Global Titanium Market

Market Size in USD Billion

CAGR :

%

USD

2.59 Billion

USD

4.26 Billion

2024

2032

USD

2.59 Billion

USD

4.26 Billion

2024

2032

| 2025 –2032 | |

| USD 2.59 Billion | |

| USD 4.26 Billion | |

|

|

|

|

Titanium Market Analysis

The titanium market is witnessing significant growth, driven by its widespread applications across industries such as aerospace, defense, medical, industrial, and automotive. Titanium’s high strength-to-weight ratio, corrosion resistance, and biocompatibility make it a preferred material in manufacturing lightweight aircraft components, medical implants, and high-performance industrial equipment. Advancements in production technologies, including electron beam melting, vacuum arc remelting, and additive manufacturing (3D printing), are enhancing the efficiency and cost-effectiveness of titanium processing. The aerospace sector remains a major consumer due to increasing aircraft production, while the medical sector is experiencing rising demand for titanium-based implants and prosthetics. In addition, the growing focus on sustainable manufacturing and recycling of titanium scrap is further propelling market growth. Countries such as China, the U.S., and Japan are heavily investing in expanding titanium production capacity to meet rising global demand. However, challenges such as high production costs and raw material scarcity continue to impact market expansion. With continuous technological innovations and increasing industrial adoption, the titanium market is expected to grow steadily, catering to evolving needs in high-performance applications.

Titanium Market Size

The global titanium market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 4.26 billion by 2032, with a CAGR of 6.40 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Titanium Market Trends

Rising Adoption of Titanium in Additive Manufacturing

One notable trend in the titanium market is the rising adoption of titanium in additive manufacturing (3D printing), revolutionizing industries such as aerospace, medical, and automotive. Titanium’s high strength-to-weight ratio, corrosion resistance, and biocompatibility make it ideal for manufacturing complex, lightweight, and high-performance components. The aerospace industry, for instance, is leveraging 3D-printed titanium parts to reduce aircraft weight, enhance fuel efficiency, and improve structural durability. A prime instance is Boeing and Airbus, which are increasingly using titanium 3D-printed components in next-generation aircraft. Similarly, the medical sector is witnessing growth in customized titanium implants and prosthetics, offering enhanced patient compatibility and faster recovery times. Advancements in electron beam melting (EBM) and laser powder bed fusion (LPBF) technologies are further enhancing titanium's applications in precision manufacturing. With continuous innovations in 3D printing techniques and expanding industrial adoption, this trend is expected to drive significant growth in the titanium market in the coming years.

Report Scope and Titanium Market Segmentation

|

Attributes |

Titanium Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Huntsman International LLC. (U.S.), INEOS (U.K.), Iluka Resources Limited (Australia), Sumitomo Corporation (Japan), VSMPO-AVISMA (Russia), Toho Titanium Co., Ltd. (Japan), ATI. (U.S.), Precision Castparts Corp. (U.S.), Titanium Industries, Inc. (U.S.), Norsk Titanium US Inc. (U.S.), VVTi Pigments (India), Tronox (U.S.), Kenmare Resources plc. (Ireland), M/s Bansal Brothers (India), Titanium Technologies (U.S.), Tronox Holdings Plc (U.S.), Mukesh Steel (India), KOBE STEEL, LTD. (Japan), Kilburn (India), and Hangzhou King Titanium Co., Ltd. (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Titanium Market Definition

Titanium is a strong, lightweight, and corrosion-resistant metal known for its high strength-to-weight ratio and excellent biocompatibility. It is widely used in aerospace, medical, industrial, and marine applications due to its ability to withstand extreme conditions. Titanium is commonly found in minerals such as ilmenite and rutile and is extracted through processes such as the Kroll process.

Titanium Market Dynamics

Drivers

- Growing Demand from the Aerospace Industry

The aerospace industry plays a crucial role in driving the demand for titanium due to the material’s exceptional strength-to-weight ratio, corrosion resistance, and heat resistance. As aircraft manufacturers seek to improve fuel efficiency and structural integrity, titanium is increasingly used in critical components such as jet engine parts, landing gear, fuselage structures, and fasteners. The rise in global air travel and defense spending has further accelerated the production of commercial aircraft (Boeing 787, Airbus A350) and military fighter jets (F-35, Eurofighter Typhoon), which incorporate a high percentage of titanium. For instance, the Boeing 787 Dreamliner contains around 15% titanium by weight, significantly reducing fuel consumption and maintenance costs. The growing adoption of next-generation aircraft with higher titanium content continues to expand market opportunities, making the aerospace industry one of the most significant drivers of titanium demand.

- Expanding Applications in the Medical Sector

Titanium’s biocompatibility, lightweight nature, and corrosion resistance have positioned it as a preferred material in the medical sector, particularly for implants, prosthetics, and surgical instruments. Due to its ability to integrate well with human bone, titanium is widely used in orthopedic implants such as hip and knee replacements, spinal fusion devices, and dental implants. The increasing aging population and a rise in orthopedic disorders are contributing to the higher demand for titanium-based medical solutions. In addition, advancements in 3D printing technology have revolutionized the medical sector by allowing the creation of customized titanium implants for patients, improving surgical outcomes. For instance, companies such as Stryker and Zimmer Biomet are leveraging additive manufacturing to produce personalized titanium orthopedic implants, enhancing recovery times and patient comfort. As healthcare innovations continue to evolve, titanium’s role in medical applications is expected to grow, making it a key driver in the market.

Opportunities

- Rising Industrial and Chemical Applications

Titanium’s exceptional resistance to corrosion, high temperatures, and chemical wear has made it a crucial material in various industrial and chemical applications. Sectors such as oil and gas, desalination, power generation, and chemical processing heavily rely on titanium-based heat exchangers, pressure vessels, and pipelines to withstand extreme environments. The chemical processing industry uses titanium extensively in manufacturing reactors, storage tanks, and condensers due to its ability to resist corrosive substances such as chlorides, acids, and alkalis. In addition, the increasing global demand for fresh water is driving the expansion of desalination plants, where titanium is used in evaporators and pumps for its durability and longevity. For instance, major desalination projects in the Middle East and Australia have adopted titanium-based piping and heat exchangers, ensuring reliability and extended operational life. As industrial operations continue to scale, titanium’s role in enhancing efficiency and longevity presents a significant market opportunity.

- Increasing Advancements in Titanium Production Technologies

Innovations in titanium manufacturing processes are enhancing production efficiency, reducing costs, and expanding the availability of high-quality titanium alloys across industries. Techniques such as Electron Beam Melting (EBM), Vacuum Arc Remelting (VAR), and Plasma Arc Melting (PAM) are revolutionizing the mass production of titanium, making it more affordable and accessible for aerospace, medical, and industrial applications. For instance, EBM technology, widely adopted in 3D printing, enables the production of complex, lightweight titanium components for customized aerospace parts and medical implants. Similarly, VAR and PAM technologies are improving the purity and strength of titanium alloys used in high-performance applications such as jet engines and nuclear reactors. Companies such as ATI and VSMPO-AVISMA are heavily investing in these advanced techniques to scale up production and meet the growing global demand for titanium materials. These technological advancements lower production costs and open new opportunities for titanium’s adoption across diverse industries.

Restraints/Challenges

- High Production and Processing Costs

Titanium is an expensive metal to produce and process, primarily due to its complex extraction and refinement methods. The most commonly used process, the Kroll process, involves multiple energy-intensive steps, including chlorination, reduction with magnesium, and vacuum distillation. This process requires high temperatures and specialized equipment, making it costlier than producing metals such as aluminum or steel. In addition, titanium ore must undergo extensive purification to achieve the high-quality material required for industries such as aerospace and medical devices. For instance, in the aerospace industry, where titanium is widely used for its high strength-to-weight ratio and corrosion resistance, manufacturers face significantly higher material costs compared to using aluminum or composite materials. A titanium component can cost up to 10 times more to produce than a similar steel component, limiting its widespread adoption in cost-sensitive industries such as automotive and consumer goods. These high costs pose a significant challenge to market growth, making it difficult for smaller manufacturers and emerging markets to invest in titanium production.

- Complex Manufacturing Process

Titanium’s unique physical and chemical properties make it difficult to machine and fabricate, increasing manufacturing costs and production time. Unlike other metals, titanium has low thermal conductivity, meaning heat generated during machining does not dissipate quickly, leading to tool wear and potential material damage. In addition, titanium is highly reactive with oxygen at high temperatures, requiring specialized inert atmospheres or coatings to prevent contamination during welding and forming. For instance, in the medical industry, titanium is used for implants and prosthetics due to its biocompatibility and strength. However, machining and shaping titanium for medical implants is labor-intensive, requiring precision techniques such as laser cutting, electron beam melting, and advanced coating processes. These additional steps increase production costs, making titanium implants more expensive than stainless steel alternatives, limiting their accessibility in developing markets. This complex manufacturing process remains a major challenge in expanding titanium's use in high-volume applications, such as mass-market consumer goods or cost-sensitive industries.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Titanium Market Scope

The market is segmented on the basis of product type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Titanium Concentrate

- Titanium Tetrachloride

- Titanium Sponge

- Ferrotitanium

- Titanium Pigment

- Other

Application

- Aerospace and Marine

- Industrial

- Medical

- Energy

- Pigments, Additives and Coatings

- Papers and Plastics

- Others

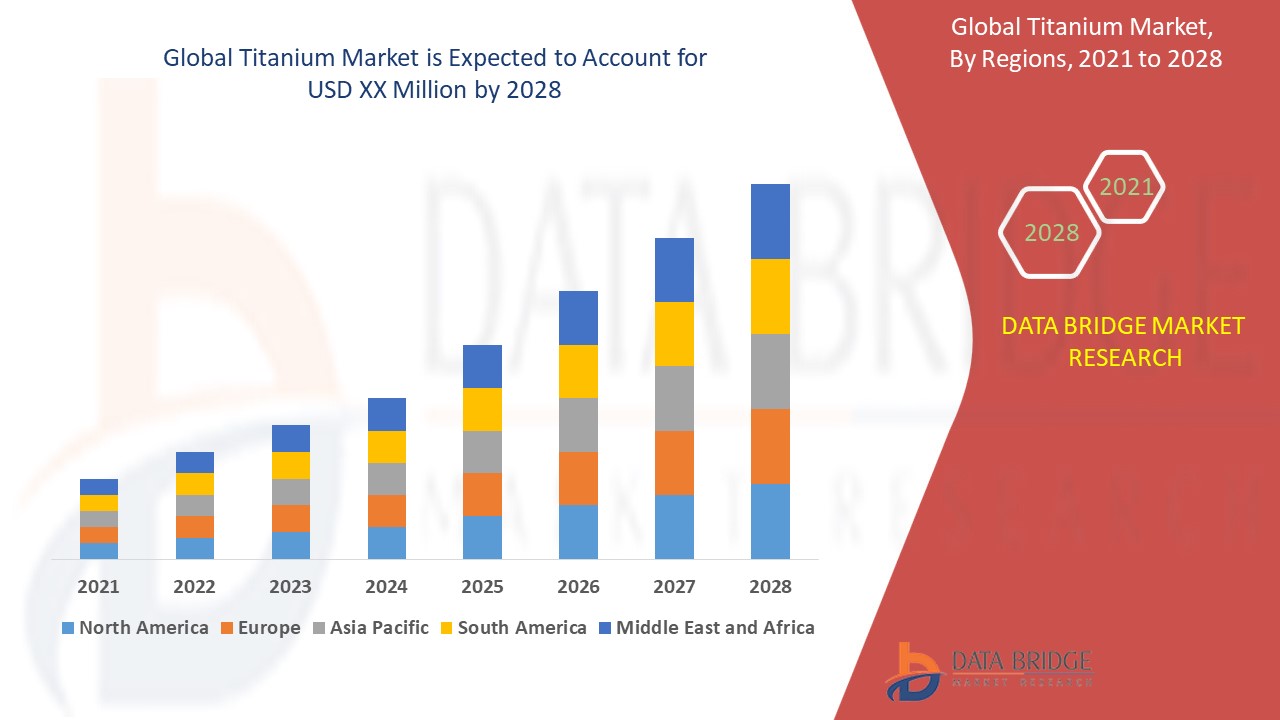

Titanium Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the titanium market, driven by rapid urbanization, infrastructure development, and expanding industrial activities in China, India, and Southeast Asian nations. The region's booming aerospace, automotive, and medical industries are fueling the demand for high-performance titanium materials. In addition, government investments in construction and manufacturing sectors are further boosting market growth. With increasing titanium production capacities and rising applications across various industries, Asia-Pacific continues to be the dominant player in the global titanium market.

Latin America and the Middle East and Africa (MEA) regions are projected to experience the fastest growth in the titanium market from 2025 to 2032, driven by a surge in photovoltaic (PV) installations. The increasing adoption of renewable energy sources, particularly solar power projects, is fueling the demand for titanium-based components in solar panels and infrastructure. In addition, supportive government policies, rising investments in clean energy, and expanding industrial applications are further accelerating market expansion. With growing awareness of sustainable energy solutions, these regions are set to emerge as key contributors to the global titanium market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Titanium Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Titanium Market Leaders Operating in the Market Are:

- Huntsman International LLC. (U.S.)

- INEOS (U.K.)

- Iluka Resources Limited (Australia)

- Sumitomo Corporation (Japan)

- VSMPO-AVISMA (Russia)

- Toho Titanium Co., Ltd. (Japan)

- ATI (U.S.)

- Precision Castparts Corp. (U.S.)

- Titanium Industries, Inc. (U.S.)

- Norsk Titanium US Inc. (U.S.)

- VVTi Pigments (India)

- Tronox (U.S.)

- Kenmare Resources plc. (Ireland)

- M/s Bansal Brothers (India)

- Titanium Technologies (U.S.)

- Tronox Holdings Plc (U.S.)

- Mukesh Steel (India)

- KOBE STEEL, LTD. (Japan)

- Kilburn (India)

- Hangzhou King Titanium Co., Ltd. (China)

Latest Developments in Titanium Market

- In July 2023, ATI, Inc., a U.S.-based manufacturing company, announced the expansion of its titanium melting operations in Richland, Washington, to increase production capacity in response to the growing demand for titanium metal in the aerospace and defense industry

- In June 2023, Toho Titanium Co., Ltd. announced plans to expand its titanium sponge production capacity by adding 3,000 tons to its annual output. The company aimed to enhance its two domestic facilities in Japan and construct a new production facility to meet the rising demand

- In November 2022, PTC Industries and Defense PSU Mishra Dhatu Nigam (MIDHANI) signed a memorandum of understanding (MoU) for a technological partnership. Under this collaboration, both companies will utilize each other's technological resources to manufacture titanium alloy pipes and tubes using locally processed raw materials, produce titanium alloy plates and sheets, and fabricate critical aerospace and defense components using PTC's advanced machining facility and Midhani's forged and rolled products

- In July 2022, Perryman Company, based in Houston, Pennsylvania, announced a major expansion of its titanium melting capacity by installing additional electron beam and vacuum arc remelt furnaces in Washington County, Pennsylvania. This expansion aimed to increase Perryman's total titanium melting capacity to 42 million pounds, adding an additional 16 million pounds, further strengthening its position as a global leader in titanium melting for aerospace and medical applications

- In July 2021, Toho Titanium moved into the demonstration development phase of its New Low-Cost, Low-Energy-Consumption Titanium Manufacturing Technology. This project was undertaken as part of the Strategic Innovation Program for Energy Conservation Technologies, conducted by the New Energy and Industrial Technology Development Organization (NEDO) to promote sustainable titanium production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Titanium Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Titanium Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Titanium Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.