Global Two Wheeler Crash Guard Market

Market Size in USD Million

CAGR :

%

USD

324.99 Million

USD

448.21 Million

2024

2032

USD

324.99 Million

USD

448.21 Million

2024

2032

| 2025 –2032 | |

| USD 324.99 Million | |

| USD 448.21 Million | |

|

|

|

|

Two Wheeler Crash Guard Market Size

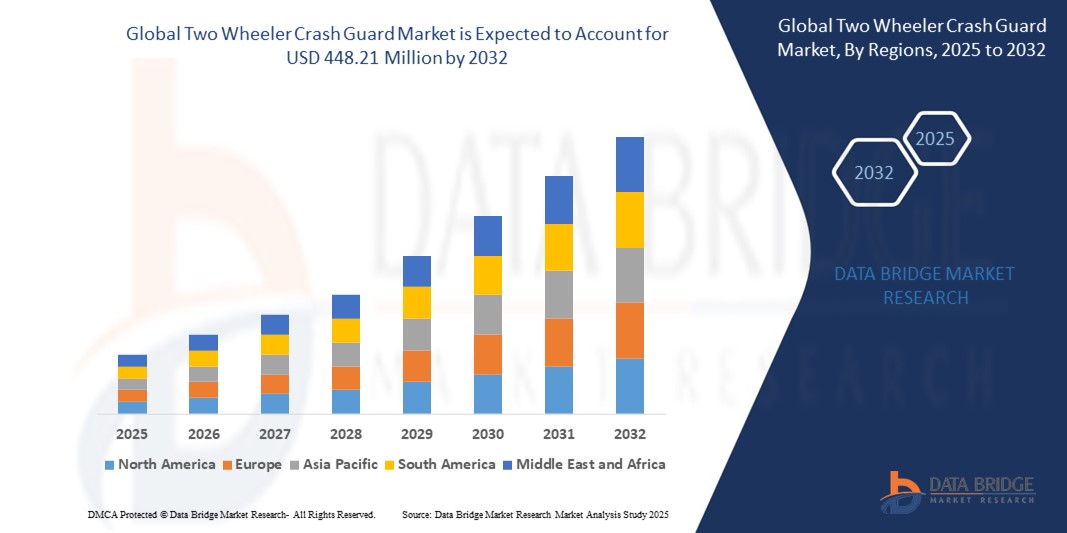

- The global two wheeler crash guard market size was valued at USD 324.99 million in 2024 and is expected to reach USD 448.21 million by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is primarily driven by increasing two-wheeler adoption, heightened awareness of rider safety, and the rising demand for aftermarket accessories to enhance vehicle protection and aesthetics

- Growing urbanization, coupled with the popularity of motorcycles and scooters in emerging economies, is further accelerating the demand for crash guards as essential safety components

Two Wheeler Crash Guard Market Analysis

- Two wheeler crash guards, designed to protect riders and vehicles during collisions or falls, are critical safety accessories for motorcycles and scooters, offering structural support and reducing damage to critical components

- The demand for crash guards is fueled by rising road safety concerns, increasing two-wheeler sales, and a growing preference for customized and durable accessories in both OEM and aftermarket segments

- Asia-Pacific dominated the two wheeler crash guard market with the largest revenue share of 45.67% in 2024, driven by high two-wheeler penetration, large-scale manufacturing, and a strong aftermarket ecosystem, particularly in countries such as India, China, and Thailand

- North America is expected to be the fastest-growing region during the forecast period, propelled by increasing motorcycle enthusiasts, rising demand for premium safety accessories, and growing adoption of adventure and touring motorcycles

- The front crash guard segment dominated the largest market revenue share of 62.3% in 2024, driven by its critical role in protecting the front components of two-wheelers, such as the engine and frame, during collisions or falls

Report Scope and Two Wheeler Crash Guard Market Segmentation

|

Attributes |

Two Wheeler Crash Guard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Two Wheeler Crash Guard Market Trends

“Increasing Demand for Safety and Customization”

- The global two-wheeler crash guard market is experiencing a significant trend toward enhanced safety and customization, driven by rising consumer awareness and preferences

- Advanced materials, such as carbon fiber composites and lightweight alloys, are being integrated into crash guard designs to improve durability while reducing weight

- Customization is gaining traction, with manufacturers offering model-specific crash guards tailored to the aesthetics and functional needs of motorcycles and scooters, such as sleek designs for urban scooters or rugged guards for adventure motorcycles

- For instance, companies are leveraging 3D printing for prototyping and producing bespoke crash guards, enabling personalized designs that enhance both safety and style

- The surge in adventure tourism and off-road biking, particularly in regions such as the Himalayas and the Rockies, is boosting demand for robust, terrain-specific crash guards

- These trends are making crash guards more appealing to both individual riders and fleet operators, enhancing their value as both safety and aesthetic accessories

Two Wheeler Crash Guard Market Dynamics

Driver

“Rising Motorcycle Sales and Focus on Rider Safety”

- The increasing global sales of two-wheelers, particularly in emerging markets such as India and Southeast Asia, are a major driver for the two-wheeler crash guard market. For instnces, India’s two-wheeler market grew by 10% in 2023, fueling demand for safety accessories such as crash guards

- Crash guards enhance rider safety by protecting critical vehicle components and reducing injury risks during low-speed crashes or tip-overs, making them essential for daily commuters and adventure riders

- Government regulations in regions such as Asia-Pacific, emphasizing road safety, are encouraging the adoption of crash guards as standard or aftermarket accessories

- The proliferation of e-commerce platforms is making crash guards more accessible, boosting aftermarket sales for both motorcycles and scooters

- Manufacturers are increasingly offering factory-fitted crash guards as standard or optional features to meet consumer expectations for safety and vehicle protection

Restraint/Challenge

“High Costs and Concerns over Material Quality”

- The high initial cost of premium crash guards, particularly those made from advanced materials such as stainless steel or carbon fiber, can be a barrier to adoption, especially in cost-sensitive emerging markets

- Retrofitting crash guards onto existing two-wheelers can be complex and expensive, deterring some consumers from investing in aftermarket solutions

- Concerns about poorly made materials, such as low-quality mild steel prone to rust, pose challenges to market growth, as they can compromise safety and durability

- The lack of universal standards for crash guard design and installation across regions creates compatibility issues, complicating manufacturing and distribution for global suppliers

- These factors may limit market expansion, particularly in regions where cost sensitivity is high or awareness of quality standards is low

Two Wheeler Crash Guard market Scope

The market is segmented on the basis of product type, sales channel, materials type, and two wheeler type.

- By Product Type

On the basis of product type, the global two wheeler crash guard market is segmented into front crash guard and rear crash guard. The front crash guard segment dominated the largest market revenue share of 62.3% in 2024, driven by its critical role in protecting the front components of two-wheelers, such as the engine and frame, during collisions or falls. Front crash guards are widely adopted due to their ability to enhance rider safety and reduce repair costs.

The rear crash guard segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness of comprehensive vehicle protection and the rising popularity of rear crash guards for aesthetic enhancements and safety in urban commuting scenarios. Advancements in lightweight and durable materials further boost adoption.

- By Sales Channel

On the basis of sales channel, the global two wheeler crash guard market is segmented into OEM and aftermarket. The OEM segment dominated the market with a revenue share of 58.7% in 2024, primarily due to the integration of crash guards as standard or optional features during vehicle manufacturing. OEMs are increasingly incorporating crash guards to meet safety regulations and consumer demand for enhanced protection.

The aftermarket segment is anticipated to exhibit the fastest growth rate of 8.2% from 2025 to 2032, fueled by the rising trend of customization, increasing demand for aftermarket accessories for leisure activities such as off-road riding, and the need for replacement parts for aging two-wheelers.

- By Materials Type

On the basis of materials type, the global two wheeler crash guard market is segmented into stainless steel, mild steel, and others (including carbon fiber composites and advanced polymers). The stainless steel segment accounted for the largest market revenue share of 54.6% in 2024, owing to its high durability, corrosion resistance, and cost-effectiveness, making it a preferred choice for both OEMs and aftermarket consumers.

The others segment, particularly carbon fiber composites and advanced polymers, is expected to experience the fastest growth from 2025 to 2032. This is driven by advancements in lightweight, high-strength materials that enhance crash guard performance without adding excessive weight, aligning with consumer preferences for fuel efficiency and aesthetic appeal.

- By Two Wheeler Type

On the basis of two wheeler type, the global two wheeler crash guard market is segmented into motorcycle and scooter. The motorcycle segment held the largest market revenue share of 68.4% in 2024, driven by the high global demand for motorcycles, particularly in emerging markets such as India and China, where they are used for both commuting and recreational purposes. Motorcycles often require robust crash guards due to their exposure to diverse riding conditions.

The scooter segment is projected to witness rapid growth at a CAGR of 7.9% from 2025 to 2032, fueled by increasing urban mobility needs, rising scooter adoption in densely populated regions, and growing consumer preference for safety accessories tailored to scooter designs.

Two Wheeler Crash Guard Market Regional Analysis

- Asia-Pacific dominated the two wheeler crash guard market with the largest revenue share of 45.67% in 2024, driven by high two-wheeler penetration, large-scale manufacturing, and a strong aftermarket ecosystem, particularly in countries such as India, China, and Thailand

- Consumers prioritize crash guards for enhanced protection of vehicle components and rider safety, especially in regions with dense traffic and diverse road conditions

- Growth is supported by advancements in materials, such as lightweight carbon fiber composites and durable stainless steel, alongside rising adoption in both OEM and aftermarket segments

Japan Two Wheeler Crash Guard Market Insight

Japan’s two-wheeler crash guard market is expected to witness significant growth due to strong consumer preference for high-quality, durable crash guards that enhance rider safety and vehicle aesthetics. The presence of major motorcycle manufacturers and the integration of crash guards in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Two Wheeler Crash Guard Market Insight

China holds the largest share of the Asia-Pacific two-wheeler crash guard market, propelled by rapid urbanization, rising two-wheeler ownership, and increasing demand for safety solutions. The country’s growing middle class and focus on affordable mobility support the adoption of crash guards. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Two Wheeler Crash Guard Market Insight

The U.S. two wheeler crash guard market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of safety and vehicle protection benefits. The trend toward recreational motorcycling and customization, coupled with stringent safety regulations, boosts market expansion. Automakers’ integration of crash guards in premium motorcycles complements aftermarket sales, creating a robust product ecosystem.

Europe Two Wheeler Crash Guard Market Insight

The Europe two-wheeler crash guard market is expected to witness significant growth, supported by regulatory focus on rider safety and vehicle durability. Consumers seek crash guards that offer protection while maintaining aesthetic appeal. The growth is prominent in both OEM installations and aftermarket retrofits, with countries such as Germany and Poland showing notable uptake due to increasing motorcycle usage and safety awareness.

U.K. Two Wheeler Crash Guard Market Insight

The U.K. market for two-wheeler crash guards is anticipated to experience rapid growth, driven by demand for enhanced rider safety and vehicle protection in urban and rural settings. Rising interest in motorcycle aesthetics and awareness of crash guard benefits in reducing repair costs encourage adoption. Evolving safety regulations influence consumer choices, balancing protection with compliance.

Germany Two Wheeler Crash Guard Market Insight

Germany is expected to witness strong growth in the two-wheeler crash guard market, attributed to its advanced motorcycle manufacturing sector and high consumer focus on safety and vehicle longevity. German consumers prefer technologically advanced crash guards made from materials such as stainless steel and carbon composites for durability and style. The integration of these guards in premium motorcycles and aftermarket options supports sustained market growth.

Two Wheeler Crash Guard Market Share

The two wheeler crash guard industry is primarily led by well-established companies, including:

- AltRider (U.S.)

- Zana International Pvt Ltd. (India)

- Aadit Industries (India)

- Hogworkz (U.S.)

- Lincoln Industries (U.S.)

- Kuryakyn (U.S.)

- Cobra USA Inc. (U.S.)

- LEMANS CORPORATION (U.S.)

- Outback Motortek (Canada)

- SPEEDX (India)

- TVS Motor Company (India)

- Yamaha Motor Co., Ltd. (Japan)

- Hero MotoCorp Ltd. (India)

- HARLEY-DAVIDSON (U.S.)

- Vega (India)

- Omax Autos Limited (India)

- OSRAM (Germany)

- GV Sports (India)

- Issuu Inc. (U.S.)

- Steelbird Helmets India (India)

- YF Protector Co., Ltd. (China)

What are the Recent Developments in Global Two Wheeler Crash Guard Market?

- In October 2024, Zana International Pvt Ltd. introduced a new range of advanced crash guards tailored for premium motorcycles. These guards feature lightweight, high-strength aluminum alloys and modular construction, offering enhanced protection while elevating the bike’s visual appeal. Designed to meet the rising demand for customizable and durable safety gear across the Asia-Pacific region, the launch reinforces Zana’s reputation as a leading innovator in two-wheeler accessories

- In August 2024, Hero MotoCorp formed a strategic alliance with YF Protector Co., Ltd., a Chinese specialist in protective gear, to co-develop crash guards featuring integrated impact-absorption technology. This partnership is focused on enhancing rider safety across Hero’s motorcycle range, particularly in emerging markets where demand for durable and safety-compliant accessories is rising. The collaboration reflects Hero’s commitment to innovation and global partnerships aimed at meeting evolving safety standards and consumer expectations

- In June 2024, Cobra USA Inc., a prominent U.S. motorcycle accessories manufacturer, completed the acquisition of a specialist crash guard firm to broaden its product lineup. This strategic merger boosts Cobra’s manufacturing capacity and reinforces its foothold in the North American market, which is experiencing heightened demand for advanced safety components amid tightening regulatory standards. The move aligns with Cobra’s commitment to innovation and rider protection, positioning the company to better serve premium motorcycle segments with enhanced safety gear

- In May 2024, Yamaha Motor Co., Ltd. rolled out a new line of crash guards tailored for its sport and adventure motorcycles. These guards incorporate corrosion-resistant materials and aerodynamic profiles, engineered to deliver superior protection during high-speed and off-road riding. The launch aligns with the surging popularity of adventure biking, offering riders enhanced safety without compromising performance or style

- In March 2024, TVS Motor partnered with Steelbird Hi-Tech to co-develop smart crash guards equipped with embedded sensor technology. These advanced guards are designed to detect collisions and send real-time alerts to riders via a connected mobile app, enhancing safety and situational awareness. The collaboration reflects a growing global trend toward intelligent, safety-focused accessories in the two-wheeler segment,

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.