Global Usage Based Insurance Market

Market Size in USD Billion

CAGR :

%

USD

39.83 Billion

USD

263.86 Billion

2024

2032

USD

39.83 Billion

USD

263.86 Billion

2024

2032

| 2025 –2032 | |

| USD 39.83 Billion | |

| USD 263.86 Billion | |

|

|

|

|

Usage-Based Insurance Market Size

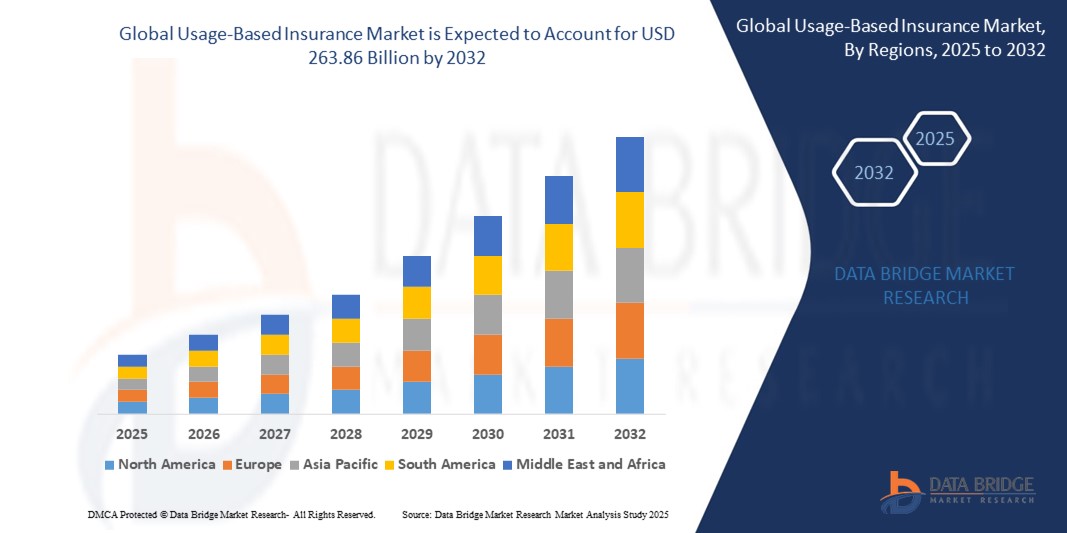

- The global usage-based insurance market size was valued at USD 39.83 billion in 2024 and is expected to reach USD 263.86 billion by 2032, at a CAGR of 26.66% during the forecast period

- The market's expansion is largely driven by the accelerating integration of technology. Connected devices and smart systems foster increased digitalization in both residential and commercial environments, making UBI solutions more viable

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions establishes UBI as a modern insurance choice. These converging factors significantly boost industry growth by increasing data-driven policy uptake

Usage-Based Insurance Market Analysis

- Usage-Based Insurance (UBI) uses telematics and real-time data to offer personalized premiums based on driving behavior and mileage, encouraging safer driving and aligning insurance costs with individual risk profiles

- Growing connected vehicle adoption, consumer demand for affordable insurance, and telematics technology advancements are the main drivers increasing UBI market growth worldwide

- Asia-Pacific dominates the UBI market with a 42.3% revenue share in 2024, driven by rapid urbanization, rising vehicle sales, and strong government support for telematics-based insurance policies in countries like China and India

- North America is the fastest-growing region due to early adoption of UBI models, strong insurer partnerships with automakers, and increasing consumer interest in Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD) insurance programs

- The Pay-How-You-Drive (PHYD) segment leads with 45.3% market share in 2024, offering premium discounts for safe driving and reducing claim costs, making it preferred by insurers and policyholders alike

Report Scope and Usage-Based Insurance Market Segmentation

|

Attributes |

Usage-Based Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Usage-Based Insurance Market Trends

“Advanced Telematics and AI-Driven Risk Assessment”

- A key trend in the global Usage-Based Insurance (UBI) market is the increasing integration of AI and advanced telematics, enabling insurers to analyze driver behavior in real time for more accurate risk profiling and personalized premiums

- For instance, Progressive’s snapshot program uses telematics data combined with AI algorithms to assess driving habits, offering tailored discounts and alerts, while Allstate’s Drivewise app provides real-time feedback and safety tips to policyholders

- AI integration allows insurers to detect risky driving patterns, predict accident likelihood, and optimize claim processing. For instance, some providers use machine learning models to flag erratic braking or speeding for intervention and premium adjustments

- The fusion of telematics with AI-powered mobile apps enhances user engagement, allowing drivers to monitor their performance, receive coaching, and improve their safety scores, which can translate to lower insurance costs over time

- This trend toward smarter, data-driven insurance solutions is reshaping customer expectations. Companies like Metromile offer AI-driven pay-per-mile policies that provide flexible coverage and real-time usage insights, appealing to urban drivers and fleet operators

- Demand for UBI products leveraging AI and telematics is rapidly growing, driven by consumers’ desire for fair pricing and insurers’ aim to reduce claim costs through better risk management and proactive driver support

Usage-Based Insurance Market Dynamics

Driver

“Increasing Demand Due to Rising Road Safety Concerns and Connected Vehicle Adoption”

- Growing concerns about road safety and rising vehicle accident rates, combined with increased adoption of connected car technologies, are major drivers boosting the demand for usage-based insurance globally

- For instance, in March 2025, Progressive expanded its Snapshot telematics program by integrating more advanced driving behavior sensors, enabling more accurate risk assessments and personalized premiums, which is expected to accelerate UBI adoption

- As consumers seek affordable insurance options tied to actual driving habits, UBI provides benefits such as pay-as-you-drive pricing, promoting safer driving and rewarding low-risk behaviors over traditional flat-rate policies

- Furthermore, government regulations encouraging safer driving and insurance transparency in regions like Europe and North America are supporting broader telematics insurance acceptance

- The growing penetration of smartphones, IoT devices, and affordable telematics hardware makes UBI accessible to a wider population, while insurer partnerships with automakers facilitate embedding telematics directly into new vehicles

Restraint/Challenge

“Concerns Regarding Data Privacy and High Implementation Costs”

- Concerns around data privacy and personal information security pose a significant challenge to UBI adoption, as these systems collect detailed driving behavior, location data, and other sensitive information through telematics devices and mobile apps

- For instance, multiple consumer advocacy groups in Europe have raised concerns over how insurers use and store telematics data, prompting stricter data handling regulations under frameworks like the General Data Protection Regulation (GDPR)

- Addressing these privacy concerns requires insurers to adopt transparent data policies, secure encryption standards, and consent-based data sharing, which is essential to build consumer trust in UBI programs

- In addition, the relatively high initial investment for telematics hardware, mobile app development, and backend analytics infrastructure can be a barrier, especially for small insurers and in emerging markets with limited tech maturity

- While mobile-based UBI models offer a more affordable entry point, full-featured solutions with advanced analytics and real-time tracking often demand significant upfront costs for implementation and ongoing system maintenance

- Overcoming these challenges through robust cybersecurity practices, transparent communication, and the rollout of low-cost telematics solutions will be essential to drive broader adoption of UBI globally

Usage-Based Insurance Market Scope

The market is segmented on the basis of vehicle type, package type, device offering, technology, vehicle age, and electric and hybrid vehicle type.

By Vehicle Type:

The Passenger Car segment accounts for the largest market share (over 67% in 2023). This dominance is driven by the vast volume of passenger vehicles globally and the increasing adoption of telematics-based insurance by individual car owners who seek premiums based on actual usage and driving behavior, offering significant cost savings.

The Commercial Vehicle segment is expected to witness substantial growth. While smaller, demand in this sector is increasing as businesses seek ways to lower insurance costs and monitor driver behavior in fleet operations. Despite complexities in fleet management, the benefits of UBI are becoming more appealing to commercial entities.

By Package Type:

Pay-As-You-Drive (PAYD) held the largest market share, capturing over 66.4% of the UBI industry in 2023. This dominant position is due to its straightforward approach, where premiums are directly linked to mileage, appealing especially to low-mileage drivers seeking cost-effective and flexible insurance alternatives to traditional fixed-rate policies.

The Pay-How-You-Drive (PHYD) model is the fastest-growing segment. This rapid expansion is driven by its focus on monitoring specific driving behaviors (speed, braking) and rewarding safe practices. As consumers become more safety-conscious, PHYD's ability to incentivize and provide feedback on responsible driving fuels its rising popularity.

By Device Offering:

Company Provided devices (OBD-II dongles, black boxes) historically held a significant share due to their accuracy and direct integration with vehicle diagnostics. Insurers provide these to ensure consistent data collection, offering detailed insights into driving patterns for accurate risk assessment and premium calculation.

The Bring Your Own Device (BYOD) segment, primarily smartphone-based solutions, is the fastest-growing. Its growth is fueled by widespread smartphone penetration and user convenience, eliminating the need for additional hardware installation. Smartphone apps leverage built-in sensors, offering a cost-effective and user-friendly platform for UBI data collection and driver feedback.

By Technology:

OBD-II (On-Board Diagnostics II) technology held a dominant market position, capturing over 45.1% of the UBI market in 2023. Its leadership stems from the established reliability and accuracy of OBD-II devices in collecting comprehensive vehicle performance and driver behavior data, making it a trusted choice for insurers assessing risk.

Smartphone-based technology is the fastest-growing segment. This is due to the increasing sophistication of mobile applications and their user-friendliness, allowing drivers to conveniently monitor habits and receive instant feedback. Leveraging GPS and accelerometer data, smartphones offer comprehensive insights without extra hardware.

By Vehicle Age:

The New Vehicles segment held the largest market share in 2023 and is expected to be the fastest-growing. This is driven by increasing sales of new cars globally, which are often equipped with advanced safety features and pre-fitted telematics devices, attracting favorable insurance premiums and creating new revenue streams for insurers.

The On-Road Vehicles (Used Vehicles) segment also holds a substantial share, catering to the large existing fleet of vehicles. While not the fastest growing, its consistent demand is driven by the vast number of older vehicles eligible for UBI, offering cost-effective alternatives to traditional insurance.

By Electric and Hybrid Vehicle Type:

The Hybrid Electric Vehicle (HEV) segment currently holds a significant share, given their longer market presence and growing adoption. UBI solutions for HEVs track typical usage patterns, rewarding efficient driving behaviors that align with the hybrid system's benefits, making insurance more appealing for these vehicles.

Battery Electric Vehicle (BEV) UBI is anticipated to be the fastest-growing segment. This is fueled by the surging global sales and government incentives for EVs. As more parc data on EVs becomes available, insurers can better assess risk and offer tailored, often lower, premiums, driving BEV adoption in UBI.

By Electric and Hybrid Vehicle Type:

On the basis of electric and hybrid vehicle type, the UBI market is segmented into Hybrid Electric Vehicle (HEV), Plug-In Hybrid Vehicle (PHEV), and Battery Electric Vehicle (BEV). The Battery Electric Vehicle (BEV) segment is expected to witness substantial growth in UBI adoption, driven by the unique driving patterns of EVs shorter trips, specific charging behaviors) and the need for specialized insurance.

The Hybrid Electric Vehicle (HEV) and Plug-In Hybrid Vehicle (PHEV) segments also offer growth opportunities for UBI, as insurers increasingly tailor policies to account for their combined fuel and electric usage patterns.

Usage-Based Insurance Market Regional Analysis

- Asia-Pacific dominates the usage-based insurance market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, growing vehicle ownership, and strong governmental initiatives supporting road safety and telematics-based insurance solutions

- Consumers in the region are increasingly adopting UBI programs due to their affordability, real-time monitoring benefits, and incentives for safe driving, especially in densely populated countries such as China, India, and Japan

- This widespread adoption is further fueled by rising smartphone penetration, expanding connected vehicle infrastructure, and partnerships between insurers and automakers, positioning UBI as a preferred model for both individual and commercial vehicle policies

Japan Usage-Based Insurance Market Insight

Japan holds a significant share of the Asia-Pacific usage-based insurance (UBI) market in 2024, supported by its advanced automotive sector and high telematics adoption. The country's safety-conscious driving culture aligns well with UBI models, encouraging consumer interest in behavior-based premiums. Major automakers like Toyota and Nissan are integrating telematics systems to support insurer partnerships. In addition, government-backed smart mobility initiatives are accelerating UBI adoption across urban centers.

China Usage-Based Insurance Market Insight

China is projected to witness strong growth in the usage-based insurance (UBI) market during the forecast period, driven by rapid urbanization and a surge in connected vehicle adoption. Government support for telematics and smart transportation initiatives is accelerating UBI integration. Chinese insurers are increasingly partnering with domestic automakers to embed telematics in new vehicles. Rising consumer awareness of personalized, cost-effective insurance options is further propelling market expansion.

Europe Usage-Based Insurance Market Insight

Europe is expected to grow steadily in the usage-based insurance (UBI) market, fueled by strict road safety regulations and increasing demand for transparent, behavior-based insurance pricing. Countries like the U.K., Germany, and Italy are witnessing rising adoption of telematics programs among private and fleet drivers. Insurers are leveraging partnerships with automakers to expand PAYD and PHYD models. Additionally, growing consumer preference for data-driven, cost-efficient policies is accelerating UBI uptake across the region.

U.K. Usage-Based Insurance Market Insight

The U.K. is a key contributor to Europe’s usage-based insurance market, driven by growing interest in fair, behavior-based premium models. British insurers are actively deploying telematics solutions, especially among young and high-risk drivers. Government emphasis on road safety and digital transformation is further supporting market growth. In addition, strong consumer demand for cost-effective and transparent insurance options is boosting UBI adoption across both urban and rural areas.

Germany Usage-Based Insurance Market Insight

Germany is emerging as a strong market for usage-based insurance (UBI), supported by its advanced automotive sector and strong regulatory focus on road safety. Insurers are adopting telematics to offer customized premiums, especially for younger and high-risk drivers. Collaborations between insurers and automakers like BMW and Mercedes-Benz are boosting in-vehicle UBI integration. Additionally, Germany’s digitally aware consumers are increasingly opting for data-driven insurance solutions that reward responsible driving behavior.

North America Usage-Based Insurance Market Insight

North America holds a leading position in the usage-based insurance (UBI) market, driven by early telematics adoption and a strong focus on road safety. The U.S. dominates the region, with insurers like Progressive and Allstate offering well-established UBI programs. High vehicle ownership, tech-savvy consumers, and widespread smartphone usage support market expansion. In addition, increasing demand for personalized, cost-efficient insurance plans is encouraging further adoption of telematics-based policies across private.

U.S. Usage-Based Insurance Market Insight

The U.S. is the largest contributor to the North American usage-based insurance (UBI) market in 2024, driven by mature telematics infrastructure and strong insurer participation. Programs like Progressive’s Snapshot and Allstate’s Drivewise have seen wide adoption across diverse driver demographics. Consumers are drawn to behavior-based discounts and real-time feedback on driving performance. In addition increasing smartphone penetration and integration with in-car systems are making UBI more accessible and appealing nationwide.

Usage-Based Insurance Market Share

The usage-based insurance industry is primarily led by well-established companies, including:

- Cambridge Mobile Telematics (U.S.)

- insurethebox (U.K.)

- Progressive Casualty Insurance Company (U.S.)

- Modus Group, LLC.(U.S.)

- Inseego Corp. (U.S.)

- Lemonade Inc. Metromile (U.S.)

- The Floow Limited (U.K.)

- Allstate Insurance Company (U.S.)

- Octo Group S.p.A (Italy)

- TomTom International BV. (Netherlands)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Liberty Mutual Insurance (U.S.)

- Equitable Holdings, Inc.(Italy)

- MAPFRE (Spain)

- Sierra Wireless (Canada)

- Verizon (U.S.)

- Allianz Partners (Germany)

- ZKTeco (China)

- Tesa (Spain)

Latest Developments in Global Usage-Based Insurance Market

- In April 2024, Allstate announced that customers using its Drivewise application experienced a 25% reduction in severe collisions compared to non-users. The app provides real-time feedback on safe driving behaviors, encouraging safer habits while offering potential insurance savings. Drivewise users also demonstrate 44% less phone handling, 23% less speeding, and 11% fewer hard brakes, improving road safety

- In September 2023, Definity introduced Sonnet Shift, a usage-based insurance (UBI) product designed to provide personalized premiums based on driving behavior. This initiative promotes safer driving habits while offering cost-effective insurance solutions. Sonnet Shift is the first UBI product in Canada to feature quarterly price adjustments based on recent driving scores

- In August 2023, Citroën India partnered with ICICI Lombard General Insurance to introduce a Usage-Based Insurance (UBI) program for its eC3 electric vehicle. This initiative offers Pay-As-You-Drive (PAYD) policies, linking insurance premiums to individual driving behavior. Customers with higher driving scores benefit from lower renewal premiums, encouraging safer driving habits. The UBI program can be activated at vehicle purchase or later via the Citroën My Connect App

- In June 2023, UnipolSai launched BeRebel, a pay-per-use car insurance policy, offering cost-effective premiums based on actual vehicle usage. Customers pay a fixed monthly fee, covering 200 km, with additional kilometers charged at.02/km. Unused kilometers roll over to the next month, and driving behavior influences discounts. The policy is fully digital, managed via an app, and includes a self-installed telematics device for tracking mileage and providing assistance in case of accidents

- In March 2023, Liberty Mutual Insurance partnered with Ford to integrate usage-based insurance (UBI) into connected vehicles. This collaboration enables personalized premiums based on real-time driving data, improving customer engagement and promoting safer driving habits. The initiative eliminates the need for plug-in telematics devices, leveraging FordPass Connect for seamless data collection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.