Global Transaction Handling Market

Market Size in USD Billion

CAGR :

%

USD

15.30 Billion

USD

98.40 Billion

2024

2032

USD

15.30 Billion

USD

98.40 Billion

2024

2032

| 2025 –2032 | |

| USD 15.30 Billion | |

| USD 98.40 Billion | |

|

|

|

|

Transaction Handling Market Analysis

The transaction handling market has seen substantial growth, driven by advancements in digital technologies, the rise of e-commerce, and the increasing demand for secure payment solutions. As businesses and consumers shift towards cashless transactions, the need for efficient, real-time processing systems has intensified. The adoption of electronic payment systems, such as mobile wallets, contactless payments, and cryptocurrencies, has expanded market opportunities. In addition, advancements in blockchain technology and artificial intelligence (AI) have enhanced the security, transparency, and speed of transaction handling, mitigating the risk of fraud and improving customer experience. One of the key trends in the transaction handling market is the integration of AI and machine learning (ML) for fraud detection and prevention. AI algorithms can analyze transaction patterns in real time, quickly identifying potential threats. In addition, the rise of biometric authentication, such as facial recognition and fingerprint scanning, has further strengthened security measures.

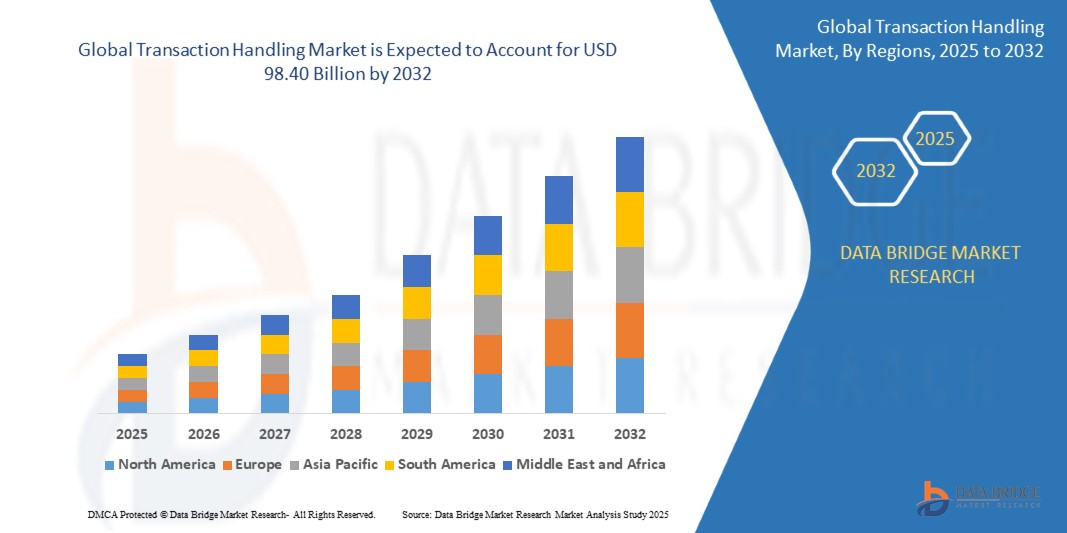

North America remains the dominant region due to the high adoption of digital payment systems, while Asia-Pacific is witnessing the fastest growth, driven by the increasing number of digital transactions in countries such as China and India. As regulatory frameworks evolve and consumer trust increases, the market for transaction handling solutions is expected to expand significantly.

Transaction Handling Market Size

The global transaction handling market size was valued at USD 15.30 billion in 2024 and is projected to reach USD 98.40 billion by 2032, with a CAGR of 26.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Transaction Handling Market Trends

“Growing Integration of Artificial Intelligence (AI) and Machine Learning (ML)”

The transaction handling market is evolving rapidly, with one key trend being the integration of artificial intelligence (AI) and machine learning (ML) for enhanced fraud detection and real-time transaction processing. AI algorithms are increasingly being deployed to monitor transaction patterns, identify anomalies, and prevent fraudulent activities before they occur. For instance, PayPal uses AI-driven systems to detect suspicious transactions, allowing for faster and more accurate fraud prevention. This trend is critical as the volume of digital transactions continues to rise, particularly in regions such as North America and Asia-Pacific, where e-commerce and mobile payments are expanding rapidly. In addition, blockchain technology is gaining traction, offering increased transparency and security for handling transactions, particularly in financial services and supply chain management. As these technologies continue to mature, they are driving market growth by providing safer, more efficient, and transparent solutions for businesses and consumers asuch as, ensuring a seamless transaction experience while maintaining high security standards.

Report Scope and Transaction Handling Market Segmentation

|

Attributes |

Transaction Handling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of Sonouth America as part of South America |

|

Key Market Players |

IDology (U.S.), ACI Worldwide (U.S.), ACTICO GmbH (Germany), BAE Systems (U.K.), Beam Solutions (U.S.), Bottomline Technologies, Inc. (U.S.), Caseware International Inc. (Canada), ComplianceWise (Netherlands), ComplyAdvantage (U.K.), Eastnets (Jordan), Experian (Ireland), FICO (U.S.), FIS (U.S.), Fiserv, Inc. (U.S.), Infrasoft Technologies (India), IdentityMind Global (U.S.), NICE (Israel), Oracle (U.S.), LSEG Data & Analytics (U.K.), SAS Institute Inc. (U.S.), and Software GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Transaction Handling Market Definition

Transaction handling refers to the process of managing, processing, and securing financial or data transactions between parties, typically involving the exchange of goods, services, or information. This includes activities such as payment authorization, fraud prevention, record-keeping, and ensuring the integrity and security of the transaction data.

Transaction Handling Market Dynamics

Drivers

- Increase in Digital Payments

The increase in digital payments has become a significant driver of the transaction handling market, as more consumers and businesses embrace online shopping, mobile wallet usage, and contactless payments. For instance, platforms such as PayPal and Apple Pay have revolutionized the way people make purchases, driving a shift toward cashless transactions. As these digital payment methods become more prevalent, the demand for efficient and secure transaction handling systems has grown. The need for fast and seamless payment processing is essential to meet consumer expectations for quick transactions while ensuring security against fraud. In addition, the rise of mobile commerce and peer-to-peer (P2P) payment systems, such as Venmo and Alipay, further fuels the demand for robust transaction systems that can handle high transaction volumes securely. This growing adoption of digital payments is pushing the market toward innovations in transaction processing technologies, making it a key driver for the expansion of the transaction handling market.

- Increasing Adoption of Smart Devices

The increasing adoption of smart devices is a key driver for the growth of the Transaction Handling market. As the use of smart speakers, smartphones, and virtual assistants becomes more widespread, consumers are increasingly relying on these devices for everyday tasks, including managing their bank accounts. Voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri have integrated banking features that allow users to check balances, transfer funds, and make payments through simple voice commands. For instance, customers of Bank of America can link their accounts to Alexa and ask for balance updates or recent transactions. This convenience of accessing banking services hands-free, paired with the growing prevalence of smart devices in homes and on mobile phones, is encouraging more users to adopt Transaction Handling. The rise in smart device adoption, combined with its ease of use, continues to drive the market, making Transaction Handling more accessible and appealing to consumers.

Opportunities

- Increasing Advancements in Security Technologies

Advancements in security technologies present a significant opportunity in the transaction handling market, as the increasing frequency of cyber threats drives the demand for more robust and secure systems. Technologies such as blockchain are being integrated into payment systems to enhance transparency, traceability, and security by creating immutable transaction records, reducing the risk of fraud and tampering. For instance, Ripple leverages blockchain to offer secure and fast cross-border payments, improving transaction reliability. Similarly, AI-powered fraud detection systems, such as those used by Mastercard and Visa, use machine learning algorithms to monitor transactions in real-time, identifying and blocking fraudulent activities before they occur. In addition, biometric authentication methods such as facial recognition and fingerprint scanning are being incorporated into payment solutions to add an extra layer of security, ensuring that only authorized individuals can complete transactions. As businesses and consumers continue to prioritize security, these technological advancements offer a growing market opportunity, with companies investing in cutting-edge systems to safeguard transactions and build consumer trust.

- Growing Regulations on Data Privacy and Financial Transactions

Regulatory compliance is increasingly shaping the transaction handling market as governments around the world implement stricter regulations on data privacy and financial transactions. For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe and Payment Services Directive 2 (PSD2) require businesses to ensure that transaction systems protect customer data and provide secure payment processes. These regulations have driven businesses to invest in compliant transaction handling systems that meet legal standards and enhance consumer trust. For instance, Stripe, a global payment processor, ensures compliance with both GDPR and PSD2 by incorporating features such as strong customer authentication (SCA) in its payment systems. As a result, the need for secure, compliant solutions presents a market opportunity for companies to innovate and develop systems that help businesses adhere to complex regulatory frameworks. The ongoing evolution of data privacy laws and financial regulations further fuels the demand for transaction handling systems that guarantee compliance, creating a lucrative growth area for market players.

Restraints/Challenges

- Cost Management

Cost management is a significant challenge in the transaction handling market, as the implementation and ongoing maintenance of these systems can be costly. Businesses must invest in the initial setup of transaction processing infrastructure and in continuous updates, security patches, and ensuring compliance with evolving regulations. For instance, the introduction of the General Data Protection Regulation (GDPR) in the European Union required companies to overhaul their data management practices, leading to substantial costs for updating systems and ensuring compliance. In addition, the need for advanced encryption, fraud detection systems, and maintaining high levels of uptime adds to the financial burden. These ongoing expenses, combined with the pressures of meeting customer expectations for security and speed, make cost management a constant challenge for businesses operating in this space, especially for small and medium-sized enterprises with limited budgets.

- Fraud and Security Risks

Fraud and security risks are a major challenge in the transaction handling market, as the increasing frequency and sophistication of cyber threats and fraud attempts can result in significant data breaches, financial losses, and a decline in consumer trust. For instance, in 2017, Equifax, one of the largest credit reporting agencies, suffered a massive data breach exposing the personal data of over 147 million people, leading to financial losses and severe reputational damage. Similarly, in the payment processing sector, fraud attempts, such as credit card skimming and phishing attacks, often compromise transaction data, prompting businesses to invest heavily in encryption technologies, multi-factor authentication, and real-time fraud detection systems. The constant evolution of cyber threats means transaction handling systems must continuously update their security measures, making this a significant and ongoing challenge for businesses in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Transaction Handling Market Scope

The market is segmented on the basis of solution, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Electronic Signatures

- Workflow Automation

- Authentication

- Document Archival

- Others

Deployment Mode

- On-premise

- Cloud

Organization Size

- SMEs

- Large Companies

Vertical

- Banking and Financial Services

- Insurance

- Government and Defense

- IT and Telecommunications

- Retail

- Healthcare

- Energy

- Utilities

- Manufacturing

- Others

Transaction Handling Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, solution, deployment mode, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the transaction handling market, driven by the widespread adoption of advanced digital technologies and the presence of key industry players. The region benefits from robust financial infrastructure and high demand for secure and efficient transaction solutions across various sectors, including banking, retail, and e-commerce. In addition, North America’s emphasis on regulatory compliance and cybersecurity has fueled the adoption of innovative platforms that enhance transaction accuracy and safety. This dominant position is further supported by increased investments in technology and growing consumer preference for seamless digital experiences.

Asia-Pacific is experiencing the fastest growth in the transaction handling market, fueled by rapid digital transformation and the increasing adoption of electronic payment systems. The region's expanding e-commerce sector, coupled with rising smartphone penetration, has driven the demand for efficient and secure transaction solutions. Governments in countries such as India and China are actively promoting cashless economies through initiatives such as digital wallets and unified payment interfaces, further accelerating market growth. In addition, the region's large and growing population presents a vast consumer base, making Asia-Pacific a key area of focus for market players.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Transaction Handling Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Transaction Handling Market Leaders Operating in the Market Are:

- IDology (U.S.)

- ACI Worldwide (U.S.)

- ACTICO GmbH (Germany)

- BAE Systems (U.K.)

- Beam Solutions (U.S.)

- Bottomline Technologies, Inc. (U.S.)

- Caseware International Inc. (Canada)

- ComplianceWise (Netherlands)

- ComplyAdvantage (U.K.)

- Eastnets (Jordan)

- Experian (Ireland)

- FICO (U.S.)

- FIS (U.S.)

- Fiserv, Inc. (U.S.)

- Infrasoft Technologies (India)

- IdentityMind Global (U.S.)

- NICE (Israel)

- Oracle (U.S.)

- LSEG Data & Analytics (U.K.)

- SAS Institute Inc. (U.S.)

- Software GmbH (Germany)

Latest Developments in Transaction Handling Market

- In June 2024, OneSpan Inc. introduced the OneSpan Integration Platform, a solution aimed at simplifying the integration of eSignatures into widely used applications. In the platform enhances efficiency by streamlining the processes of sending, signing, and storing transactions. In with businesses using an average of 342 SaaS applications, the platform addresses challenges faced by IT teams in maintaining security and performance while optimizing business processes

- In May 2023, DocuSign unveiled the DocuSign Agreement Cloud, a comprehensive platform that combines its electronic signature technology with advanced document management and process automation features, enabling organizations to streamline their agreement workflows effectively

- In November 2023, DocuSign launched WhatsApp Delivery, a feature enabling users to expedite deal closures by integrating eSignatures with WhatsApp. In this feature sends real-time notifications to signers, linking them directly to agreements and providing a secure and efficient signing experience through their preferred communication platform

- In September 2022, DocuSign partnered with Zavvie to integrate its eSignature technology with the MoxiEngage CRM. In this collaboration enhances Zavvie’s digital transaction management system, enabling agents to seamlessly manage transactions and agreement workflows with their clients

- In December 2022, Skyslope announced a partnership with Weichert, Realtors, to bring its digital transaction management solutions to over 7,000 corporate associates. In this collaboration expands Skyslope's reach across the U.S. and Canada, offering agents access to a leading digital signature platform for real estate transactions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.