Global Veterinary Clostridium Vaccine Market

Market Size in USD Million

CAGR :

%

USD

800.50 Million

USD

2,182.93 Million

2024

2032

USD

800.50 Million

USD

2,182.93 Million

2024

2032

| 2025 –2032 | |

| USD 800.50 Million | |

| USD 2,182.93 Million | |

|

|

|

|

Veterinary Clostridium Vaccine Market Size

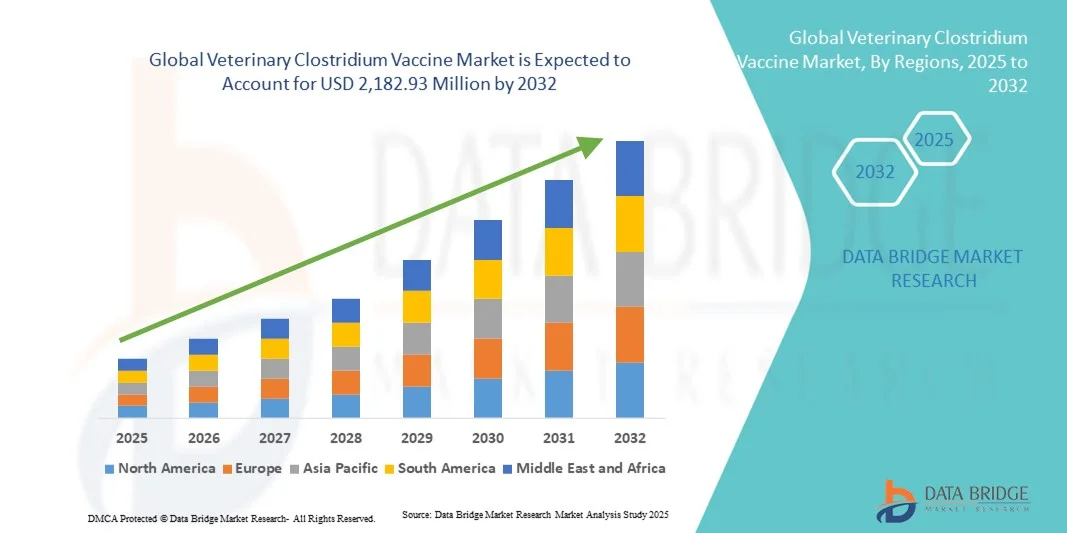

- The global veterinary clostridium vaccine market size was valued at USD 800.50 billion in 2024 and is expected to reach USD 2,182.93 million by 2032, at a CAGR of 13.36% during the forecast period

- The market growth is largely fueled by the increasing prevalence of clostridial infections among livestock and pets, along with rising investments in preventive animal healthcare solutions

- Furthermore, growing awareness among livestock owners and veterinarians about animal health, coupled with technological advancements in vaccine development, is establishing clostridium vaccines as a critical component of livestock and pet management programs. These converging factors are accelerating the adoption of clostridium vaccine solutions, thereby significantly boosting the industry's growth

Veterinary Clostridium Vaccine Market Analysis

- Veterinary clostridium vaccines, providing immunization against Clostridium species in livestock and poultry, are increasingly vital components of modern animal health management in both farm and companion animal settings due to their role in preventing severe infections, reducing mortality, and enhancing overall productivity

- The escalating demand for veterinary clostridium vaccines is primarily fueled by the rising prevalence of clostridial diseases, growing awareness of animal health among farmers, and advancements in vaccine formulations and delivery methods

- North America dominated the veterinary clostridium vaccine market with the largest revenue share of 39% in 2024, characterized by a well-established veterinary healthcare infrastructure, high livestock population, and strong presence of key vaccine manufacturers, with the U.S. experiencing substantial adoption driven by innovations in vaccine technologies and efficient distribution networks

- Asia-Pacific is expected to be the fastest growing region in the veterinary clostridium vaccine market during the forecast period due to increasing livestock farming, expanding veterinary healthcare services, rising disposable incomes among farmers, and investments by major vaccine manufacturers in the region

- Livestock segment dominated the veterinary clostridium vaccine market in 2024 with a market share of 43.2%, driven by the high prevalence of clostridial infections in cattle, sheep, and goats, and the critical need for preventive vaccination in large-scale farming operations

Report Scope and Veterinary Clostridium Vaccine Market Segmentation

|

Attributes |

Veterinary Clostridium Vaccine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Veterinary Clostridium Vaccine Market Trends

Advancements in Vaccine Technology and Delivery Methods

- A significant and accelerating trend in the global veterinary clostridium vaccine market is the development of advanced vaccine technologies, including inactivated, toxoid, and recombinant formulations, which are improving efficacy and safety for livestock and poultry

- For instance, Zoetis has introduced recombinant clostridium vaccines that provide broader protection and reduce adverse reactions, allowing farmers to implement more effective immunization programs

- Innovations in vaccine delivery methods, such as oral and multi-dose formulations, enable easier administration, reduce stress on animals, and enhance herd-level immunity. For instance, Elanco’s multi-dose clostridium vaccines facilitate mass vaccination of cattle with minimal handling

- The integration of vaccines with herd health management platforms allows centralized tracking of immunization schedules, disease incidence, and vaccine performance, improving overall farm biosecurity

- This trend towards more efficient, safer, and technology-enabled vaccines is reshaping farmer expectations for livestock disease prevention, prompting companies such as Hipra to invest in next-generation clostridium vaccine solutions

- The demand for vaccines with improved efficacy, simplified administration, and broader protection is growing rapidly across large-scale livestock and poultry operations, as animal health management becomes more data-driven and preventive-focused

Veterinary Clostridium Vaccine Market Dynamics

Driver

Increasing Prevalence of Clostridial Diseases and Preventive Healthcare Awareness

- The rising incidence of clostridial infections in livestock and poultry, coupled with growing awareness of preventive animal healthcare, is a significant driver for the increased adoption of veterinary clostridium vaccines

- For instance, in March 2024, Boehringer Ingelheim launched targeted vaccination campaigns in North America to combat clostridial infections in cattle, highlighting preventive healthcare benefits

- As farmers recognize the economic losses caused by livestock morbidity and mortality, vaccines provide a cost-effective solution to maintain herd health and productivity

- Furthermore, government and industry guidelines promoting vaccination in livestock operations encourage routine immunization practices, expanding market penetration

- The convenience of multi-dose and broad-spectrum vaccines, combined with herd health management programs, is propelling adoption in large-scale farms, reducing disease outbreaks and improving operational efficiency

- Increased awareness campaigns and training programs by veterinary associations are educating farmers on the importance of timely vaccination, boosting market demand

- Strategic partnerships between vaccine manufacturers and agricultural cooperatives are enhancing distribution networks, ensuring vaccines reach remote farming communities efficiently

Restraint/Challenge

High Vaccine Costs and Cold Chain Management Requirements

- The relatively high production costs of advanced clostridium vaccines and the need for strict cold chain storage pose challenges to widespread adoption, particularly in developing regions

- For instance, smaller farms in Asia-Pacific face logistical difficulties in maintaining required storage temperatures for inactivated vaccines, limiting accessibility

- Ensuring vaccine potency throughout distribution requires specialized refrigeration, increasing operational complexity and cost for veterinarians and farmers

- Furthermore, price-sensitive farmers may hesitate to adopt premium vaccine formulations, preferring lower-cost alternatives despite reduced efficacy

- Overcoming these challenges through cost optimization, improved cold chain infrastructure, and development of more stable formulations will be crucial for sustained market growth

- Limited awareness among small-scale farmers about the benefits of clostridium vaccination can restrict market penetration in certain regions

- Regulatory hurdles for approval of new recombinant or combination vaccines in different countries may delay product launches, affecting overall market growth

Veterinary Clostridium Vaccine Market Scope

The market is segmented on the basis of disease, type, technology, and distribution channel.

- By Disease

On the basis of disease, the veterinary clostridium vaccine market is segmented into swine pneumonia, avian influenza, rabies, coccidiosis, brucellosis, and canine distemper. The Swine Pneumonia segment dominated the market with the largest revenue share in 2024, driven by the high prevalence of respiratory clostridial infections in swine and the substantial economic losses associated with outbreaks. Farmers and commercial pig farms prioritize vaccination programs to prevent disease spread, maintain growth rates, and reduce mortality. Government initiatives promoting swine disease control and large-scale vaccination campaigns further enhance adoption. In addition, advancements in multi-dose and inactivated vaccines improve herd-level immunity and operational efficiency. The segment’s dominance is supported by increasing awareness of biosecurity and preventive livestock healthcare among farmers.

The Avian Influenza segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising poultry farming activities and increasing preventive healthcare awareness. Poultry operations require effective immunization programs to maintain flock health and ensure consistent meat and egg production. Advancements in oral and in-ovo vaccine delivery methods enable efficient mass vaccination of large flocks. Expansion of commercial poultry farms in emerging markets is creating higher demand for clostridium vaccines. Strategic initiatives by key players to introduce combination vaccines further accelerate adoption. Increasing government and private sector support for disease prevention in poultry is contributing to rapid growth in this segment.

- By Type

On the basis of type, the market is segmented into poultry, livestock, aquaculture, porcine, and canine. The Livestock segment dominated the market in 2024 with the largest share of 43.2%, driven by the high prevalence of clostridial infections in cattle, sheep, and goats. Farmers implement routine vaccination programs to prevent losses in meat and dairy production, making livestock vaccines essential for large-scale agricultural operations. Multi-dose formulations and herd-level immunization strategies simplify administration and reduce stress on animals. Government policies promoting livestock health and preventive care further support adoption. The segment is also driven by the rising economic importance of livestock and growing investment in veterinary healthcare infrastructure. In addition, established supply chains and widespread veterinary support increase vaccine accessibility for large farms.

The Poultry segment is expected to witness the fastest growth from 2025 to 2032, driven by the rapid expansion of poultry farming in Asia-Pacific and Africa. Rising demand for eggs and poultry meat requires preventive vaccination to maintain flock productivity. Oral and in-ovo vaccine delivery methods enhance ease of administration and reduce labor costs. Commercial poultry farms are increasingly adopting multi-strain vaccines for broader protection. Investments by vaccine manufacturers in emerging markets are accelerating availability. Awareness campaigns on poultry disease prevention among small-scale farmers further support the segment’s growth.

- By Technology

On the basis of technology, the market is segmented into inactivated, toxoid, and recombinant vaccines. The Toxoid segment dominated the market in 2024, capturing the largest revenue share due to its long-established use, proven efficacy, and safety profile. Toxoid vaccines are widely used in livestock and poultry operations to provide stable protection against multiple Clostridium species. Their adoption is supported by extensive clinical validation and farmer trust in traditional formulations. Multi-dose packaging and compatibility with herd-level immunization strategies further enhance adoption. Established supply chains and availability through veterinary hospitals and clinics ensure consistent distribution. Continuous R&D efforts to improve toxoid vaccines sustain their market dominance.

The Recombinant segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advances in biotechnology enabling safer, targeted, and multi-strain vaccines. Recombinant vaccines reduce adverse reactions and improve immune response in animals. The technology allows production of combination vaccines, lowering handling and administration time. Increasing regulatory approvals for recombinant vaccines enhance market availability. Key players are investing in recombinant vaccine development to meet growing demand in large-scale farms. Adoption is further supported by government and private sector initiatives promoting preventive healthcare in livestock and poultry.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, veterinary research institutes, and retail pharmacies. The Veterinary Hospital segment dominated the market in 2024, capturing the largest share due to professional administration, proper cold chain management, and access to comprehensive animal healthcare services. Hospitals ensure accurate dosing and post-vaccination monitoring, increasing farmer confidence. Multi-dose vaccines and herd health programs offered by hospitals enhance operational efficiency. The segment is further supported by well-established veterinary networks and supply chains. Advanced services and advisory support on preventive healthcare strengthen market dominance. Government partnerships with hospitals for vaccination campaigns also boost adoption.

The Veterinary Clinic segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing access to veterinary services in semi-urban and rural regions. Clinics provide convenient vaccination for small and medium-scale farms as well as companion animals. Mobile veterinary services and outreach programs improve coverage in remote areas. Awareness campaigns by clinics educate farmers on the importance of preventive vaccination. Expanding network of private clinics in emerging markets contributes to rapid adoption. Growing trust in veterinary professionals and ease of accessing vaccination services further accelerate the segment’s growth.

Veterinary Clostridium Vaccine Market Regional Analysis

- North America dominated the veterinary clostridium vaccine market with the largest revenue share of 39% in 2024, characterized by a well-established veterinary healthcare infrastructure, high livestock population, and strong presence of key vaccine manufacturers

- Farmers and commercial livestock operators in the region prioritize preventive vaccination programs to protect herd health, reduce mortality, and maintain productivity, while veterinary hospitals and clinics ensure proper administration and cold chain management

- This widespread adoption is further supported by government initiatives promoting livestock disease control, strong presence of key vaccine manufacturers, and increasing awareness of preventive animal healthcare, establishing clostridium vaccines as an essential solution for both large-scale and small-scale farming operations

U.S. Veterinary Clostridium Vaccine Market Insight

The U.S. veterinary clostridium vaccine market captured the largest revenue share of 82% in 2024 within North America, fueled by the high prevalence of clostridial infections in livestock and well-established veterinary healthcare services. Farmers and commercial livestock operators prioritize preventive vaccination programs to maintain herd health, reduce mortality, and protect productivity. The growing adoption of multi-dose and recombinant vaccines, combined with strong veterinary networks and cold chain management, further propels the market. Moreover, government initiatives promoting livestock disease control and the presence of leading vaccine manufacturers are significantly contributing to market expansion. The increasing awareness of preventive animal healthcare among small and large-scale farmers is also driving adoption.

Europe Veterinary Clostridium Vaccine Market Insight

The Europe veterinary clostridium vaccine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations for livestock health and the rising prevalence of clostridial diseases. Increasing urbanization and modernization of livestock farming practices are fostering the adoption of vaccines. European farmers are also adopting vaccines to enhance herd productivity and prevent economic losses from disease outbreaks. The region is witnessing significant growth across cattle, sheep, and poultry operations, with vaccines being incorporated into both large-scale farms and smaller commercial setups. Strong veterinary infrastructure and proactive government policies further support market growth.

U.K. Veterinary Clostridium Vaccine Market Insight

The U.K. veterinary clostridium vaccine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing livestock disease awareness and a desire for improved herd productivity. Concerns regarding clostridial outbreaks are encouraging farmers to implement routine vaccination programs. The U.K.’s robust veterinary healthcare network, advanced cold chain facilities, and well-established distribution channels are expected to continue stimulating market growth. In addition, adoption of multi-strain vaccines and preventive healthcare campaigns is increasing among both small and large-scale livestock operations. E-commerce and retail availability of veterinary products further enhance accessibility for farmers.

Germany Veterinary Clostridium Vaccine Market Insight

The Germany veterinary clostridium vaccine market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of livestock disease prevention and the demand for high-quality vaccines. Germany’s advanced veterinary infrastructure, focus on sustainable and efficient livestock farming, and emphasis on animal welfare promote vaccine adoption. Vaccines are increasingly integrated into herd health programs, with a strong preference for multi-strain and recombinant formulations. The government’s support for preventive healthcare in livestock and veterinary training initiatives further encourages market growth. Advanced cold chain logistics and reliable distribution networks strengthen adoption in both commercial and small-scale farms.

Asia-Pacific Veterinary Clostridium Vaccine Market Insight

The Asia-Pacific veterinary clostridium vaccine market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by increasing livestock and poultry farming, rising disposable incomes among farmers, and growing awareness of animal health. The region’s expanding commercial farming sector and government initiatives promoting disease prevention are driving vaccine adoption. Furthermore, Asia-Pacific is emerging as a manufacturing hub for veterinary vaccines, improving affordability and accessibility. Rapid urbanization, technological adoption in farming, and large livestock populations in countries such as China, India, and Japan are supporting market expansion. Strategic investments by key vaccine manufacturers in the region are also accelerating growth.

Japan Veterinary Clostridium Vaccine Market Insight

The Japan veterinary clostridium vaccine market is gaining momentum due to advanced livestock management practices, high technological adoption, and rising preventive healthcare awareness. The Japanese market emphasizes herd health and disease prevention, leading to growing adoption of multi-dose and recombinant vaccines. Integration of vaccines into modern livestock monitoring systems is fueling growth. In addition, government-supported vaccination campaigns and veterinary advisory services enhance accessibility. Japan’s aging farming population is such asly to spur demand for easier-to-administer vaccines in both cattle and poultry operations. Focus on animal welfare and productivity further drives market expansion.

India Veterinary Clostridium Vaccine Market Insight

The India veterinary clostridium vaccine market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding livestock and poultry sectors, rising awareness of preventive healthcare, and high rates of vaccine adoption. India is one of the fastest-growing markets for veterinary vaccines, with increasing implementation in both rural and urban farms. Government initiatives for livestock disease control and the push towards organized dairy and poultry farming are key factors propelling the market. Availability of affordable vaccines from domestic manufacturers and strategic outreach programs for farmers further enhance adoption. The focus on improving herd health and productivity is driving continued growth in the Indian market.

Veterinary Clostridium Vaccine Market Share

The Veterinary Clostridium Vaccine industry is primarily led by well-established companies, including:

- Zoetis Services LLC. (U.S.)

- Merck & Co., Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Elanco Animal Health (U.S.)

- Virbac (France)

- Ceva (France)

- Bayer AG (Germany)

- Bimeda, Inc. (U.S.)

- MSD Animal Health (U.S.)

- Sanofi (France)

- Phibro Animal Health Corporation (U.S.)

- Hester Biosciences Limited (India)

- Neogen Corporation (U.S.)

- HIPRA (Spain)

- Biogénesis Bagó (Argentina)

- Tianjin Ringpu Biotechnology Co., Ltd. (China)

- Colorado Serum Company (U.S.)

- Vetoquinol (France)

- LABORATORIOS HIPRA S.A. (Spain)

- Vaxxinova (U.S.)

What are the Recent Developments in Global Veterinary Clostridium Vaccine Market?

- In October 2023, Boehringer Ingelheim introduced Alpha™, a single-dose vaccine designed to protect cattle against multiple clostridial diseases. This vaccine also offers optional pinkeye protection, providing comprehensive disease prevention for cattle herds. The launch underscores Boehringer Ingelheim's commitment to advancing cattle health through innovative vaccine solutions

- In September 2025, Zoetis received conditional approval for Dectomax®-CA1 Injectable for the prevention and treatment of New World Screwworm Myiasis in cattle. This approval marks a significant advancement in parasitic disease control in livestock

- In November 2023, scientists at the University of Saskatchewan initiated studies to determine optimal vaccination protocols for sheep against clostridial diseases. Their research aims to establish guidelines for effective disease prevention in sheep populations

- In April 2023, researchers at NC State Veterinary Medicine published findings on Clostridium perfringens, a bacterium causing necrotic enteritis in chickens. Their research emphasizes the importance of understanding clostridial pathogens to develop effective vaccines and control strategies in poultry farming

- In July 2022, Elanco announced the integration of a novel adjuvant technology into its clostridium vaccine, enhancing the immune response in cattle. This advancement aims to improve the efficacy of the vaccine, providing better protection against clostridial diseases in livestock. The incorporation of this technology reflects Elanco's dedication to innovation in animal health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.