Global Third Party Logistics Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

2.16 Billion

2024

2032

USD

1.14 Billion

USD

2.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.14 Billion | |

| USD 2.16 Billion | |

|

|

|

|

Third Party Logistics Market Analysis

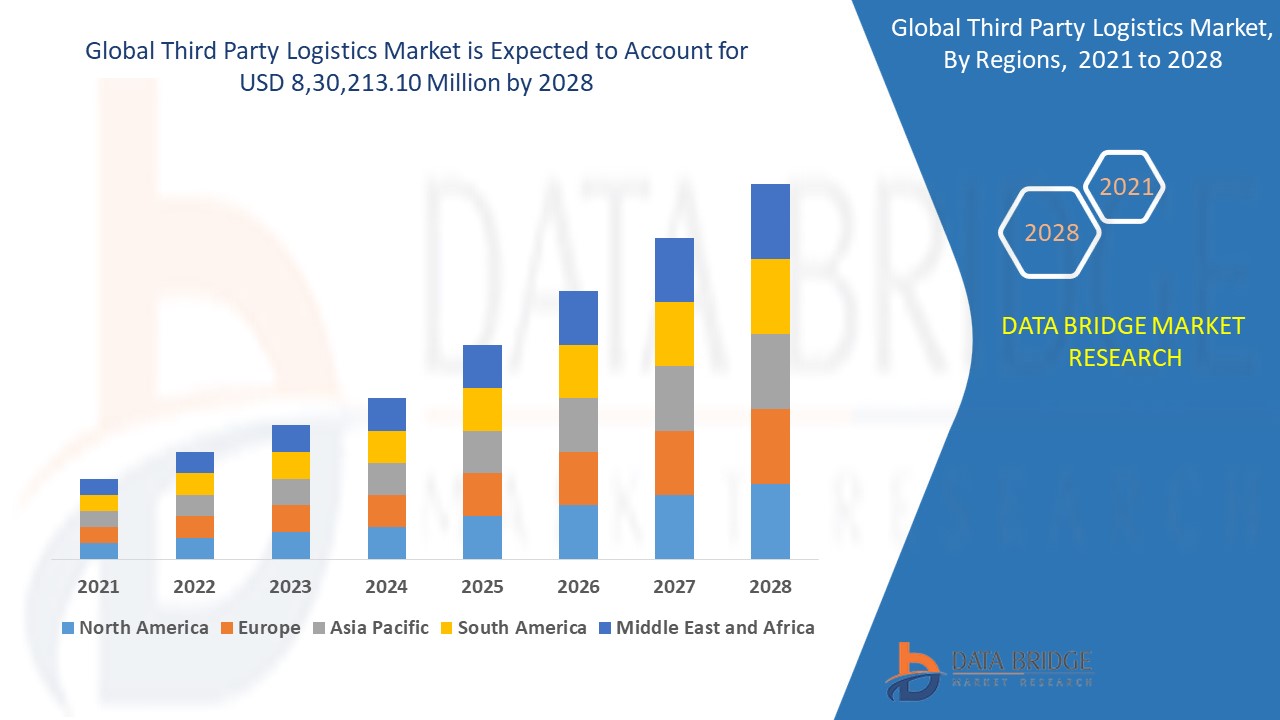

The third party logistics market is growing due to increasing global trade, rising e-commerce demand, and the need for cost-effective supply chain solutions. Third party logistics providers offer services such as transportation, warehousing, freight forwarding, and value-added logistics to help businesses streamline operations. The market is driven by advancements in automation, digitalization, and demand for integrated logistics solutions. Key players include DHL, FedEx, C.H. Robinson, and DB Schenker. Recent developments include investments in AI-driven supply chain management, blockchain for transparency, and sustainability initiatives. The rise of omni-channel retailing and cross-border trade is fueling demand. North America and Asia-Pacific lead the market due to strong logistics networks and manufacturing hubs. The market faces challenges such as fluctuating fuel costs and regulatory complexities. However, technological advancements and increasing outsourcing of logistics functions by businesses continue to drive growth, making third party logistics a critical component of modern supply chains.

Third Party Logistics Market Size

The global third party logistics market size was valued at USD 1.14 billion in 2024 and is projected to reach USD 2.16 billion by 2032, with a CAGR of 8.30% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Third Party Logistics Market Trends

“Rapid Expansion of E-commerce”

The rapid expansion of online shopping is significantly boosting the demand for agile and efficient third party logistics services. Consumers now expect faster deliveries, seamless order fulfillment, and real-time tracking, pushing logistics providers to enhance their operations. Companies are investing in automated warehouses, AI-driven route optimization, and last-mile delivery solutions to meet rising expectations. The surge in same-day and next-day delivery services has increased the need for advanced distribution networks, micro-fulfillment centers, and strategic partnerships. In addition, cross-border e-commerce is fueling demand for international shipping solutions and customs management. As online retail continues to grow, logistics providers must continuously innovate to handle higher order volumes while ensuring speed, accuracy, and cost-effectiveness in supply chain operations.

Report Scope and Third Party Logistics Market Segmentation

|

Attributes |

Third Party Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

BDP International Inc. (U.S.), Burris Logistics (U.S.), GEODIS (France), C.H. Robinson Worldwide, Inc. (U.S.), CEVA Logistics (France), NYK Line (Japan), Hub Group, Inc. (U.S.), GOGOX (Hong Kong), DSV (Denmark), Sinotrans Limited (China), DB SCHENKER (Germany), FedEx (U.S.), United Parcel Service of America, Inc. (U.S.), Deutsche Post AG (Germany), J.B. Hunt Transport, Inc. (U.S.), Nippon Express Co., Ltd. (Japan), A.P. Moller - Maersk (Denmark), XPO, Inc. (U.S.), Kuehne + Nagel (Switzerland), YUSEN LOGISTICS CO. LTD (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Third Party Logistics Market Definition

Third party logistics (3PL) refers to outsourcing logistics and supply chain management functions to external service providers. These companies offer transportation, warehousing, inventory management, freight forwarding, and value-added services such as packaging and order fulfillment. 3PL providers help businesses streamline operations, reduce costs, and improve efficiency by leveraging their expertise, technology, and infrastructure. They play a crucial role in managing complex supply chains, especially in industries such as retail, manufacturing, healthcare, and e-commerce. By integrating advanced technologies such as AI, IoT, and automation, 3PL providers enhance real-time tracking, optimize routes, and improve delivery speed. The growing reliance on third party logistics is driven by globalization, increasing online shopping, and the need for flexible, scalable logistics solutions.

Third Party Logistics Market Dynamics

Drivers

- Growing Demand for Fast and Flexible Delivery

The increasing consumer preference for same-day and next-day delivery is a major driver of the third party logistics market. E-commerce growth, fueled by rising digital transactions and customer expectations for instant gratification, has intensified the need for faster, more efficient logistics networks. To meet these demands, third party logistics providers are investing in automation, artificial intelligence-powered route optimization, and strategically located fulfillment centers. In addition, innovations in last-mile delivery, such as drone technology and autonomous vehicles, are enhancing efficiency. This shift toward ultra-fast delivery is pushing logistics companies to optimize operations, reduce transit times, and enhance supply chain agility.

- Rising Manufacturing and Retail Sectors

As global manufacturing and trade activities expand, the need for third party logistics services is growing. Companies are producing more goods to meet international and local demands, leading to an increased flow of materials and products across borders. This surge in production requires efficient supply chain management, warehousing, transportation, and inventory solutions, and making third party logistics providers essential. These providers help businesses navigate complex global trade regulations, optimize shipping routes, and ensure timely deliveries. As industries scale, outsourcing logistics to specialized firms offers businesses cost savings, operational efficiency, and the ability to focus on core competencies, further driving the market's growth.

Opportunities

- Globalization of Supply Chains

As businesses expand globally, managing cross-border trade, customs regulations, and international transportation has become increasingly complex. Outsourcing logistics to third party providers offers a significant market opportunity by helping companies navigate these challenges effectively. Logistics providers specialize in managing international shipping, customs compliance, and handling paperwork, ensuring smooth and timely deliveries across borders. This allows businesses to focus on their core operations while benefiting from the expertise and global networks of third-party logistics providers. As global trade continues to grow, the demand for outsourcing these logistics functions is expected to rise, creating further opportunities for 3PL providers.

- Expansion of Cold Chain Logistics

The growing demand for temperature-sensitive transportation is emerging as a significant market opportunity, particularly in the healthcare, food, and beverage sectors. With the rising need to transport perishable goods, pharmaceuticals, and vaccines, businesses require specialized logistics solutions that ensure products remain within required temperature ranges throughout transit. Third-party logistics providers are capitalizing on this opportunity by offering advanced cold chain solutions, including refrigerated transport, temperature-controlled warehouses, and real-time monitoring. As the need for safe and efficient handling of perishable and temperature-sensitive goods continues to rise, logistics providers can expand their services to meet these critical demands, driving market growth.

Restraints/Challenges

- Labor Shortages in the Logistics Sector

The logistics sector is currently grappling with a significant shortage of skilled labor, particularly drivers and warehouse personnel, which presents a major challenge for the industry. With the increasing demand for faster deliveries and efficient operations, the lack of qualified workers can lead to delays, reduced service quality, and increased operational costs. The shortage is exacerbated by factors such as an aging workforce, low wages, and the physical demands of the job. This labor gap forces logistics providers to invest heavily in recruitment, training, and retention strategies, affecting overall service efficiency and profitability.

- Fluctuations in Fuel Prices

Fluctuating fuel prices present a significant restraint for the third party logistics market, as they directly impact the cost of transportation and delivery services. Transportation is a key component of logistics, and increases in fuel prices can substantially raise operational expenses, leading to higher costs for both logistics providers and their clients. This unpredictability makes it difficult for companies to maintain stable pricing and profitability, particularly in global supply chains where transportation costs are a major factor. Logistics providers must continuously adjust their strategies to manage these fluctuations, often passing the increased costs onto customers, which can affect market competitivenes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Third Party Logistics Market Scope

The market is segmented on the basis of service type, transport, and end users. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Dedicated Contract Carriage (DCC)

- Freight Forwarding

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Warehousing and Distribution (W&D)

- Value-added Logistics Services (VALs)

Transport

- Roadways

- Railways

- Waterways

- Airways

End Users

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Third Party Logistics Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, service type, transport, and end users as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the third-party logistics market, driven by the rising need for cold storage solutions and the region's robust logistics infrastructure. The presence of leading logistics companies further strengthens its position in the market. As a result, North America continues to experience significant growth in demand for advanced supply chain and transportation services.

Asia-Pacific is the fastest growing region in the third-party logistics market, driven by the increasing development of trans-regional trade corridors and key logistics gateways. This expansion is fueled by the region’s growing economic influence, which enhances cross-border trade and supply chain connectivity. With improvements in infrastructure and trade agreements, the demand for efficient logistics solutions in Asia-Pacific is expected to rise, positioning the region as a major player in global logistics.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Third Party Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Third Party Logistics Market Leaders Operating in the Market Are:

- BDP International Inc. (U.S.)

- Burris Logistics (U.S.)

- GEODIS (France)

- C.H. Robinson Worldwide, Inc. (U.S.)

- CEVA Logistics (France)

- NYK Line (Japan)

- Hub Group, Inc. (U.S.)

- GOGOX (Hong Kong)

- DSV (Denmark)

- Sinotrans Limited (China)

- DB SCHENKER (Germany)

- FedEx (U.S.)

- United Parcel Service of America, Inc. (U.S.)

- Deutsche Post AG (Germany)

- J.B. Hunt Transport, Inc. (U.S.)

- Nippon Express Co., Ltd. (Japan)

- A.P. Moller - Maersk (Denmark)

- XPO, Inc. (U.S.)

- Kuehne + Nagel (Switzerland)

- YUSEN LOGISTICS CO. LTD (Japan)

Latest Developments in Third Party Logistics Market

- In February 2024, Germany-based DHL entered into a partnership with Reflaunt, a resale-as-a-service company. Through this collaboration, DHL will offer comprehensive fulfillment, shipping, and platforming services for brands seeking to expand into the secondhand market. This move allows brands to tap into the growing resale industry, providing them with efficient logistics solutions to manage returns and reselling. By leveraging Reflaunt’s expertise, DHL is enhancing its service portfolio to meet the demand for sustainable and circular business models

- In January 2024, C.H. Robinson became the first third-party logistics provider to implement an electronic Bill of Lading (eBOL), a critical shipping document. The company advanced the digitization of the less-than-truckload (LTL) industry by integrating this eBOL with ten major LTL carriers, with plans to include four more. Developed by the National Motor Freight Traffic Association (NMFTA), the eBOL standard improves shipping efficiency, real-time visibility, and overall operational transparency for LTL shippers. This initiative positions C.H. Robinson as a leader in modernizing logistics and enhancing customer experience

- In November 2023, DHL expanded its warehouse automation efforts by deploying 1,000 robots in collaboration with Autostore. This marks a significant milestone in DHL’s long-standing partnership with Autostore, which spans over 12 years. The automation expansion will optimize warehouse efficiency and operational capacity. DHL is already operating nine AutoStore projects across Singapore, the U.S., and Germany, with additional sites planned, positioning the company at the forefront of industry innovation in warehouse operations

- In July 2023, A.P. Moller–Maersk inaugurated its third warehousing and distribution facility in Dubai, UAE, featuring its first cold storage facility in the country. Spanning 13,000 square meters, this state-of-the-art facility is strategically located near major transport hubs, including Jebel Ali Port, Al Maktoum International Airport, and the Etihad Rail freight terminal. The new facility enhances Maersk’s regional capabilities, allowing it to meet the growing demand for temperature-sensitive goods while offering improved logistics connectivity across the UAE

- In June 2023, DHL Supply Chain entered a partnership with Vizient, the leading healthcare performance improvement company in the U.S. This collaboration provides Vizient’s members, including hospital systems and healthcare suppliers, access to DHL’s world-class third-party logistics (3PL) services. By leveraging DHL’s supply chain expertise, Vizient members will benefit from enhanced logistics solutions, improving the efficiency and reliability of healthcare supply chains. The agreement strengthens DHL’s position in the healthcare logistics sector, a critical component of the U.S. economy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.