Global Vendor Neutral Archive (VNA) Market Segmentation, By Delivery Mode (On-Premise VNA, Hybrid VNA, and Fully Cloud-Hosted VNA), Procurement Mode (Departmental VNA, Multi-Departmental VNA, and Multi-Site VNA), Imaging Modality (Angiography, Mammography, Computed Tomography, Digital Fluoroscopy, Digital Radiography, Magnetic Resonance Imaging, Nuclear Imaging, Ultrasound, and Other), Usage Model (Single Department, Multiple Departments, and Multiple Sites), Player Type (PACS, Independent Software, and Infrastructure) – Industry Trends and Forecast to 2032

Vendor Neutral Archive (VNA) Market Analysis

The global Vendor Neutral Archive (VNA) market is experiencing significant growth due to the increasing demand for efficient data management solutions across healthcare and medical imaging sectors. VNAs enable healthcare providers to manage, store, and access medical imaging data without being tied to specific vendor systems. This interoperability is crucial as it allows for seamless data exchange, reduces data silos, and improves collaboration between different healthcare entities. As healthcare systems adopt digital transformation strategies, the need for cloud-based VNA solutions is rising, as they offer scalability, security, and easy integration with other healthcare IT systems, such as Electronic Health Records (EHRs). Additionally, VNAs enhance patient care by ensuring faster access to medical images and enabling remote consultations. The growing emphasis on regulatory compliance and data security further drives the demand for VNAs. With these advantages, the VNA market is poised to continue its expansion, particularly in regions with advanced healthcare infrastructure and a growing focus on data interoperability.

Vendor Neutral Archive (VNA) Market Size

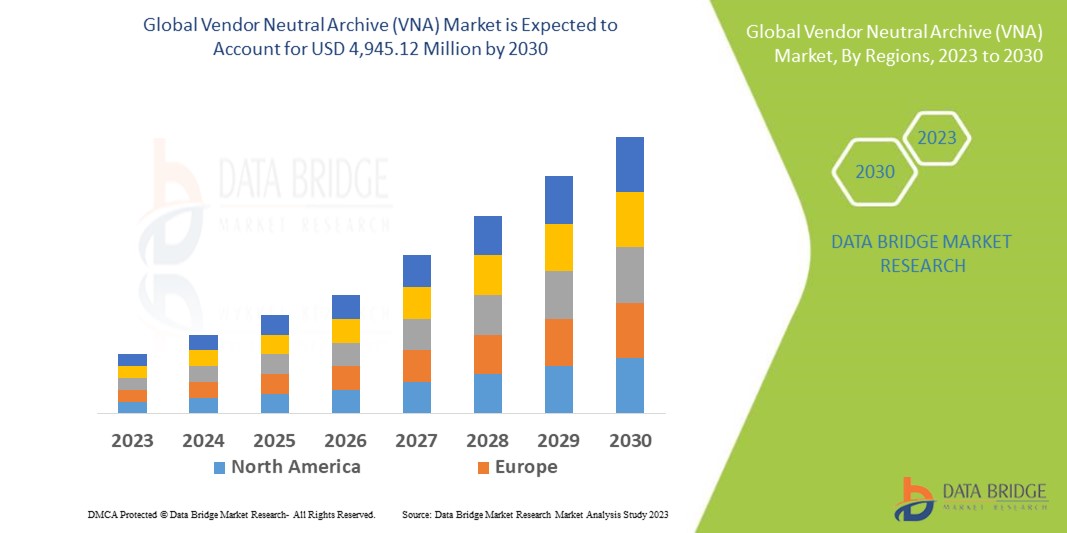

The global Vendor Neutral Archive (VNA) market size was valued at USD 3.68 billion in 2024 and is projected to reach USD 5.50 billion by 2032, with a CAGR of 5.13% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Vendor Neutral Archive (VNA) Market Trends

“Rising Adoption of Cloud-Based VNAs”

The global Vendor Neutral Archive (VNA) market is expanding rapidly, driven by the increasing need for healthcare organizations to manage vast amounts of medical imaging data efficiently. VNAs allow for secure, standardized storage and easy access to imaging data regardless of the original vendor, improving interoperability across various systems. A notable trend within the market is the rising adoption of cloud-based VNAs. These solutions offer scalability, enhanced data security, and cost-effective storage options, making them an attractive choice for healthcare institutions looking to streamline their operations. For instance, the collaboration between GE Healthcare and Tribun Health to integrate Tribun’s Health Suite with GE’s VNA solutions highlights the industry's move towards data consolidation and seamless access. Cloud-based VNAs reduce IT infrastructure costs and facilitate faster, remote access to medical images, crucial for telemedicine and global healthcare practices. With the growing demand for digital transformation and improved patient care, the VNA market is expected to continue flourishing.

Report Scope and Vendor Neutral Archive (VNA) Market Segmentation

|

Attributes

|

Vendor Neutral Archive (VNA) Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

PaxeraHealth (U.S.), Siemens Healthineers AG (Germany), DiaCom Corporation (U.S.), KLAS Research (U.S.), Carestream Health (U.S.), Agfa-Gevaert Group (Belgium), Intelerad (Canada), FUJIFILM Corporation (Japan), GE HealthCare (U.S.), Sectra AB (Sweden), Koninklijke Philips N.V. (Netherlands), Lexmark International, Inc. (U.S.), BridgeHead Software Ltd (U.K.), Dedalus S.p.A. (Italy), Merative (U.S.), Kanteron Systems S.L.U. (Spain), Medicai USA, Inc. (U.S.), SynApps Solutions Ltd. (U.K.), InsiteOne (U.S.), Hyland Software, Inc. (U.S.), Brit Systems (U.S.), Millensys Health (U.S.), Simplirad (U.S.), and INFINITT North America Inc. (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Vendor Neutral Archive (VNA) Market Definition

A vendor neutral archive (VNA) is a healthcare data management solution designed to store, manage, and provide access to medical imaging data across different systems and vendors. Unlike traditional Picture Archiving and Communication Systems (PACS), which are typically tied to specific manufacturers, VNAs enable interoperability by allowing images from various diagnostic tools, regardless of the vendor, to be consolidated into a centralized archive. This promotes easier sharing and retrieval of patient data across different healthcare facilities and systems.

Vendor Neutral Archive (VNA) Market Dynamics

Drivers

- Increasing Digitalization of Healthcare

The increasing digitalization of healthcare, driven by the shift from traditional film-based imaging to electronic health records (EHRs) and digital imaging, is significantly fueling the demand for Vendor Neutral Archives (VNAs). Healthcare organizations are transitioning to digital formats for the convenience of accessing and sharing medical data and to improve efficiency and patient care. For instance, according to the 2020 Digital Health Consumer Survey by Accenture, more than 80% of healthcare organizations in the U.S. had implemented digital imaging systems by 2020, and this trend is expected to grow as more hospitals adopt fully integrated EHR systems. As healthcare systems generate an ever-increasing volume of digital data, VNAs provide a scalable solution for the secure, centralized management and long-term storage of medical images across different formats and platforms. This digital transition, combined with the need to comply with regulatory requirements and enhance data accessibility, positions VNAs as a key enabler of healthcare's digital transformation.

- Increasing Volume of Medical Imaging Data

The rapid growth of medical imaging data is a significant market driver for Vendor Neutral Archives (VNAs). As imaging technologies evolve and produce higher-resolution scans, the volume of data generated has surged. Increased data volume, which includes 3D and 4D imaging, along with diagnostic imaging from various modalities, creates a pressing need for efficient storage and management solutions. VNAs are essential for handling this vast influx of data, offering centralized, interoperable storage systems that support multiple file formats and vendors. By ensuring seamless access and secure archiving of images, VNAs help healthcare providers manage this data explosion, enabling improved patient care and regulatory compliance. This rapid data growth directly drives the demand for VNAs as essential infrastructure in healthcare settings.

Opportunities

- Growing Regulatory Compliances for Patient Data Protection

Regulatory compliance is a significant market opportunity driving the adoption of Vendor Neutral Archives (VNAs) in healthcare. With the increasing emphasis on patient data protection, regulations such as HIPAA in the U.S. and GDPR in the European Union have created stringent requirements for securing and managing medical data, including images. For instance, healthcare organizations must ensure that patient information is stored securely, accessible only by authorized personnel, and retained for specified periods. VNAs address these needs by providing a centralized, secure storage solution that ensures compliance with these regulations. They enable healthcare providers to manage medical images and data in a way that meets legal requirements, such as encryption, audit trails, and access controls. Moreover, VNAs offer a flexible platform for data access, ensuring that healthcare professionals can retrieve necessary images quickly while maintaining strict data protection standards. As the regulatory landscape continues to tighten, VNAs present a growing opportunity for healthcare organizations to streamline compliance processes and safeguard patient information, driving their widespread adoption across the industry.

- Rising Mergers and Acquisitions in Healthcare

Mergers and acquisitions (M&A) in healthcare create a significant market opportunity for Vendor Neutral Archives (VNAs) as organizations need to integrate disparate legacy systems. When healthcare institutions merge or acquire other facilities, they often face the challenge of consolidating patient data from multiple platforms, which may include varying imaging formats and storage systems. VNAs provide a standardized solution by offering a unified platform for storing, managing, and accessing medical images across different systems, regardless of the vendor. For instance, when HCA Healthcare acquired Parallon, it faced the challenge of integrating imaging data from different hospitals, which were using different picture archiving and communication systems (PACS). By implementing a VNA, HCA was able to streamline the process, ensuring seamless access to medical images across its expanded network of facilities. This ability to harmonize imaging data is increasingly crucial as healthcare organizations grow through M&A, driving demand for VNAs as essential tools for improving data interoperability, reducing IT complexity, and ensuring a smooth transition during integration. Thus, VNAs offer a valuable market opportunity as healthcare systems increasingly rely on them to manage large-scale data consolidation during M&A activities.

Restraints/Challenges

- Data Security and Privacy

Data security and privacy concerns represent a significant challenge for the Vendor Neutral Archive (VNA) market, as healthcare data is inherently sensitive and must be protected against breaches and unauthorized access. VNAs are required to comply with stringent data privacy regulations such as HIPAA in the U.S. and GDPR in the EU, which mandate secure storage, transmission, and access control for patient data. The complexity of safeguarding medical data across diverse platforms ranging from on-premises data centers to cloud-based solutions adds to the challenge. For instance, the 2019 breach of the American Medical Collection Agency (AMCA) exposed the personal health information of over 20 million patients, underscoring the vulnerability of healthcare systems. As healthcare organizations increasingly adopt cloud-based storage solutions for scalability and cost-effectiveness, ensuring the security of sensitive data across these varied environments is a persistent challenge. This heightened concern around data security and privacy acts as a market challenge for VNAs, as healthcare providers demand solutions that offer end-to-end protection and compliance with evolving regulations.

- High Initial Costs Associated with the Adoption of Vendor Neutral Archives (VNAs)

High initial costs present a significant challenge for the adoption of Vendor Neutral Archives (VNAs), especially for small to medium-sized healthcare institutions. While VNAs offer long-term benefits such as improved data accessibility and reduced dependence on proprietary formats, the upfront investment in hardware, software, and system integration can be substantial. Smaller healthcare providers may struggle with these high costs, especially when considering additional expenses for staff training, data migration, and system maintenance. Despite the potential for long-term savings through more efficient data management, the financial burden of initial setup can be prohibitive for many organizations, hindering widespread adoption of VNA solutions. This financial challenge remains a critical barrier for healthcare providers looking to modernize their imaging infrastructure.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Vendor Neutral Archive (VNA) Market Scope

The market is segmented on the basis of delivery mode, procurement mode, imaging modality, usage model, and player type. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Delivery Mode

- On-Premise VNA

- Hybrid VNA

- Fully Cloud-Hosted VNA

Procurement Mode

- Departmental VNA

- Multi-Departmental VNA

- Multi-Site VNA

Imaging Modality

- Angiography

- Mammography

- Computed Tomography

- Digital Fluoroscopy

- Digital Radiography

- Magnetic Resonance Imaging

- Nuclear Imaging

- Ultrasound

- Other

Usage Model

- Single Department

- Multiple Departments

- Multiple Sites

Player Type

- PACS

- Independent Software

- Infrastructure

Vendor Neutral Archive (VNA) Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, delivery mode, procurement mode, imaging modality, usage model, and player type as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the global vendor neutral archive (VNA) market in both market share and revenue, and is expected to maintain this dominance throughout the forecast period from 2025 to 2032. This growth is driven by higher investments in research and development, increased government initiatives to support healthcare technologies, and advancements in healthcare infrastructure across the region. Additionally, the rising adoption of digital healthcare solutions and the demand for seamless data management further fuel the market's expansion. These factors collectively contribute to North America's continued leadership in the VNA market.

Asia-Pacific is expected to experience the highest growth rate in the global vendor neutral archive (VNA) market during the forecast period from 2025 to 2032. This growth is driven by increased government spending on healthcare infrastructure and a strong push towards digital health technologies. Furthermore, the region is seeing significant technological advancements, along with government-backed initiatives aimed at improving healthcare delivery. These factors are creating a favorable environment for the adoption and expansion of VNA solutions across Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Vendor Neutral Archive (VNA) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Vendor Neutral Archive (VNA) Market Leaders Operating in the Market Are:

- PaxeraHealth (U.S.)

- Siemens Healthineers AG (Germany)

- DiaCom Corporation (U.S.)

- KLAS Research (U.S.)

- Carestream Health (U.S.)

- Agfa-Gevaert Group (Belgium)

- Intelerad (Canada)

- FUJIFILM Corporation (Japan)

- GE HealthCare (U.S.)

- Sectra AB (Sweden)

- Koninklijke Philips N.V. (Netherlands)

- Lexmark International, Inc. (U.S.)

- BridgeHead Software Ltd (U.K.)

- Dedalus S.p.A. (Italy)

- Merative (U.S.)

- Kanteron Systems S.L.U. (Spain)

- Medicai USA, Inc. (U.S.)

- SynApps Solutions Ltd. (U.K.)

- InsiteOne (U.S.)

- Hyland Software, Inc. (U.S.)

- Brit Systems (U.S.)

- Millensys Health (U.S.)

- Simplirad (U.S.)

- INFINITT North America Inc. (U.S.)

Latest Developments in Vendor Neutral Archive (VNA) Market

- In February 2024, FUJIFILM Healthcare Americas Corporation announced that it’s Synapse VNA and Synapse Radiology PACS solutions (in Asia/Oceania) were ranked #1 in the 2024 Best in KLAS Awards: Software and Services. The recognition, based on insights from KLAS Research, highlights companies excelling in improving patient care through their software and services

- In February 2023, Avicenna.AI, a medical imaging company, launched CINA-iPE, a CE-marked AI tool designed to analyze chest CT scans for the presence of incidental pulmonary embolism. This marks the debut of CINA Incidental, a new suite of imaging solutions from Avicenna.AI that detects unsuspected pathologies on CT scans

- In October 2022, GE Healthcare and Tribun Health formed a partnership aimed at providing digital pathology departmental solutions that offer healthcare providers a more comprehensive view of patient records. The collaboration focuses on integrating Tribun's Health Suite data into GE Healthcare’s solutions, including its vendor-neutral archive (VNA)

- In April 2022, FUJIFILM Holdings Corporation teamed up with the United States Department of Defense (DoD) to implement its Synapse PACS solution in U.S. Naval and Air Force medical treatment facilities. The collaboration aims to standardize the facilities' digital imaging networks, specifically the Picture Archiving and Communication Systems (DIN-PACS), for the next 10 years

- In March 2022, Philips introduced Ultrasound Workspace at the American College of Cardiology’s Annual Scientific Session & Expo (ACC2022). The solution is a vendor-neutral 2D/3D echocardiography analysis, viewing, and reporting platform, designed to enhance echocardiography analysis and streamline the reporting process

SKU-