Global Tire Cutting Machine Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

1.87 Billion

2024

2032

USD

1.33 Billion

USD

1.87 Billion

2024

2032

| 2025 –2032 | |

| USD 1.33 Billion | |

| USD 1.87 Billion | |

|

|

|

|

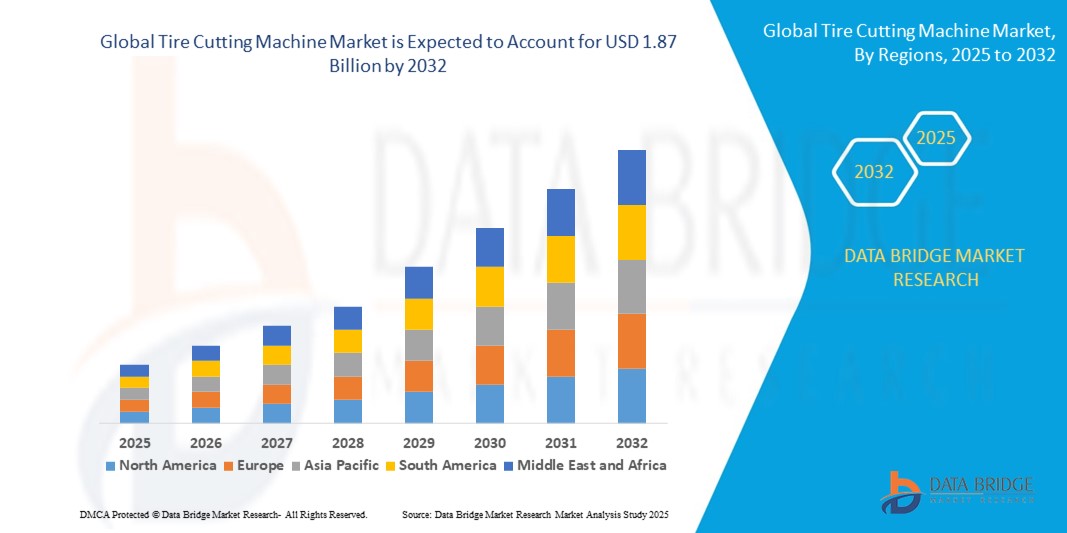

What is the Global Tire Cutting Machine Market Size and Growth Rate?

- The global tire cutting machine market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 1.87 billion by 2032, at a CAGR of 4.30% during the forecast period

- The increasing volume of used tires, resulting from the rising number of vehicles, fuels the demand for these machines. They efficiently process tires for recycling and disposal, addressing the challenge of tire waste management, which is further fueled by stringent environmental regulations mandating proper tire disposal

- Growing awareness about the benefits of tire recycling among industries and governments drives the need for machines that facilitate tire processing for reuse in multiple applications

What are the Major Takeaways of Tire Cutting Machine Market?

- Traditional tires on electric vehicles (EV) wear out about 30% faster than conventional tires. As a result, aramid fibres are being used by manufacturers to create extremely lightweight and wear-resistant tires for the electric vehicle industry. The nylon tire cord fabric is dominating the U.S. market. Widespread product utilisation in the production of lightweight, wear-resistant tires for passenger cars, SUVs, trucks, and aircraft is expected to be the primary factor driving growth in the coming years

- Asia-Pacific dominated the tire cutting machine market with the largest revenue share of 38.52% in 2024, attributed to rising tire waste volumes, expanding automotive manufacturing, and growing focus on sustainable recycling practices

- North America is projected to grow at the fastest CAGR of 8.61% from 2025 to 2032, due to a rising focus on sustainable waste management, circular economy goals, and stricter landfill regulations

- The More Than 50 Tires Per Hour segment dominated the market with the largest revenue share of 59.3% in 2024, driven by the rising demand from high-throughput tire recycling facilities and industrial operations that prioritize efficiency and large-volume processing

Report Scope and Tire Cutting Machine Market Segmentation

|

Attributes |

Tire Cutting Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Tire Cutting Machine Market?

Automation-Driven Precision and Sustainability in Tire Recycling

- A defining trend in the global tire cutting machine market is the integration of automated control systems and precision engineering to enhance cutting accuracy, reduce labor dependency, and optimize recycling outcomes

- For instance, Eagle International introduced an automated double sidewall cutter that streamlines the separation process, reducing cycle time and improving throughput

- IoT sensors and PLC controls are increasingly embedded in cutting machines to monitor blade wear, temperature, and load, enabling predictive maintenance and reducing machine downtime

- Sustainable recycling goals are pushing manufacturers to develop energy-efficient machines with low emissions and noise levels for urban deployment

- There’s a rising adoption of modular tire cutting systems that allow recyclers to scale operations easily and adapt to different tire sizes and compositions

- As global regulations tighten around tire disposal, the market is witnessing a surge in demand for smart, eco-compliant tire cutters that reduce environmental impact while increasing processing efficiency

What are the Key Drivers of Tire Cutting Machine Market?

- Growing global concerns over scrap tire accumulation and environmental pollution are fueling investments in efficient tire recycling solutions

- For instance, in July 2024, Eldan Recycling A/S launched a high-capacity tire cutter integrated with a hydraulic system designed for minimal operator intervention and low energy consumption

- Rising demand for reclaimed rubber, steel, and textile materials from shredded tires is driving the expansion of tire cutting facilities across Europe, Asia-Pacific, and North America

- Government-backed waste management regulations and extended producer responsibility (EPR) laws are compelling tire manufacturers to invest in end-of-life processing technologies

- The rapid growth of the automotive and construction industries in emerging economies is increasing the demand for retreaded tires and recycled rubber-based products, boosting machine installations

- In addition, increasing emphasis on worker safety and operational efficiency is driving the replacement of manual cutting tools with semi- and fully-automated tire cutters

Which Factor is challenging the Growth of the Tire Cutting Machine Market?

- A major challenge is the high initial investment and maintenance costs of advanced tire cutting machines, especially for small-scale recyclers in developing regions

- For instance, many local operators struggle with the cost of automation upgrades, hydraulic system maintenance, and blade replacements, limiting technology adoption

- Limited technical expertise and lack of trained labor to operate and troubleshoot modern tire cutters restrict operational efficiency and raise downtime risks

- The complexity in cutting varied tire types (e.g., solid, off-road, or steel-belted tires) demands customized solutions, raising engineering and procurement costs

- Noise and dust emissions from high-powered machines can lead to regulatory compliance issues and require additional investment in safety infrastructure

- To address these concerns, leading vendors are focusing on affordable modular machines, providing on-site training, and developing low-maintenance cutter designs to expand access and adoption in underserved regions

How is the Tire Cutting Machine Market Segmented?

The market is segmented on the basis of cutting capacity, motor power, and end-use.

- By Cutting Capacity

On the basis of cutting capacity, the tire cutting machine market is segmented into Less Than 50 Tires Per Hour and More Than 50 Tires Per Hour. The More Than 50 Tires Per Hour segment dominated the market with the largest revenue share of 59.3% in 2024, driven by the rising demand from high-throughput tire recycling facilities and industrial operations that prioritize efficiency and large-volume processing. These machines are preferred for their ability to handle bulk tire loads with minimal downtime.

Conversely, the Less Than 50 Tires Per Hour segment is anticipated to grow steadily during the forecast period, supported by small-scale recycling units and MRO centers that focus on localized or low-capacity operations.

- By Motor Power

On the basis of motor power, the tire cutting machine market is categorized into Less Than 3 Hp, 3 Hp – 5 Hp, and More Than 5 Hp. In 2024, the 3 Hp – 5 Hp segment held the dominant market share of 47.8%, owing to its optimal balance between energy efficiency and cutting strength. These machines are ideal for mid-range tire processing applications across both small and large enterprises.

The More Than 5 Hp segment is expected to witness substantial growth during 2025–2032, fueled by large-scale recycling companies demanding robust cutting capabilities and enhanced operational life.

- By End-use

Based on end-use, the tire cutting machine market is segmented into MRO Centres and Tire Recycling Companies. The Tire Recycling Companies segment emerged as the leading contributor with a revenue share of 65.4% in 2024, as a result of growing environmental regulations, increasing awareness around waste management, and surging demand for recycled rubber in construction and manufacturing.

Meanwhile, the MRO Centres segment is projected to expand at a moderate pace, driven by ongoing vehicle servicing needs and the repurposing of end-of-life tires within maintenance workshops.

Which Region Holds the Largest Share of the Tire Cutting Machine Market?

- Asia-Pacific dominated the tire cutting machine market with the largest revenue share of 38.52% in 2024, attributed to rising tire waste volumes, expanding automotive manufacturing, and growing focus on sustainable recycling practices

- The region's developing economies are increasingly adopting tire recycling machinery to meet environmental mandates, reduce landfill pressure, and recover valuable rubber and steel materials

- Government regulations supporting circular economy initiatives in countries such as India, China, and Indonesia are significantly boosting demand for efficient tire cutting machines in both urban and industrial sectors

China Tire Cutting Machine Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by rapid industrialization, environmental protection laws, and the dominance of local equipment manufacturers. The expansion of tire recycling parks, along with government subsidies for eco-friendly waste management technologies, continues to stimulate market demand.

India Tire Cutting Machine Market Insight

India is emerging as a key player in the regional market due to increasing awareness of tire-derived fuel (TDF), rising demand for recycled rubber, and growing investment in sustainable infrastructure. Efforts by the Central Pollution Control Board (CPCB) and State Pollution Control Boards (SPCBs) to regulate scrap tire disposal are accelerating the adoption of automated tire cutting machinery across MRO centers and recycling units.

Japan Tire Cutting Machine Market Insight

Japan's market is steadily growing, supported by its advanced recycling ecosystem and strict environmental compliance norms. The country emphasizes automation, safety, and compact equipment design, making it a key adopter of high-precision tire cutters in urban and industrial settings.

Which Region is the Fastest Growing in the Tire Cutting Machine Market?

North America is projected to grow at the fastest CAGR of 8.61% from 2025 to 2032, due to a rising focus on sustainable waste management, circular economy goals, and stricter landfill regulations. Adoption of advanced recycling technologies and automated tire shredding systems is on the rise across sectors including automotive, logistics, and construction. The presence of key manufacturers, coupled with increasing demand for energy-efficient and low-maintenance machinery, is driving growth across the U.S. and Canada.

U.S. Tire Cutting Machine Market Insight

The U.S. dominated the North American market in 2024, supported by stringent EPA regulations, state-level bans on whole tire landfilling, and expanding pyrolysis and rubber reclaiming industries. Demand for modular and portable tire cutters is gaining traction across independent recycling operations and fleet maintenance centers.

Canada Tire Cutting Machine Market Insight

Canada is witnessing rising demand due to growing recycling targets under Extended Producer Responsibility (EPR) programs and increasing investments in green technologies. Provinces such as Ontario and British Columbia are leading the adoption of tire cutting systems as part of broader zero-waste goals.

Mexico Tire Cutting Machine Market Insight

Mexico is steadily progressing with tire recycling infrastructure development, supported by public-private partnerships and growing automotive sector demands. Increased awareness of fire risks associated with tire dumps is encouraging adoption of pre-shredding and cutting solutions to streamline disposal processes.

Which are the Top Companies in Tire Cutting Machine Market?

The tire cutting machine industry is primarily led by well-established companies, including:

- Cosmos Tech (India)

- Bright Tyre Moulds & Engineering Works (India)

- Star Steel Products (U.S.)

- Kiran Engineers (India)

- Deluxe Pre-cured Machinery Private Limited (India)

- Sivan Industrial Engineering (India)

- Indo Green Enviro Private Limited (India)

- KMT Industries (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tire Cutting Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tire Cutting Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tire Cutting Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.