Global Tumor Necrosis Factor Tnf Inhibitor Drugs Market

Market Size in USD Billion

CAGR :

%

USD

25.57 Billion

USD

31.64 Billion

2025

2033

USD

25.57 Billion

USD

31.64 Billion

2025

2033

| 2026 –2033 | |

| USD 25.57 Billion | |

| USD 31.64 Billion | |

|

|

|

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Size

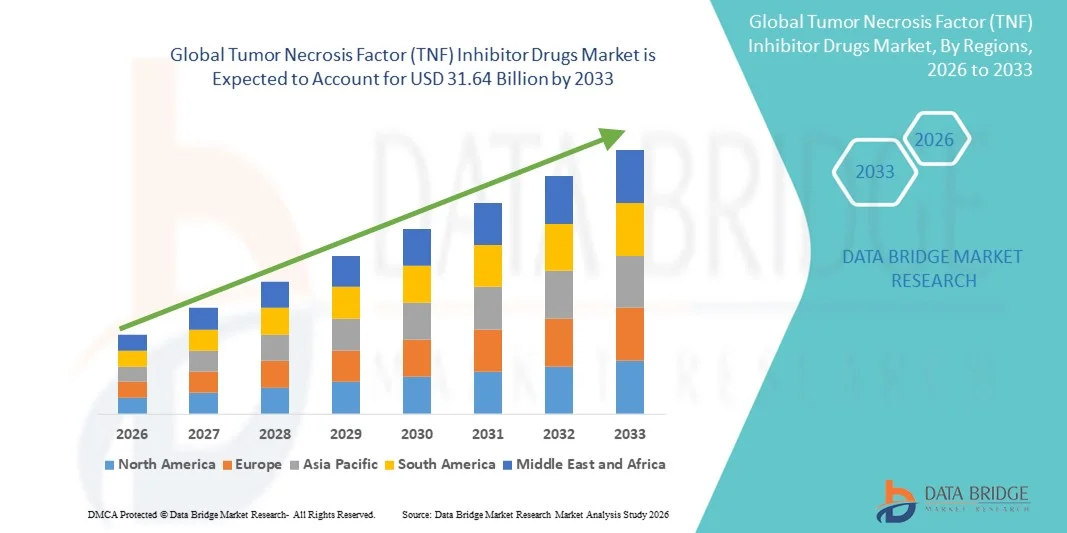

- The global Tumor Necrosis Factor (TNF) inhibitor drugs market size was valued at USD 25.57 billion in 2025 and is expected to reach USD 31.64 billion by 2033, at a CAGR of 2.7% during the forecast period

- The market growth is largely fueled by the rising prevalence of autoimmune and inflammatory disorders, increasing adoption of targeted biologic therapies, and advancements in treatment modalities that improve long-term disease management

- Furthermore, growing patient demand for effective, well-tolerated, and accessible therapeutic options combined with expanded availability of biosimilars continues to position TNF inhibitors as a foundational class in immunology care. These converging factors are strengthening uptake across global healthcare systems, thereby significantly boosting the industry’s growth

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Analysis

- Tumor Necrosis Factor (TNF) inhibitor drugs, which work by blocking the inflammatory cytokine TNF-α, are increasingly vital components of modern treatment strategies for autoimmune and chronic inflammatory disorders, including rheumatoid arthritis, psoriasis, Crohn’s disease, and ulcerative colitis, due to their strong clinical effectiveness, ability to control long-term inflammation, and meaningful improvements in patient outcomes

- The escalating demand for Tumor Necrosis Factor (TNF) inhibitor drugs is primarily fueled by the rising global prevalence of autoimmune diseases, increasing diagnosis and treatment rates, expanding adoption of biologic therapies, and a growing preference for targeted immunomodulators that offer reliable, sustained symptom relief

- North America dominated the Tumor Necrosis Factor (TNF) inhibitor drugs market with the largest revenue share of 45.2% in 2025, supported by high disease incidence, advanced healthcare infrastructure, favorable reimbursement frameworks, and a strong presence of leading pharmaceutical companies, with the U.S. experiencing notable growth driven by continued uptake of both originator biologics and approved biosimilars

- Asia-Pacific is expected to be the fastest-growing region in the Tumor Necrosis Factor (TNF) inhibitor drugs market during the forecast period due to increasing awareness of autoimmune disorders, rising access to biologic therapies, expanding healthcare spending, and accelerated availability of cost-effective TNF inhibitor biosimilars

- The adalimumab segment dominated the Tumor Necrosis Factor (TNF) inhibitor drugs market with the largest market share of 35.9% in 2025, driven by its broad therapeutic indications, extensive clinical validation, widespread physician preference, and strong global presence supported by both branded and biosimilar formulations

Report Scope and Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Segmentation

|

Attributes |

Tumor Necrosis Factor (TNF) Inhibitor Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Trends

Advancement of Precision Biologics and AI-Enabled Clinical Optimization

- A significant and accelerating trend in the global Tumor Necrosis Factor (TNF) inhibitor drugs market is the growing shift toward precision biologics and AI-driven clinical decision tools, which support more accurate diagnosis, optimized dosing, and improved treatment monitoring for chronic autoimmune disorders

- For instance, several pharmaceutical companies are integrating AI-based predictive models to identify patient subgroups that are more such asly to respond to TNF inhibitors, enhancing treatment personalization and improving long-term therapeutic outcomes

- AI integration in autoimmune disease management enables capabilities such as predicting flare patterns, monitoring therapy effectiveness using real-time biomarkers, and assisting clinicians in making more informed adjustments to TNF inhibitor regimens

- The seamless integration of TNF inhibitor therapies with digital health platforms and remote monitoring apps allows physicians to track patient progress, medication adherence, and inflammatory markers in a centralized interface, improving care coordination and patient engagement

- This trend toward more intelligent, data-driven, and interconnected autoimmune disease management systems is fundamentally reshaping patient expectations and clinical standards in rheumatology and gastroenterology

- The demand for TNF inhibitor therapies supported by digital-enabled monitoring tools is growing rapidly across global healthcare systems, as clinicians increasingly prioritize precise, proactive, and evidence-based biologic treatment strategies

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Dynamics

Driver

Growing Need Due to Rising Autoimmune Disease Burden and Biologic Therapy Adoption

- The increasing global prevalence of autoimmune and chronic inflammatory disorders, coupled with rising adoption of advanced biologic treatments, is a significant driver for the heightened demand for Tumor Necrosis Factor (TNF) inhibitor drugs

- For instance, major pharmaceutical companies are advancing next-generation TNF inhibitor formulations and expanding access programs in key markets to support early intervention and long-term management of conditions such as rheumatoid arthritis and Crohn’s disease

- As patients and clinicians become more aware of the clinical benefits and disease-modifying capabilities of TNF inhibitors, these therapies offer a compelling upgrade over conventional treatments with limited long-term efficacy

- Furthermore, the growing use of combination therapy approaches and integration of TNF inhibitors into broader immunology treatment pathways are strengthening their role as foundational biologics in autoimmune disease care

- The convenience of self-injectable delivery systems, improved biosimilar availability, and broader reimbursement coverage are key factors propelling the adoption of TNF inhibitor drugs across both developed and emerging healthcare markets

Restraint/Challenge

Injection-Site Reactions and Regulatory Compliance Hurdle

- Concerns surrounding potential adverse effects of biologics, including injection-site reactions and immunosuppression risks, pose a significant challenge to broader market penetration of TNF inhibitor drugs

- For instance, reported cases of infections or hypersensitivity events have made some clinicians cautious when prescribing TNF inhibitors, particularly for patients with multiple comorbidities or compromised immune systems

- Addressing these clinical concerns through enhanced patient monitoring, improved formulation technologies, and comprehensive safety communication is crucial for strengthening confidence among prescribers and patients

- While biosimilars have reduced treatment costs, the perceived high price of long-term biologic therapy can still hinder the widespread adoption of TNF inhibitors in cost-sensitive regions or among uninsured populations

- Overcoming these challenges through expanded biosimilar penetration, improved pharmacovigilance systems, and streamlined regulatory pathways will be vital for sustaining the long-term growth of the Tumor Necrosis Factor (TNF) inhibitor drugs market

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Scope

The market is segmented on the basis of drug, product, application, and distribution channel.

- By Drug

On the basis of drug, the Tumor Necrosis Factor (TNF) inhibitor drugs market is segmented into adalimumab, certolizumab, etanercept, golimumab, infliximab, and pipeline analysis. Adalimumab dominated the market with the largest market revenue share of 35.9% in 2025, driven by its broad range of approved indications across rheumatology, dermatology, and gastroenterology. Its long-standing clinical evidence, strong physician confidence, and extensive reimbursement coverage have positioned it as a first-line biologic in many treatment guidelines. The availability of multiple biosimilars has expanded patient access while preserving overall demand for the adalimumab therapeutic class. Patient-friendly delivery formats such as prefilled pens and auto-injectors further support adherence and outpatient use. Its deep penetration across developed and emerging markets sustains its revenue leadership.

The Certolizumab segment is anticipated to witness the fastest growth rate from 2026 to 2033, attributed to its unique pegylated, Fc-free formulation that minimizes placental transfer and supports use in pregnant patients. Growing clinical adoption for Crohn’s disease, axial spondyloarthritis, and psoriatic arthritis is expanding its label utility and market uptake. Favorable dosing intervals and real-world evidence demonstrating safety in sensitive populations are increasing physician preference. Expansion into emerging healthcare systems and targeted marketing toward women of childbearing age are accelerating uptake. Enhanced awareness of its differentiated safety profile is enabling rapid geographic expansion. These factors combine to support Certolizumab’s faster-than-average growth trajectory.

- By Product

On the basis of product, the Tumor Necrosis Factor (TNF) inhibitor drugs market is segmented into humira, enbrel, remicade, simponi, and cimzia. Humira dominated the product segment with the largest market revenue share in 2025, supported by its multi-indication approvals, widespread formulary inclusion, and deep clinical legacy. The brand’s global recognition and extensive long-term efficacy and safety data have fostered strong prescriber trust. Even with biosimilar competition, Humira retains significant prescription volumes due to physician familiarity and patient continuity programs. Broad reimbursement access in major markets ensures sustained demand across chronic indications. Its established distribution and support infrastructure further reinforce its market dominance.

The Cimzia segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its Fc-free design and safety advantages during pregnancy and lactation, making it a preferred option for women of reproductive age. Increasing approvals and guideline endorsements for gastrointestinal and rheumatologic indications are broadening its clinical use. Longer dosing intervals and flexible self-administration contribute to improved patient adherence. Enhanced real-world outcomes and tolerability data are convincing prescribers to adopt Cimzia more widely. Geographic expansion into Asia-Pacific and Latin America, along with focused physician education, is accelerating its uptake and market share growth.

- By Application

On the basis of application, the Tumor Necrosis Factor (TNF) inhibitor drugs market is segmented into rheumatoid arthritis, psoriasis, inflammatory bowel disease, ankylosing spondylitis, crohn’s disease, plaque psoriasis, ulcerative colitis, hidradenitis suppurativa, juvenile arthritis, uveitis, and others. Rheumatoid Arthritis dominated the application segment with the largest treatment share in 2025, owing to the high global prevalence of RA and the early, widespread adoption of TNF inhibitors as cornerstone biologic therapy. Strong guideline recommendations, long-term outcome data, and extensive clinician experience underpin continued reliance on TNF inhibitors for moderate-to-severe RA. Early diagnosis and treat-to-target approaches have increased biologic initiation rates, supporting volume growth. Reimbursement frameworks in key markets facilitate access to biologics for RA patients. The multiplicity of approved agents provides therapeutic choice, further consolidating RA’s leading position.

Inflammatory Bowel Disease (including Crohn’s Disease and Ulcerative Colitis) is expected to be the fastest-growing application segment from 2026 to 2033, driven by rising IBD incidence globally and earlier adoption of biologic therapy in treatment algorithms. TNF inhibitors remain a primary option for inducing and maintaining remission in moderate-to-severe IBD, leading to strong uptake in gastroenterology practice. Improved diagnostic infrastructure and specialist care expansion in emerging regions are enlarging the treated population. The availability of subcutaneous options and biosimilars has improved outpatient management and affordability. Real-world evidence of mucosal healing and long-term benefit is reinforcing broader clinician adoption and patient demand.

- By Distribution Channel

On the basis of distribution channel, the Tumor Necrosis Factor (TNF) inhibitor drugs market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital Pharmacy dominated the distribution channel with the largest share in 2025, due to specialist-led initiation, infusion center requirements for intravenous TNF inhibitors, and hospital oversight of complex treatment regimens. Hospitals and specialty clinics provide integrated services including monitoring, pharmacovigilance, and nurse-led infusion that are critical for certain biologics such as infliximab. Centralized procurement and reimbursement processing through hospitals streamline access for high-cost therapies. Patient initiation, dose titration, and management of adverse events typically occur in hospital settings, reinforcing this channel’s primacy. Cold-chain handling and inventory systems in hospitals also ensure biologic integrity and uninterrupted supply.

The Online Pharmacy segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by rising telemedicine adoption, expanding specialty e-pharmacy services, and patient preference for home delivery of chronic medications. Self-injectable TNF inhibitors are particularly amenable to online fulfillment and subscription refill models that improve adherence. Digital platforms facilitate home delivery, remote patient education, and automated reminders—enhancing convenience for long-term therapy. Competitive pricing for biosimilars and greater geographic reach of e-commerce enable better access in suburban and rural areas. Regulatory acceptance of e-prescriptions and partnerships between specialty pharmacies and healthcare providers further accelerate online channel growth.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Regional Analysis

- North America dominated the Tumor Necrosis Factor (TNF) inhibitor drugs market with the largest revenue share of 45.2% in 2025, supported by high disease incidence, advanced healthcare infrastructure, favorable reimbursement frameworks, and a strong presence of leading pharmaceutical companies, with the U.S. experiencing notable growth driven by continued uptake of both originator biologics and approved biosimilars

- Patients and healthcare providers in the region place substantial value on the proven efficacy, long-term safety data, and broad clinical indications associated with TNF inhibitors, supporting consistent utilization across chronic inflammatory diseases

- This widespread adoption is further reinforced by well-established reimbursement systems, strong biologics distribution networks, and the presence of major pharmaceutical manufacturers, positioning North America as a leading market for TNF inhibitor drugs across both infusion-based and self-administered formulations

U.S. Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The U.S. TNF inhibitor drugs market captured the largest revenue share of the North American region in 2025, fueled by the high prevalence of autoimmune disorders such as rheumatoid arthritis, Crohn’s disease, and psoriasis. Physicians and patients increasingly prioritize biologics due to their strong clinical efficacy and long-term disease-modifying outcomes. The robust healthcare infrastructure, widespread insurance coverage, and availability of both branded and biosimilar TNF inhibitors further accelerate market adoption. In addition, the expanding use of self-injectable formulations and digital adherence tools is propelling growth. Moreover, ongoing FDA approvals, active clinical research, and strong biologics distribution networks continue to strengthen the U.S. market outlook.

Europe Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The Europe TNF inhibitor drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing autoimmune disease incidence and strong demand for advanced biologic therapies. The region’s well-established healthcare systems, combined with broad reimbursement policies, support high adoption of TNF inhibitors across rheumatology and gastroenterology applications. European patients are drawn to evidence-based biologics that provide durable symptom control and quality-of-life improvements. The market is also supported by rising biosimilar penetration, which boosts affordability and access. In addition, continued clinical guideline updates across EU countries are reinforcing the role of TNF inhibitors in first- and second-line treatment settings.

U.K. Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The U.K. TNF inhibitor drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising autoimmune disease diagnoses and expanding utilization of biologics in the NHS. Strong clinical evidence and favorable treatment outcomes continue to encourage physicians to prescribe TNF inhibitors across multiple indications. In addition, concerns around disease progression and disability are prompting patients to seek earlier biologic intervention. The U.K.’s structured reimbursement pathways and increasing uptake of TNF biosimilars are also enhancing market access. Furthermore, the growing presence of specialty clinics and coordinated care models is expected to sustain long-term demand.

Germany Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The Germany TNF inhibitor drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong focus on innovative biologics and advanced immunology care. Germany’s highly developed healthcare infrastructure, paired with rigorous clinical standards, supports the widespread adoption of TNF inhibitors across diverse therapeutic areas. The emphasis on precision medicine, treatment safety, and long-term disease control aligns well with the clinical strengths of TNF inhibitors. In addition, rising physician preference for established biologics and broader biosimilar availability contribute to market growth. The integration of digital health monitoring solutions is further enhancing treatment adherence and outcomes.

Asia-Pacific Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The Asia-Pacific TNF inhibitor drugs market is poised to grow at the fastest CAGR during the forecast period, driven by rising autoimmune disease burden, expanding healthcare expenditure, and increasing biologic therapy adoption in countries such as China, Japan, India, and South Korea. The region’s accelerating shift toward advanced immunology treatments, supported by government healthcare reforms, is improving patient access to TNF inhibitors. Growing awareness of early diagnosis and specialty care is also fueling demand. In addition, APAC’s emergence as a leading biosimilar manufacturing hub is significantly increasing affordability and market penetration. The expansion of specialty hospitals and biologics distribution networks further strengthens regional growth.

Japan Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The Japan TNF inhibitor drugs market is gaining momentum due to the country’s strong focus on advanced healthcare technologies, precision medicine, and chronic disease management. Japanese clinicians prioritize the use of established biologics for treating rheumatoid arthritis, ulcerative colitis, and other inflammatory disorders, ensuring consistent market demand. The integration of TNF inhibitors with digital monitoring tools and hospital-based biologic infusion programs further supports their adoption. In addition, Japan’s aging population—which is more susceptible to autoimmune and degenerative conditions—is such asly to fuel long-term demand. Strong R&D activity and robust regulatory standards continue to shape the Japanese biologics landscape.

India Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insight

The India TNF inhibitor drugs market accounted for one of the largest market shares within Asia-Pacific in 2025, driven by growing autoimmune disease diagnoses, expanding access to biologics, and rising healthcare affordability. India has become a significant market for biosimilar TNF inhibitors, making therapies more accessible to a larger patient population. Increasing adoption of specialty care clinics and improved diagnostic capabilities are accelerating treatment uptake. In addition, initiatives supporting healthcare modernization and insurance expansion are improving access to chronic disease therapies. The presence of strong domestic biologics developers and competitively priced biosimilars further strengthens India’s market momentum.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Share

The Tumor Necrosis Factor (TNF) Inhibitor Drugs industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- UCB S.A. (Belgium)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Samsung (South Korea)

- Celltrion, Inc. (South Korea)

- Sandoz AG (Switzerland)

- Biocon Biologics Limited (India)

- Fresenius Kabi AG (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- GSK plc (U.K.)

- AstraZeneca (U.K.)

What are the Recent Developments in Global Tumor Necrosis Factor (TNF) Inhibitor Drugs Market?

- In October 2025, the FDA expanded the approved indications for YUFLYMA to include pediatric use for Hidradenitis Suppurativa (HS) in adolescents ≥12 years and Uveitis (UV) in children ≥2 years significantly broadening the patient population eligible for TNF inhibitor therapy

- In May 2025, YUFLYMA (adalimumab‑aaty), a biosimilar to Humira, was granted full “interchangeable” status by the U.S. U.S. Food and Drug Administration (FDA) across all dosage forms prefilled syringes and autoinjectors making it fully substitutable with Humira and such asly boosting accessibility and cost‑effectiveness for patients needing TNF therapy

- In May 2024, long‑term data from the extended pivotal studies (LIBERTY-CD and LIBERTY-UC) for ZYMFENTRA demonstrated sustained efficacy and safety over two years of maintenance therapy in patients with Crohn’s disease and ulcerative colitis reinforcing confidence among clinicians and patients in subcutaneous infliximab as a durable TNF‑inhibitor option

- In March 2024, ZYMFENTRA became commercially available across the United States, making subcutaneous infliximab accessible to patients for the first time which can significantly reduce treatment burden and improve adherence compared with infusion‑based therapy

- In October 2023, ZYMFENTRA (infliximab‑dyyb), the first and only FDA‑approved subcutaneous infliximab, received approval in the U.S. for maintenance therapy of Ulcerative Colitis (UC) and Crohn’s Disease (CD), offering patients a convenient alternative to infusions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.