Global Trocars Market

Market Size in USD Million

CAGR :

%

USD

815.90 Million

USD

1,449.73 Million

2024

2032

USD

815.90 Million

USD

1,449.73 Million

2024

2032

| 2025 –2032 | |

| USD 815.90 Million | |

| USD 1,449.73 Million | |

|

|

|

|

Trocars Market Size

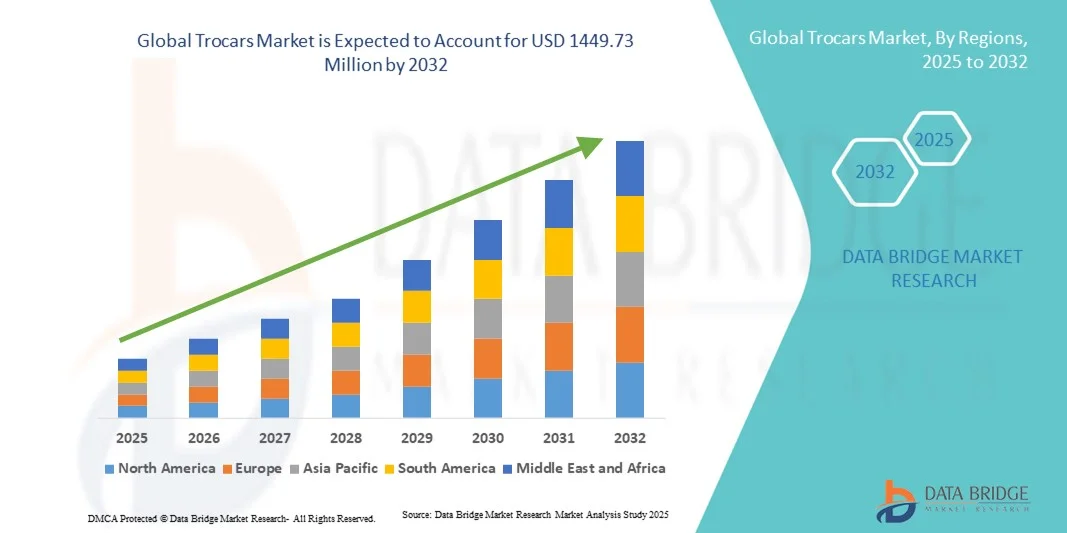

- The global trocars market size was valued at USD 815.90 Million in 2024 and is expected to reach USD 1449.73 Million by 2032, at a CAGR of 7.45% during the forecast period

- The market growth is largely fueled by the growing adoption of minimally invasive surgical procedures and continuous technological advancements in surgical instruments, leading to increased precision, reduced patient recovery time, and improved procedural efficiency across healthcare facilities

- Furthermore, rising demand for cost-effective, reusable, and disposable trocars, along with the growing prevalence of chronic diseases requiring laparoscopic interventions, is driving the adoption of Trocars solutions, thereby significantly boosting the industry’s growth

Trocars Market Analysis

- Trocars, which serve as essential surgical access devices for laparoscopic and minimally invasive procedures, are increasingly vital in modern operating rooms across hospitals and surgical centers due to their precision, safety, and adaptability to various surgical applications

- The escalating demand for trocars is primarily driven by the growing adoption of minimally invasive surgeries, technological advancements in trocar design such as optical and bladeless entry systems, and the rising global burden of chronic diseases requiring surgical intervention

- North America dominated the trocars market with the largest revenue share of 42.8% in 2024, attributed to advanced healthcare infrastructure, a high volume of laparoscopic procedures, and a strong presence of key medical device manufacturers. The U.S. experienced substantial growth in trocar utilization, supported by increased healthcare spending, rapid adoption of innovative surgical technologies, and a focus on reducing hospital stays through minimally invasive techniques

- Asia-Pacific is expected to be the fastest-growing region in the Trocars market during the forecast period, expanding at a CAGR of 12.9% from 2025 to 2032, driven by rising healthcare investments, expanding hospital networks, and growing awareness of the benefits of minimally invasive procedures in countries such as China, India, and Japan

- The disposable trocars segment dominated the largest market revenue share of 47.8% in 2024, primarily due to their single-use nature which minimizes cross-contamination risks and ensures sterility during surgical procedures

Report Scope and Trocars Market Segmentation

|

Attributes |

Trocars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Trocars Market Trends

Advancements in Design and Material Innovation Enhancing Surgical Precision

- A significant and accelerating trend in the global trocars market is the rapid advancement in design optimization and the use of innovative materials aimed at enhancing surgical precision and minimizing patient trauma. Modern trocars are being engineered with ergonomic handles, improved sealing mechanisms, and atraumatic tips to ensure minimal tissue damage during laparoscopic procedures

- For instance, several leading manufacturers are introducing bladeless and optical trocars that enhance visualization and control during initial abdominal entry, thereby improving safety in minimally invasive surgeries. These trocars reduce postoperative complications and shorten patient recovery time

- Material innovation is also a key factor shaping market trends. The integration of biocompatible polymers and lightweight alloys has led to the development of high-performance trocars that offer better durability, maneuverability, and reduced risk of infection

- In addition, single-use disposable trocars are gaining traction due to their ability to minimize cross-contamination risks in hospital settings. Hospitals and surgical centers are increasingly adopting these solutions as part of infection control strategies

- Technological progress, such as integration with insufflation systems and enhanced sealing valves, is improving workflow efficiency in laparoscopic and robotic-assisted surgeries. Manufacturers are also focusing on trocar systems compatible with robotic surgical instruments to meet growing demand for precision and automation

- This trend toward advanced, safer, and ergonomically improved trocar designs is fundamentally transforming minimally invasive surgery standards, driving hospitals worldwide to upgrade to newer, more reliable systems that ensure both surgeon comfort and patient safety

Trocars Market Dynamics

Driver

Growing Adoption of Minimally Invasive Surgeries Globally

- The rising global preference for minimally invasive surgeries (MIS) due to shorter hospital stays, reduced postoperative pain, and faster recovery times is a major driver for the Trocars market. The shift from open to laparoscopic and robotic-assisted procedures across specialties such as general surgery, gynecology, and urology has significantly boosted trocar utilization rates

- For instance, the World Health Organization (WHO) and various surgical associations have highlighted the growing trend of laparoscopic adoption in both developed and emerging regions, supported by government programs to expand access to advanced surgical care

- The demand for reusable and disposable trocars is rising in tandem with the growing number of laparoscopic procedures, fueled by healthcare infrastructure modernization and increasing surgical volumes worldwide

- Furthermore, rising awareness among surgeons regarding the safety benefits of bladeless and optical entry systems has strengthened product adoption. Hospitals are actively investing in trocar systems offering improved precision and reduced port-site complications

- Technological advancements, such as integrated insufflation valves and anti-leak seal systems, have made trocar use more efficient and reliable, thereby encouraging wider deployment in complex surgeries

- Overall, the expanding MIS landscape, coupled with healthcare cost-efficiency goals, is expected to sustain steady growth in the Trocars market over the coming years, supported by ongoing product innovation and training initiatives by manufacturers

Restraint/Challenge

High Cost and Limited Reusability in Resource-Constrained Settings

- Despite their growing demand, the high cost associated with advanced trocar systems remains a major barrier to broader adoption, especially in low- and middle-income countries. Premium products with advanced safety seals, optical components, and ergonomic features often carry a significantly higher price tag than traditional models

- The limited reusability of disposable trocars further adds to procedural costs for hospitals, particularly in facilities handling high surgical volumes

- For instance, in February 2023, Applied Medical Resources Corporation reported increasing demand for single-use trocars but highlighted that hospitals in emerging markets often face cost pressures that limit their ability to replace disposable devices frequently, prompting a shift toward semi-reusable models to manage operational expenses

- Moreover, inadequate awareness and limited surgeon training in advanced laparoscopic techniques can hinder effective utilization of modern trocar systems in certain regions. This challenge is particularly evident in smaller hospitals lacking access to specialized MIS training programs

- Environmental concerns regarding medical waste from disposable trocars are also emerging as a notable restraint. Regulatory bodies are increasingly emphasizing sustainable production and disposal methods for medical devices

- Another challenge is compatibility issues between trocars and newer robotic-assisted surgical platforms, which can lead to additional equipment costs or operational inefficiencies

- To overcome these challenges, manufacturers are focusing on developing cost-efficient hybrid trocars, expanding surgeon education programs, and introducing eco-friendly single-use designs to balance affordability, safety, and sustainability—ensuring continued market growth across diverse healthcare economies

Trocars Market Scope

The market is segmented on the basis of product, tip, application, and end user.

- By Product

On the basis of product, the Trocars market is segmented into disposable trocars, reposable trocars, reusable trocars, and accessories. The disposable trocars segment dominated the largest market revenue share of 47.8% in 2024, primarily due to their single-use nature which minimizes cross-contamination risks and ensures sterility during surgical procedures. These trocars are preferred in hospitals and clinics for their convenience and compliance with infection control standards. The rising number of laparoscopic and minimally invasive surgeries, combined with the post-COVID emphasis on sterile medical consumables, has bolstered their demand. Manufacturers are focusing on cost-effective, ergonomic, and safety-shield-equipped disposable trocars, enhancing surgeon efficiency. The segment also benefits from regulatory encouragement for infection-free surgical tools. Their easy availability and wide compatibility with various surgical devices sustain their dominance globally.

The reposable trocars segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, attributed to growing emphasis on sustainability and cost efficiency. Reposable systems combine reusable and disposable components, reducing waste and ensuring cost savings for hospitals. Increasing adoption in developed markets such as the U.S. and Germany, where sustainability initiatives are prioritized, drives growth. Their eco-friendly appeal, coupled with ongoing innovations in sterilization and design optimization, makes them increasingly viable alternatives to fully disposable trocars. The ability to maintain consistent performance while reducing per-procedure costs positions reposable trocars as a key growth driver in the upcoming years. Expanding hospital budgets for reusable technologies further supports this growth trend.

- By Tip

On the basis of tip, the Trocars market is segmented into bladeless trocars, optical trocars, blunt trocars, and bladed trocars. The bladeless trocars segment dominated the largest market share of 39.6% in 2024, owing to their superior safety profile and reduced risk of internal organ injury. These trocars are widely used in laparoscopic and general surgeries due to their atraumatic entry and precision. Their compatibility with both reusable and disposable types enhances their market appeal. Surgeons prefer bladeless designs because they minimize postoperative complications and recovery times. The introduction of bladeless systems with integrated sealing mechanisms and ergonomic grips by major players such as Medtronic and Johnson & Johnson further strengthens their use. The growing preference for patient safety and improved surgical outcomes continues to drive this segment’s leadership globally.

The optical trocars segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by increasing demand for precision-based minimally invasive procedures. Optical trocars enable direct visualization during insertion, improving procedural accuracy and reducing injury risks. Their usage is rapidly growing in laparoscopic and robotic-assisted surgeries, especially for gynecological and bariatric operations. Continuous advancements in integrated camera technology and enhanced optical clarity are enhancing their reliability. Surgeons are increasingly shifting towards optical trocars for real-time visual feedback during access. The segment’s growth is further supported by hospital investments in advanced visualization systems and training programs promoting safer surgical practices.

- By Application

On the basis of application, the Trocars market is segmented into general surgery, gynecological surgery, urological surgery, pediatric surgery, and others. The general surgery segment dominated the largest market revenue share of 41.3% in 2024, owing to the high volume of laparoscopic procedures performed globally such as appendectomy, cholecystectomy, and hernia repair. Surgeons prefer trocars in these procedures for their ease of access and minimal tissue trauma. The segment benefits from ongoing innovations in surgical instruments improving efficiency and precision. Growing adoption of minimally invasive techniques in general surgery, especially in developed regions, continues to boost demand. Hospitals and surgical centers heavily rely on trocars for various general procedures, contributing to sustained market share. Increasing healthcare expenditure and focus on faster patient recovery further enhance segment growth.

The gynecological surgery segment is projected to witness the fastest CAGR of 10.7% from 2025 to 2032, driven by the increasing prevalence of gynecological conditions and the rise in laparoscopic and robotic-assisted procedures. Trocars are integral to surgeries such as hysterectomies and myomectomies due to their ability to facilitate safe and accurate instrument entry. The growing trend of minimally invasive techniques for female reproductive health and fertility-related surgeries also contributes to growth. Improved trocar designs with optical entry options enhance visibility and precision. In addition, rising government initiatives supporting women’s health, coupled with increasing awareness about advanced surgical options, further fuel the segment’s expansion globally.

- By End User

On the basis of end user, the Trocars market is segmented into hospitals and other end users. The hospitals segment dominated the largest market revenue share of 72.4% in 2024, driven by the large number of surgeries conducted in hospital settings and the availability of advanced surgical infrastructure. Hospitals remain the primary centers for laparoscopic, urological, and general surgeries due to their comprehensive care facilities and skilled professionals. High patient inflow and investments in modern equipment further strengthen this dominance. Major hospitals are also adopting innovative trocar systems to improve precision and reduce operating time. The need for infection control and standardized sterilization procedures ensures continued demand for disposable and reposable trocars. The expansion of multi-specialty and tertiary care hospitals worldwide also contributes to segment growth.

The other end users segment, which includes ambulatory surgical centers and specialty clinics, is expected to witness the fastest CAGR of 11.5% from 2025 to 2032. The segment’s growth is primarily driven by the increasing adoption of outpatient and day-care surgeries due to their cost-effectiveness and convenience. Ambulatory centers increasingly utilize advanced trocar systems for minimally invasive procedures with shorter recovery times. Technological advancements have made compact, user-friendly trocar devices ideal for these settings. The growing trend toward decentralized surgical care and the expansion of stand-alone clinics specializing in laparoscopy are propelling this segment. In addition, government efforts to promote same-day surgeries for cost containment and patient satisfaction support rapid growth across developed and emerging regions.

Trocars Market Regional Analysis

- North America dominated the trocars market with the largest revenue share of 42.8% in 2024, attributed to advanced healthcare infrastructure,

- High volume of laparoscopic procedures, and a strong presence of key medical device manufacturers

- The region’s growth is further supported by increasing healthcare spending, rapid adoption of innovative surgical technologies, and a focus on reducing hospital stays through minimally invasive techniques

U.S. Trocars Market Insight

The U.S. trocars market captured the largest revenue share in 2024 within North America, fueled by the swift adoption of laparoscopic and robotic-assisted surgical procedures. Hospitals and ambulatory surgical centers are increasingly prioritizing the use of single-use and bladeless trocars to minimize infection risks and enhance patient safety. Furthermore, the presence of major players such as Medtronic, Johnson & Johnson, and Teleflex, along with robust R&D investments in product innovation, continues to strengthen the U.S. market. The growing shift toward outpatient and same-day surgeries is also propelling demand for cost-effective and efficient trocar systems.

Europe Trocars Market Insight

The Europe trocars market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising adoption of minimally invasive surgical procedures and the implementation of stringent safety and quality regulations. Increasing awareness about faster recovery times and lower post-operative complications is encouraging both hospitals and surgeons to transition toward advanced trocar systems. Countries such as Germany, France, and the U.K. are witnessing notable demand due to well-established healthcare infrastructure and strong government support for surgical innovation.

U.K. Trocars Market Insight

The U.K. trocars market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of gallbladder disorders, obesity, and gynecological conditions requiring laparoscopic intervention. In addition, the growing focus of the National Health Service (NHS) on promoting day-care and minimally invasive surgeries is further enhancing trocar utilization. Increasing investments in healthcare modernization and surgeon training programs are expected to fuel steady market growth across the country.

Germany Trocars Market Insight

The Germany trocars market is expected to expand at a considerable CAGR during the forecast period, fueled by the strong presence of advanced medical technology manufacturers and increasing adoption of robotic and image-guided surgeries. The country’s emphasis on patient safety, product reliability, and precision-based surgical tools is fostering greater demand for high-quality disposable trocars. Moreover, growing healthcare expenditure and the integration of digital technologies in hospitals are contributing to the market’s positive outlook.

Asia-Pacific Trocars Market Insight

The Asia-Pacific trocars market poised to grow at the fastest CAGR of 12.9% during the forecast period of 2025 to 2032, driven by rising healthcare investments, expanding hospital networks, and growing awareness of the benefits of minimally invasive procedures in countries such as China, Japan, and India. The increasing number of laparoscopic surgeries, coupled with supportive government healthcare reforms, is creating a strong demand for affordable and high-performance trocar devices. The presence of emerging local manufacturers and the growing penetration of global medical device companies are further fueling the region’s market expansion.

Japan Trocars Market Insight

The Japan trocars market is gaining momentum due to the country’s aging population, strong preference for minimally invasive techniques, and technological advancements in surgical instrumentation. Japan’s healthcare system is witnessing increasing demand for precision-based and ergonomic trocar systems that improve surgeon control and patient outcomes. Moreover, collaborations between hospitals and medical device manufacturers are encouraging continuous product innovation and adoption of next-generation laparoscopic solutions.

China Trocars Market Insight

The China trocars market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, expanding healthcare infrastructure, and increasing adoption of laparoscopic surgeries. The growing number of domestic manufacturers offering cost-effective trocar systems, along with government initiatives promoting modern surgical techniques, is driving the market’s growth. In addition, China’s position as a leading medical device manufacturing hub ensures the availability and affordability of advanced trocar products across both public and private healthcare facilities.

Trocars Market Share

The Trocars industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Johnson & Johnson and its affiliates (U.S.)

• B. Braun SE (Germany)

• CONMED Corporation (U.S.)

• Teleflex Incorporated (U.S.)

• Apollo Endosurgery, Inc. (U.S.)

• The Cooper Companies, Inc. (U.S.)

• Genicon, Inc. (U.S.)

• TROKAMED GmbH (Germany)

• Laprosurge Ltd. (U.K.)

• Purple Surgical (U.K.)

• Grena Ltd. (U.K.)

• LaproSurge Medical Devices (U.K.)

• Fannin Ltd. (Ireland)

• Peters Surgical (France)

Latest Developments in Global Trocars Market

- In March 2022, CMR Surgical entered into a partnership with Surgical Innovations to develop an advanced hybrid surgical port access system combining a reusable trocar and a single-use valve. This collaboration was aimed at enhancing surgical efficiency while significantly reducing medical waste by up to 70%. The initiative also supports growing sustainability efforts in minimally invasive surgical procedures by reducing disposable components without compromising patient safety

- In October 2023, Ethicon, a subsidiary of Johnson & Johnson, announced the launch of its next-generation bladeless trocar system, designed to minimize tissue trauma and improve visualization during laparoscopic surgeries. The innovation incorporates ergonomic enhancements and optimized sealing technology to reduce gas leakage and improve procedural precision. This launch strengthened Ethicon’s position in the global minimally invasive surgery market and emphasized its focus on surgeon safety and patient outcomes

- In April 2024, Medtronic plc introduced a new series of optical and blunt trocars compatible with its laparoscopic platforms. The new product line was engineered for improved instrument stability and reduced insertion force, offering surgeons better control during abdominal entry. This product development aligns with Medtronic’s broader strategy to integrate enhanced visualization and ergonomic design into its minimally invasive surgery tools portfolio

- In November 2024, B. Braun Melsungen AG announced an upgrade to its Visiport Optical Trocar System, featuring improved optical clarity and an integrated safety shield to prevent unintentional organ injury. This enhancement was based on clinical feedback and aimed to strengthen procedural safety during general and gynecological surgeries. The update reflects the company’s continued investment in developing safer and more user-friendly access devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.