Global Threat Detection Systems Market

Market Size in USD Billion

CAGR :

%

USD

179.79 Billion

USD

511.07 Billion

2024

2032

USD

179.79 Billion

USD

511.07 Billion

2024

2032

| 2025 –2032 | |

| USD 179.79 Billion | |

| USD 511.07 Billion | |

|

|

|

Threat Detection Systems Market Analysis

The threat detection systems market is experiencing significant growth driven by advancements in technology and the increasing need for security across various industries. These systems are designed to identify potential threats such as explosives, radiological hazards, and intrusions, ensuring protection in high-risk environments. With the rise of cyberattacks, terrorism, and the increasing complexity of criminal activities, organizations are adopting innovative solutions for threat detection. The market has seen the integration of artificial intelligence (AI), machine learning (ML), and advanced sensors to enhance real-time monitoring, automate detection processes, and improve the accuracy of threat identification. Recent advancements include more powerful explosive detection systems, personal radiation detectors, and AI-powered surveillance tools. In addition, smart city developments and the expansion of defense, healthcare, and public infrastructure sectors are further fueling market growth. Companies such as Smiths Detection and Teledyne FLIR LLC are leading the charge in providing cutting-edge solutions, offering systems that meet stringent government regulations. As security concerns continue to rise globally, the demand for advanced threat detection technologies is expected to increase, providing immense opportunities for market expansion.

Threat Detection Systems Market Size

The global threat detection systems market size was valued at USD 179.79 billion in 2024 and is projected to reach USD 511.07 billion by 2032, with a CAGR of 13.95% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Threat Detection Systems Market Trends

“Integration of Artificial Intelligence (AI) and Machine Learning (ML)”

A significant trend in the threat detection systems market is the integration of artificial intelligence (AI) and machine learning (ML) to enhance detection accuracy and response times. These technologies enable threat detection systems to analyze vast amounts of data in real-time, identifying patterns and anomalies that could indicate a security threat. For instance, AI-powered surveillance systems in airports can automatically detect suspicious behavior or objects, improving efficiency and reducing the response time to potential threats. In addition, ML algorithms allow systems to continuously improve their detection capabilities by learning from past data, making them more effective over time. Companies such as Teledyne FLIR and Smiths Detection are leading this trend, integrating AI into their advanced systems such as explosive and radiation detectors. This trend is improving security and making threat detection systems more cost-effective by automating many manual processes and reducing the reliance on human intervention, which is crucial for high-security environments such as defense and critical infrastructure.

Report Scope and Threat Detection Systems Market Segmentation

|

Attributes |

Threat Detection Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Smiths Group plc (U.K.), Stellar Cyber (U.S.), Vectra AI, Inc. (U.S.), CreativelifeStyles (U.S.), TrapWire, Inc. (U.S.), Teledyne FLIR LLC (U.S.), Thales (France), Safran (France), Rapiscan Systems (U.S.), Chemring Group PLC (U.K.), ChemImage Corporation (U.S.), Mirion Technologies, Inc. (U.S.), Axis Communication AB (Sweden), Exabeam (U.S.), Coptrz (U.K.), Collins Aerospace (U.S.), Lockheed Martin Corporation (U.S.), Blighter Surveillance Systems Limited (U.K.), and Analogic Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Threat Detection Systems Market Definition

Threat detection systems are technologies and solutions designed to identify, assess, and respond to potential security threats in various environments. These systems use a combination of sensors, software, and analytics to monitor and detect activities, anomalies, or objects that may pose a risk, such as explosives, chemicals, intrusions, or cybersecurity threats.

Threat Detection Systems Market Dynamics

Drivers

- Increasing Security Concerns

The growing frequency of terrorist activities, industrial espionage, and cyber threats has significantly raised the demand for effective and timely threat detection systems. For instance, the increase in cyberattacks targeting government, healthcare, and financial institutions has led to the development of advanced cybersecurity threat detection systems. In sectors such as defense, the ability to detect and neutralize potential threats such as bombings or sabotage is crucial. Similarly, in transportation, real-time monitoring systems are being adopted to prevent terrorist threats and other safety risks. As threats evolve and become more sophisticated, the need for accurate, reliable detection solutions across critical sectors becomes paramount, driving the growth of the threat detection systems market.

- Rise Of Remote Work (WFH) and Bring-Your-Own-Device (BYOD)

The rise of remote work (WFH) and bring-your-own-device (BYOD) policies has significantly expanded the attack surface for cybercriminals, increasing the risk of unauthorized access, data breaches, and ransomware attacks. With employees accessing corporate networks from personal and often unsecured devices, traditional perimeter-based security models have become ineffective. A key instance of this vulnerability was the Colonial Pipeline ransomware attack (2021), where hackers exploited a compromised remote access VPN account, leading to a major fuel supply disruption in the U.S. This incident underscored the critical need for stronger endpoint threat detection systems that can monitor remote access, detect anomalies, and prevent unauthorized intrusions. As a result, organizations are increasingly investing in Endpoint Detection & Response (EDR) solutions and Zero-Trust Security Architectures, which require continuous verification of users and devices before granting access. This market driver is pushing cybersecurity vendors to develop advanced AI-powered EDR tools and Zero-Trust frameworks to secure remote work environments and mitigate cyber risks.

Opportunities

- Increasing Technological Advancements

The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into threat detection systems is significantly enhancing their capabilities. AI and ML algorithms allow systems to analyze vast amounts of data in real time, detecting anomalous patterns and potential threats faster and more accurately than traditional methods. For instance, AI-powered video surveillance systems can automatically detect suspicious behavior or unauthorized access, providing immediate alerts for further investigation. The IoT also enables the interconnectedness of threat detection devices, allowing seamless data sharing and coordination among various sensors, cameras, and alarms. This convergence of AI, ML, and IoT is improving the efficiency of threat detection systems and expanding their applications across industries such as defense, retail, healthcare, and smart cities. As organizations seek more reliable and responsive security solutions, the adoption of these advanced technologies is fueling the growth of the threat detection systems market.

- Increasing Regulatory and Compliance Requirements

Governments and regulatory bodies worldwide are imposing stricter security standards across various industries, especially in sectors such as transportation, healthcare, and energy, where safety and compliance are critical. For instance, the Transportation Security Administration (TSA) mandates the use of advanced screening technologies at airports to meet security regulations. In the healthcare sector, regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. require healthcare organizations to secure patient data and prevent unauthorized access. These evolving regulatory frameworks are creating an increasing demand for advanced threat detection systems that can ensure compliance and protect against security breaches. As organizations strive to meet these stringent requirements, the market for advanced detection systems that can provide real-time threat analysis and ensure regulatory compliance is expanding, presenting a significant market opportunity for vendors offering such solutions.

Restraints/Challenges

- High Costs of Implementation

The high upfront cost of implementing advanced threat detection systems is a significant market challenge, particularly for small and medium-sized enterprises (SMEs). These businesses often lack the budget or resources to deploy sophisticated technologies, such as AI-driven or machine learning-based detection solutions, which are crucial for identifying advanced cyber threats. For instance, an SME in the retail industry might find it financially challenging to invest in an AI-powered system designed to analyze network traffic and detect potential vulnerabilities in real time. The cost is not just for the software itself, and for the hardware, skilled personnel, and training required to operate and maintain such systems. As a result, many SMEs opt for basic security measures, leaving them more vulnerable to evolving cyber threats. This high cost barrier limits the broader adoption of threat detection systems, hindering market growth, particularly in the SME sector where budget constraints are more prevalent.

- Data Privacy Concerns

Another key challenge in the Threat Detection Systems Market is the growing concern over data privacy and compliance with data protection regulations. As threat detection systems collect vast amounts of data to identify potential security breaches, there are significant risks related to how this data is stored, analyzed, and shared. In regions such as the European Union, GDPR (General Data Protection Regulation) imposes strict rules on how personal data is handled. This can restrict the ability of organizations to freely process and store data for threat detection purposes. For instance, a company may find it difficult to implement a cloud-based detection system that collects data from various global sources due to concerns about cross-border data flow. These concerns can slow down the adoption of threat detection solutions, especially for organizations that operate in multiple regions and must adhere to strict regulatory frameworks. Balancing effective threat detection with data privacy laws is a complex issue, presenting a challenge to the widespread implementation of advanced threat detection systems.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Threat Detection Systems Market Scope

The market is segmented on the basis of detection type, product, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Detection System

- Explosive Detection

- Radiological and Nuclear Detection

- Narcotics Detection

- Intrusion Detection

Product

- Explosive and Narcotics Detectors

- Personal Radiation Detectors (PRD)

- Dosimeters

- Survey Meters

- Identifiers

- Photo-Ionization Detectors (PID)

- Air Samplers

- Chemical Agent Detectors

- Others

Application

- Defence

- Public Infrastructure

- Commercial Places

- Industrial

- Institutional

- Residential (Home Surveillance)

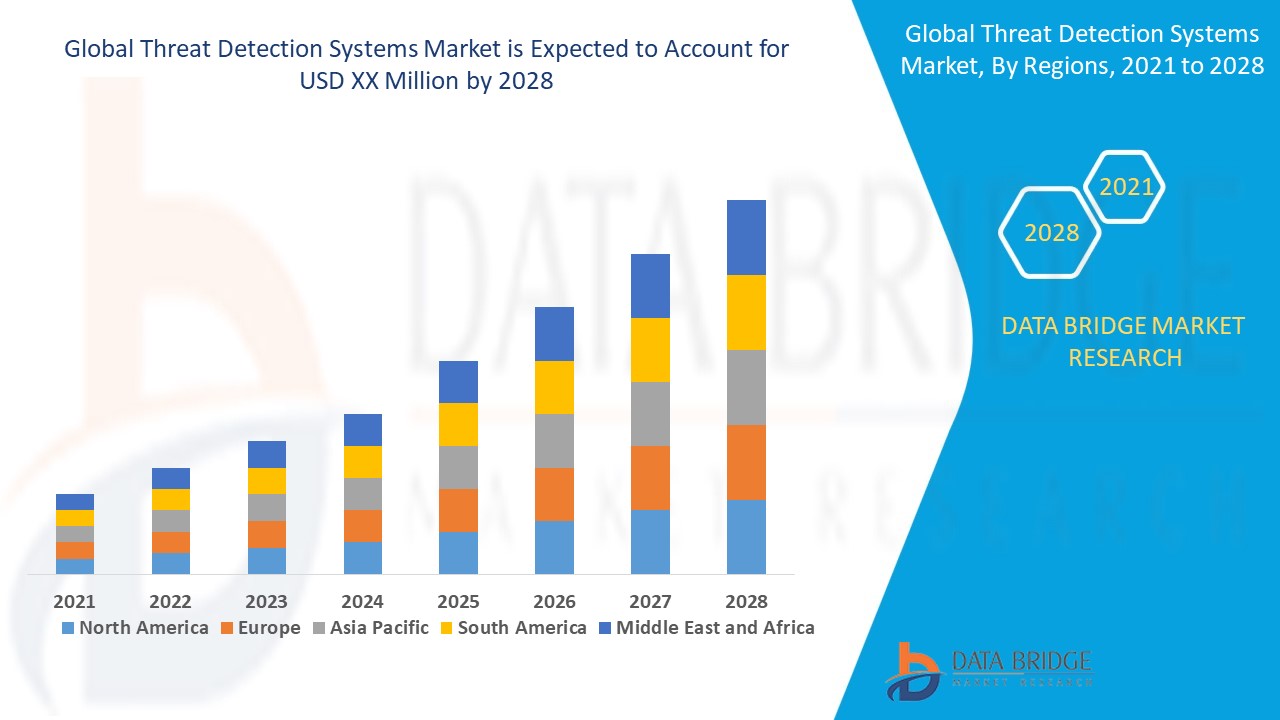

Threat Detection Systems Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, detection type, product, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the threat detection systems market throughout the forecast period, primarily driven by significant investments in research and development. The region’s advanced technological infrastructure and high government and private sector spending on cybersecurity initiatives contribute to its leadership. In addition, the growing emphasis on enhancing national security and combating evolving threats further fuels demand for advanced detection systems. As a result, North America is well-positioned to continue its stronghold in the market due to these ongoing investments and strategic priorities.

Asia-Pacific is expected to experience fastest growth during the forecast period, driven by the increasing demand for enhanced security solutions across various sectors. The rise in industrial, defense, commercial, and residential security needs, particularly in rapidly developing economies, is fueling this growth. In addition, the region’s focus on modernizing infrastructure and adopting advanced technologies to counter emerging threats further boosts demand for threat detection systems. As security concerns grow, both governments and private organizations are prioritizing the implementation of cutting-edge detection technologies, positioning Asia-Pacific for robust market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Threat Detection Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Threat Detection Systems Market Leaders Operating in the Market Are:

- Smiths Group plc (U.K.)

- Stellar Cyber (U.S.)

- Vectra AI, Inc. (U.S.)

- CreativelifeStyles (U.S.)

- TrapWire, Inc. (U.S.)

- Teledyne FLIR LLC (U.S.)

- Thales (France)

- Safran (France)

- Rapiscan Systems (U.S.)

- Chemring Group PLC (U.K.)

- ChemImage Corporation (U.S.)

- Mirion Technologies, Inc. (U.S.)

- Axis Communication AB (Sweden)

- Exabeam (U.S.)

- Coptrz (U.K.)

- Collins Aerospace (U.S.)

- Lockheed Martin Corporation (U.S.)

- Blighter Surveillance Systems Limited (U.K.)

- Analogic Corporation (U.S.)

Latest Developments in Threat Detection Systems Market

- In November 2024, Contextal announced the release of Contextal Platform, an advanced open-source solution that transforms data processing and threat detection with a contextual approach. Developed by the original creators of ClamAV, the world’s leading open-source anti-malware solution, the platform combines innovative detection capabilities, custom scenarios, and enhanced processing for diverse use cases, including threat intelligence and data governance

- In February 2023, Noida International Airport signed an agreement with Smiths Detection for the installation of screening systems for passenger carry-on luggage. Smiths Detection will provide the HI-SCAN 6040 DV, a high-resolution dual-view X-ray screening system, and the HI-SCAN 10080 XCT, a next-generation high-speed Computed Tomography (CT) explosives detection system, which complies with TSA, ECAC regulations, and BCAS standards

- In August 2022, Smiths Detection partnered with Block MEMS to develop a non-contact chemical detection device for the U.S. Department of Defense, enhancing their security solutions for sensitive applications

- In May 2022, Renesas and Intel joined forces to develop a new BCM powered by Intel's Atom processor. This new BCM offers improved power efficiency and performance over its predecessors, supporting advanced features such as ADAS and autonomous driving capabilities

- In March 2021, Smiths Detection was selected by the Heathrow Airport Administration to supply the HI-SCAN 6040 CTiX magnetic resonance X-rays, which offer enhanced security and efficiency. This partnership expands the company's presence in the global security sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Threat Detection Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Threat Detection Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Threat Detection Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.