Global Vaccum Gas Oil Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

1.82 Billion

2024

2032

USD

1.18 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Vaccum Gas Oil Market Size

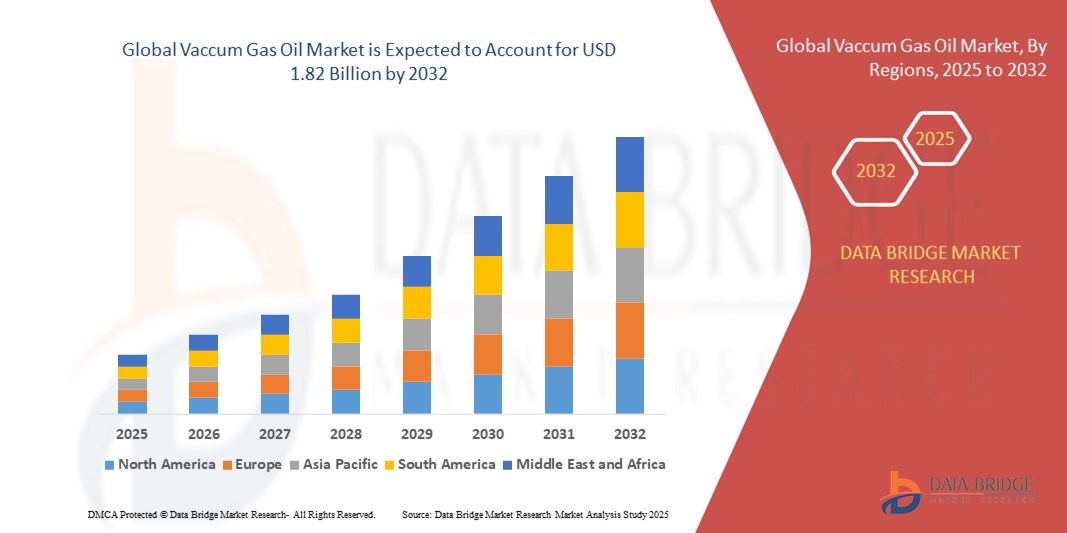

- The global vaccum gas oil market size was valued at USD 1.18 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the increasing demand for cleaner transportation fuels and the expanding adoption of advanced refining technologies that convert vacuum gas oil (VGO) into high-value end products such as diesel, gasoline, and jet fuel

- Furthermore, rising global fuel consumption, coupled with tightening environmental regulations, is pushing refiners to invest in hydrocracking and catalytic cracking processes, where VGO plays a critical role as a primary feedstock. These converging factors are accelerating the demand for VGO, thereby significantly boosting the industry's growth

Vaccum Gas Oil Market Analysis

- Vacuum gas oil is a heavy petroleum distillate derived during the vacuum distillation of crude oil and is primarily used as a feedstock in fluid catalytic cracking (FCC) and hydrocracking units to produce light and middle distillates

- The escalating demand for VGO is driven by its critical role in maximizing refinery output of cleaner fuels, its adaptability to evolving fuel quality standards, and the global push for efficient utilization of heavy oil fractions to meet increasing energy needs

- North America dominated the vaccum gas oil market with a share of 46.3% in 2024, due to the presence of complex refineries, robust downstream infrastructure, and steady demand for transportation fuels

- Asia-Pacific is expected to be the fastest growing region in the vaccum gas oil market during the forecast period due to rapid economic development, rising urbanization, and the expansion of refining capacities across key countries

- Low Sulfur VGO segment dominated the market with a market share of 61.9% in 2024, due to its critical role in meeting stringent global sulfur regulations, such as IMO 2020 and Euro VI standards. Refiners prefer low sulfur VGO to reduce the need for expensive desulfurization processes and to maintain compliance with environmental mandates. Its use facilitates smoother downstream processing and aligns with the global transition toward cleaner fuel alternatives

Report Scope and Vaccum Gas Oil Market Segmentation

|

Attributes |

Vaccum Gas Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vaccum Gas Oil Market Trends

Increasing Refinery Operations

- The vacuum gas oil market is expanding as refineries worldwide increase processing capacities and upgrade facilities to meet rising demand for transportation fuels and petrochemicals

- For instance, leading refiners such as ExxonMobil, Shell, and LUKOIL are investing heavily in new vacuum distillation units and catalytic cracking capacity expansions to optimize VGO production and improve refining margins

- Technological advancements in vacuum distillation and fluid catalytic cracking improve conversion efficiency, enabling better yield of high-value products such as diesel, gasoline, and jet fuel from heavy crude fractions

- Growing regulatory focus on producing cleaner fuels has prompted refiners to adopt advanced VGO hydrocracking technologies that reduce sulfur and emissions while maximizing fuel quality

- Expansion of petrochemical industries globally, particularly in Asia Pacific and Middle East regions, increases demand for VGO as a critical feedstock for naphtha and aromatic production

- Integration of refinery operations with bio-refining and co-processing bio-oil with vacuum gas oil is emerging as a trend to enhance sustainability and reduce carbon footprint in fuel production

Vaccum Gas Oil Market Dynamics

Driver

Increasing Demand for Refined Petroleum Products

- The expanding global transportation sector and industrial activities are driving up demand for refined petroleum products such as diesel, gasoline, and jet fuel, which directly fuels the need for vacuum gas oil as a feedstock in refineries

- For instance, according to IMARC Group, companies such as PetroChina and Saudi Aramco utilize VGO extensively in fluid catalytic cracking units to meet the growing consumption of diesel and gasoline in emerging and developed economies

- Rising urbanization, economic growth, and increasing vehicle ownership in regions such as Asia Pacific and Latin America contribute significantly to refined product demand growth

- Increasing air travel and freight movement boost jet fuel consumption, indirectly augmenting demand for VGO used in refining jet fuel components

- Industry trends such as increasing focus on fuel quality and lowering emissions stimulate investment in VGO upgrading technologies and refining capacity

Restraint/Challenge

Volatility in Crude Oil Prices

- Fluctuations and unpredictability in crude oil prices create challenges for vacuum gas oil market stability, as raw material costs directly affect refinery operating margins and pricing of downstream products

- For instance, sudden price spikes or drops driven by geopolitical tensions, supply-demand imbalances, or OPEC+ production decisions impact the economics of VGO production for companies such as Shell and ExxonMobil, affecting investment decisions and market growth

- Volatile crude prices may also influence crude slate selections at refineries, leading to variable VGO availability and quality, which complicates processing and pricing structures

- Price instability discourages long-term contracts and capital-intensive investments in upgrading infrastructure, slowing technological advancements and capacity expansions in certain regions

- The uncertainty also affects downstream industries reliant on stable VGO supply and pricing, potentially leading to supply chain disruptions and cost pressures

Vaccum Gas Oil Market Scope

The market is segmented on the basis of product, sulfur content, and application.

- By Product

On the basis of product, the vacuum gas oil market is segmented into heavy vacuum gas oil (HVGO) and light vacuum gas oil (LVGO). The heavy vacuum gas oil segment dominated the largest market revenue share in 2024, primarily due to its extensive utilization in hydrocracking and catalytic cracking processes within refineries. HVGO is valued for its higher molecular weight and carbon content, making it a preferred feedstock for producing diesel and other middle distillates. Its adaptability across various upgrading units in complex refineries strengthens its role in boosting overall yield and profitability.

The light vacuum gas oil segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for lighter, cleaner fuels amid tightening emission standards. LVGO, with its lower viscosity and better flow characteristics, is gaining favor in modern refineries where flexibility in feed blending and operational efficiency are key. Growing emphasis on producing higher-value fuels with lower environmental impact supports the expansion of LVGO use, especially in regions investing in advanced refining technologies.

- By Sulfur Content

On the basis of sulfur content, the market is segmented into low sulfur VGO and high sulfur VGO. Low sulfur VGO accounted for the largest market revenue share of 61.9% in 2024, supported by its critical role in meeting stringent global sulfur regulations, such as IMO 2020 and Euro VI standards. Refiners prefer low sulfur VGO to reduce the need for expensive desulfurization processes and to maintain compliance with environmental mandates. Its use facilitates smoother downstream processing and aligns with the global transition toward cleaner fuel alternatives.

High sulfur VGO is expected to register the fastest growth during 2025 to 2032, particularly in markets with relaxed sulfur caps or where cost considerations favor the use of high-sulfur feedstocks. Emerging economies with limited refinery upgrades and lenient environmental frameworks continue to process high sulfur VGO due to its lower procurement cost and compatibility with older cracking units. However, technological advancements in sulfur recovery units are enabling broader utilization while managing emissions effectively.

- By Application

On the basis of application, the market is segmented into gasoline production and diesel oil or kerosene production. Gasoline production dominated the largest share of the vacuum gas oil market in 2024, propelled by the high demand for personal vehicles and the wide adoption of VGO in fluid catalytic cracking (FCC) units to produce high-octane gasoline components. Refiners continue to optimize gasoline yields using VGO as it balances operational cost-efficiency and product value.

The diesel oil or kerosene production segment is projected to grow at the fastest rate from 2025 to 2032, supported by rising global diesel consumption in transportation, logistics, and industrial sectors. VGO's suitability for hydrocracking into diesel and kerosene makes it a strategic feedstock amid tightening regulations and growing middle distillate demand. The shift toward cleaner-burning fuels and expansion of aviation and freight infrastructure are further accelerating the use of VGO in diesel and kerosene production.

Vaccum Gas Oil Market Regional Analysis

- North America dominated the vaccum gas oil market with the largest revenue share of 46.3% in 2024, driven by the presence of complex refineries, robust downstream infrastructure, and steady demand for transportation fuels

- The region benefits from technological advancements in upgrading units such as hydrocrackers and FCCs, which efficiently utilize VGO to produce high-value fuels

- A stable regulatory environment, abundant crude supplies, and the continuous expansion of refining capacities contribute to North America's leading position in the global VGO market

U.S. Vacuum Gas Oil Market Insight

The U.S. vacuum gas oil market held the largest revenue share within North America in 2024, underpinned by its world-class refining capacity and technological edge. The country’s refining sector is increasingly focused on maximizing middle distillate output to meet growing domestic and export demand. With stringent regulations promoting low-sulfur fuel usage, U.S. refiners are leveraging VGO in hydrocracking units to produce cleaner diesel and kerosene. In addition, access to cost-effective crude oil sources and strong pipeline and terminal infrastructure enables seamless integration of VGO into refinery operations, maintaining the U.S.'s leadership position in the region.

Europe Vacuum Gas Oil Market Insight

Europe accounted for a significant share of the global vacuum gas oil market in 2024, driven by the region’s strong emphasis on cleaner fuel production and strict environmental standards. European refineries are increasingly optimizing operations to convert VGO into low-sulfur diesel and other middle distillates that comply with Euro VI emission norms. The region has been proactive in upgrading refining facilities to handle diverse feedstocks efficiently while reducing carbon and sulfur emissions. Countries such as Germany, the Netherlands, and Italy are at the forefront of these developments, supported by policy initiatives and investments in fuel quality improvements. In addition, the rising demand for energy-efficient transport fuels and the move toward energy transition are reinforcing the role of VGO in Europe’s fuel production strategy.

Germany Vacuum Gas Oil Market Insight

The Germany vacuum gas oil market is poised for considerable growth over the forecast period, bolstered by the country’s commitment to sustainable energy practices and industrial innovation. As one of Europe’s largest refining hubs, Germany is actively upgrading its facilities to improve conversion rates and environmental performance. Demand for low-sulfur diesel, especially from the logistics and transport sectors, is spurring the use of VGO in advanced hydrocracking units. Furthermore, Germany’s focus on energy efficiency, carbon reduction, and environmental stewardship is accelerating the transition to cleaner fuel production methods, where VGO plays a pivotal role.

Asia-Pacific Vacuum Gas Oil Market Insight

The Asia-Pacific vacuum gas oil market is projected to register the fastest CAGR from 2025 to 2032, driven by rapid economic development, rising urbanization, and the expansion of refining capacities across key countries. As fuel demand surges in China, India, and Southeast Asia, regional refiners are increasingly investing in complex refining infrastructure capable of upgrading VGO into higher-value products. The shift toward energy security and self-sufficiency, alongside favorable government policies promoting domestic refining, is supporting broader VGO consumption. Moreover, the emergence of APAC as a manufacturing and export hub for refined fuels further reinforces the region’s growth trajectory in the VGO market.

China Vacuum Gas Oil Market Insight

China accounted for the largest share of the Asia-Pacific vacuum gas oil market in 2024, supported by its vast refining infrastructure and rising demand for clean fuels. As the country continues to modernize its refineries to meet tightening fuel quality regulations, VGO has emerged as a key feedstock in catalytic and hydrocracking processes. Government initiatives aimed at reducing air pollution and boosting domestic fuel output are accelerating VGO use, particularly in the production of diesel and gasoline. In addition, China’s strong presence of domestic VGO producers and its role as a central player in the global refined product supply chain solidify its leadership in the regional market.

India Vacuum Gas Oil Market Insight

India’s vacuum gas oil market is expected to grow significantly over the forecast period, driven by increasing fuel consumption and the expansion of refinery infrastructure. The government’s push for cleaner fuels under the Bharat Stage VI (BS-VI) norms and the rising demand for diesel in transport and logistics are key factors driving VGO utilization. India is investing in high-conversion refining units capable of processing VGO efficiently into low-sulfur fuels, aligning with environmental goals and growing energy needs. In addition, strategic efforts to reduce dependency on fuel imports and improve energy resilience are further promoting VGO adoption across the country.

Vaccum Gas Oil Market Share

The vaccum gas oil industry is primarily led by well-established companies, including:

- TAIF-NK (Russia)

- Kuwait Petroleum Corporation (Kuwait)

- KazMunayGas (Kazakhstan)

- Shell (U.S.)

- Zhejiang Petroleum & Chemical Co Ltd, (China)

- Vertex (U.S.)

- LUKOIL (Russia)

- Exxon Mobil Corporation (U.S.)

- Saudi Arabian Oil Co. (Saudi Arabia)

- China National Petroleum Corporation (China)

- BP plc (U.K.)

- Shell plc (U.K.)

- PDVSA - Petróleos de Venezuela, SA. (Venezuela)

- Gazprom (Russia)

- Chevron Corporation. (U.S.)

- Petrobras (Brazil)

- LUKOIL (Russia)

- ROSNEFT (Russia)

- Abu Dhabi National Oil Company (U.A.E.)

- China Petrochemical Corporation (China)

Latest Developments in Global Vaccum Gas Oil Market

- In January 2024, ExxonMobil implemented an expansion at its Beaumont facility in Texas to strengthen its vacuum gas oil (VGO) production capacity. This strategic move comes in response to the surge in global demand for cleaner fuels and underlines the company’s commitment to improving operational efficiency and environmental performance. The expansion enhances ExxonMobil’s supply capabilities in North America and also aligns with its broader sustainability objectives by facilitating the production of low-emission fuels through optimized VGO processing

- In December 2023, Shell announced a significant investment to expand the VGO hydrocracking capacity at its Pernis refinery in the Netherlands. This development is aimed at addressing the growing demand for diesel and jet fuel in Europe by improving the refinery’s ability to convert VGO into high-quality middle distillates. The enhancement of hydrocracking operations positions Shell to better serve the European clean fuel market and reinforces its role in supporting the EU's push for energy transition and emissions reduction

- In November 2023, TotalEnergies entered into a supply agreement with a Middle Eastern vendor to secure a consistent flow of vacuum gas oil to its refineries in France and Belgium. The long-term contract is expected to stabilize the company’s feedstock supply chain, improving operational efficiency and fuel output at its European facilities. By ensuring uninterrupted access to high-quality VGO, TotalEnergies aims to bolster its production of clean fuels, contributing to both regional energy security and environmental compliance

- In October 2023, Indian Oil Corporation (IOC) commissioned a new vacuum gas oil (VGO) hydrocracker unit at its Paradip refinery, aimed at boosting the production of high-quality gas oil-based fuels. This strategic upgrade enhances the refinery’s ability to convert VGO into cleaner fuels more efficiently. Aligned with India’s growing demand for hydrocarbons and its long-term net-zero emission goals, the investment reflects IOC’s commitment to modernizing its operations while supporting the country’s transition toward more sustainable energy sources

- In June 2022, ExxonMobil completed a $2.5 billion acquisition of Marathon Petroleum Corporation’s VGO-related assets. The deal included Marathon’s Garyville refinery in Louisiana and its VGO marketing and trading operations. This acquisition significantly expanded ExxonMobil’s downstream footprint and feedstock flexibility, allowing it to increase its control over VGO supply, enhance its refining network, and strengthen its competitive positioning in the global VGO market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vaccum Gas Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vaccum Gas Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vaccum Gas Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.