Global Ventilators Market

Market Size in USD Billion

CAGR :

%

USD

8.30 Billion

USD

16.06 Billion

2024

2032

USD

8.30 Billion

USD

16.06 Billion

2024

2032

| 2025 –2032 | |

| USD 8.30 Billion | |

| USD 16.06 Billion | |

|

|

|

|

Global Ventilator Market Size

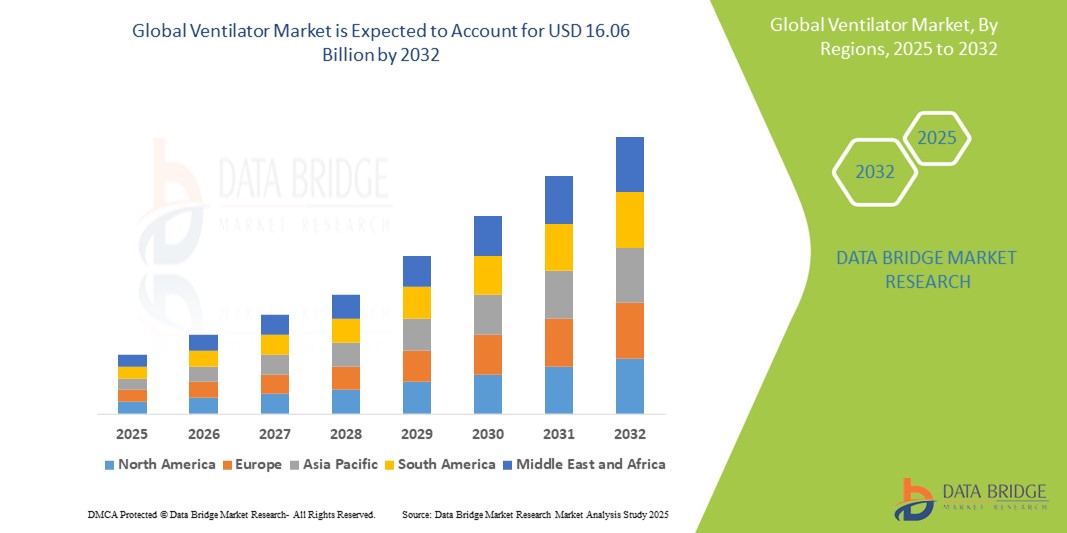

- The global ventilator market size was valued at USD 8.30 billion in 2024 and is expected to reach USD 16.06 billion by 2032, at a CAGR of 8.6% during the forecast period

- This growth is driven by factors such as the rising prevalence of respiratory diseases, technological advancements, and integration of telemedicine and remote monitoring

Global Ventilator Market Analysis

- Ventilators are critical medical devices used to support or replace the breathing process in patients with respiratory failure or severe respiratory distress. They are essential in intensive care units (ICUs), emergency rooms, and home care settings, providing life-saving respiratory support

- The demand for ventilators is significantly driven by the rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and acute respiratory distress syndrome (ARDS), along with the increasing geriatric population globally

- North America is expected to dominate the global ventilator market, accounting for 42.4% of the market share, driven by advanced healthcare infrastructure, high healthcare spending, technological advancements, continuous innovation in ventilator technology, and high ICU admission rates, significant demand for ventilators in intensive care units (ICUs)

- Asia-Pacific is expected to be the fastest growing region in the global ventilator market, with an CAGR of 10.5%, driven by rapid urbanization, expanding healthcare infrastructure, increasing respiratory disease prevalence, rising cases of chronic respiratory conditions, and government support, favorable policies promoting healthcare investments

- Intensive care ventilators segment is expected to dominate the global ventilator market with a market share of 60.1%, driven by their critical role in managing severe respiratory distress in intensive care units (ICUs)

Report Scope and Global Ventilator Market Segmentation

|

Attributes |

Global Ventilator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Ventilator Market Trends

“Technological Advancements in Ventilator Systems for Enhanced Patient Care”

- One prominent trend in the evolution of ventilator systems is the integration of advanced technologies, including artificial intelligence (AI), automation, and real-time monitoring, which are transforming respiratory care

- These innovations enhance patient outcomes by optimizing ventilation parameters, reducing lung injury, and providing personalized respiratory support

- For instance, AI-powered ventilators can automatically adjust ventilation settings based on real-time patient data, improving outcomes in critical care situations and reducing the workload on healthcare professionals. In addition, portable ventilators equipped with IoT connectivity enable remote patient monitoring, supporting home-based care and reducing hospital readmissions

- These advancements are significantly improving patient outcomes, enhancing care efficiency, and driving the demand for next-generation ventilators in both hospital and homecare settings

Global Ventilator Market Dynamics

Driver

“Rising Prevalence of Respiratory Diseases and Aging Population”

- The increasing prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, pneumonia, and acute respiratory distress syndrome (ARDS) is significantly contributing to the growing demand for ventilators

- As the global population ages, the incidence of respiratory diseases continues to rise, with older adults being more susceptible to respiratory infections and chronic lung conditions that often require mechanical ventilation

- In addition, the impact of environmental pollution and the long-term effects of COVID-19 have further highlighted the need for advanced ventilatory support systems

For instance,

- In December 2024, according to a report by the World Health Organization (WHO), COPD is expected to become the third leading cause of death globally by 2030, driven by factors such as tobacco smoking, air pollution, and aging populations. This trend significantly boosts the demand for ventilators in critical care settings

- As a result of the rising prevalence of respiratory diseases and the aging population, there is a substantial increase in the demand for ventilators to ensure improved patient outcomes and reduced respiratory complications

Opportunity

“Integration of Advanced Technologies in Ventilator Systems”

- Technological advancements in ventilator systems, including the integration of artificial intelligence (AI), Internet of Things (IoT), and real-time data analytics, are transforming respiratory care

- AI-powered ventilators can automatically adjust ventilation settings based on real-time patient data, enhancing patient outcomes and reducing clinician workload

- In addition, IoT-enabled ventilators can facilitate remote monitoring, predictive maintenance, and data-driven decision-making, improving overall patient care and operational efficiency

For instance,

- In January 2025, a study published in the Journal of Medical Systems highlighted that AI-integrated ventilators have the potential to reduce hospital stay durations by optimizing ventilation settings, minimizing lung injury, and improving patient recovery rates. This approach significantly reduces healthcare costs and improves patient outcomes

- The adoption of such advanced technologies in ventilator systems can revolutionize critical care, enhance patient safety, and drive the overall growth of the ventilator market

Restraint/Challenge

“High Equipment Costs and Regulatory Challenges”

- The high cost of ventilators, particularly those with advanced features such as AI integration and real-time monitoring, poses a significant challenge for market growth, especially in developing regions with constrained healthcare budgets

- These devices can range from several thousand to hundreds of thousands of dollars, limiting their adoption in smaller healthcare facilities and low-resource settings

- In addition, stringent regulatory requirements and the need for regular maintenance further add to the overall operational costs, creating financial burdens for healthcare providers

For instance,

- In November 2024, according to a report by the International Journal of Health Economics, the high upfront cost of ventilators, combined with ongoing maintenance expenses, can significantly impact the financial stability of healthcare facilities, particularly in emerging economies where funding is limited

- These financial barriers can limit access to advanced respiratory care, ultimately affecting patient outcomes and hindering the overall growth of the ventilator market

Global Ventilator Market Scope

The market is segmented on the basis of product type, modality, ventilator type, mode and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Modality |

|

|

By Ventilator type |

|

|

By Mode |

|

|

By End User |

|

In 2025, the intensive care ventilators is projected to dominate the market with a largest share in product type segment

The intensive care ventilators segment is expected to dominate the global ventilator market with the largest share of 60.1% in 2025, driven by their critical role in managing severe respiratory distress in intensive care units (ICUs). As essential equipment for critically ill patients, these ventilators offer precise oxygen delivery, real-time monitoring, and multi-mode ventilation, enhancing patient outcomes. The rising number of ICU admissions, increasing prevalence of chronic respiratory diseases, and growing geriatric population further contribute to the dominance of this segment.

The non-invasive ventilation is expected to account for the largest share during the forecast period in modality market

In 2025, the non-invasive ventilation segment is expected to dominate the market with the largest market share of 45.3% due to its growing adoption in homecare settings, long-term care facilities, and emergency departments. As a preferred choice for patients with mild to moderate respiratory distress, non-invasive ventilators reduce the risk of infection, improve patient comfort, and lower the need for sedation, driving market growth. Advancements in portable ventilator technology and increasing awareness of non-invasive ventilation benefits further contribute to its market dominance.

Global Ventilator Market Regional Analysis

“North America Holds the Largest Share in the Global Ventilator Market”

- North America dominates the global ventilator market, accounting for 42.4% of the market share, driven by advanced healthcare infrastructure, high healthcare spending, technological advancements, continuous innovation in ventilator technology, and high ICU admission rates, significant demand for ventilators in intensive care units (ICUs)

- U.S. leads the North American market, commanding 75.5% of the regional share driven by strong R&D investment, substantial funding for medical technology development, robust hospital networks, presence of advanced healthcare facilities, and high critical care capacity, large number of ICU beds supporting ventilator demand

“Asia-Pacific is Projected to Register the Highest CAGR in the Global Ventilator Market”

- Asia-Pacific is expected to witness the highest growth rate in the global ventilator market, with an estimated CAGR of 10.5%, driven by rapid urbanization, expanding healthcare infrastructure, increasing respiratory disease prevalence, rising cases of chronic respiratory conditions, and government support, favorable policies promoting healthcare investments

- China dominates the regional market, holding 61.2% of the Asia-Pacific market share, driven by large-scale manufacturing, extensive ventilator production capacity, government support, significant investments in healthcare technology, and high demand, growing number of ICU admissions

- India is projected to register the highest CAGR of 8.4% in the Asia-Pacific market, driven by healthcare infrastructure expansion, rapid growth in hospital networks, and medical tourism, increasing demand for advanced medical devices

Global Ventilator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Air Liquide (France)

- Hamilton Medical (Switzerland)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Medtronic (Ireland)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Smiths Group plc (U.K.)

- Getinge (Sweden)

- Drägerwerk AG & Co. KGaA (Germany)

- Leistung Equipamentos LTDA (Brazil)

- Penlon Limited (U.K.)

- ResMed (U.S.)

- Vyaire Medical (U.S.)

- Zoll Medical Corporation (U.S.)

- GE Healthcare (U.S.)

Latest Developments in Global Ventilator Market

- In March 2025, Medtronic announced the launch of its latest Puritan Bennett 980 ventilator, featuring enhanced AI-driven monitoring capabilities and improved patient-ventilator synchrony to optimize respiratory support in ICUs. The device aims to reduce complications and improve outcomes for critically ill patients with respiratory failure

- In January 2025, Hamilton Medical unveiled the latest version of its high-end ventilator, the Hamilton-C6, with advanced modes for personalized ventilation therapy and integrated remote monitoring features. These innovations are designed to support complex cases including ARDS and COVID-19 patients

- In November 2024, GE Healthcare introduced the CARESCAPE R860 ventilator with upgraded touchscreen interface and improved battery life, targeting greater ease of use and mobility in emergency and critical care settings globally

- In October 2024, Philips Respironics expanded its portfolio by launching the Trilogy Evo, a versatile portable ventilator optimized for homecare and transport, featuring robust battery options and compatibility with multiple ventilation modes

- In September 2024, Drägerwerk AG & Co. KGaA launched the latest Draeger Evita V600 ventilator, which offers enhanced lung protective ventilation features and integrated infection control measures. This product is aimed at improving care quality and safety in critical care units worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.