Global Vascular Patches Market

Market Size in USD Million

CAGR :

%

USD

589.55 Million

USD

1,174.71 Million

2024

2032

USD

589.55 Million

USD

1,174.71 Million

2024

2032

| 2025 –2032 | |

| USD 589.55 Million | |

| USD 1,174.71 Million | |

|

|

|

|

Vascular Patches Market Size

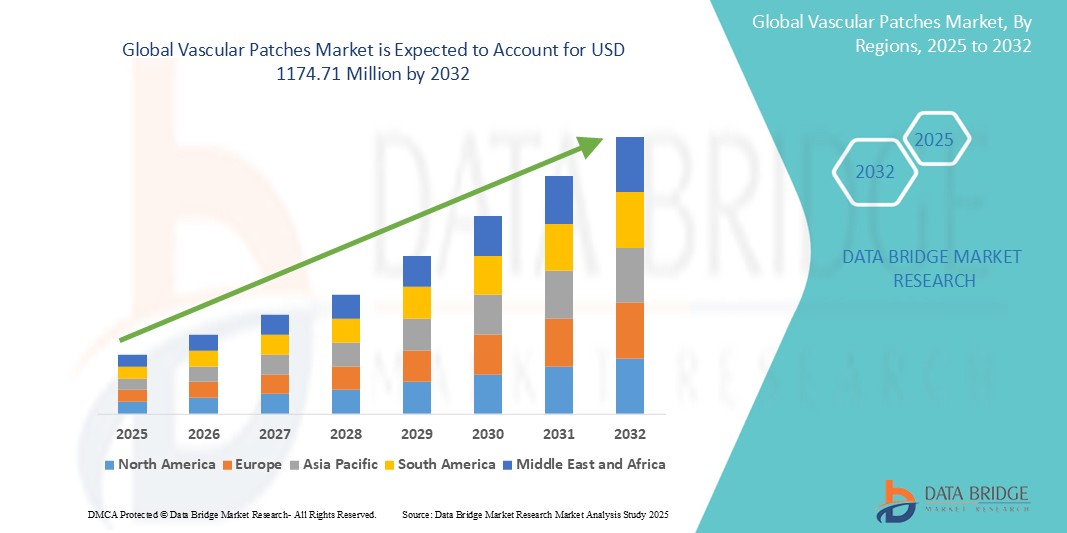

- The global vascular patches market size was valued at USD 589.55 million in 2024 and is expected to reach USD 1174.71 million by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of cardiovascular diseases and the rising number of vascular surgeries globally

- The growing geriatric population, which is more susceptible to vascular disorders, is significantly driving demand for vascular patches in procedures such as carotid endarterectomy and peripheral artery repair

- Technological advancements in patch materials such as bioengineered and synthetic options—are improving surgical outcomes, biocompatibility, and reducing post-operative complications, thus encouraging wider adoption

Vascular Patches Market Analysis

- The global vascular patches market is currently witnessing a steady rise in demand due to increasing surgical procedures that require soft tissue reinforcement, for instance in carotid endarterectomy or peripheral vascular surgeries devices

- Market analysis reflects a strong preference for biologically derived vascular patches over synthetic alternatives owing to their improved biocompatibility and reduced risk of post-surgical complications such as infection or thrombosis

- North America dominates the Vascular Patches market with the share of 45.05% in 2024, driven by a well-established healthcare infrastructure and high prevalence of cardiovascular diseases

- Asia-Pacific is expected to be the fastest growing region in the vascular patches market during the forecast period 30.05% market share in 2024 due to rapid urbanization, rising healthcare expenditure, and increasing incidence of cardiovascular diseases in countries

- The carotid endarterectomy segment dominates the largest market share of 65.05% in 2024, as it is one of the most common vascular surgeries requiring patch closure to prevent restenosis

Report Scope and Vascular Patches Market Segmentation

|

Attributes |

Vascular Patches Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Vascular Patches Market Trends

“Rising Adoption of Biological Vascular Patch Solutions”

- The global vascular patches market is experiencing a growing trend toward the use of biological materials due to their compatibility with human tissues

- Hospitals and surgical centers are increasingly adopting biologically sourced patches to minimize immune response during vascular repair procedures

- Surgeons prefer biological vascular patches as they integrate more naturally with the body, reducing the such aslihood of graft rejection

- For instance, bovine pericardium patches are commonly chosen in cardiovascular surgeries for their ease of handling and long-term durability

- Manufacturers are focusing on enhancing biological patch performance by improving processing techniques and sterilization methods

- In conclusion, this trend highlights a clear shift in the market toward safer, more reliable biological solutions in vascular surgery

Vascular Patches Market Dynamics

Driver

“Increasing Volume of Cardiovascular Surgeries Globally”

- The global vascular patches market is being driven by the increasing number of cardiovascular surgeries such as carotid endarterectomy and peripheral artery bypass, which often require patch-based vessel repair

- Rising prevalence of heart-related conditions due to aging populations and lifestyle factors is pushing more patients toward surgical treatments that utilize vascular patches for reinforcement and closure

- For instance, the American Heart Association reported over 1.5 million cardiovascular procedures in the U.S. in 2023, many involving vascular patch application

- Developing nations are seeing improvements in healthcare infrastructure and surgical access, leading to higher volumes of vascular procedures especially in urban hospitals and cardiac centers

- With more investment in cardiovascular training and technology, the availability of skilled surgeons and diagnostic tools continues to expand the use of vascular patches globally

- In conclusion, this consistent growth in cardiovascular surgeries is strongly supporting the increasing demand for vascular patches across medical facilities

Restraint/Challenge

“High Cost of Advanced Vascular Patches”

- One major challenge in the vascular patches market is the high cost of advanced biological patches, which are more expensive than synthetic versions due to complex processing and safety measures

- The total cost includes manufacturing, sterilization, preservation, and quality assurance, making premium patches less accessible in resource-limited healthcare settings

- For instance, in countries such as India and Brazil, public hospitals often prefer synthetic patches or delay surgeries due to limited budgets, even when biological options offer better outcomes

- Inadequate reimbursement frameworks in several healthcare systems result in higher out-of-pocket expenses for patients, reducing the demand for advanced patch materials

- The need for additional training to use new-generation patches adds to hospital operating costs, especially where surgical teams lack exposure to the latest technologies

- In conclusion, these financial and systemic constraints limit the adoption of premium vascular patches, acting as a key restraint to market growth despite proven clinical benefits

Vascular Patches Market Scope

The market is segmented on the basis of material, application, and end user.

- By Material

On the basis of material, the vascular patches market is segmented into biologic and synthetic. The biologic segment dominates the largest market revenue share in 2024, supported by its superior biocompatibility and reduced risk of postoperative complications. Surgeons increasingly prefer biologic patches for procedures such as carotid endarterectomy due to better tissue integration and healing outcomes.

The synthetic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, longer shelf life, and consistent availability, particularly in high-volume surgical centers.

- By Application

On the basis of application, the vascular patches market is segmented into carotid endarterectomy, open repair of abdominal aortic aneurysms, and vascular bypass surgery. The carotid endarterectomy segment dominates the largest market share of 65.05% in 2024, as it is one of the most common vascular surgeries requiring patch closure to prevent restenosis. For instance, in many surgical facilities worldwide, patch angioplasty is a standard step in carotid repair procedures due to its proven clinical outcomes.

The vascular bypass surgery segment is projected to experience the fastest growth from 2025 to 2032 due to increasing cases of peripheral artery disease and demand for surgical reconstruction.

- By End Users

On the basis of end users, the vascular patches market is segmented into hospitals, and ambulatory surgical centers. The hospitals segment accounts for the largest market share of 40.05% in 2024 due to the availability of advanced surgical equipment, experienced vascular teams, and high patient inflow.

The ambulatory surgical centers segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the rising trend of minimally invasive procedures and a shift toward cost-effective outpatient care options.

Vascular Patches Market Regional Analysis

- North America dominates the vascular patches market with the share of 45.05% in 2024, driven by a well-established healthcare infrastructure and high prevalence of cardiovascular diseases

- North America leads the vascular patches market with the largest revenue share in 2024, supported by a strong healthcare system and high cardiovascular disease rates. The presence of key medical device companies and advanced surgical facilities further boosts market growth. The region’s focus on innovation ensures availability of effective vascular patch solutions

- Biologic vascular patches see high adoption in North America due to their better patient outcomes and reduced complications. Surgeons prefer these patches for critical procedures, supported by extensive clinical research. The region’s regulatory environment encourages innovation and safety

U.S. Vascular Patches Market Insight

The U.S. vascular patches market held a significant share in North America in 2024, driven by the rising prevalence of cardiovascular diseases and increasing surgical interventions requiring vascular repair. Advancements in biomaterials and the introduction of synthetic and biologic vascular patches with improved biocompatibility and reduced complication rates are boosting market growth. In addition growing awareness among healthcare professionals about minimally invasive vascular repair techniques and rising investments in healthcare infrastructure contribute to the market expansion. The U.S. healthcare system’s emphasis on personalized treatment solutions further supports the demand for innovative vascular patches.

Europe Vascular Patches Market Insight

The European vascular patches market is expected to grow at a robust CAGR throughout the forecast period, supported by increasing incidences of vascular diseases and a rising geriatric population. Regulatory approvals for new and advanced vascular patch products and growing adoption of tissue-engineered vascular patches are key factors fueling market growth. Countries such as Germany, France, and Italy show strong demand, driven by their well-established healthcare systems and high healthcare expenditure. Moreover, collaborative research initiatives and government funding for cardiovascular disease management foster innovation and market development.

U.K. Vascular Patches Market Insight

The U.K. vascular patches market is projected to expand steadily, propelled by increasing cardiovascular surgeries and technological advancements in patch materials. The NHS’s focus on improving cardiovascular care and enhancing surgical outcomes is encouraging the use of advanced vascular patches. Additionally, rising patient awareness and the availability of reimbursement policies for vascular interventions contribute to market growth. The U.K.’s strong biomedical research infrastructure supports continuous product innovations, making it a promising market for vascular patches.

Germany Vascular Patches Market Insight

Germany’s vascular patches market is poised for significant growth with share of 27.12%, driven by the country’s advanced healthcare infrastructure and high prevalence of vascular disorders. The market benefits from ongoing innovations in patch design, including bioresorbable and drug-eluting vascular patches. The emphasis on improving patient outcomes and minimizing post-surgical complications boosts adoption rates. Additionally, Germany’s robust medical device regulatory framework ensures the availability of safe and effective vascular patches, fostering trust and wider acceptance among healthcare providers.

Asia-Pacific Vascular Patches Market Insight

The Asia-Pacific vascular patches market is expected to register strong growth, capturing over 30.05% market share in 2024 due to rapid urbanization, rising healthcare expenditure, and increasing incidence of cardiovascular diseases in countries such as China, India, and Japan are major growth drivers. The expansion of healthcare infrastructure and growing awareness about advanced vascular repair techniques are accelerating market adoption. Moreover, the presence of cost-effective manufacturing hubs in the region is making vascular patches more affordable and accessible to a broader patient population.

Japan Vascular Patches Market Insight

Japan’s vascular patches market is growing steadily, supported by the country’s aging population and high standards of healthcare delivery. The demand for easy-to-use, biocompatible, and long-lasting vascular patches is increasing, particularly in the context of minimally invasive surgeries. Integration with digital health technologies for better patient monitoring and post-operative care is becoming more prevalent. Japan’s focus on research and development and early adoption of innovative medical devices further propels market expansion.

China Vascular Patches Market Insight

China accounted for the largest revenue share in the Asia-Pacific vascular patches market in 2024, fueled by rapid urbanization, an expanding middle class, and increased awareness of cardiovascular health. Government initiatives to improve healthcare infrastructure and promote medical innovation support market growth. The widespread availability of affordable vascular patches, produced by strong domestic manufacturers, facilitates widespread adoption across hospitals and clinics. Additionally, the country’s focus on smart healthcare solutions, including the integration of vascular patches with telemedicine and remote patient management systems, is a key growth driver.

Vascular Patches Market Share

The Vascular Patches industry is primarily led by well-established companies, including:

- W. L. Gore & Associates, Inc. (U.S.)

- Anteris (Australia)

- Labcor Laboratórios (Brazil)

- Johnson & Johnson Private Limited (U.S.)

- Terumo Corporation (Japan)

- BD (U.S.)

- B. Braun Melsungen AG (Germany)

- LeMaitre Vascular, Inc. (U.S.)

- Getinge AB (Sweden)

- Baxter (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Neovasc Inc. (Canada)

- CryoLife, Inc. (U.S.)

- Medtronic (U.S.)

- McKesson Medical-Surgical Inc. (U.S.)

- Agilent Technologies (U.S.)

- Axogen Corporation (U.S.)

- C. R. Bard, Inc. (U.S.)

Latest Developments in Global Vascular Patches Market

- In May 2022, Getinge AB increased production of its high-quality vascular grafts at its France facility to meet growing demand. This capacity boost enhances the company’s ability to supply advanced vascular repair solutions globally and strengthens its position in the regenerative medicine market.

- In December 2021, Aziyo Biologics, Inc. Aziyo Biologics secured USD 14 million in December 2021 through PIPE financing to fuel growth in regenerative medicine. The funds support R&D, manufacturing expansion, and commercialization of biologic vascular patches, enabling the company to capitalize on rising market demand

- In July 2020, LeMaitre Vascular acquired the business and assets of Artegraft, Inc. LeMaitre Vascular acquired Artegraft, Inc. in July 2020, enhancing its portfolio with biologic vascular patches. This acquisition broadened LeMaitre’s product range and strengthened its offerings for vascular repair surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.