Global Unified Communications As A Service Ucaas Market

Market Size in USD Billion

CAGR :

%

USD

79.39 Billion

USD

270.32 Billion

2024

2032

USD

79.39 Billion

USD

270.32 Billion

2024

2032

| 2025 –2032 | |

| USD 79.39 Billion | |

| USD 270.32 Billion | |

|

|

|

|

Unified Communication as a Service (Ucaas) Market Size

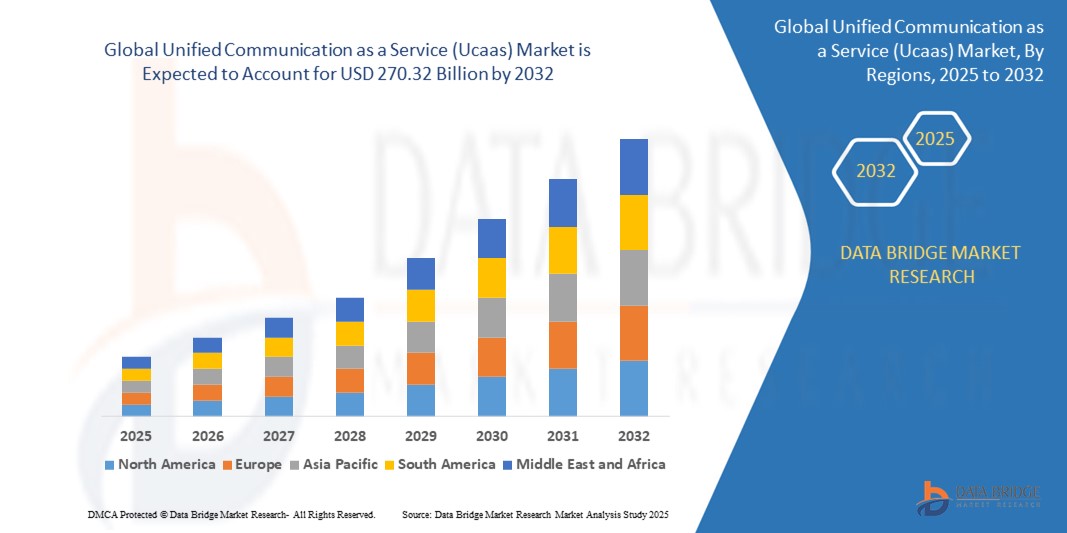

- The global unified communication as a service (Ucaas) market size was valued at USD 79.39 billion in 2024 and is expected to reach USD 270.32 billion by 2032, at a CAGR of 16.55% during the forecast period

- The market growth is primarily driven by the increasing adoption of cloud-based communication solutions, digital transformation across industries, and the need for seamless remote collaboration tools

- Growing demand for integrated, scalable, and cost-effective communication platforms is positioning unified communication as a service (Ucaas) as a preferred solution for businesses seeking enhanced productivity and connectivity

Unified Communication as a Service (Ucaas) Market Analysis

- Unified communication as a service (Ucaas) solutions, encompassing telephony, unified messaging, conferencing, and collaboration platforms, are critical for modern business communication, offering flexibility, scalability, and integration with existing enterprise systems

- The rising adoption of hybrid work models, increasing demand for real-time collaboration, and advancements in cloud technology are key drivers of unified communication as a service (Ucaas) market growth

- North America dominated the unified communication as a service (Ucaas) market with the largest revenue share of 40.01% in 2024, driven by early adoption of cloud technologies, high technological infrastructure, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid digitalization, increasing internet penetration, and growing adoption of cloud services in emerging economies

- The telephony segment dominated the largest market revenue share of 32% in 2024, driven by its critical role in providing cloud-based voice communication solutions, including cloud PBX and VoIP technologies, which streamline enterprise communication and enhance productivity, particularly for small and medium enterprises (SMEs)

Report Scope and Unified Communication as a Service (Ucaas) Market Segmentation

|

Attributes |

Unified Communication as a Service (Ucaas) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Unified Communication as a Service (Ucaas) Market Trends

“Increasing Integration of AI and Advanced Analytics”

- The unified communication as a service (Ucaas) market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and advanced analytics to enhance communication and collaboration capabilities

- These technologies enable sophisticated data processing, providing insights into user engagement, communication patterns, and operational efficiency

- AI-powered unified communication as a service (Ucaas) solutions offer features such as intelligent virtual assistants, automated transcription, sentiment analysis, and predictive analytics for optimizing workflows and improving user experience

- For instances, companies are developing AI-driven platforms that analyze communication data to provide real-time meeting summaries, suggest optimal collaboration strategies, or enhance customer interactions in contact centers

- This trend is increasing the appeal of unified communication as a service (Ucaas) solutions for both large enterprises and SMEs by improving productivity and enabling data-driven decision-making

- AI algorithms can analyze communication behaviors, such as call frequency, meeting durations, and response times, to tailor solutions for specific industries or user needs

Unified Communication as a Service (Ucaas) Market Dynamics

Driver

“Rising Demand for Remote Work Solutions and Enhanced Collaboration”

- The growing demand for seamless, cloud-based communication tools, driven by the rise of remote and hybrid work models, is a major driver for the unified communication as a service (Ucaas) market

- Unified communication as a service (Ucaas) systems enhance organizational efficiency by providing integrated features such as voice calling, video conferencing, instant messaging, and file sharing within a single platform

- Government initiatives promoting digital transformation and improved broadband infrastructure, particularly in North America, are accelerating the adoption of unified communication as a service (Ucaas) solutions

- The proliferation of 5G technology and the Internet of Things (IoT) is further enabling faster data transmission and low-latency communication, supporting advanced unified communication as a service (Ucaas) applications

- Enterprises are increasingly adopting unified communication as a service (Ucaas) as standard solutions to meet employee expectations for flexible, mobile-friendly communication tools and to enhance collaboration across geographically dispersed teams

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant upfront costs associated with deploying unified communication as a service (Ucaas) solutions, including hardware, software, and integration expenses, can be a barrier, particularly for SMEs in emerging markets

- Integrating unified communication as a service (Ucaas) platforms with existing IT infrastructure can be complex and costly, requiring specialized expertise

- Data security and privacy concerns are major challenges, as unified communication as a service (Ucaas) systems collect and transmit sensitive communication data, raising risks of breaches or misuse

- Compliance with varying data protection regulations, such as GDPR in Europe or HIPAA in healthcare, complicates operations for global providers and users

- These factors may deter adoption in regions with high cost sensitivity or strong awareness of data privacy issues, potentially limiting market growth in certain areas

Unified Communication as a Service (Ucaas) market Scope

The market is segmented on the basis of unified communication as a service (Ucaas).

- By Component

On the basis of component, the Global Unified Communication as a Service (UCaaS) market is segmented into telephony, unified messaging, conferencing, and collaboration platforms and applications. The telephony segment dominated the largest market revenue share of 32% in 2024, driven by its critical role in providing cloud-based voice communication solutions, including cloud PBX and VoIP technologies, which streamline enterprise communication and enhance productivity, particularly for small and medium enterprises (SMEs).

The collaboration platforms and applications segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for integrated tools that support real-time messaging, video conferencing, file sharing, and team collaboration. Advancements in artificial intelligence (AI) and machine learning (ML) are enhancing the functionality of these platforms, improving user experience and enabling seamless communication across geographically dispersed teams.

- By Organization Size

On the basis of organization size, the Global Unified Communication as a Service (UCaaS) market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment held the largest market revenue share of 62% in 2024, driven by their widespread adoption of UCaaS solutions to support global operations, reduce telephony costs, and enhance collaboration among geographically dispersed teams. The increasing adoption of Bring Your Own Device (BYOD) policies and the need for scalable, cloud-based communication solutions further bolster this segment's dominance.

The SMEs segment is anticipated to witness the fastest growth rate of 18.2% from 2025 to 2032, fueled by the growing need for cost-effective, flexible, and scalable communication solutions. SMEs are increasingly adopting UCaaS to enhance mobility, streamline operations, and compete with larger enterprises, supported by government initiatives for digitalization.

- By Verticals

On the basis of verticals, the Global Unified Communication as a Service (UCaaS) market is segmented into Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Consumer Goods and Retail, Healthcare, Public Sector and Utilities, Logistics and Transportation, Travel and Hospitality, and Others. The Telecom and IT segment held the largest market revenue share of 22% in 2024, driven by the sector’s need for reliable, scalable, and integrated communication tools to manage vast networks and support global operations. The high adoption of BYOD and enterprise mobility trends in this sector further accelerates unified communication as a service demand.

The Healthcare segment is expected to experience robust growth from 2025 to 2032. The increasing need for secure, compliant communication channels, such as those meeting HIPAA regulations, and the demand for real-time collaboration among healthcare professionals to improve patient care and streamline administrative tasks are key drivers. The adoption of unified communication as a service in healthcare is further supported by initiatives such as the National Health Service (NHS) implementing unified communication as a service solutions.

Unified Communication as a Service (Ucaas) Market Regional Analysis

- North America dominated the unified communication as a service (Ucaas) market with the largest revenue share of 40.01% in 2024, driven by early adoption of cloud technologies, high technological infrastructure, and the presence of major industry players

- Businesses prioritize unified communication as a service solutions for seamless collaboration, improved productivity, and cost-effective communication, particularly in industries requiring real-time interaction and remote work capabilities

- Growth is supported by advancements in unified communication as a service technology, including AI-driven analytics, video conferencing, and integration with collaboration platforms, alongside increasing adoption in both large enterprises and SMEs

U.S. Unified Communication as a Service (Ucaas) Market Insight

The U.S. unified communication as a service (Ucaas) market captured the largest revenue share of 78.8% in 2024 within North America, fueled by strong demand from enterprises seeking scalable communication solutions and growing adoption of hybrid work models. The trend towards digital transformation and increasing regulatory support for data security and compliance further boost market expansion. The integration of unified communication as a service in industries such as BFSI, healthcare, and IT complements both large enterprises and SME adoption, creating a diverse ecosystem.

Europe Unified Communication as a Service (Ucaas) Market Insight

The Europe unified communication as a service market is expected to witness significant growth, supported by regulatory emphasis on data privacy and seamless enterprise communication. Businesses seek unified communication as a service solutions that enhance collaboration, improve operational efficiency, and ensure compliance with GDPR. Growth is prominent in both large enterprises and SMEs, with countries such as Germany and France showing significant uptake due to rising digitalization and hybrid work trends.

U.K. Unified Communication as a Service (Ucaas) Market Insight

The U.K. market for unified communication as a service is expected to witness rapid growth, driven by demand for enhanced collaboration tools and real-time communication in urban business hubs. Increased focus on employee productivity and rising awareness of cloud-based communication benefits encourage adoption. Evolving data protection regulations influence enterprise choices, balancing functionality with compliance.

Germany Unified Communication as a Service (Ucaas) Market Insight

Germany is expected to witness rapid growth in the unified communication as a service market, attributed to its advanced IT infrastructure and high enterprise focus on operational efficiency and digital transformation. German businesses prefer technologically advanced unified communication as a service solutions that support remote collaboration and integrate with existing systems. The adoption of these solutions in BFSI, automotive, and manufacturing sectors supports sustained market growth.

Asia-Pacific Unified Communication as a Service (Ucaas) Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid digitalization, expanding IT infrastructure, and rising adoption of cloud-based solutions in countries such as China, India, and Japan. Increasing awareness of collaboration tools, cost efficiency, and scalability is boosting demand. Government initiatives promoting digital transformation and smart cities further encourage the use of advanced unified communication as a service solutions.

Japan Unified Communication as a Service (Ucaas) Market Insight

Japan’s unified communication as a service market is expected to witness rapid growth due to strong enterprise preference for high-quality, AI-enhanced communication platforms that improve productivity and collaboration. The presence of major technology providers and integration of unified communication as a service in industries such as manufacturing and retail accelerate market penetration. Rising interest in cloud-based customization also contributes to growth.

China Unified Communication as a Service (Ucaas) Market Insight

China holds the largest share of the Asia-Pacific unified communication as a service market, propelled by rapid urbanization, increasing enterprise cloud adoption, and growing demand for cost-effective communication solutions. The country’s expanding digital economy and focus on smart enterprise solutions support the adoption of unified communication as a service . Strong domestic technological capabilities and competitive pricing enhance market accessibility.

Unified Communication as a Service (Ucaas) Market Share

The unified communication as a service (Ucaas) industry is primarily led by well-established companies, including:

- Google (U.S.)

- RingCentral, Inc. (U.S.)

- BT (U.K.)

- Verizon (U.S.)

- Orange (France)

- 8x8, Inc. (U.S.)

- Cisco (U.S.)

- Microsoft (U.S.)

- LogMeIn, Inc. (U.S.)

- Mitel Networks Corp. (Canada)

- DIALPAD, INC. (U.S.)

- Fuze (U.S.)

- StarBlue. (U.K.)

- Windstream Intellectual Property Services, LLC (U.S.)

- ALE International (France)

- NTT Communications (Japan)

- Vonage (U.S.)

- Intrado. (U.S.)

- Masergy Communications, Inc. (U.S.)

- Revation Systems, Inc. (U.S.)

What are the Recent Developments in Global Unified Communication as a Service (Ucaas) Market?

- In June 2024, UCaaS providers are accelerating the integration of AI-powered features to enhance collaboration and streamline operations. This ongoing trend—evident throughout 2023 and into 2024—includes innovations such as AI-enabled videoconferencing, smart telephony, automated transcriptions, real-time translations, chatbots, and meeting summaries. These capabilities aim to augment human intelligence, improve knowledge management, and boost productivity by automating routine tasks and enabling smarter workflows. The result is a more intuitive and efficient communication ecosystem that supports hybrid workforces and global teams.

- In February 2024, NextPlane introduced two advanced solutions—OpenAxys and OpenCall—to integrate generative AI into Microsoft Teams, Unified Communications (UCaaS), and Call Center (CX) platforms. OpenCall enables seamless PSTN calling and presence integration within Teams, while leveraging AI to transcribe and analyze calls for actionable insights. OpenAxys connects UC and CX platforms with leading AI tools and large language models, automating customer interaction summaries and enhancing agent performance through sentiment analysis. These innovations aim to boost productivity, streamline communication, and reduce operational costs, offering organizations a smarter, more connected collaboration ecosystem

- In February 2023, Zoho Corporation launched Trident, a unified communications and collaboration (UC&C) platform that merges tools such as Zoho Cliq, Zoho Mail, Zoho Voice, and Zoho Meeting into a single native desktop application for Windows and macOS. Trident is designed to streamline business communication by integrating email, messaging, audio/video calls, calendar, tasks, and more—offering a seamless experience for hybrid and remote workforces. This launch reflects Zoho’s broader strategy to unify its productivity suite and reduce tool fragmentation, enhancing collaboration across teams and ecosystems

- In January 2023, Atos confirmed it had entered exclusive negotiations with Mitel Networks for the sale of its Unified Communications & Collaboration Services (Unify) business. Unify, which serves around 40 million users across 90 countries, offers a mix of on-premises UC, UCaaS, and CCaaS solutions. The proposed acquisition—expected to close in the second half of 2023—would significantly expand Mitel’s global footprint, customer base, and managed services capabilities

- In April 2022, Genesys and 8x8, Inc. announced a strategic integration of 8x8 Work with Genesys Cloud CX, combining Unified Communications as a Service (UCaaS) with Contact Center as a Service (CCaaS) to enhance both employee collaboration and customer experience. This partnership enables seamless in-network call transfers, unified directories, shared presence status, and single sign-on—breaking down silos between departments and empowering agents to collaborate with subject matter experts across the enterprise. The move reflects a broader industry shift toward converged communication platforms that improve productivity, reduce friction, and drive loyalty

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.