Supply Chain Ecosystem Analysis now part of DBMR Reports

Global Usage-Based Insurance for Automotive Market, Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD) and Manage-How-You-Drive (MHYD)), Technology (OBD II, Black Box, Smartphones and Others), Vehicle Type (Passenger Auto and Commercial Auto), and Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of the Middle East and Africa) Industry Trends and Forecast to 2028.

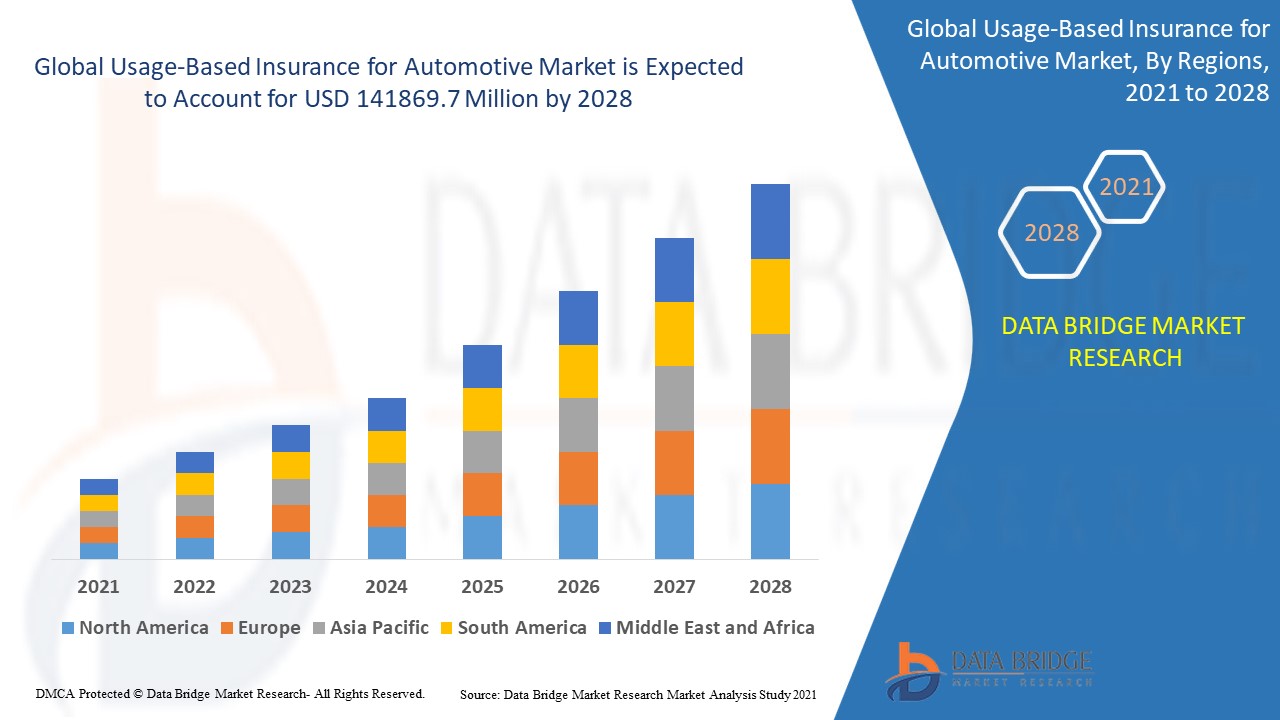

The usage-based insurance for automotive market is expected to witness market growth at a rate of 22.30% in the forecast period of 2021 to 2028 and is expected to reach USD 141869.7 million by 2028. Data Bridge Market Research report on usage-based insurance for automotive market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the penetration of usage-based insurance is escalating the growth of usage-based insurance for automotive market.

Usage-based insurance is known to be a type of insurance policy where the premium of the policy is directly linked with the utilization of the vehicle.

Major factors that are expected to boost the growth of the usage-based insurance for automotive market in the forecast period are the rise in the acceptance of telematics and connected cars. Furthermore, the decrease in the insurance premium and risk-related costs is further anticipated to propel the growth of the usage-based insurance for automotive market. Moreover, the increase in the acceptance of usage-based insurance amongst the end-users because of its several features like offering precise and timely data collection methods and flexible insurance is further estimated to cushion the growth of the usage-based insurance for automotive market. On the other hand, the ambiguity over regulations and legislative environments is further projected to impede the growth of the usage-based insurance for automotive market in the timeline period.

This usage-based insurance for automotive market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on usage-based insurance for automotive market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

The usage-based insurance for automotive market is segmented on the basis of type, technology, and vehicle type. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

The usage-based insurance for automotive market is analyzed, and market size, volume information is provided by country, type, technology, and vehicle type as referenced above.

The countries covered in the usage-based insurance for automotive market report are the U.S., Canada, and Mexico in North America, Brazil, Argentina, and rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, rest of the Middle East and Africa (MEA) as a part of the Middle East and Africa (MEA).

North America dominates the usage-based insurance for automotive market due to the occurrence of major key players. Furthermore, technological developments and a rising demand for interconnected services will further boost the growth usage-based insurance for automotive market in the region during the forecast period. Asia-Pacific is projected to observe a significant amount of growth in the usage-based insurance for automotive market due to the rise in consumer awareness. Moreover, the occurrence of major players of the market targeting advancing countries is further anticipated to propel the growth usage-based insurance for automotive market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

The usage-based insurance for automotive market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to usage-based insurance for automotive market.

The major players covered in the usage-based insurance for automotive market report are Progressive Corporation Assicurazioni Generali S.p.A., Mapfre S.A., American International Group, Inc., Mechatronic Systems Inc., Nationwide Mutual Insurance Company, Esurance Insurance Services, Inc., The Travelers Indemnity Company, Progressive Casualty Insurance Co, Metromile Inc., Liberty Mutual Insurance, Trak Global Group, Allianz, Desjardins General Insurance, Insurance Box Pty Ltd, Verizon, Sierra Wireless, The Floow Limited, TomTom International BV., Cambridge Mobile Telematics, among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.