Global Triphala Extracts Market

Market Size in USD Billion

CAGR :

%

USD

1.25 Billion

USD

2.01 Billion

2024

2032

USD

1.25 Billion

USD

2.01 Billion

2024

2032

| 2025 –2032 | |

| USD 1.25 Billion | |

| USD 2.01 Billion | |

|

|

|

|

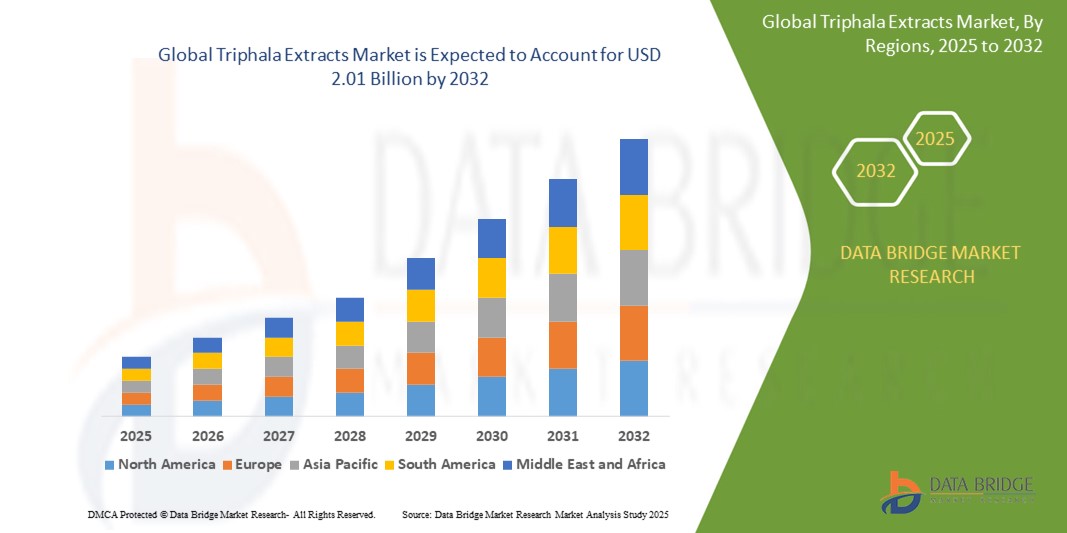

What is the Global Triphala Extracts Market Size and Growth Rate?

- The global triphala extracts market size was valued at USD 1.25 billion in 2024 and is expected to reach USD 2.01 billion by 2032, at a CAGR of 6.10% during the forecast period

- Triphala extracts market is experiencing growth due to advancements in extraction techniques such as supercritical fluid extraction, which ensures higher purity and potency. These methods enhance bioavailability, making products more effective. The rising demand for natural and organic supplements has driven the adoption of triphala in various formulations, boosting market expansion, particularly in the nutraceutical and dietary supplement sectors

What are the Major Takeaways of Triphala Extracts Market?

- Triphala is increasingly being incorporated into functional foods and beverages, catering to health-conscious consumers seeking added nutritional benefits. For instance, companies are launching products such as Triphala-infused teas, energy bars, and smoothies, leveraging its antioxidant and digestive properties

- This trend is driving the Triphala extracts market as more consumers look for convenient ways to integrate Ayurvedic ingredients into their daily diets

- Asia-Pacific dominated the triphala extracts market with the largest revenue share of 39.86% in 2024, owing to increasing consumer preference for traditional and herbal remedies, growing awareness of Ayurveda, and rising health consciousness across emerging economies

- North America is the fastest-growing region with a CAGR of 5.87 in the triphala extracts market, fueled by rising consumer preference for natural, clean-label supplements

- The powder segment dominated the Triphala Extracts market with the largest market revenue share of 46.8% in 2024, owing to its high solubility, ease of blending into smoothies or health drinks, and longer shelf life

Report Scope and Triphala Extracts Market Segmentation

|

Attributes |

Triphala Extracts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Triphala Extracts Market?

“Enhanced Convenience through New Formats and Functional Innovation”

- A notable trend in the global triphala extracts market is the rising focus on product innovation, including new consumption formats and functional blends, to enhance user convenience and appeal

- Brands are introducing easy-to-consume forms such as capsules, powders, chewable tablets, liquid tonics, and effervescent tablets to meet varied consumer preferences and improve daily intake adherence

- These innovations aim to overcome traditional barriers such as bitterness and preparation time associated with Triphala, making it more accessible to modern, on-the-go consumers

- Furthermore, companies are blending Triphala with ingredients such as ashwagandha, turmeric, and probiotics to offer multifunctional benefits such as digestion support, stress relief, and immunity boosting

- This user-focused innovation is helping position Triphala as a versatile functional supplement in the expanding Ayurvedic wellness and nutraceutical markets

- In April 2024, Organic India launched Triphala Effervescent Tablets in international markets, targeting health-conscious consumers seeking natural yet convenient gut health solutions

- This growing trend toward easy, flavorful, and multi-benefit Triphala products is reshaping consumer adoption patterns and broadening the ingredient’s global appeal

What are the Key Drivers of Triphala Extracts Market?

- Increasing global interest in Ayurveda and herbal medicine, coupled with rising awareness of gut health, is fueling demand for triphala extracts across various age groups

- Triphala's natural detoxifying, digestive, and antioxidant properties make it a preferred supplement for preventive health and chronic condition management, particularly in the post-COVID era

- The surge in plant-based, chemical-free, and clean-label wellness products is aligning with Triphala’s traditional image, boosting its market acceptance in both developing and developed regions

- Supportive government policies in countries such as India are encouraging herbal supplement exports and cultivation of medicinal plants, reducing costs and increasing availability

- In February 2024, Dabur India announced a 20% expansion of its herbal product line, with a focus on Triphala-based formulations targeting immunity and digestive wellness

- Triphala is rapidly gaining recognition as a time-tested, plant-based remedy suited to modern wellness trends, with growth propelled by consumer trust, clinical efficacy, and global health awareness

Which Factor is challenging the Growth of the Triphala Extracts Market?

- A key challenge limiting the market growth of triphala extracts is inconsistency in product quality due to variations in raw material sourcing, processing methods, and standardization across regions

- Lack of stringent regulatory frameworks and unified standards often results in poor efficacy, contamination risks, and consumer skepticism toward Ayurvedic supplements in global markets

- Triphala’s naturally bitter taste can be unappealing to some consumers, particularly in Western countries unfamiliar with its traditional usage, affecting repeat purchase rates

- Premium pricing for organic and clinically tested formulations also restricts accessibility in cost-sensitive segments, especially where herbal supplements are not covered by health plans

- In 2023, the European Medicines Agency highlighted discrepancies in the quality of imported Triphala products, citing lack of standard dosage and insufficient safety documentation

- Addressing these concerns through global standardization, transparent labeling, taste-masking innovations, and affordability will be critical for sustaining growth and trust in the Triphala market

How is the Triphala Extracts Market Segmented?

The market is segmented on the basis of form, nature, application, and distribution channel.

- By Form

On the basis of form, the triphala extracts market is segmented into liquid, powder, and capsule. The powder segment dominated the market with the largest revenue share of 42.7% in 2024, owing to its ease of consumption when mixed with water or herbal teas, and its widespread use in Ayurvedic and wellness formulations. Powdered Triphala is also preferred in detox regimens and traditional cleansing practices due to its quick absorption and customizable dosage.

The capsule segment is projected to witness the fastest growth from 2025 to 2032, driven by its convenience, standardized dosage, and ability to mask Triphala’s bitter taste. Capsules are increasingly favored by modern consumers who seek traditional health benefits without compromising on taste and portability.

- By Nature

On the basis of nature, the market is segmented into organic and conventional. The conventional segment held the largest market share in 2024, accounting for 58.4%, due to wider availability, lower cost of production, and higher consumer penetration in emerging markets. These products often meet the demands of budget-conscious consumers and local retailers.

However, the organic segment is expected to register the fastest growth rate, supported by increasing health awareness, rising demand for chemical-free supplements, and growing trust in certified organic labels. The trend toward clean-label and eco-conscious consumption is further boosting the segment.

- By Application

On the basis of application, the triphala extracts market is segmented into health care and dietary supplements. The dietary supplements segment dominated in 2024, capturing 63.1% of the market share, as Triphala is widely known for aiding digestion, detoxification, and immunity support. The growing use of Triphala in weight management and gut health supplements is also contributing to this segment’s dominance.

The health care segment is anticipated to grow rapidly during the forecast period due to ongoing clinical studies and increased formulation of Triphala in therapeutic remedies, eye care, and oral hygiene products. Its anti-inflammatory and antioxidant properties are being increasingly recognized in functional healthcare applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B and B2C. The B2C segment led the market with a dominant revenue share of 55.2% in 2024, driven by growing consumer interest in self-care, direct-to-consumer brand strategies, and increasing online supplement purchases. The ease of online access and informational content on wellness benefits have further supported this segment.

The B2B segment is projected to experience notable growth between 2025 and 2032, fueled by bulk demand from wellness brands, Ayurvedic clinics, nutraceutical companies, and contract manufacturers who incorporate Triphala into a variety of finished products for global retail.

Which Region Holds the Largest Share of the Triphala Extracts Market?

- Asia-Pacific dominated the triphala extracts market with the largest revenue share of 39.86% in 2024, owing to increasing consumer preference for traditional and herbal remedies, growing awareness of Ayurveda, and rising health consciousness across emerging economies

- Countries such as India, China, and Japan are driving demand due to their long-standing cultural acceptance of Triphala and government initiatives to promote herbal wellness

- The presence of a large population base, rising disposable incomes, and expansion of herbal product availability through modern retail and online platforms are further strengthening Asia-Pacific’s position in the global market

India Triphala Extracts Market Insight

The India triphala extracts market led the Asia-Pacific region in 2024, driven by deep-rooted Ayurvedic traditions and increased health awareness. With Triphala being a staple in Indian herbal medicine, demand is high across all age groups for digestive support, immunity enhancement, and detoxification. Government initiatives such as the AYUSH Ministry are actively promoting herbal wellness, supporting both local production and export. Urbanization and digital platforms are expanding access to Triphala-based capsules, powders, and teas. Rising disposable income, growing wellness centers, and evolving consumer preferences toward chemical-free supplements are further catalyzing the market’s growth across both urban and semi-urban regions.

China Triphala Extracts Market Insight

The China triphala extracts market witnessed strong revenue share in 2024 due to growing demand for herbal and plant-based health products. Although Triphala is not native to China, it is gaining traction due to its detoxifying and digestive benefits, aligning with the rising interest in Traditional Chinese Medicine (TCM) alternatives. An expanding middle class, rapid urbanization, and increased e-commerce penetration are making Ayurvedic products more accessible. Local manufacturers are also forming partnerships with Indian exporters to introduce certified Triphala formulations. Government support for functional foods and the growing number of health-conscious consumers is expected to sustain market expansion in the forecast period.

Japan Triphala Extracts Market Insight

The Japan triphala extracts market is showing promising growth, supported by the country’s emphasis on longevity, digestive wellness, and preventive healthcare. Japanese consumers prefer natural, evidence-backed supplements, and Triphala is being incorporated into capsules, herbal teas, and functional beverages. Increasing popularity of Ayurvedic wellness retreats and product awareness via digital health influencers is enhancing adoption. The aging population is driving demand for gentle, natural solutions for digestion and immunity, and Triphala aligns well with these needs. In addition, Japan’s strong health supplement regulatory framework ensures high-quality imports, fostering consumer trust and aiding the market’s long-term potential.

Which Region is the Fastest Growing Region in the Triphala Extracts Market?

North America is the fastest-growing region with a CAGR of 5.87 in the triphala extracts market, fueled by rising consumer preference for natural, clean-label supplements. Increased awareness of Ayurveda, along with growing interest in gut health, detoxification, and immunity, is driving demand for Triphala-based products. The region’s robust wellness culture, higher disposable income, and strong e-commerce infrastructure enable easy access to herbal supplements. Leading nutraceutical brands are incorporating Triphala into capsules, powders, and teas, targeting health-conscious millennials and aging populations. Strategic partnerships with Indian manufacturers and product innovation across the U.S. and Canada are accelerating market growth, making North America a key emerging hub for Ayurvedic extracts.

U.S. Triphala Extracts Market Insight

The U.S. triphala extracts market is the largest in North America, driven by rising consumer interest in natural and Ayurvedic remedies. The trend of clean-label, plant-based supplements is propelling the popularity of Triphala among health-conscious individuals, particularly millennials and the elderly. It's commonly used for digestive health, detox, and weight management in powder and capsule formats. E-commerce platforms such as Amazon and wellness retailers such as Whole Foods have significantly boosted availability and visibility. Clinical studies supporting the efficacy of Triphala are improving consumer confidence, while collaborations between Ayurvedic brands and U.S. nutraceutical companies are expanding market reach.

Canada Triphala Extracts Market Insight

The triphala extracts market in Canada is expanding steadily, with growing awareness of holistic health and interest in alternative medicine. Canadian consumers are adopting Ayurvedic supplements such as Triphala as part of their wellness routines, especially for digestion and detoxification. The presence of specialty health stores, yoga centers, and Ayurvedic practitioners is facilitating product education and trust. Regulatory support for natural health products and clean-label trends are encouraging market penetration. Triphala products are available across multiple channels, including online platforms and pharmacies. Rising immigrant populations from South Asia are also playing a vital role in promoting Ayurvedic traditions across Canadian cities.

Mexico Triphala Extracts Market Insight

The Mexico triphala extracts market is emerging rapidly due to increasing interest in natural and herbal supplements. While still a niche segment, awareness of Triphala’s health benefits is growing among middle-class consumers focused on digestive wellness and immunity. Ayurvedic brands are entering the Mexican market via online platforms and herbal product distributors. Health and wellness influencers are playing a significant role in introducing Ayurvedic remedies to urban youth. Demand is also supported by growing health food stores and wellness chains that are expanding their product portfolios with imported supplements. Government interest in alternative health systems may further boost the herbal segment.

Which are the Top Companies in Triphala Extracts Market?

The triphala extracts industry is primarily led by well-established companies, including:

- ALTAIGA SIBERIAN PINE NUTS (Russia)

- Almanda J. Chr. Magkoutas S.A. (Greece)

- SHILOH FARMS (U.S.)

- Credé Natural Oils (South Africa)

- Kenkko Corporation Ltd. (Japan)

- J.M. van de Sandt B.V. (Netherlands)

- BARDAKCIGROUP (Turkey)

- Bedemco Inc. (U.S.)

- Diamond Foods (U.S.)

- Freeworld Trading Ltd. (U.K.)

- Red River Foods (U.S.)

- JOHN B. SANFILIPPO & SON INC. (U.S.)

- RM Curtis & Co. Ltd. (U.K.)

- Voicevale Ltd (U.K.)

- Sabra Dipping Company (U.S.)

- Dashi International (U.S.)

- Peyman (Iran)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Triphala Extracts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Triphala Extracts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Triphala Extracts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.