Global Vehicle Emission Testers Market

Market Size in USD Million

CAGR :

%

USD

680.00 Million

USD

770.00 Million

2022

2030

USD

680.00 Million

USD

770.00 Million

2022

2030

| 2023 –2030 | |

| USD 680.00 Million | |

| USD 770.00 Million | |

|

|

|

|

Vehicle Emission Testers Market Analysis and Size

Vehicle emission testers are devices or equipment used to assess and measure the pollutants and emissions generated by vehicles, such as cars, trucks, motorcycles, and buses. These testers play a crucial role in environmental protection and public health by ensuring that vehicles comply with established emissions standards and regulations.

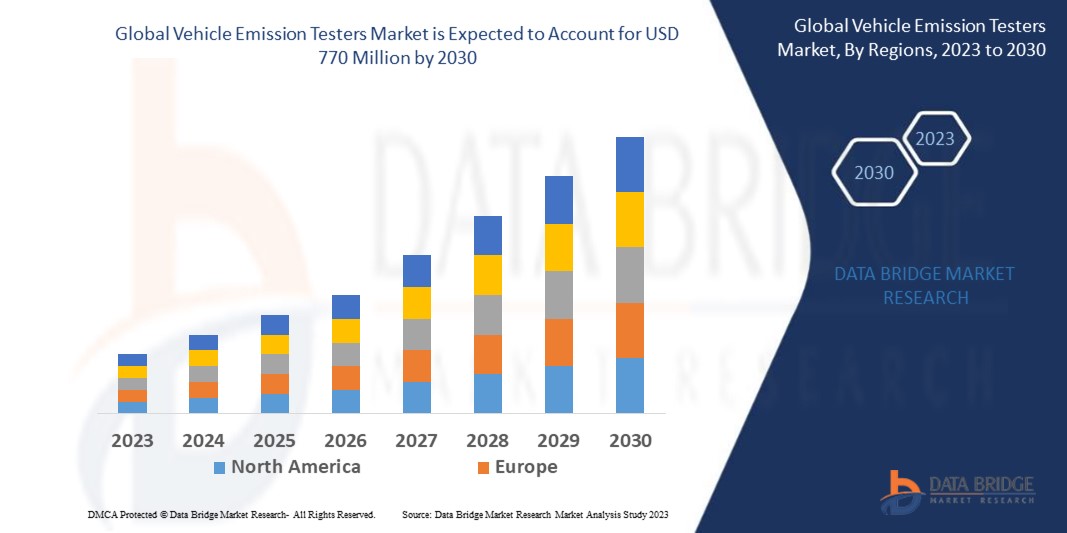

Data Bridge Market Research analyses that the vehicle emission testers market which was USD 680 million in 2022, would rocket up to USD 770 million by 2030, and is expected to undergo a CAGR of 5.5% during the forecast period. Vehicle emission testers quantify the levels of various pollutants released into the atmosphere by a vehicle's exhaust, including carbon monoxide (CO), hydrocarbons (HC), nitrogen oxides (NOx), and particulate matter (PM). By product type segment is expected to dominate the market because the type of emission tester to be used largely depends on its product category. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Vehicle Emission Testers Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (NDIR (Non-Dispersive Infrared) Testers, Flame Ionization Detectors, Smoke Meters, Cross Duct Testers, Emission and Combustion Testers with Chillers and Others), Solution Outlook (Emission Test Equipment, Emission Test Software and Emission Test Services), Equipment Outlook (Opacity Meters/Smoke Meters and Other Vehicle Emission Test Equipment), Vehicle Type (Passenger Cars, Two Wheelers, Tractors, Automated Guided Vehicles (AVG), Economic Passenger Cars, Mid-Sized Passenger Cars, Luxury Passenger Cars, Commercial Vehicles Light Commercial Vehicle, and Heavy Commercial Vehicle), Application (CO2 Testing, O2 Testing, Hydrocarbons (HC) Testing, NO Testing and Other Particulate Matters) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Bosch Limited (Germany), Siemens (Germany), Honeywell International Inc. (U.S.), ABB (Switzerland), BorgWarner Inc. (U.S.), Horiba (Japan), Opus Group AB (Sweden), GEMCO. (U.S.), TÜV NORD GROUP (Germany), Capelec (France), Applus+ (Spain), SGS SA (Switzerland), AVL List GmbH (Austria), TEXA S.p.A. (Italy), ETG Risorse (Italy), CODEL International Ltd (U.K.), Wuhan Cubic Optoelectronics Co.,Ltd (China), E Instruments International, LLC (U.S.), ENERAC (U.S.), Eurotron Instruments UK Ltd (U.K.), ECOM America, LTD.(U.S.), LANDTEC NORTH AMERICA (U.S.), Fuji Electric Co., Ltd.(Japan) |

|

Market Opportunities |

|

Market Definition

The vehicle emission testers market refers to the industry involved in the production and deployment of specialized equipment and technologies used to measure and assess the emissions of vehicles, including automobiles, trucks, and motorcycles. These testers are essential for regulatory compliance, ensuring vehicles meet emissions standards, and reducing air pollution. The market encompasses a range of emission testing equipment, from portable handheld devices to automated testing stations, serving both government regulatory agencies and private testing facilities. Factors such as tightening environmental regulations and the need for cleaner transportation drive the demand for vehicle emission testers globally.

Global Vehicle Emission Testers Market Dynamics

Drivers

- Environmental Regulations

Stricter environmental regulations aimed at reducing vehicle emissions are a significant driver for the market. Governments around the world are implementing stringent emission standards to combat air pollution and climate change. Compliance with these regulations requires regular emissions testing, driving demand for emission testing equipment

- Growing Vehicle Fleet

The increasing number of vehicles on the road, especially in emerging markets, drives the need for regular emission testing to ensure compliance with regulations. As vehicle fleets expand, so does the market for emission testing equipment and services

- Technological Advancements

Advancements in emission testing technology, such as the development of portable and wireless testing equipment, have made testing more efficient and convenient. Improved accuracy and ease of use attract both government agencies and private vehicle testing facilities

Opportunities

- Consumer Awareness

Growing awareness among consumers about the environmental impact of vehicle emissions has led to increased demand for emission testing. This is particularly true in regions where consumers actively seek eco-friendly vehicles and want assurance that their vehicles meet emission standards

Restraints/Challenges

- High Initial Costs

Emission testing equipment, especially advanced and accurate models, can be expensive to purchase and install. This initial investment can be a significant barrier for smaller vehicle testing facilities and emerging markets

- Rapid Technological Advancements

While technological advancements can be a driver, they can also pose challenges. The fast pace of technological change can lead to obsolescence of older testing equipment, requiring frequent updates or replacements to stay compliant with evolving emission standards

Recent Development

- In April 2022, Applus+ purchased IDV and will run the three mandatory vehicle inspection stations in the Madrid area

- In June 2022, AVL Boosts Vehicle Testing Capabilities with Rohde & Schwarz GNSS Simulator

Global Vehicle Emission Testers Market Scope

The vehicle emission testers market is segmented on the basis of product, solution outlook, equipment outlook, vehicle type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- NDIR (Non-Dispersive Infrared) Testers

- Flame Ionization Detectors

- Smoke Meters

- Cross Duct Testers

- Emission and Combustion Testers with Chillers

- Others

Solution Outlook

- Emission Test Equipment

- Emission Test Software

- Emission Test Services

Equipment Outlook

- Opacity Meters/Smoke Meters

- Other Vehicle Emission Test Equipment

Vehicle Type

- Passenger Cars

- Two Wheelers

- Tractors

- Automated Guided Vehicles (AVG)

- Economic Passenger Cars

- Mid-Sized Passenger Cars

- Luxury Passenger Cars

- Commercial Vehicles Light Commercial Vehicle

- Heavy Commercial Vehicle

Application

- CO2 Testing

- O2 Testing

- Hydrocarbons (HC) Testing

- NO Testing

- Other Particulate Matters

Vehicle Emission Testers Market Regional Analysis/Insights

The vehicle emission testers market is analysed and market size insights and trends are provided by product, solution outlook, equipment outlook, vehicle type and application as referenced above.

The countries covered in the vehicle emission testers market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the vehicle emission testers market because of its stringent environmental regulations that require regular emissions testing. The region's large automotive industry and technological advancements also contribute to its leadership in this sector. In addition, a growing focus on sustainability and reducing carbon emissions further drives the demand for advanced emission testing equipment in North America.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 due to the region's expanding automotive industry, rapid urbanization, and increasing environmental concerns. Stringent emission regulations and a rising awareness of air quality issues are driving the adoption of emission testing equipment in this market. Furthermore, the shift towards electric and hybrid vehicles in Asia-Pacific is likely to fuel the demand for advanced emission testing technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Vehicle Emission Testers Market Share Analysis

The vehicle emission testers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to vehicle emission testers market.

Some of the major players operating in the vehicle emission testers market are:

- Bosch Limited (Germany)

- Siemens (Germany)

- Honeywell International Inc. (U.S.)

- ABB (Switzerland)

- BorgWarner Inc. (U.S.)

- Horiba (Japan)

- Opus Group AB (Sweden)

- GEMCO. (U.S.)

- TÜV NORD GROUP (Germany)

- Capelec (France)

- Applus+ (Spain)

- SGS SA (Switzerland)

- AVL List GmbH (Austria)

- TEXA S.p.A. (Italy)

- ETG Risorse (Italy)

- CODEL International Ltd (U.K.)

- Wuhan Cubic Optoelectronics Co.,Ltd (China)

- E Instruments International, LLC (U.S.)

- ENERAC (U.S.)

- Eurotron Instruments UK Ltd (U.K.)

- ECOM America, LTD. (U.S.)

- LANDTEC NORTH AMERICA (U.S.)

- Fuji Electric Co., Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.