Global Vehicle Telematics Market

Market Size in USD Billion

CAGR :

%

USD

102.29 Billion

USD

397.73 Billion

2024

2032

USD

102.29 Billion

USD

397.73 Billion

2024

2032

| 2025 –2032 | |

| USD 102.29 Billion | |

| USD 397.73 Billion | |

|

|

|

|

Vehicle Telematics Market Analysis

The vehicle telematics market is experiencing significant growth, driven by advancements in IoT, data analytics, and connectivity technologies. Telematics systems, which combine telecommunications and vehicle technologies, offer real-time tracking, diagnostics, and monitoring, enabling fleet management, vehicle safety, and enhanced customer experiences. The market is expanding across industries such as transportation, logistics, and automotive, where businesses are increasingly adopting telematics solutions for fleet tracking, fuel management, and driver behavior analysis. Recent developments include the integration of AI and machine learning, improving predictive maintenance, and the rise of connected vehicle technologies. As vehicle manufacturers and service providers collaborate to offer integrated solutions, the demand for telematics services continues to rise globally. Governments' regulatory initiatives promoting vehicle safety and environmental standards also contribute to market growth. The market's future is shaped by increasing consumer demand for safety, efficiency, and sustainability, as well as technological advancements that enable greater connectivity and data-driven insights.

Vehicle Telematics Market Size

The global vehicle telematics market size was valued at USD 102.29 billion in 2024 and is projected to reach USD 397.73 billion by 2032, with a CAGR of 18.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Vehicle Telematics Market Trends

“Demand for Telematics Solutions”

The vehicle telematics market is evolving rapidly, driven by innovations in IoT, artificial intelligence, and data analytics. Telematics systems are transforming industries such as transportation, logistics, and automotive by providing real-time data on vehicle location, performance, and driver behavior. One key trend is the integration of predictive analytics, which helps businesses optimize fleet management by predicting maintenance needs and minimizing downtime. This innovation enhances operational efficiency and improves vehicle safety and reduces operational costs. As connected vehicles and autonomous driving technologies advance, the demand for telematics solutions is expected to increase, offering new opportunities for market growth. The market continues to be shaped by the need for smarter, data-driven decision-making and improved user experiences in both personal and commercial vehicles.

Report Scope and Vehicle Telematics Market Segmentation

|

Attributes |

Vehicle Telematics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Verizon (U.S.), Zonar Systems, Inc. (U.S.), TomTom International BV (Netherlands), Robert Bosch GmbH (Germany), HARMAN International (U.S.), Volkswagen Group (Germany), MiX by Powerfleet (South Africa), Omnitracs (U.S.), CalAmp (U.S.), Bridgestone Mobility Solutions B.V. (Netherlands), Inseego Corp (U.S.), Octo Group S.p.A (Italy) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Vehicle Telematics Market Definition

Vehicle telematics refers to the integrated use of telecommunications, global positioning system (GPS), and on-board sensors in vehicles to collect, transmit, and analyze data in real-time. This technology enables tracking of vehicle location, speed, fuel consumption, engine performance, and driver behavior, allowing for enhanced fleet management, predictive maintenance, and improved safety. It plays a crucial role in optimizing operational efficiency, reducing costs, and providing insights into vehicle performance, all while enabling better decision-making for businesses and consumers alike.

Vehicle Telematics Market Dynamics

Drivers

- Rising Demand for Fleet Management

Companies in transportation, logistics, and delivery services are rapidly adopting telematics solutions to enhance fleet management and improve operational efficiency. By integrating telematics technology, businesses can track real-time vehicle location, monitor driver behavior, and optimize routes, leading to significant reductions in fuel consumption and operational costs. Additionally, telematics systems offer predictive maintenance capabilities, allowing companies to avoid costly breakdowns and minimize downtime. These solutions also improve driver safety by providing insights into risky driving behaviors and enabling proactive interventions. This growing adoption is a key driver for the vehicle telematics market, fueling its expansion across industries.

- Consumer Demand for Connected Vehicles

The increasing consumer demand for connected and smart vehicles is a significant driver of growth in the vehicle telematics market. As consumers seek more advanced, tech-driven features in their vehicles, telematics systems play a central role in delivering these innovations. Telematics is essential for enabling features such as driver assistance systems, real-time vehicle diagnostics, and advanced infotainment solutions. By providing seamless connectivity and data exchange between the vehicle and external networks, telematics enhances the overall driving experience, safety, and convenience. This growing interest in connected vehicles is propelling the adoption of telematics, further fueling market demand.

Opportunities

- Expansion of Electric Vehicles (EVs)

As electric vehicle (EV) adoption grows, telematics solutions are becoming crucial in optimizing the performance and efficiency of EVs. Telematics systems are now used to monitor battery health, track energy consumption, and optimize charging schedules to ensure the longevity and reliability of electric vehicles. These solutions allow for real-time data collection, enabling predictive maintenance and reducing operational costs for EV owners and fleet operators. With the increasing demand for electric vehicles, telematics presents a significant market opportunity, as companies innovate to meet the evolving needs of the EV segment, offering smarter, more efficient solutions for energy management.

- Fleet Telematics for Small and Medium Enterprises (SMEs)

While fleet telematics has traditionally been used by large enterprises, small and medium-sized enterprises (SMEs) are now increasingly adopting these solutions to enhance fleet management. Telematics helps SMEs improve operational efficiency by optimizing routes, monitoring driver behavior, reducing fuel consumption, and lowering maintenance costs. These solutions also ensure regulatory compliance by providing real-time tracking and reporting features, particularly for industries requiring fleet management adherence to local laws. As SMEs recognize the benefits of telematics, this shift opens up a significant growth opportunity for the vehicle telematics market, offering tailored, cost-effective solutions for smaller businesses seeking efficiency and scalability.

Restraints/Challenges

- Lack of Standardization in Telematics Systems

The lack of industry-wide standards for telematics systems presents a significant challenge for the market, as it can lead to compatibility issues between different devices and software from various vendors. Organizations may struggle to integrate multiple telematics solutions into their existing systems, leading to inefficiencies, data silos, and increased operational costs. The absence of standardized protocols makes it difficult for businesses to choose the most suitable products and solutions, potentially hindering scalability and flexibility. This challenge calls for the development of universal standards that enable seamless integration, improve data exchange, and enhance the overall effectiveness of telematics systems across industries.

- High Initial Investment

The upfront costs involved in implementing vehicle telematics systems, including the purchase of hardware, software, and installation, can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). These businesses often operate on tighter budgets and may find it challenging to justify the initial investment, especially when the financial return on telematics solutions is realized over time. The high costs can deter SMEs from adopting these technologies, limiting their ability to benefit from improved fleet efficiency, safety, and regulatory compliance. This restraint calls for more affordable, scalable telematics solutions to drive broader market adoption among SMEs.

Vehicle Telematics Market Scope

The market is segmented on the basis of provider type, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Provider Type

- Original Equipment Manufacturers (OEM)

- Aftermarket

Vertical

- Transportation

- Logistics

- Government

- Utilities

- Travel

- Tourism

- Construction

- Education

- Healthcare

- Media

- Entertainment

Application

- Information and Navigation

- Safety and Security

- Fleet/Asset Management

- Insurance Telematics

- Infotainment System

- Others

Technology

- Integrated

- Tethered

- Embedded

Vehicle Telematics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, provider type, and vertical as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

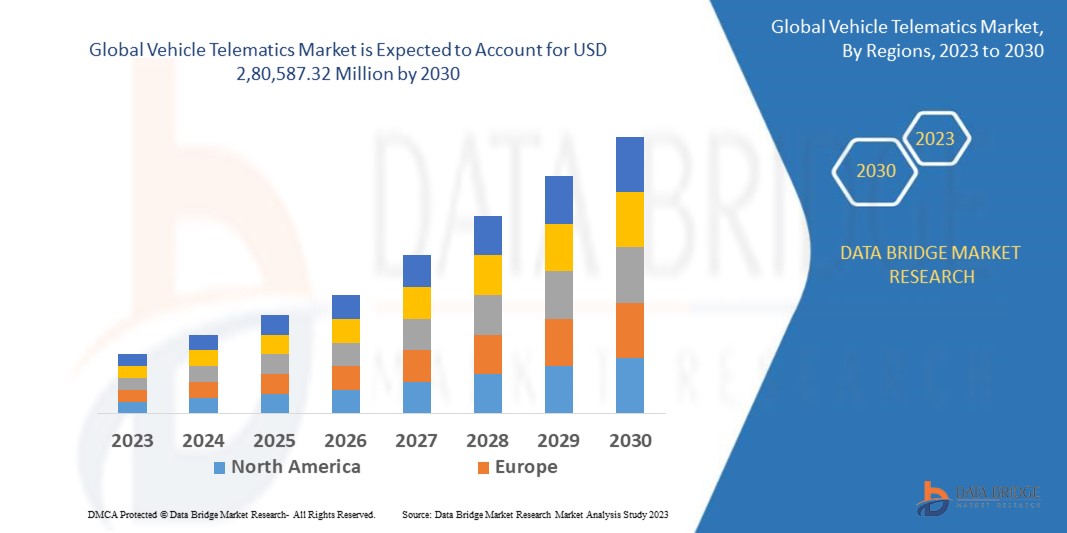

North America leads the global vehicle telematics market, driven by a robust automotive industry and the presence of key market players. The region benefits from a well-established infrastructure and continuous innovation in telematics technologies. Additionally, strong demand for fleet management solutions and connected vehicle systems further supports North America's dominant position in the market.

Asia-Pacific is projected to experience substantial growth in the global vehicle telematics market from 2025 to 2032. This growth is driven by increased government initiatives to raise awareness, a rise in automotive manufacturing facilities, and growing research and development activities in the region. Additionally, the presence of a large, untapped market and a significant population further contribute to the region's expanding market potential.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Vehicle Telematics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Vehicle Telematics Market Leaders Operating in the Market Are:

- Verizon (U.S.)

- Zonar Systems, Inc. (U.S.)

- TomTom International BV (Netherlands)

- Robert Bosch GmbH (Germany)

- HARMAN International (U.S.)

- Volkswagen Group (Germany)

- MiX by Powerfleet (South Africa)

- Omnitracs (U.S.)

- CalAmp (U.S.)

- Bridgestone Mobility Solutions B.V. (Netherlands)

- Inseego Corp (U.S.)

- Octo Group S.p.A (Italy)

Latest Developments in Vehicle Telematics Market

- In October 2023, Cummins collaborated with Eclipse Foundation, Microsoft, and other industry leaders to launch a new telematics software for commercial vehicles. The Open Telematics Framework aims to streamline the development process, enabling companies to reduce time to market and cut costs. This initiative is designed to enhance the efficiency of telematics integration for the commercial vehicle sector

- In September 2022, Cambridge Mobile Telematics, a leading provider of vehicle telematics applications, introduced DriveWell Crash & Claims. This innovative solution is designed to streamline the vehicle insurance claims process, offering high efficiency in handling claims related to accidents. The tool leverages telematics data to enhance accuracy and speed, benefiting both insurers and policyholders

- In August 2022, IDEMIA, a leader in identity technologies, launched its Automotive Connectivity Manager Platform, marking the industry's first large-scale remote SIM access campaign. In collaboration with Mercedes-Benz AG, IDEMIA facilitated the transfer of over 700,000 vehicles, transitioning them to a new mobile network application provider via over-the-air applications. This milestone underscores IDEMIA's role in enhancing automotive connectivity and remote management capabilities in the industry

- In June 2022, Geotab, a leading provider of IoT and connected transportation solutions, announced a partnership with Renault to integrate vehicle telematics technologies with its fleet management platform, MyGeotab. This collaboration aims to enhance fleet performance through seamless telematics data integration. By combining Renault's vehicle technologies with Geotab's platform, the partnership seeks to offer more efficient fleet management solutions

- In July 2022, Edelweiss General Insurance, a prominent insurance provider, introduced SWITCH, an on-demand comprehensive motor insurance product in India, under the IRDIA’s Sandbox initiative. SWITCH uses mobile telematics technology to automatically detect vehicle motion and activate insurance coverage as the vehicle is in use. This innovative approach offers customers dynamic, usage-based insurance, bringing flexibility and efficiency to motor insurance policies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.