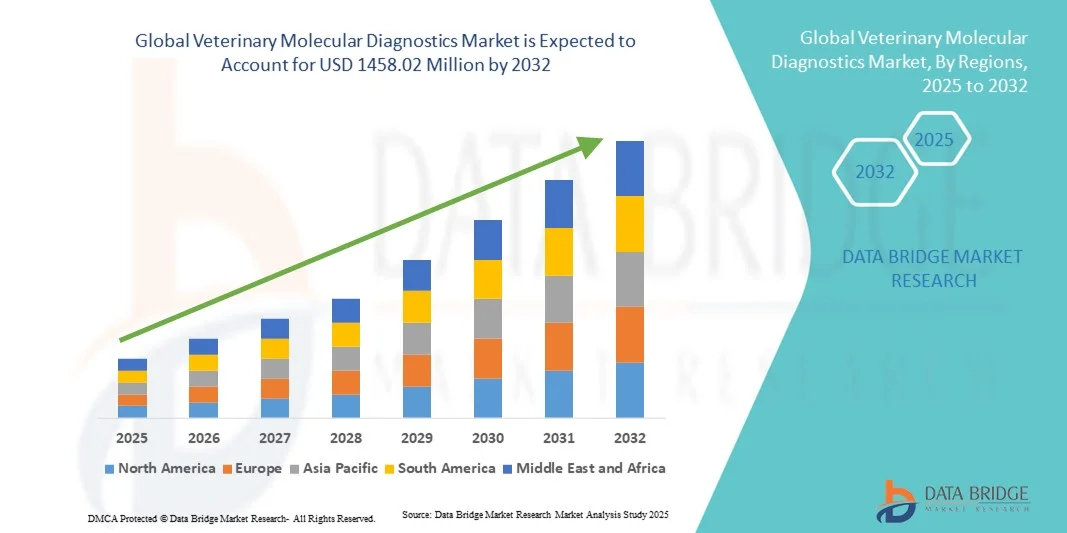

- The global veterinary molecular diagnostics market size was valued at USD 732.81 Million in 2024 and is expected to reach USD 1458.02 Million by 2032, at a CAGR of 8.98% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic technologies, growing awareness of animal health, and the rising need for accurate, rapid, and cost-effective detection of infectious diseases in livestock and companion animals. The growing emphasis on early disease detection and prevention is encouraging the integration of molecular diagnostic techniques, such as PCR and real-time PCR, across veterinary laboratories and clinics

- Furthermore, continuous technological advancements, expanding veterinary healthcare infrastructure, and increasing investment by key players in developing innovative molecular assays are accelerating the uptake of Veterinary Molecular Diagnostics solutions, thereby significantly boosting the industry's growth

Veterinary Molecular Diagnostics Market Analysis

- Veterinary molecular diagnostics, which enable precise detection of pathogens and genetic conditions in animals through techniques such as PCR, qPCR, and microarrays, are becoming increasingly vital in modern veterinary medicine due to their accuracy, speed, and ability to support effective disease management across livestock and companion animals

- The rising demand for veterinary molecular diagnostics is primarily fueled by the growing prevalence of zoonotic and infectious diseases, increasing pet ownership, and heightened awareness regarding animal health and food safety. In addition, advancements in genomic technologies and the development of portable, point-of-care diagnostic solutions are further propelling market growth

- North America dominated the veterinary molecular diagnostics market with the largest revenue share of 39.8% in 2024, driven by strong investments in veterinary research, a well-established diagnostic infrastructure, and a growing emphasis on companion animal health. The U.S. leads the region with widespread adoption of molecular diagnostic testing in veterinary clinics, research centers, and livestock management programs, supported by technological innovations from key market players

- Asia-Pacific is expected to be the fastest-growing region, expanding at a CAGR of 10.5% during the forecast period, owing to the increasing number of veterinary laboratories, growing government initiatives to control animal-borne diseases, and expanding livestock production across countries such as China, India, and Japan

- The livestock animals segment dominated the market with a share of 58.9% in 2024, primarily due to the growing demand for animal-derived food products and the rising emphasis on herd health management

Report Scope and Veterinary Molecular Diagnostics Market Segmentation

|

Attributes |

Veterinary Molecular Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Veterinary Molecular Diagnostics Market Trends

Enhanced Diagnostic Precision Through AI and Automation Integration

- A significant and accelerating trend in the global veterinary molecular diagnostics market is the integration of artificial intelligence (AI) and automation technologies to enhance diagnostic precision, data interpretation, and workflow efficiency in veterinary laboratories

- AI-driven algorithms are increasingly being incorporated into molecular diagnostic platforms to improve the accuracy of pathogen detection, analyze genomic data faster, and reduce the potential for human error in result interpretation

- For instance, in July 2024, Thermo Fisher Scientific introduced advanced AI-powered data analysis software integrated with its veterinary PCR systems, enabling faster detection of zoonotic diseases with higher analytical confidence

- Automation in sample preparation and processing has also emerged as a transformative force, streamlining testing procedures and improving throughput, particularly in large-scale animal health research and surveillance programs

- The growing demand for rapid and reliable diagnostic results in livestock management, companion animal healthcare, and outbreak monitoring has further accelerated the adoption of AI-enabled systems

- Major companies are focusing on developing connected platforms that can process large datasets, identify emerging disease trends, and assist veterinarians in making evidence-based clinical decisions

- For instance, Zoetis and IDEXX are exploring AI-based algorithms that integrate diagnostic results with clinical records to offer predictive insights into disease progression and treatment efficacy

- This convergence of molecular diagnostics with AI and automation not only improves accuracy but also allows real-time disease tracking and advanced genomic sequencing analysis across species

- In addition, automated platforms support higher testing capacity with reduced manual intervention, enhancing laboratory productivity and consistency

- The trend toward intelligent diagnostics is expected to redefine the standards of veterinary healthcare by providing veterinarians with deeper insights, faster turnaround times, and data-driven disease management strategies

- As a result, the adoption of AI-integrated veterinary molecular diagnostic systems is growing rapidly across developed and emerging markets, positioning this segment as a cornerstone of the next generation of animal health technologies

Veterinary Molecular Diagnostics Market Dynamics

Driver

Rising Prevalence of Zoonotic Diseases and Growing Focus on Animal Health Surveillance

- The increasing incidence of zoonotic and infectious diseases among livestock and companion animals is a major driver propelling the growth of the veterinary molecular diagnostics market globally

- Heightened awareness of animal-to-human disease transmission, particularly following outbreaks such as avian influenza and African swine fever, has emphasized the need for rapid, precise, and field-deployable molecular diagnostic tools

- For instance, in May 2023, IDEXX Laboratories launched its new RealPCR African Swine Fever test kit, offering early and accurate detection capabilities to prevent large-scale herd losses

- National and international animal health organizations, including the World Organisation for Animal Health (WOAH), are encouraging the adoption of molecular diagnostic solutions for disease monitoring and biosecurity programs

- Governments and research institutions are investing heavily in animal disease surveillance infrastructure, especially in Asia-Pacific and Europe, driving demand for molecular-level testing technologies

- The growing emphasis on food safety and livestock productivity has also made molecular diagnostics indispensable for identifying pathogens affecting animal reproduction, milk quality, and meat safety

- Moreover, technological advancements, such as multiplex PCR assays and portable molecular analyzers, have improved accessibility and affordability for veterinary clinics and farms

- Companies such as Thermo Fisher and Qiagen are actively expanding their veterinary diagnostic portfolios to cater to regional disease challenges and regulatory requirements

- The driver is further strengthened by the global push for early detection, as veterinarians increasingly depend on molecular assays for real-time insights into antimicrobial resistance and emerging viral strains

- Overall, the rising prevalence of zoonoses, along with advancements in PCR, sequencing, and AI-based diagnostic interpretation, continues to accelerate market growth during the forecast period

Restraint/Challenge

High Cost of Advanced Diagnostic Equipment and Lack of Skilled Professionals

- Despite rapid technological advancements, the widespread adoption of veterinary molecular diagnostics faces significant challenges due to the high cost of equipment and reagents

- Advanced PCR systems, next-generation sequencing (NGS) instruments, and AI-integrated diagnostic platforms often require substantial capital investment, making them less accessible to small veterinary clinics and field laboratories

- For instance, high-throughput molecular analyzers with automated data interpretation capabilities can cost several thousand dollars, posing affordability issues in cost-sensitive markets such as Latin America and parts of Asia

- In addition, the lack of skilled personnel trained in molecular biology techniques and bioinformatics interpretation remains a critical barrier to effective utilization of these technologies

- Many veterinary practitioners, especially in developing regions, rely on conventional diagnostic methods due to limited technical training and infrastructure suppor

- The complexity of molecular workflows, including sample extraction, amplification, and result interpretation, often requires specialized expertise that may not be available in rural or small-scale animal health facilities

- Furthermore, recurring costs associated with consumables, maintenance, and software updates can deter long-term adoption, particularly among independent veterinary laboratories

- Data management and cybersecurity challenges related to the storage and sharing of genomic information also add layers of operational complexity

- Addressing these challenges will require coordinated efforts between governments, academic institutions, and diagnostic manufacturers to establish training programs and financial assistance models

- While innovation continues to drive technological progress, ensuring affordability and accessibility will be vital to achieving widespread adoption of molecular diagnostics across the global veterinary sector

- Therefore, overcoming cost constraints and the shortage of skilled professionals remains a primary challenge to sustaining the market’s growth momentum through 2032

Veterinary Molecular Diagnostics Market Scope

The market is segmented on the basis of product type, technology, disease type, animal type, application, and end user.

- By Product Type

On the basis of product type, the Veterinary Molecular Diagnostics market is segmented into instruments and software, kits and reagents, and services. The kits and reagents segment dominated the largest market revenue share of 52.8% in 2024, owing to their crucial role in enabling efficient and accurate molecular testing procedures. These products are essential components for PCR, sequencing, and other molecular diagnostic methods widely used in both livestock and companion animal testing. Growing awareness regarding early detection of zoonotic and infectious diseases has increased the regular usage of testing kits. Additionally, the introduction of ready-to-use, disease-specific PCR kits by key players such as IDEXX and Thermo Fisher Scientific has enhanced workflow efficiency. The growing preference for customizable reagent panels and the recurring nature of their consumption ensure consistent revenue generation. Furthermore, supportive government initiatives to improve animal health diagnostics continue to strengthen the segment’s dominance.

The instruments and software segment is projected to witness the fastest CAGR of 19.6% from 2025 to 2032, driven by the increasing adoption of automation and digitization in veterinary laboratories. Technological advancements such as AI-enabled analyzers, real-time data monitoring, and portable molecular instruments have revolutionized testing capabilities. Compact diagnostic platforms offering high accuracy and reduced turnaround time are gaining rapid acceptance among field veterinarians. Moreover, software-driven platforms that provide remote access, cloud-based data analysis, and automated result interpretation are further streamlining diagnostic workflows. Continuous product innovation and increased funding for advanced veterinary diagnostic infrastructure are expected to propel the segment’s growth globally.

- By Technology

On the basis of technology, the Veterinary Molecular Diagnostics market is segmented into conventional PCR, singleplex PCR, multiplex PCR, real-time PCR, and others. The real-time PCR segment dominated the market with the largest revenue share of 47.1% in 2024, attributed to its superior speed, sensitivity, and quantitative accuracy in detecting pathogens. Real-time PCR technology is the preferred method in detecting zoonotic and infectious diseases such as swine fever, avian influenza, and bovine tuberculosis. Its ability to provide high-throughput results with minimal contamination risk enhances clinical decision-making efficiency. Continuous technological innovations, including the development of cost-effective and portable qPCR devices, have further strengthened its market position. Major players are integrating cloud-based data analysis features, making real-time PCR even more versatile for veterinary diagnostics.

The multiplex PCR segment is expected to register the fastest CAGR of 21.2% from 2025 to 2032, fueled by its ability to simultaneously detect multiple pathogens in a single reaction. This efficiency not only saves time and cost but also enables comprehensive disease surveillance across large animal populations. Multiplex PCR panels are increasingly utilized in identifying complex infections in both livestock and companion animals. The growing need for differential diagnosis in mixed infections and the rise in multi-pathogen outbreaks are accelerating adoption. Companies such as Bio-Rad and Agilent Technologies are introducing multiplex assay kits optimized for veterinary use, further boosting market penetration.

- By Disease Type

On the basis of disease type, the Veterinary Molecular Diagnostics market is segmented into vector-borne diseases, respiratory pathogens, diarrhea pathogens, and others. The vector-borne diseases segment dominated the market with a share of 41.3% in 2024, owing to the high global incidence of tick-borne infections, leishmaniasis, and anaplasmosis. Increasing climate variability and rising vector populations have amplified the spread of these diseases, particularly in tropical and subtropical regions. Molecular diagnostics have become essential tools for accurate and early detection, enabling better disease management and outbreak prevention. Global animal health organizations are also prioritizing vector-borne surveillance programs, creating sustained demand for molecular testing tools.

The respiratory pathogens segment is projected to grow at the fastest CAGR of 20.5% from 2025 to 2032, driven by the increasing occurrence of respiratory illnesses in livestock and companion animals. The rise in zoonotic respiratory infections, coupled with expanding livestock density, has intensified the need for rapid molecular detection systems. PCR-based assays targeting Mycoplasma, Bordetella, and Influenza pathogens are being increasingly adopted in diagnostic settings. Companies are also developing multiplex respiratory panels capable of detecting both viral and bacterial pathogens in a single test, further boosting demand.

- By Animal Type

On the basis of animal type, the Veterinary Molecular Diagnostics market is segmented into companion animals and livestock animals. The livestock animals segment dominated the market with a share of 58.9% in 2024, primarily due to the growing demand for animal-derived food products and the rising emphasis on herd health management. Livestock diagnostics are critical for controlling economically significant diseases such as bovine tuberculosis, swine fever, and avian influenza. Increasing government funding and animal health awareness programs are encouraging routine molecular testing in farms. The use of molecular tools to ensure traceability, food safety, and improved productivity is also a key growth driver.

The companion animals segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by the growing pet population and increasing human-animal bond worldwide. Rising cases of cancer, zoonotic infections, and hereditary disorders in pets are fostering greater adoption of molecular diagnostics in veterinary clinics. The development of user-friendly diagnostic devices tailored for small animal practices has expanded access to testing services. Additionally, increased spending on pet healthcare and insurance coverage in developed economies supports the segment’s robust growth trajectory.

- By Application

On the basis of application, the Veterinary Molecular Diagnostics market is segmented into infectious diseases, oncology, genetics, and microbiology. The infectious diseases segment held the largest market revenue share of 55.4% in 2024, driven by the widespread occurrence of bacterial, viral, and parasitic infections among both livestock and companion animals. Continuous threats of zoonotic disease outbreaks have led to the integration of molecular diagnostics into routine veterinary screening. The growing use of real-time PCR kits for early pathogen detection ensures quick treatment initiation and disease containment. Major diagnostic companies continue to develop pathogen-specific molecular assays, driving sustained demand in this segment.

The oncology segment is anticipated to grow at the fastest CAGR of 20.1% from 2025 to 2032, supported by advancements in cancer genomics and the increasing adoption of personalized veterinary medicine. Rising cancer prevalence among pets, particularly dogs and cats, is pushing veterinarians to incorporate molecular techniques for early tumor profiling. The availability of PCR-based and sequencing assays that detect genetic mutations and cancer biomarkers is transforming animal oncology diagnostics. Moreover, comparative oncology research initiatives linking human and animal cancer studies are further expanding this market’s scope.

- By End User

On the basis of end user, the Veterinary Molecular Diagnostics market is segmented into veterinary hospitals, clinical laboratories, and research institutes. The veterinary hospitals segment dominated the market with the largest revenue share of 48.5% in 2024, attributed to the growing number of animal healthcare facilities equipped with molecular testing systems. Hospitals play a central role in providing diagnostic and preventive care services for both livestock and pets. Continuous upgrades in laboratory infrastructure, coupled with on-site PCR systems and automation, have significantly enhanced testing capacity. The segment benefits from integrated workflows that support rapid diagnosis, treatment monitoring, and disease prevention programs.

The clinical laboratories segment is forecasted to record the fastest CAGR of 19.8% from 2025 to 2032, driven by increasing outsourcing of diagnostic services by smaller veterinary clinics. Clinical labs are investing in high-throughput molecular platforms capable of handling large sample volumes efficiently. Strategic partnerships between laboratories and diagnostic manufacturers are leading to the introduction of specialized testing services across multiple regions. Moreover, the growing establishment of reference laboratories and their expanding role in nationwide disease surveillance further contribute to this segment’s strong growth.

Veterinary Molecular Diagnostics Market Regional Analysis

- North America dominated the veterinary molecular diagnostics market with the largest revenue share of 39.8% in 2024, driven by strong investments in veterinary research, a well-established diagnostic infrastructure, and a growing emphasis on companion animal health

- The region’s leadership is further supported by the presence of key market players, technological innovations, and increasing demand for early disease detection in pets and livestock

- The market leads the North American market, benefiting from advanced veterinary healthcare systems, continuous R&D in molecular testing, and expanding applications of PCR and real-time PCR-based assays across clinics and research institutions

U.S. Veterinary Molecular Diagnostics Market Insight

The U.S. veterinary molecular diagnostics market captured the majority share within North America in 2024, propelled by the widespread adoption of advanced diagnostic platforms for animal health monitoring. The country’s growing companion animal population and heightened awareness regarding zoonotic diseases are key factors boosting market demand. Additionally, the presence of established players such as IDEXX Laboratories and Thermo Fisher Scientific, alongside continuous technological advancements in molecular testing kits and reagents, further strengthen the U.S. market position.

Europe Veterinary Molecular Diagnostics Market Insight

The Europe veterinary molecular diagnostics market is projected to expand at a steady CAGR during the forecast period, fueled by growing awareness of animal health management and government support for zoonotic disease control programs. The region is witnessing increased adoption of molecular diagnostic assays in livestock disease surveillance and companion animal care. Countries such as Germany, France, and the U.K. are leading contributors, driven by strong veterinary research networks and robust regulatory frameworks for animal disease diagnostics.

U.K. Veterinary Molecular Diagnostics Market Insight

The U.K. veterinary molecular diagnostics market is expected to grow significantly during the forecast period, supported by a rising focus on animal welfare, genetic testing, and the prevention of infectious diseases. The country’s expanding network of veterinary hospitals and diagnostic laboratories, coupled with the adoption of advanced PCR-based tests for companion animals, is driving market growth.

Germany Veterinary Molecular Diagnostics Market Insight

Germany’s veterinary molecular diagnostics market continues to expand rapidly, underpinned by its advanced biotechnology sector and focus on precision diagnostics in veterinary medicine. Government support for R&D initiatives in animal health, along with the country’s leadership in molecular research and laboratory automation, is fostering the use of innovative diagnostic technologies in both livestock and companion animal segments.

Asia-Pacific Veterinary Molecular Diagnostics Market Insight

The Asia-Pacific veterinary molecular diagnostics market is expected to grow at the fastest CAGR of 10.5% during 2025–2032, driven by the increasing number of veterinary laboratories, expanding livestock population, and rising prevalence of infectious animal diseases. Rapid urbanization, growing pet ownership, and supportive government programs for disease surveillance and control are further propelling market growth.

Japan Veterinary Molecular Diagnostics Market Insight

Japan’s veterinary molecular diagnostics market is gaining traction due to the country’s advanced biotechnology capabilities and high pet healthcare expenditure. The growing emphasis on genetic testing, infectious disease detection, and preventive care in companion animals is driving adoption among veterinary clinics and academic research institutions.

China Veterinary Molecular Diagnostics Market Insight

China veterinary molecular diagnostics market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its growing livestock population, expanding veterinary diagnostic infrastructure, and government-led initiatives for animal disease control. The presence of domestic diagnostic kit manufacturers and increasing investments in biotechnology are accelerating market growth.

Veterinary Molecular Diagnostics Market Share

The Veterinary Molecular Diagnostics industry is primarily led by well-established companies, including:

• Zoetis Inc. (U.S.)

• IDEXX Laboratories, Inc. (U.S.)

• Thermo Fisher Scientific Inc. (U.S.)

• QIAGEN N.V. (Netherlands)

• Bio-Rad Laboratories, Inc. (U.S.)

• Neogen Corporation (U.S.)

• Biomerieux S.A. (France)

• Agilent Technologies, Inc. (U.S.)

• Heska Corporation (U.S.)

• Promega Corporation (U.S.)

• Indical Bioscience GmbH (Germany)

• Biovet Inc. (Canada)

• Enzo Life Sciences, Inc. (U.S.)

• MERCK KGaA (Germany)

• Tecan Group Ltd. (Switzerland)

• Eurofins Scientific (Luxembourg)

• Abaxis, Inc. (U.S.)

• Generi Biotech s.r.o. (Czech Republic)

• Precision Diagnostics (U.S.)

• Genomia s.r.o. (Czech Republic)

Latest Developments in Global Veterinary Molecular Diagnostics Market

- In January 2024, Zoetis expanded the diagnostic capabilities of its Vetscan Imagyst platform by adding AI-powered urine sediment analysis, enabling rapid, point-of-care microscopic evaluation with automated image interpretation. This addition strengthened Zoetis’s push to bring lab-quality analytics to clinics and supported faster, more consistent diagnostic decision-making for companion animals worldwide, particularly benefiting small animal practices that need rapid, reliable results without sending samples to central labs

- In September 2024, QIAGEN broadened its QIAcuity digital PCR portfolio and released new assay kits and software updates that increased the platform’s applicability for high-sensitivity pathogen detection and food-safety testing workflows; these enhancements made digital PCR more accessible to veterinary and animal-health laboratories by improving multiplexing options, simplifying assay set-up, and expanding the catalog of validated assays useful for animal pathogen surveillance and research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.