Global Ultrafiltration Market

Market Size in USD Billion

CAGR :

%

USD

3.04 Billion

USD

9.34 Billion

2024

2032

USD

3.04 Billion

USD

9.34 Billion

2024

2032

| 2025 –2032 | |

| USD 3.04 Billion | |

| USD 9.34 Billion | |

|

|

|

|

Ultrafiltration Market Size

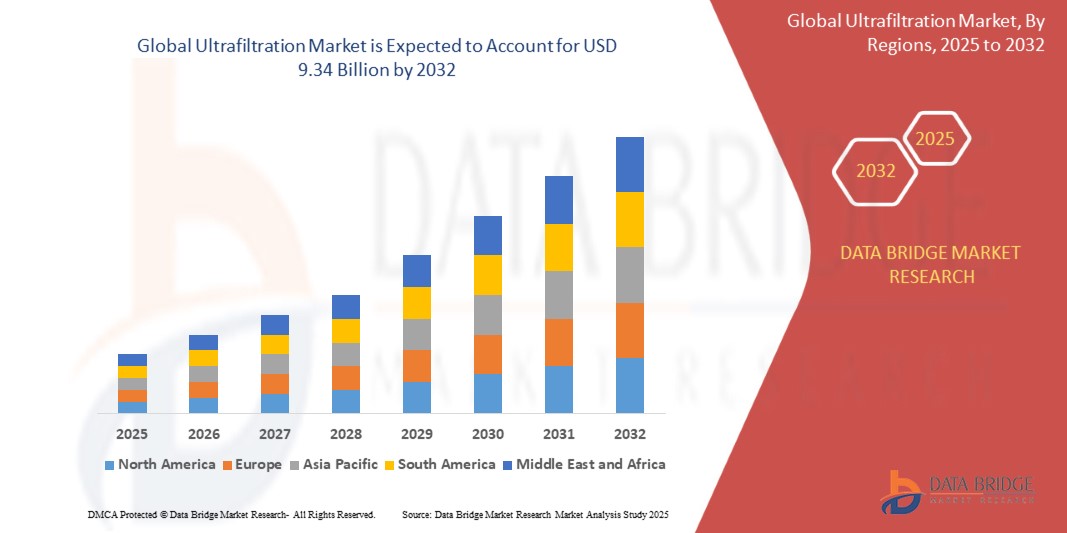

- The global ultrafiltration market size was valued at USD 3.04 billion in 2024 and is expected to reach USD 9.34 billion by 2032, at a CAGR of 15.05% during the forecast period

- This growth is driven by driven by increasing demand for clean and safe water across industries such as water treatment, food and beverage processing, and pharmaceuticals

Ultrafiltration Market Analysis

- Ultrafiltration is a membrane filtration process widely used across industries for the separation of particles, bacteria, and macromolecules from liquids, offering high efficiency, low energy consumption, and compact design. It plays a vital role in water and wastewater treatment, food and beverage processing, pharmaceuticals, and chemical manufacturing, ensuring product purity and process reliability

- The market is primarily driven by increasing global concerns over water scarcity, stringent environmental regulations, and rising demand for high-quality filtration systems in industrial and municipal applications. Technological advancements in membrane materials and configurations, including hollow fiber and polymeric modules, are further propelling the adoption of ultrafiltration systems

- Asia-Pacific holds the largest share in the ultrafiltration market, supported by rapid urbanization, industrial growth, and heavy investments in water infrastructure, particularly in China, India, and Southeast Asia. The region’s strong manufacturing base and government initiatives toward sustainable water management fuel its dominance

- North America is expected to register the highest CAGR during the forecast period due to rising adoption of advanced membrane technologies, increasing demand for ultrapure water in healthcare and biotech sectors, and government funding for water recycling and reuse projects across the U.S. and Canada

- The polymeric segment is expected to dominate the ultrafiltration market, with a projected share of 66.14%, owing to its cost-effectiveness, ease of manufacturing, and suitability for a wide range of applications, from industrial water treatment to dairy processing

Report Scope and Ultrafiltration Market Segmentation

|

Attributes |

Ultrafiltration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Ultrafiltration Market Trends

“Integration of IoT and Automation in Ultrafiltration Systems”

- The rise of smart water management is driving the integration of Internet of Things (IoT) sensors, automation, and data analytics into ultrafiltration systems to optimize performance, reduce downtime, and enable real-time monitoring

- Advanced control systems allow predictive maintenance, automated backwashing, and remote diagnostics, significantly improving operational efficiency in industrial and municipal filtration

- Major manufacturers are now offering digital-enabled ultrafiltration modules with cloud connectivity to meet growing industry demands for intelligent and sustainable filtration solutions

- For instance, in February 2024, SUEZ launched its digitally integrated ultrafiltration system “ULTRA-iQ” that enables predictive analytics and performance optimization for wastewater treatment plants

- This trend is expected to enhance ultrafiltration system efficiency, reduce lifecycle costs, and push the industry toward smarter, more sustainable water treatment infrastructure

Ultrafiltration Market Dynamics

Driver

“Expanding Role of Ultrafiltration in Food and Beverage Processing”

- Ultrafiltration is gaining traction in the dairy, beverage, and food ingredient industries for its ability to concentrate proteins, clarify liquids, and remove bacteria without compromising taste or nutritional value

- It plays a crucial role in lactose reduction, whey protein separation, juice clarification, and enzyme recovery, supporting cleaner-label production and functional food trends

- The rising global demand for nutraceuticals, high-protein beverages, and plant-based alternatives is fueling greater investment in membrane-based processing lines

- For instance, in September 2024, Tetra Pak announced new investments in ultrafiltration technology for its dairy and plant-based processing plants across Europe and Asia

- This driver highlights the expanding commercial relevance of ultrafiltration beyond water treatment into high-value segments of the global food and beverage industry

Opportunity

“Growing Demand for Decentralized Water Treatment Solutions”

- The shift toward point-of-use and decentralized water systems in rural and urban fringe areas is opening new markets for compact ultrafiltration units

- Ultrafiltration’s ease of maintenance, modularity, and chemical-free operation make it ideal for schools, hospitals, residential complexes, and remote communities

- Governments and NGOs are increasingly deploying these systems to improve access to clean drinking water in underserved regions

- For instance, in August 2024, Pentair launched a solar-powered ultrafiltration kit targeting decentralized water purification projects in Sub-Saharan Africa and Southeast Asia

- This opportunity underscores how ultrafiltration technology is pivotal to solving global water security challenges and achieving sustainable development goals

Restraint/Challenge

“High Initial Investment and Operational Costs for Industrial Users”

- Despite long-term savings, the upfront costs of ultrafiltration systems—equipment, installation, and staff training—can deter adoption in small and mid-sized enterprises (SMEs)

- Operational expenses including energy consumption, membrane replacement, and maintenance also impact total cost of ownership, especially in developing economies

- Industries with tight capital expenditure budgets may delay upgrading to membrane technologies, limiting market penetration in price-sensitive sectors

- For instance, in November 2023, a survey by the Indian Chamber of Water Treatment revealed that over 38% of SMEs cited capital constraints as a key barrier to ultrafiltration adoption

- To overcome this challenge, manufacturers must develop low-cost, modular solutions and explore leasing or as-a-service models to boost market accessibility

Ultrafiltration Market Scope

The market is segmented on the basis of type, module, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Module |

|

|

By Application |

|

In 2025, the polymeric is projected to dominate the market with a largest share in type segment

The polymeric segment is expected to dominate the ultrafiltration market with the largest share of 66.14% in 2025 due to applications such as water treatment, food and beverage processing, and pharmaceuticals owing to their high efficiency in removing suspended solids, bacteria, and large macromolecules.

The tubular module is expected to account for the largest share during the forecast period in module market

In 2025, the tubular segment is expected to dominate the ultrafiltration market with the largest share of 62.05% due to its modular design enhances the filtration process by enabling the tubes to manage higher dirt loads while being less susceptible to fouling than other membrane type.

Ultrafiltration Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Ultrafiltration Market”

- Asia-Pacific dominates the ultrafiltration market, driven by rapid industrialization, increasing demand for clean water, and significant investments in water treatment technologies

- China holds a major share, attributed to its extensive manufacturing base, growing industrial sectors, and a strong focus on improving water treatment capabilities across various regions

- The rising adoption of ultrafiltration in water treatment plants, food and beverage processing, and pharmaceuticals is boosting market demand, particularly in urban and industrial areas

- In addition, government initiatives to improve wastewater management and water purification are further accelerating the growth of the ultrafiltration market across Asia-Pacific

“North America is projected to register the Highest CAGR in the Ultrafiltration Market”

- North America is expected to witness the highest growth rate in the ultrafiltration market, driven by increasing demand for advanced water filtration systems, stricter environmental regulations, and expanding applications in food and beverage processing, healthcare, and wastewater treatment

- The U.S. and Canada are key contributors, supported by strong investments in water treatment infrastructure, rising demand for clean water solutions, and growing adoption of ultrafiltration in municipal water systems and industrial processes

- The U.S., in particular, is seeing a significant rise in the use of ultrafiltration for industrial and commercial applications, such as food processing, pharmaceuticals, and oil and gas industries, due to its superior filtration capabilities and cost-effectiveness

- In addition, government regulations aimed at improving water quality and sustainability, along with a growing preference for eco-friendly technologies, are fueling the expansion of the Ultrafiltration market across North America

Ultrafiltration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koch Membrane Systems, Inc. (U.S.)

- Pall Corporation (U.S.)

- SUEZ (France)

- 3M (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- ALFA LAVAL (Sweden)

- Beijing Originwater Technology Co., Ltd. (China)

- Beijing OriginWater Technology Co., Ltd. (China)

- GEA Group Aktiengesellschaft (Germany)

- Markel Group Inc. (U.S.)

- Membranium (Russia)

- MANN+HUMMEL Water & Fluid Solutions GmbH (Germany)

- Parker Hannifin Corp (U.S.)

- PCI Membranes (U.K.)

- Beijing Sino Water Technology Co., Ltd. (China)

- Synder Filtration, Inc. (U.S.)

- TOYOBO CO., LTD (Japan)

- Veolia (France)

Latest Developments in Global Ultrafiltration Market

- In September 2024, Sartorius unveiled the Vivaflow SU, a revolutionary solution that redefines laboratory-specific tangential flow filtration (TFF). Designed for enhanced usability and flexibility, the Vivaflow SU facilitates more efficient and sustainable ultrafiltration and diafiltration processes, supporting feed volumes ranging from 100 to 1,000 mL. This advancement positions Sartorius as a leader in the laboratory filtration market

- In April 2024, Michael Lesniak delved into Taiwan's USD 13 billion investment in semiconductor water treatment during an interview with Smart Water Magazine. His insights highlight the growing importance of water management in the semiconductor industry, particularly in Taiwan's booming tech sector

- In April 2024, QUA, an innovator in advanced membrane technologies for water and wastewater treatment, announced the opening of its cutting-edge membrane manufacturing center in Pune, India. This new facility marks a significant milestone in QUA's global expansion and will help meet increasing demand for high-performance filtration solutions

- In September 2020, DuPont partnered with Sun Chemicals to collaborate on developing advanced water treatment solutions. This partnership aimed to leverage both companies' expertise in chemicals and technology to create more efficient and sustainable water treatment processes, which has paved the way for future innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultrafiltration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultrafiltration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultrafiltration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.