Global Turbo Trainer Market

Market Size in USD Million

CAGR :

%

USD

466.87 Million

USD

832.66 Million

2025

2033

USD

466.87 Million

USD

832.66 Million

2025

2033

| 2026 –2033 | |

| USD 466.87 Million | |

| USD 832.66 Million | |

|

|

|

|

What is the Global Turbo Trainer Market Size and Growth Rate?

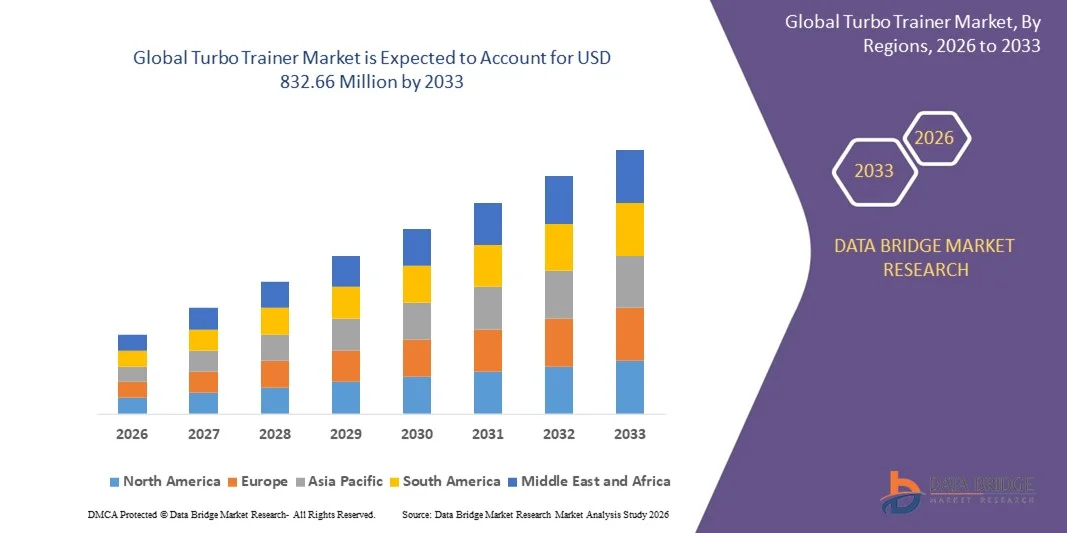

- The global turbo trainer market size was valued at USD 466.87 million in 2025 and is expected to reach USD 832.66 million by 2033, at a CAGR of7.50% during the forecast period

- This rise in turbo trainer value can be attributed to the various factors such as increased focus of the product manufacturers on product innovations, growing demand for fitness and training equipment, growing popularity of e-commerce platforms especially in the developing economies and increasing personal disposable income

What are the Major Takeaways of Turbo Trainer Market?

- Rising popularity of cycling and increasing personal disposable income are the major factors fostering the growth of the market. Growth and expansion of fitness industry especially in the developing economies, surge in the participation of youngsters and different kinds of sports, evolving consumer preferences for indoor fitness equipment and rise in the research and development activities in regards to the incorporation of lightweight materials are some other indirect market growth determinants

- North America dominated the turbo trainer market with a 39.36% revenue share in 2025, driven by rising adoption of connected fitness solutions, smart indoor cycling systems, and growing consumer preference for home-based workouts

- Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid digital fitness adoption, expanding e-commerce penetration, and growing urban fitness culture across China, Japan, India, South Korea, and Southeast Asia

- The Wheel-on Turbo Trainer segment dominated the market with a 52.3% share in 2025, owing to its affordability, portability, and ease of setup

Report Scope and Turbo Trainer Market Segmentation

|

Attributes |

Turbo Trainer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Turbo Trainer Market?

Increasing Shift Toward Smart, Connected, and App-Integrated Turbo Trainers

- The turbo trainers market is witnessing strong adoption of smart, compact, and digitally connected trainers that integrate seamlessly with training apps, virtual cycling platforms, and performance analytics tools

- Manufacturers are introducing direct-drive, high-accuracy power measurement, and electromagnetic resistance-based trainers that support real-time feedback, gradient simulation, and adaptive training modes

- Growing demand for space-efficient, portable, and home-friendly indoor training solutions is driving adoption among amateur cyclists, professional athletes, and fitness enthusiasts

- For instance, companies such as Wahoo Fitness, Garmin (Tacx), Elite, and Technogym have upgraded turbo trainers with Bluetooth/ANT+ connectivity, virtual ride compatibility, and cloud-based performance tracking

- Increasing preference for PC-, tablet-, and smartphone-integrated training ecosystems is accelerating the shift toward smart turbo trainers

- As indoor cycling becomes more data-driven and immersive, Turbo Trainers will remain central to structured training, virtual racing, and performance optimization

What are the Key Drivers of Turbo Trainer Market?

- Rising demand for accurate power measurement, structured training plans, and year-round cycling solutions among recreational and professional cyclists

- For instance, in 2024–2025, leading brands such as Wahoo Fitness, Tacx, Wattbike, and Elite introduced next-generation trainers with improved power accuracy, quieter operation, and enhanced virtual ride realism

- Growing popularity of virtual cycling platforms, online racing, and at-home fitness routines across the U.S., Europe, and Asia-Pacific is expanding the user base

- Advancements in sensor technology, resistance control, firmware intelligence, and connectivity standards have improved training precision and user experience

- Increasing focus on data-driven fitness, AI-based coaching, and personalized performance analytics is boosting demand for smart turbo trainers

- Supported by rising health awareness and investment in connected fitness ecosystems, the Turbo Trainers market is poised for sustained long-term growth

Which Factor is Challenging the Growth of the Turbo Trainer Market?

- High upfront costs of premium smart and direct-drive turbo trainers limit adoption among entry-level cyclists and price-sensitive consumers

- For instance, during 2024–2025, fluctuations in electronic component pricing and logistics costs increased manufacturing expenses for several global brands

- Complexity in setup, calibration, firmware updates, and software compatibility can discourage less tech-savvy users

- Limited awareness in emerging markets regarding smart trainer benefits, app integration, and structured indoor training slows penetration

- Competition from spin bikes, rollers, gym-based indoor cycling equipment, and outdoor seasonal training creates pricing and substitution pressure

- To overcome these challenges, manufacturers are focusing on cost-optimized models, simplified user interfaces, subscription partnerships, and enhanced customer education to drive wider adoption of Turbo Trainers

How is the Turbo Trainer Market Segmented?

The market is segmented on the basis of product type, end user, price category, and distribution channel.

- By Product Type

On the basis of product type, the turbo trainer market is segmented into Wheel-on Turbo Trainers and Direct Drive Turbo Trainers. The Wheel-on Turbo Trainer segment dominated the market with a 52.3% share in 2025, owing to its affordability, portability, and ease of setup. These trainers allow users to quickly mount their bicycles and are widely adopted by casual cyclists and home fitness enthusiasts who prioritize convenience. Their lightweight design, compatibility with multiple bike types, and ability to simulate resistance through rear wheel friction make them highly popular among beginners and intermediate riders.

The Direct Drive Turbo Trainer segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-accuracy power measurement, quieter operation, immersive virtual cycling experiences, and professional-grade training among competitive athletes and cycling studios. Advanced smart features, gradient simulation, and app integration are pushing adoption in both personal and commercial setups.

- By End User

On the basis of end user, the turbo trainer market is segmented into Personal and Commercial. The Personal segment dominated the market with a 61.7% share in 2025, fueled by increasing home workouts, virtual cycling participation, and growing awareness of structured indoor training. Personal users benefit from the compact design, ease of integration with smartphones and tablets, and app-based metrics for performance tracking.

The Commercial segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by high adoption in gyms, cycling studios, sports academies, and professional training centers. Demand is propelled by the need for multi-user durability, high-power accuracy, advanced connectivity, and software integration for coaching and performance analytics. Rising investments in indoor cycling infrastructure and commercial fitness technology are further accelerating market growth.

- By Price Category

On the basis of price category, the turbo trainer market is segmented into Below USD 200, USD 200–USD 300, USD 300–USD 400, USD 400–USD 500, USD 500–USD 600, USD 600–USD 700, USD 700–USD 800, USD 800–USD 900, USD 900–USD 1,000, and Above USD 1,000. The USD 400–USD 500 segment dominated the market with a 34.8% share in 2025, as it provides an ideal balance of affordability, reliability, and smart features for home users. Trainers in this price range typically support moderate app integration, virtual cycling platforms, and adjustable resistance suitable for casual to semi-professional cyclists.

The Above USD 1,000 segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by high demand for premium smart trainers with advanced direct-drive systems, professional-grade power measurement, ultra-quiet operation, and immersive training experiences for competitive and elite cyclists. Increasing adoption of high-end trainers in commercial gyms and professional setups is further fueling growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the turbo trainer market is segmented into Online and Offline channels. The Online segment dominated the market with a 58.2% share in 2025, supported by the rapid growth of e-commerce platforms, direct-to-consumer sales models, and virtual product demonstrations. Consumers prefer online purchases due to convenience, wider selection of smart trainers, detailed product reviews, and access to international brands.

The Offline segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for in-store demonstrations, professional setup assistance, and immersive experience centers in gyms and specialty sports retailers. Retail stores and showroom networks are increasingly offering demo rides, personalized coaching, and bundled accessory packages to attract both personal and commercial customers, expanding adoption across local markets.

Which Region Holds the Largest Share of the Turbo Trainer Market?

- North America dominated the turbo trainer market with a 39.36% revenue share in 2025, driven by rising adoption of connected fitness solutions, smart indoor cycling systems, and growing consumer preference for home-based workouts. Strong growth in e-commerce, cycling culture, and fitness awareness across the U.S. and Canada continues to fuel demand for smart and traditional Turbo Trainers among personal users, gyms, and commercial fitness centers

- Leading companies in North America are introducing high-performance, app-integrated, and connectivity-enabled trainers with advanced resistance simulation, precise power measurement, and immersive virtual cycling experiences, strengthening the region’s technological leadership. Continuous investment in R&D, digital fitness platforms, and professional cycling infrastructure further supports long-term market expansion

- Widespread availability of fitness studios, commercial gyms, and home cycling equipment, coupled with strong consumer purchasing power and digital engagement, reinforces North America’s dominance in the global Turbo Trainer market

U.S. Turbo Trainer Market Insight

The U.S. is the largest contributor in North America, supported by the growing popularity of indoor cycling apps, virtual races, and smart training devices. Rising adoption of connected Turbo Trainers in personal homes, professional cycling studios, and gyms drives sustained growth. Increasing development of interactive, app-compatible trainers with precise power measurement, silent operation, and immersive virtual riding experiences fuels demand. Presence of major fitness tech companies, strong startup ecosystems, and high consumer engagement further accelerates market penetration.

Canada Turbo Trainer Market Insight

Canada contributes significantly to North American growth, driven by rising interest in health and wellness, gym memberships, and connected fitness technologies. Home-based trainers, commercial gym setups, and cycling studios increasingly utilize app-enabled Turbo Trainers for structured training and virtual competitions. Government-backed wellness programs, urban cycling initiatives, and growing availability of online fitness retail platforms strengthen adoption across the country. High disposable income and fitness-conscious consumers further enhance market demand.

Asia-Pacific Turbo Trainer Market

Asia-Pacific is projected to register the fastest CAGR of 8.24% from 2026 to 2033, driven by rapid digital fitness adoption, expanding e-commerce penetration, and growing urban fitness culture across China, Japan, India, South Korea, and Southeast Asia. Rising disposable income, health consciousness, and demand for connected smart trainers support market growth. Increasing use of home gyms, virtual cycling platforms, and indoor training solutions in high-density urban regions accelerates adoption of both wheel-on and direct-drive Turbo Trainers.

China Turbo Trainer Market Insight

China is the largest contributor to Asia-Pacific, supported by growing consumer awareness of indoor cycling, rising adoption of fitness apps, and increasing home gym penetration. Demand is fueled by affordable local manufacturing of smart trainers, app integration, and online retail accessibility. Urban population growth, digital fitness trends, and government wellness initiatives further strengthen market adoption.

Japan Turbo Trainer Market Insight

Japan shows steady growth, backed by a mature fitness culture, precision manufacturing of high-quality trainers, and increasing adoption of digital cycling platforms. Premium trainers with immersive virtual training experiences, silent operation, and precise power measurement are highly favored by commercial and personal users. Rising interest in structured indoor training and technological integration supports long-term market expansion.

India Turbo Trainer Market Insight

India is emerging as a key growth hub, driven by rising fitness awareness, gym expansion, and e-commerce penetration. Adoption of wheel-on and direct-drive trainers is increasing among personal users and boutique gyms. Government initiatives promoting sports, fitness, and wellness contribute to growing demand for indoor cycling equipment. Increasing urbanization and disposable income further accelerate market adoption.

South Korea Turbo Trainer Market Insight

South Korea contributes significantly due to strong demand for connected fitness devices, smart home gyms, and professional cycling studios. Rising adoption of high-tech trainers, immersive apps, and interactive training solutions drives growth. Technological innovation, urban fitness culture, and growing e-commerce channels support sustained expansion of the Turbo Trainer market across the country.

Which are the Top Companies in Turbo Trainer Market?

The turbo trainer industry is primarily led by well-established companies, including:

- ELITE (Italy)

- JetBlack Cycling (Australia)

- Kurt (U.S.)

- Decathlon Sports India Pvt Ltd. (France)

- MINOURA JAPAN (Japan)

- Tacx (Netherlands)

- Garmin Ltd. (U.S.)

- Technogym S.p.A. (Italy)

- Wahoo Fitness. (U.S.)

- Wattbike (U.K.)

- Stages Indoor Cycling LLC. (U.S.)

- Cycling Sports Group, Inc. (U.S.)

- Dorel Industries, Inc. (Canada)

- CycleOps (U.S.)

- BKOOL, S.L. (Spain)

- GistGear (U.S.)

- Conquer Equipment (China)

- Blackburn (U.S.)

- Precor Incorporated (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.