Global Travel Retail Market

Market Size in USD Billion

CAGR :

%

USD

79.93 Billion

USD

229.45 Billion

2024

2032

USD

79.93 Billion

USD

229.45 Billion

2024

2032

| 2025 –2032 | |

| USD 79.93 Billion | |

| USD 229.45 Billion | |

|

|

|

|

Travel Retail Market Size

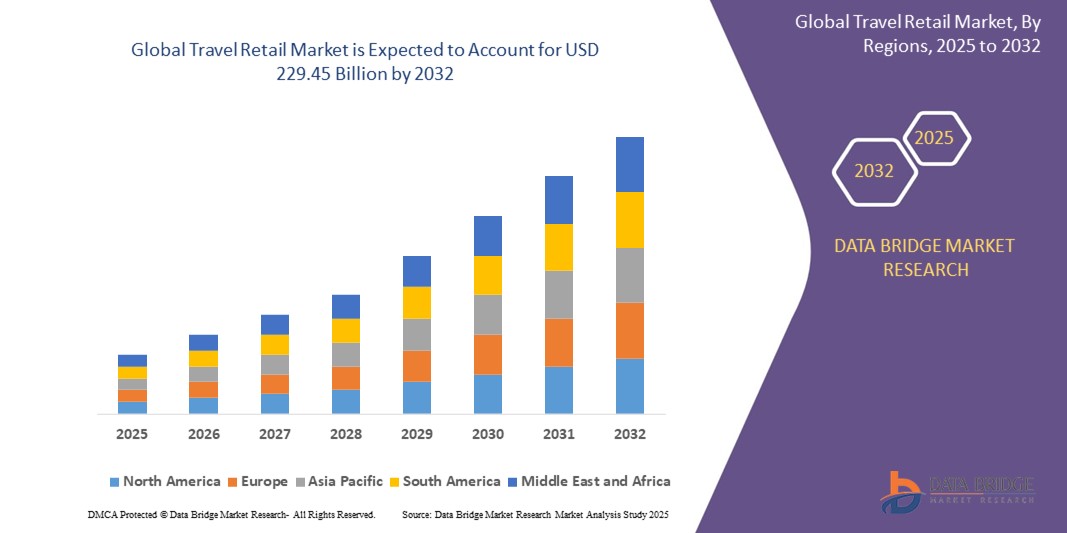

- The global travel retail market size was valued at USD 79.93 billion in 2024 and is expected to reach USD 229.45 billion by 2032, at a CAGR of 14.09% during the forecast period

- The market growth is largely fuelled by the rising international tourism, increasing air passenger traffic, and the growing demand for premium and duty-free products among global travelers

- The market growth is also supported by the expansion of airport infrastructure and the strategic placement of retail outlets offering luxury goods, cosmetics, and alcoholic beverages, enhancing the overall shopping experience for travelers

Travel Retail Market Analysis

- The travel retail market is witnessing strong momentum as global travelers increasingly prefer shopping at airports for exclusive, tax-free products, especially in categories such as beauty, fashion, and alcohol

- Leading brands are enhancing visibility and sales through interactive retail experiences, digital promotions, and limited-edition offerings tailored for international passengers

- Asia-Pacific dominated the global travel retail market in 2024, driven by strong international tourism, a rising middle-class population, and increasing investments in airport infrastructure and luxury retail development

- Europe region is expected to witness the highest growth rate in the global travel retail market, driven by the resurgence of international tourism, increased airport investments, and rising demand for premium and luxury goods among travelers

- The perfume and cosmetics segment held the largest revenue share in 2024, driven by high consumer interest in premium beauty products and exclusive travel-only offerings. Brands often launch limited-edition items and travel sets, enhancing appeal among international travelers looking for high-value purchases

Report Scope and Travel Retail Market Segmentation

|

Attributes |

Travel Retail Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Travel Retail Market Trends

“Experiential Shopping Enhancing Consumer Engagement in Travel Retail”

- Brands are using pop-ups and interactive booths to boost in-store engagement; for instance, Chanel set up airport-exclusive beauty pop-ups offering customized skincare consultations

- Personalized product recommendations and real-time consultations enhance the shopper experience, such as Dior providing skin analysis tools in duty-free locations

- Sensory elements such as scent zones and hands-on product trials create emotional connections and increase purchase intent among travelers

- Liquor and cosmetics brands offer tastings and immersive virtual brand stories at airport outlets to educate and captivate international consumers

- Experiential retail formats extend dwell time, drive impulse purchases, and build brand loyalty in a competitive travel retail environment

Travel Retail Market Dynamics

Driver

“Increasing International Passenger Traffic and Tourism Growth”

- The surge in international air travel and tourism is significantly increasing footfall in airports, cruise lines, and duty-free shops, driving higher retail demand in transit zones

- Improved airport infrastructure and the launch of new international routes are expanding shopping opportunities for travelers during their journeys

- Travel retail leverages a captive audience in a duty-free environment, where attractive pricing on premium goods encourages impulse and luxury purchases

- Travelers increasingly see in-transit purchases as part of the experience, especially favoring exclusive and locally themed products

- For instance, airports such as Singapore Changi and Dubai International are enhancing retail spaces with luxury and cosmetics outlets to meet rising passenger expectations and boost spending

Restraint/Challenge

“Regulatory Restrictions and Duty-Free Limitations”

- The travel retail market faces challenges due to inconsistent international trade regulations and duty-free limitations, affecting product availability and pricing across borders

- Travelers often struggle to understand duty-free purchase limits, which may discourage buying or result in unintentional policy violations

- Government restrictions on products such as alcohol and tobacco in certain regions limit the assortment that travel retailers can offer

- Currency volatility and changes in taxation policies complicate pricing strategies, especially for global brands that aim for consistency

- For instance, differing labeling and packaging standards across countries force retailers to manage complex compliance requirements, increasing operational burdens and slowing global expansion

Travel Retail Market Scope

The market is segmented on the basis of product, distribution channel, sector, and end users.

- By Product

On the basis of product, the travel retail market is segmented into perfume and cosmetics, wine and spirit, electronics, luxury goods, food, confectionery, and catering, tobacco, and others. The perfume and cosmetics segment held the largest revenue share in 2024, driven by high consumer interest in premium beauty products and exclusive travel-only offerings. Brands often launch limited-edition items and travel sets, enhancing appeal among international travelers looking for high-value purchases.

The wine and spirit segment is projected to witness the fastest growth rate from 2025 to 2032, due to increasing demand for premium alcoholic beverages and exclusive global travel editions. This growth is supported by partnerships between brands and airport retailers, offering tasting stations and personalized shopping experiences to elevate customer engagement.

- By Distribution Channel

On the basis of distribution channel, the retail market is segmented into airport, cruise liner, railway station, and border, downtown, and hotel shop. The airport segment dominated the market in 2024 due to high passenger volumes and a well-established retail infrastructure. Airports provide ideal conditions for brands to reach global travelers through high-traffic environments, offering visibility and convenience.

Downtown and hotel shop channels is projected to witness the fastest growth rate from 2025 to 2032, as retailers expand their footprint into city centers and hotels, targeting tourists in non-airport settings. These locations offer flexibility, extended shopping hours, and curated experiences tailored to the local culture and consumer preferences.

- By Sector

On the basis of sector, the travel retail market is segmented into duty-free and duty paid. The duty-free segment led the market in 2024, fueled by price advantages and the appeal of tax-exempt luxury products. International travelers often prioritize duty-free purchases as part of their journey, especially at major airport hubs.

The duty paid segment is projected to witness the fastest growth rate from 2025 to 2032, due to a rise in downtown retail spaces and hotel-based travel shops that cater to tourists and business travelers alike. These outlets offer premium goods and provide easy access to travelers who may not transit through duty-free zones.

- By End Users

On the basis of end users, the travel retail market is segmented into children (less than 18 years old), youth (18-30 years old), middle-aged (18-59 years old), and the elder (greater than 60 years old). The middle-aged group held the largest market share in 2024, driven by higher disposable incomes, frequent travel habits, and interest in luxury and branded products.

The youth segment is projected to witness the fastest growth rate from 2025 to 2032, influenced by rising international travel among young adults and a growing preference for trendy, tech-savvy, and experience-oriented purchases. Social media influence and digital payment options further encourage spending in this demographic.

Travel Retail Market Regional Analysis

- Asia-Pacific dominated the global travel retail market in 2024, driven by strong international tourism, a rising middle-class population, and increasing investments in airport infrastructure and luxury retail development

- Consumers in the region are showing a growing preference for premium and exclusive products, such as perfumes, cosmetics, and luxury goods, often purchased as part of the travel experience

- Major airport hubs across countries such as China, South Korea, and Singapore continue to expand retail offerings, contributing to higher spending per passenger and greater market penetration

China Travel Retail Market Insight

The China travel retail market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by its position as a major global travel hub and the rapid development of domestic duty-free policies. Government support for Hainan as a duty-free destination and strong consumer demand for luxury goods are key factors supporting growth. With rising incomes and digital integration in travel shopping, China remains a dominant force in regional market expansion.

Japan Travel Retail Market Insight

The Japan travel retail market is projected to witness the fastest growth rate from 2025 to 2032, driven by the return of inbound tourism and strong domestic travel trends. Airports such as Narita and Haneda are enhancing their duty-free zones with an emphasis on Japanese cosmetics, electronics, and cultural souvenirs, appealing to both local and international travelers. Japan’s focus on technology and service excellence also supports personalized shopping experiences, further boosting market appeal.

North America Travel Retail Market Insight

The North America travel retail market held a significant share in 2024, supported by the revival of international air travel and modernization of airport terminals. The market is benefiting from the rising demand for luxury, beauty, and wellness products among travelers. Retail innovation, including self-checkout kiosks and app-based shopping, is also enhancing customer convenience and spending in key hubs such as the U.S. and Canada.

U.S. Travel Retail Market Insight

The U.S. travel retail market captured the largest share in North America in 2024, driven by its large network of international airports and strong consumer appetite for branded and premium products. Continued investment in digital technologies and curated retail experiences, especially in major airports such as JFK, LAX, and Atlanta, are stimulating growth. The country’s robust tourism industry also supports a consistent flow of international travelers engaging in duty-free shopping.

Europe Travel Retail Market Insight

The Europe travel retail market is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing intra-European travel and the demand for high-end products from tourists. Major airport hubs in France, Germany, and the U.K. are enhancing luxury retail zones to cater to both regional and global travelers. The market is also influenced by regulatory shifts and evolving shopper preferences for sustainable and personalized experiences.

U.K. Travel Retail Market Insight

The U.K. travel retail market is projected to witness the fastest growth rate from 2025 to 2032, supported by the recovery of tourism and the continued appeal of British brands in categories such as cosmetics, alcohol, and fashion. Key airports such as Heathrow and Gatwick are expanding their retail presence with a focus on exclusivity and digital engagement. The U.K.’s well-established tourism infrastructure provides a strong foundation for retail growth.

Germany Travel Retail Market Insight

The Germany travel retail market is projected to witness the fastest growth rate from 2025 to 2032, supported by a strong international travel network and a reputation for high-quality products. Major airports including Frankfurt and Munich are expanding luxury and fashion retail offerings to meet traveler demand. Moreover, Germany’s central location in Europe and high volume of business and leisure travelers make it a strategic market for both duty-free and duty-paid travel retail channels.

Travel Retail Market Share

The Travel Retail industry is primarily led by well-established companies, including:

- King Power Group (Thailand)

- Aer Rianta International (Ireland)

- DFS Group Ltd. (Hong Kong)

- Dubai Duty Free (U.A.E.)

- China Tourism Group (China)

- Gebr. Heinemann SE & Co. KG (Germany)

- Duty Free Americas, Inc. (U.S.)

- Flemingo. (India)

- Qatar Duty Free (Qatar)

- 3Sixty Duty Free (U.S.)

- Dufry (Switzerland)

- Lagardère (France)

Latest Developments in Global Travel Retail Market

- In January 2023, Lotte Duty Free partnered with South Korean beauty brand Nonfiction to diversify its product portfolio. This collaboration aims to attract travelers seeking premium and culturally authentic beauty products, enhancing customer engagement and broadening appeal in the travel retail space. The move strengthens Lotte’s positioning in offering locally renowned brands

- In June 2021, LVMH joined forces with the environmental nonprofit Canopy to promote sustainable practices in its travel retail operations. This initiative focuses on using eco-friendly materials and supply chains, aligning with the growing demand for responsible consumption and reinforcing LVMH's commitment to environmental stewardship in global retail

- In February 2021, Hudson Group introduced its Hudson Nonstop store at Dallas Love Field Airport using Amazon’s Just Walk Out technology. This innovation allows seamless, cashier-less shopping, significantly enhancing convenience and efficiency for travelers. It marks a shift toward smart retailing in travel environments, adapting to evolving consumer expectations

- In February 2021, DFS Group entered a joint venture with Shenzhen Duty Free Group to open a duty-free shopping center in Haikou Mission Hills, Hainan. The strategic location targets rising tourist footfall and reflects the industry's focus on tapping into high-potential, travel-driven markets. The development expands DFS's presence in Asia and caters to demand for accessible luxury

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRAVEL RETAIL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TRAVEL RETAIL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL TRAVEL RETAIL MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BEHAVIOR PATTERNS

5.1.1 MILLENIALS

5.1.2 GEN Z

5.1.3 BABY BOOMERS

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PORTER’S FIVE FORCES

5.4 VENDOR SELECTION CRITERIA

5.5 PESTEL ANALYSIS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 GLOBAL TRAVEL RETAIL MARKET, BY SHOPPING MEDIUM, (2022-2031) (USD MILLION)

7.1 OVERVIEW

7.2 AIRPORTS

7.2.1 DUTY-FREE SHOPS

7.2.2 DUTY-PAID SHOPS

7.2.3 LUXURY BOUTIQUES

7.2.4 OTHERS

7.3 AIRLINES

7.3.1 IN-FLIGHT SHOPPING

7.3.2 PRE-ORDER SERVICES

7.3.3 OTHERS

7.4 FERRIES

7.4.1 ONBOARD SHOPS

7.4.2 DUTY-FREE ZONES

7.4.3 OTHERS

7.5 AMUSEMENT PARKS

7.5.1 RETAIL STORES

7.5.2 THEMED MERCHANDISE SHOPS

7.5.3 OTHERS

7.6 RAILWAY STATIONS

7.7 OTHERS

8 GLOBAL TRAVEL RETAIL MARKET, BY OFFERING, (2022-2031) (USD MILLION)

8.1 OVERVIEW

8.2 COSMETICS

8.2.1 SKIN CARE

8.2.1.1. MASKS

8.2.1.2. CLEANSING CREAM

8.2.1.3. MOISTURIZERS

8.2.1.4. SUNSCREENS

8.2.1.5. TONER

8.2.1.6. FACIAL REMOVER

8.2.1.7. DAY CREAM

8.2.1.8. NIGHT SERUM

8.2.1.9. BODY LOTIONS

8.2.1.10. BODY WASH

8.2.1.11. HAND & FOOT CREAMS

8.2.1.12. OTHERS

8.2.2 HAIR CARE

8.2.2.1. SHAMPOO

8.2.2.2. HAIR COLOR

8.2.2.2.1. HAIR COLOR, BY TYPE

8.2.2.2.1.1 HAIR DYES AND COLORS

8.2.2.2.1.2 HAIR TINTS

8.2.2.2.1.3 HAIR BLEACHES

8.2.2.2.1.4 OTHERS

8.2.2.2.2. HAIR COLOR, BY HAIR TYPE

8.2.2.2.2.1 NORMAL

8.2.2.2.2.2 DRY

8.2.2.2.2.3 OILY

8.2.2.3. CONDITIONERS

8.2.2.4. SERUMS

8.2.2.5. SPRAYS

8.2.2.6. OIL

8.2.2.7. OTHERS

8.2.3 FRAGRANCES

8.2.4 MAKE UP

8.2.4.1. EYE SHADOWS

8.2.4.2. FOUNDATION

8.2.4.3. MASCARA

8.2.4.4. BRONZER

8.2.4.5. BLUSH

8.2.4.6. OTHERS

8.2.5 OTHERS

8.3 PERSONAL HYGIENE

8.3.1 SOAPS

8.3.2 HAND SANITIZERS

8.3.3 BATH & SHOWER PRODUCTS

8.3.4 FACE CARE PRODUCTS

8.3.5 OTHERS

8.4 NON-ALCOHOLIC BEVERAGES

8.4.1 CARBONATED SOFT DRINKS (CSDS)

8.4.2 FRUIT BEVERAGES

8.4.3 BOTTLED WATERS

8.4.4 FUNCTIONAL BEVERAGES

8.4.5 SPORTS DRINKS

8.4.6 OTHERS

8.5 ALCOHOLIC BEVERAGES

8.5.1 WINE

8.5.1.1. TABLE WINE

8.5.1.2. DESSERT WINE

8.5.1.3. SPARKLING WINE

8.5.1.4. OTHERS

8.5.2 BEER

8.5.2.1. LAGER

8.5.2.2. ALE

8.5.2.3. OTHERS

8.5.3 SPIRITS

8.5.3.1. WHISKEY

8.5.3.2. RUM

8.5.3.3. VODKA

8.5.3.4. GIN

8.5.3.5. OTHERS

8.5.4 TEQUILLA

8.5.5 LIQUER

8.5.6 AMARO AND APERTIVO

8.6 TOBACCO

8.6.1 SMOKELESS

8.6.1.1. SNUS

8.6.1.2. SNUFF

8.6.1.3. CHEWING TOBACCO

8.6.1.4. OTHERS

8.6.2 CIGARETTES

8.6.2.1. SLIM

8.6.2.2. SUPER SLIM

8.6.2.3. KING SIZE

8.6.2.4. REGULAR

8.6.3 CIGAR & CIGARILLOS

8.6.4 E-CIGARETTES AND VAPES

8.6.5 E-HOOKAHS

8.6.6 OTHERS

8.7 CONFECTIONERY

8.7.1 FLOUR CONFECTIONERY

8.7.2 HARD-BOILED SWEETS

8.7.3 MINTS

8.7.4 GUMS & JELLIES

8.7.5 CHOCOLATE

8.7.5.1. WHITE

8.7.5.2. DARK

8.7.5.3. MILK

8.7.6 CARAMELS & TOFFEES

8.7.7 MEDICATED CONFECTIONERY

8.7.8 OTHERS

8.8 BAKERY PRODUCTS

8.8.1 BISCUITS

8.8.2 BREAD & ROLLS

8.8.3 CAKES & PASTRIES

8.8.4 RUSKS

8.8.5 COOKIES

8.8.6 TORTILLAS

8.8.7 PRETZEL

8.8.8 PIZZA CRUSTS

8.8.9 OTHERS

8.9 CLOTHING

8.9.1 JACKETS & COATS

8.9.2 BLAZERS

8.9.3 POLO SHIRTS

8.9.4 CASUAL SHIRTS

8.9.5 T-SHIRTS

8.9.6 SHORTS & TROUSERS

8.9.7 JUMPERS & CARDIGANS

8.9.8 HOODIES & SWEATSHIRTS

8.9.9 FORMAL SHIRTS

8.9.10 TRACKSUITS

8.9.11 JEANS

8.9.12 SUITS & TAILORING

8.9.13 LOUNGE & SLEEPWEAR

8.9.14 SWIMWEAR

8.9.15 SHAPEWEAR

8.9.16 BLOUSES

8.9.17 SKIRTS

8.9.18 SLEEPWEAR

8.9.19 OTHERS

8.1 ELECTRONICS

8.10.1 TELEVISIONS

8.10.2 CELL PHONES

8.10.3 SPEAKERS

8.10.4 BLUETOOTH HEAD SETS

8.10.5 I-PODS

8.10.6 GADGET CHARGERS

8.10.7 KITCHEN APPLIANCES

8.10.8 OTHERS

8.11 BAGS

8.11.1 TRAVEL BAGS

8.11.2 CASUAL BAGS

8.11.3 BUSINESS BAGS

8.11.4 ROLLABLE LUGGAGE

8.11.5 DUFFEL BAGS

8.11.6 SUITCASE & BRIEFCASE

8.11.7 OTHERS

8.12 HOME FURNISHING

8.12.1 CUSHIONS & CURTAINS

8.12.2 DECORATIVE ACCESSORIES

8.12.3 DESK ACCESSORIES

8.12.4 DOOR MATS

8.12.5 POTS AND PLANTERS

8.12.6 MIRRORS

8.12.7 FURNITURE

8.12.8 OTHERS

8.13 FOOTWEAR

8.13.1 SHOES

8.13.2 SANDALS

8.13.3 FLIP FLOPS/SLIPPERS

8.13.4 OTHERS

8.14 HEALTHCARE & MEDICAL

8.15 OTHERS

9 GLOBAL TRAVEL RETAIL MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION)

GLOBAL TRAVEL RETAIL MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

9.2 EUROPE

9.2.1 GERMANY

9.2.2 U.K.

9.2.3 ITALY

9.2.4 FRANCE

9.2.5 SPAIN

9.2.6 RUSSIA

9.2.7 SWITZERLAND

9.2.8 TURKEY

9.2.9 BELGIUM

9.2.10 NETHERLANDS

9.2.11 LUXEMBURG

9.2.12 REST OF EUROPE

9.3 ASIA-PACIFIC

9.3.1 JAPAN

9.3.2 HONG KONG

9.3.3 CHINA

9.3.4 SOUTH KOREA

9.3.5 INDIA

9.3.6 SINGAPORE

9.3.7 THAILAND

9.3.8 INDONESIA

9.3.9 MALAYSIA

9.3.10 PHILIPPINES

9.3.11 AUSTRALIA & NEW ZEALAND

9.3.12 REST OF ASIA-PACIFIC

9.4 SOUTH AMERICA

9.4.1 BRAZIL

9.4.2 ARGENTINA

9.4.3 REST OF SOUTH AMERICA

9.5 MIDDLE EAST AND AFRICA

9.5.1 SOUTH AFRICA

9.5.2 EGYPT

9.5.3 SAUDI ARABIA

9.5.4 UNITED ARAB EMIRATES

9.5.5 ISRAEL

9.5.6 REST OF MIDDLE EAST AND AFRICA

10 GLOBAL POTASSIUM CARBONATE MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.5 MERGERS AND ACQUISITIONS

10.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

10.7 EXPANSIONS

10.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

11 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

12 GLOBAL TRAVEL RETAIL MARKET - COMPANY PROFILES

12.1 LAGARDÈRE TRAVEL RETAIL, A DIVISION OF THE LAGARDÈRE GROUP

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 DFS (LVMH MOËT HENNESSY - LOUIS VUITTON)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATES

12.3 LOTTEHOTEL

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

12.4 DUFRY

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 GEBR. HEINEMANN SE & CO. KG

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATES

12.6 KING POWER CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 THE SHILLA DUTY FREE

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 EVER RICH DUTY FREE

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATES

12.9 DUBAI DUTY FREE

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATES

12.1 DUTY FREE AMERICAS

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATES

12.11 SHINSEGAE DUTY FREE

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATES

12.12 AER RIANTA INTERNATIONAL

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 WH SMITH PLC

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATES

12.14 CHINA TOURISM GROUP

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT UPDATES

12.15 DELHI DUTY FREE SERVICES PRIVATE LIMITED

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT UPDATES

12.16 FLEMINGO

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT UPDATES

12.17 HAMILA DUTY FREE (MIDDLE EAST & AFRICA DUTY FREE ASSOCIATION (MEADFA)

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT UPDATES

12.18 THE WALT DISNEY COMPANY

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT UPDATES

12.19 CANADA'S WONDERLAND

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT UPDATES

12.2 SIX FLAGS ENTERTAINMENT CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

13 RELATED REPORTS

14 QUESTIONNAIRE

15 CONCLUSION

16 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.