Global Used Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

132.18 Billion

USD

212.28 Billion

2024

2031

USD

132.18 Billion

USD

212.28 Billion

2024

2031

| 2025 –2031 | |

| USD 132.18 Billion | |

| USD 212.28 Billion | |

|

|

|

|

Used Vehicle Market Size

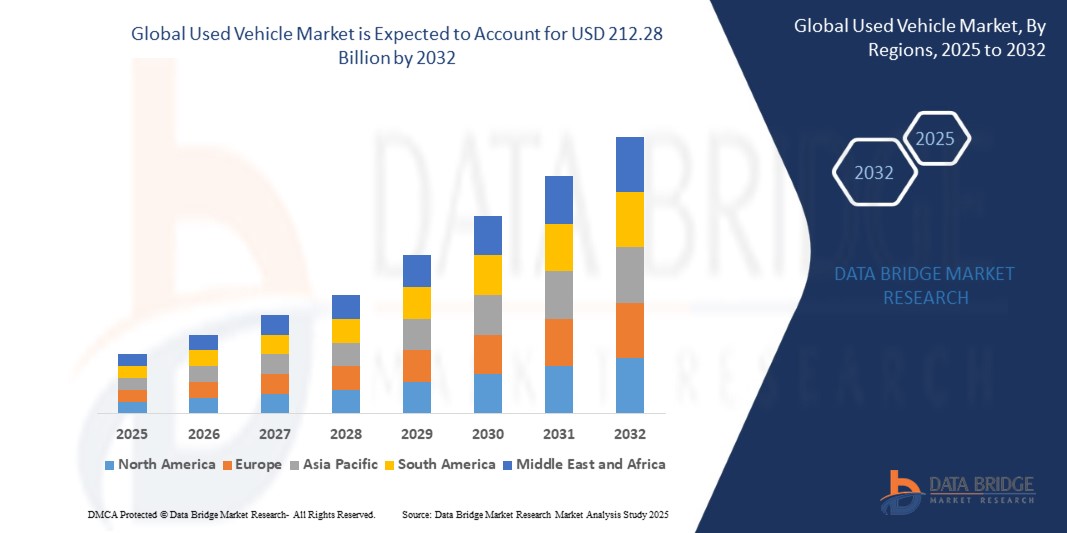

- The global used vehicle market size was valued at USD 132.18 billion in 2024 and is expected to reach USD 212.28 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the increasing affordability of used vehicles, rising demand for personal mobility, growing online vehicle sales platforms, and favorable financing options across emerging economies

- In addition, the rapid digital transformation of the automotive resale ecosystem and increased consumer awareness regarding vehicle history reports are significantly driving the market demand

Used Vehicle Market Analysis

- Rising consumer preference for value-for-money mobility solutions, especially in price-sensitive markets, is driving used vehicle sales globally

- The growing adoption of certified pre-owned (CPO) programs by automakers is boosting customer trust and influencing buying behavior

- North America dominated the used vehicle market with the largest revenue share of 33.3% in 2024, driven by strong consumer demand for affordable mobility solutions, high vehicle ownership rates, and a mature resale ecosystem

- Asia-Pacific region is expected to witness the highest growth rate in the global used vehicle market, driven by increasing urbanization, affordability gaps between new and used vehicles, government efforts to formalize the used vehicle ecosystem, and rising internet penetration supporting digital sales platforms

- The 6 to 10 years segment dominated the market with the largest market revenue share of 45.6% in 2024, driven by the balance it offers between affordability and performance. Vehicles in this range typically undergo moderate depreciation, making them a cost-effective choice while still offering relatively modern features and acceptable mileage. Buyers also favor this category for the availability of models with sufficient service history and warranty extensions

Report Scope and Used Vehicle Market Segmentation

|

Attributes |

Used Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Online Used Vehicle Marketplaces • Growing Demand for Certified Pre-Owned Vehicles |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Used Vehicle Market Trends

“Rise of Online Vehicle Retail Platforms Reshaping Consumer Buying Behaviour”

- Online platforms are transforming the used vehicle landscape by offering end-to-end digital experiences, including vehicle browsing, financing, insurance, documentation, and doorstep delivery, all within a single unified interface

- Consumers can now remotely browse thousands of vehicles filtered by parameters such as price, model, fuel type, or mileage, enabling smarter and faster decision-making without visiting multiple dealerships

- Technologies such as artificial intelligence and machine learning are being leveraged to personalize user experiences by showing curated recommendations based on browsing history, search patterns, and budget preferences

- These platforms reduce the friction associated with traditional dealerships by ensuring transparent pricing, verified paperwork, real-time availability, return policies, and service guarantees, enhancing buyer confidence and convenience

- For instance, platforms such as Carvana (U.S.) have pioneered touchless online car buying with 360-degree vehicle views, instant loan approvals, and a 7-day return window, revolutionizing how consumers purchase used vehicles online

Used Vehicle Market Dynamics

Driver

“Growing Affordability and Cost Advantage of Used Vehicles Over New Ones”

- Used vehicles typically cost 30% to 50% less than new ones, attracting price-sensitive buyers, first-time car owners, and those looking for secondary or utility vehicles for household or commercial use

- With rising demand and improved vehicle longevity, used cars today retain better resale value, helping reduce long-term ownership costs and depreciation losses for consumers

- Financial innovations such as quick loan disbursals, flexible EMI plans, and guaranteed buy-back offers are making used vehicles more accessible through both banks and digital financing platforms

- Certified pre-owned (CPO) programs by automakers and organized players now include multi-point inspections, extended warranties, and service guarantees, bridging the trust gap between new and used vehicle purchases

- For instance, Spinny (India) has built trust in the pre-owned segment by offering 200-point vehicle checks, fixed pricing, a 5-day return policy, and buyback options, enhancing both affordability and reliability for consumers

Restraint/Challenge

“Lack of Standardization and Quality Assurance in the Unorganized Sector”

- A significant share of the used vehicle market in emerging economies remains dominated by unorganized dealers who often operate without formal infrastructure, digital records, or transparent business practices

- Vehicle condition reports, past accident history, and actual odometer readings are frequently altered or concealed, resulting in post-sale issues and a lack of trust between buyers and sellers

- Consumers often struggle to verify ownership documents, check for legal encumbrances, and confirm service history in informal markets, making transactions risky and discouraging widespread adoption

- Pricing inconsistencies and limited legal recourse in disputes create additional barriers, delaying the formalization of the sector and limiting scalability for organized players

- For instance, in Nigeria, the unregulated influx of imported used vehicles known as "Tokunbo cars" often bypasses emission norms and safety standards, raising concerns around compliance, vehicle integrity, and roadworthiness for buyers

Used Vehicle Market Scope

The market is segmented on the basis of vehicle age, vehicle type, propulsion, sales channel, and market type.

• By Vehicle Age

On the basis of vehicle age, the used vehicle market is segmented into 0 to 5 years, 6 to 10 years, and 10 years and above. The 6 to 10 years segment dominated the market with the largest market revenue share of 45.6% in 2024, driven by the balance it offers between affordability and performance. Vehicles in this range typically undergo moderate depreciation, making them a cost-effective choice while still offering relatively modern features and acceptable mileage. Buyers also favor this category for the availability of models with sufficient service history and warranty extensions.

The 0 to 5 years segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising popularity of certified pre-owned (CPO) programs. These vehicles often come with extended warranties, verified inspection reports, and modern safety technologies, attracting consumers who seek near-new condition without the price tag of brand-new vehicles.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger car and commercial vehicle. The passenger car segment accounted for the largest revenue share in 2024, driven by the strong demand from urban households and individual buyers. Compact sedans, hatchbacks, and SUVs dominate this space, particularly in densely populated cities where affordability and fuel efficiency are key priorities. Passenger vehicles are also readily available across organized and unorganized sectors, ensuring wide accessibility.

The commercial vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing demand from small logistics firms and fleet operators. Used light commercial vehicles (LCVs) and trucks serve as cost-effective transport options, especially for last-mile delivery and regional operations.

• By Propulsion

On the basis of propulsion, the used vehicle market is segmented into internal combustion engine (ICE) and electric vehicle (EV). The ICE segment held the largest market share in 2024 owing to its wide availability and familiarity among buyers. Diesel and petrol-based used vehicles dominate inventory levels, supported by established fueling infrastructure and lower upfront prices.

The electric vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased awareness of environmental impact and the growing affordability of pre-owned EVs. Government incentives and expanding EV charging infrastructure are further supporting the resale value and demand for second-hand electric vehicles.

• By Sales Channel

On the basis of sales channel, the market is segmented into franchised, independent car dealers, rental car companies, and others. The independent car dealers segment captured the largest revenue share in 2024 due to their extensive networks, localized market knowledge, and competitive pricing strategies. These dealers often cater to budget-conscious consumers seeking flexible payment options and varied inventory.

The franchised segment is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer preference for warranty-backed vehicles and assurance of brand-certified standards. Automakers and branded dealerships are expanding their CPO programs to increase trust and retain customers within their brand ecosystem.

• By Market Type

On the basis of market type, the used vehicle market is segmented into online and offline. The offline segment led the market with the highest revenue share in 2024, supported by consumer inclination toward physical inspection, test drives, and in-person negotiation. Many buyers still prefer to visit local dealerships or direct sellers for a hands-on evaluation of vehicle condition.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rise of digital platforms offering transparent pricing, verified listings, and home delivery services. Online marketplaces such as CarMax and Cars24 are rapidly gaining traction for their convenience, customer support, and seamless transaction experience.

Used Vehicle Market Regional Analysis

- North America dominated the used vehicle market with the largest revenue share of 33.3% in 2024, driven by strong consumer demand for affordable mobility solutions, high vehicle ownership rates, and a mature resale ecosystem

- Consumers in the region increasingly prefer used vehicles for their lower upfront costs, favorable financing terms, and the availability of certified pre-owned programs that ensure quality and warranty coverage

- The market is further supported by the presence of well-established online platforms and dealership networks, along with rising demand for value-driven purchases in both urban and suburban regions

U.S. Used Vehicle Market Insight

The U.S. used vehicle market captured the largest revenue share in 2024 within North America, fuelled by the presence of a highly developed automotive resale infrastructure and a growing preference for cost-effective vehicle ownership. The expanding consumer base for certified pre-owned vehicles, coupled with digital advancements in vehicle listings, financing, and logistics, has contributed significantly to market growth. Companies such as CarMax and AutoNation continue to lead with strong online-to-offline integration. In addition, inflationary pressure on new car prices has accelerated the shift towards used vehicle purchases among both individuals and businesses.

Europe Used Vehicle Market Insight

The Europe used vehicle market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising emphasis on sustainability, the circular economy, and stringent emission norms affecting new car affordability. Consumers are increasingly turning to used vehicles as a practical and economical alternative. The region’s structured vehicle inspection and registration systems enhance buyer confidence and transparency. Growing acceptance of used electric vehicles (EVs), particularly in countries such as Germany, France, and the Netherlands, is expected to further boost the market in the coming years.

U.K. Used Vehicle Market Insight

The U.K. used vehicle market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong consumer demand for quality pre-owned vehicles and the growing influence of online vehicle marketplaces. With economic uncertainty and rising new car prices, buyers are turning to reliable used options supported by extensive vehicle history records and inspection services. The country’s robust online platforms and trade-in programs offered by dealers and automakers are also improving access and affordability, especially in urban regions such as London and Manchester.

Germany Used Vehicle Market Insight

The Germany used vehicle market is expected to witness the fastest growth rate from 2025 to 2032, bolstered by the country's deep-rooted automotive culture and established secondary vehicle infrastructure. Consumers value quality, durability, and transparency—factors well supported by Germany’s regulated resale practices and strong vehicle certification programs. The growing availability of used EVs and hybrids in the market is also attracting eco-conscious buyers, supported by incentives and charging infrastructure expansion. Key cities such as Berlin and Munich are becoming hubs for digital car-buying platforms and second-hand vehicle exchanges.

Asia-Pacific Used Vehicle Market Insight

The Asia-Pacific used vehicle market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, expanding middle-class population, and greater affordability gaps between new and used vehicles. Countries such as India, China, and Indonesia are witnessing a surge in demand due to the proliferation of online used vehicle platforms, financing solutions, and the rise of first-time car buyers. Government efforts to formalize and digitalize the resale ecosystem are also contributing to growth. Moreover, consumers in the region are becoming more aware of vehicle certification and service history documentation.

Japan Used Vehicle Market Insight

The Japan used vehicle market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s meticulous vehicle inspection and registration system, which ensures high-quality used vehicles. Japanese consumers prioritize reliability and low maintenance costs, making used vehicles an attractive option. In addition, the export of used Japanese cars to other Asian and African countries contributes significantly to the overall market volume. The domestic market benefits from the availability of gently used vehicles with advanced technology and safety features, appealing to both individual and commercial buyers.

China Used Vehicle Market Insight

The China used vehicle market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, the expansion of digital vehicle platforms, and rising disposable incomes. The market is undergoing rapid formalization, supported by regulatory changes aimed at increasing transparency and reducing transaction friction. Consumers are increasingly shifting toward used vehicles due to the widening price gap between new and old models, especially among younger, tech-savvy buyers. Domestic players such as Uxin and Guazi are helping standardize the ecosystem, and growth is further accelerated by the increasing resale of new energy vehicles (NEVs) in major cities such as Beijing, Shanghai, and Shenzhen.

Used Vehicle Market Share

The Used Vehicle industry is primarily led by well-established companies, including:

- CarMax Business Services, LLC (U.S.)

- Manheim (U.S.)

- The Hertz Corporation (U.S.)

- Cox Automotive (U.S.)

- Sun Toyota (U.S.)

- Alibaba Group Holding Limited (China)

- eBay Inc. (U.S.)

- TrueCar, Inc. (U.S.)

- AutoNation (U.S.)

- VROOM (U.S.)

- OLX (India)

- Asbury Automotive Group (U.S.)

- Maruti Suzuki India Limited (India)

- Mahindra First Choice (India)

- Scout24 AG (Germany)

- Lithia Motors, Inc. (U.S.)

- Hendrick Automotive Group (U.S.)

- Group1 Automotive, Inc. (U.S.)

- Quikr India Private Limited (India)

Latest Developments in Global Used Vehicle Market

- In April 2024, Droom commemorated its 10th Founding Day anniversary by introducing a range of innovative products aimed at revolutionizing the used car industry. The new offerings—MyDroom, AdReach, GoDigital, and Chairman Club—provide consumers, businesses, and dealerships with all-encompassing solutions for every phase of the car ownership experience

- In April 2024, Ashok Leyland, a leading manufacturer of commercial vehicles, introduced its e-marketplace, Re-AL, for used commercial vehicles. This platform is designed to facilitate the trade of pre-owned vehicles and help customers upgrade to new Ashok Leyland trucks and buses. By utilizing this digital solution, Ashok Leyland aims to enhance transparency within the traditionally disorganized used vehicle market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.