Global Thin Film Coatings Market

Market Size in USD Billion

CAGR :

%

USD

13.82 Billion

USD

16.83 Billion

2024

2032

USD

13.82 Billion

USD

16.83 Billion

2024

2032

| 2025 –2032 | |

| USD 13.82 Billion | |

| USD 16.83 Billion | |

|

|

|

|

Thin Film Coatings Market Size

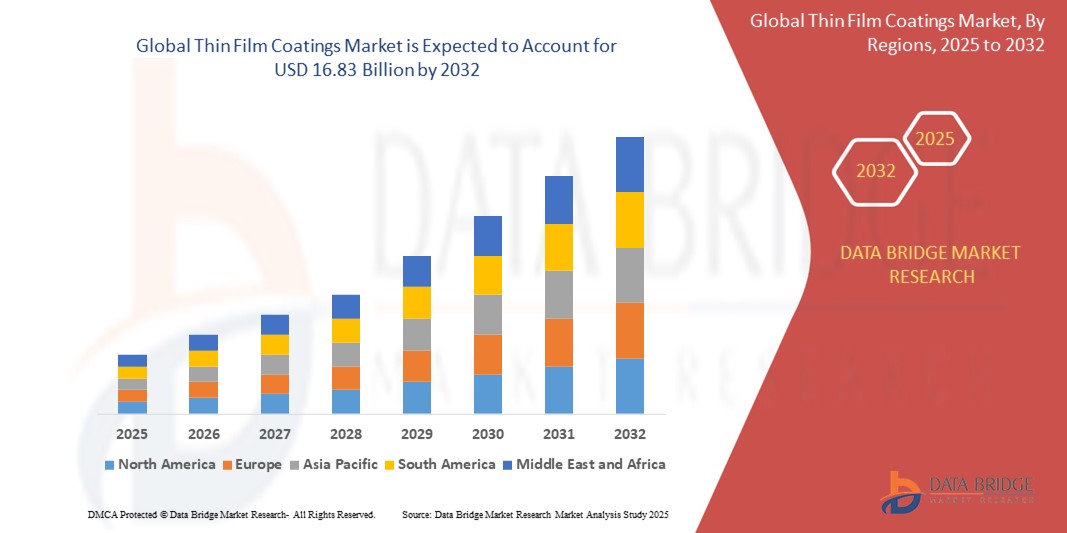

- The global thin film coatings market size was valued at USD 13.82 billion in 2024 and is expected to reach USD 16.83 billion by 2032, at a CAGR of 2.50% during the forecast period

- The market growth is largely fueled by increasing demand for advanced electronic devices and growing adoption of solar energy technologies

- Thin film coatings are widely used in semiconductors, displays, and optical devices. As consumer electronics continue to evolve with smaller, faster, and more energy-efficient components, the demand for high-performance coating solutions is accelerating

- Thin film coatings are essential in improving the efficiency and durability of photovoltaic cells. As governments and industries globally shift towards renewable energy sources, particularly solar power, the need for thin film technologies continues to rise

Thin Film Coatings Market Analysis

- The current thin film coatings market is steadily growing due to the rising demand for enhanced electronic devices that require compact, durable, and efficient components without compromising performance

- Manufacturers are increasingly relying on thin film coatings to improve the optical, electrical, and protective properties of devices such as smartphones, smartwatches, tablets, sensors, and display panels

- North America dominates the thin film coatings market with the largest revenue share of 25.05% in 2024, driven by a Strong presence of advanced manufacturing sectors such as electronics, aerospace, and automotive, which extensively utilize thin film coatings for improved performance and durability.

- Asia-Pacific is expected to be the fastest growing region in the thin film coatings market driven by increasing urbanization, rising disposable incomes, and technological advancements in countries

- The ceramic segment dominates the market with an estimated share of around 57% in 2024, attributed to its excellent hardness, chemical stability, and thermal resistance which make it preferred for applications in electronics, aerospace, and automotive industries

Report Scope and Thin Film Coatings Market Segmentation

|

Attributes |

Thin Film Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thin Film Coatings Market Trends

“Growing Importance of Thin Film Coatings in Electronics”

- The thin film coatings market is growing steadily, driven mainly by increasing demand in the electronics industry

- Electronic devices require coatings that improve durability, optical clarity, and electrical performance for better user experience

- Advancements in coating processes have made thin film coatings more efficient and adaptable to new electronic applications

- Consumer expectations for high-quality screens and longer-lasting gadgets are encouraging manufacturers to adopt better coatings

- Sustainable and eco-friendly coating solutions are gaining attention as industries aim to reduce environmental impact

- For instance, smartphone manufacturers have been investing heavily in thin film coatings to enhance screen scratch resistance and reduce glare, meeting the needs of a highly competitive market

- In conclusion, the continuous evolution of electronic devices and growing consumer demands ensure that thin film coatings will remain essential for innovation and product enhancement in this sector

Thin Film Coatings Market Dynamics

Driver

“Increasing Demand for Enhanced Device Performance”

- Increasing demand for enhanced durability and performance in electronic devices is driving the growth of the thin film coatings market as manufacturers focus on improving scratch resistance, glare reduction, and optical clarity for products such as smartphones and tablets

- For instance, the launch of Samsung’s foldable smartphones has accelerated the need for flexible thin film coatings that maintain coating integrity despite repeated bending and folding

- Miniaturization of electronic components requires precise control over electrical and thermal properties, which thin film coatings provide, ensuring device reliability in increasingly compact gadgets

- Conductive coatings are crucial in improving touch sensitivity and faster response times, as seen in the growing adoption of advanced touchscreen technologies across wearable devices such as Apple Watch and Fitbit

- The market demand extends beyond consumer electronics, with sectors such as medical devices and automotive electronics adopting thin film coatings to enhance performance and meet rigorous quality standards

- In conclusion, rising consumer expectations for premium, durable, and multifunctional electronic devices continue to propel the thin film coatings market forward across various industries

Restraint/Challenge

“High Production Costs and Complex Manufacturing Processes”

- High production costs pose a major challenge in the thin film coatings market due to the need for advanced deposition techniques such as physical vapor deposition and chemical vapor deposition that require expensive equipment and skilled labor

- Small and medium manufacturers face barriers to entry because of the significant capital investment and strict process controls necessary to produce high-quality coatings consistently

- Ensuring uniform coating thickness over large or complex surfaces is technically difficult, leading to inefficiencies, increased rejection rates, and longer production cycles that raise operational costs

- Certain coating materials demand strict environmental conditions during manufacturing to prevent defects and contamination, further adding to the cost and complexity of production

- For instance, in the automotive and packaging sectors, where profit margins are slim, the higher costs of thin film coatings compared to traditional coatings limit their broader adoption despite potential performance benefits

- In conclusion, without advancements that lower manufacturing costs and simplify processes, the complexity and expense of producing thin film coatings will continue to restrain market growth, especially in cost-sensitive industries

Thin Film Coatings Market Scope

The market is segmented on the basis of coating material, type of coating, ultraviolet coatings, and end user.

• By Coating Material

On the basis of coating material, the thin film coatings market is segmented into ceramic and metal. The ceramic segment dominates the market with an estimated share of around 57% in 2024, attributed to its excellent hardness, chemical stability, and thermal resistance which make it preferred for applications in electronics, aerospace, and automotive industries. Ceramic coatings offer superior protection against wear and corrosion, contributing to their widespread adoption.

The metal segment is expected to witness the fastest growth during the forecast period, with a compound annual growth rate of approximately 6.8%. Increasing use of metal coatings such as aluminum and titanium in flexible electronics, sensors, and medical devices is driving this growth due to their excellent electrical conductivity and mechanical properties.

• By Deposition Process

The market based on deposition process is divided into physical deposition and chemical deposition. Physical deposition process holds the largest market share, roughly 62% in 2024, thanks to established methods such as sputtering and evaporation that deliver uniform, high-quality coatings extensively used in optics and electronics.

In contrast, the chemical deposition process segment is anticipated to register the fastest growth, growing at an estimated rate of 7% CAGR from 2025 to 2032. Advances in chemical vapor deposition and atomic layer deposition allow better control over film thickness and composition, making them essential in semiconductor and biomedical industries.

• By Type of Coating

Among types of coatings, anti-reflection coatings lead the market with around 31% share in 2024 due to their wide application in display technologies, solar panels, and eyewear where minimizing glare and enhancing light transmission are critical.

Conductive coatings are projected to have the fastest growth rate, estimated at over 7% CAGR, driven by the surge in touchscreen devices and flexible electronics that require reliable electrical performance and durability.

• By End Users

On the basis of end users, electronics dominates with an estimated 42% market share in 2024, supported by extensive use in semiconductors, displays, and sensors across consumer and industrial sectors.

The medical device segment is forecasted to be the fastest growing, with a CAGR of approximately 8%, fueled by increasing demand for biocompatible and antimicrobial coatings on implants and diagnostic tools to improve safety and durability.

Thin Film Coatings Market Regional Analysis

- North America dominates the thin film coatings market with the largest revenue share of 25.05% in 2024, driven by a Strong presence of advanced manufacturing sectors such as electronics, aerospace, and automotive, which extensively utilize thin film coatings for improved performance and durability

- High R&D investments and technological innovation in material science and nanotechnology, supporting the development of advanced coating solutions

- Robust demand from the healthcare industry, particularly for medical devices and optical coatings, supported by stringent quality standards and regulatory compliance

U.S. Thin Film Coatings Market Insight

The U.S. Thin Film Coatings market captured the largest revenue share of 81% in 2024 within North America, fueled by the swift uptake of connected devices and the expanding trend of home automation. Consumers are increasingly prioritizing the enhancement of home security through intelligent, keyless entry systems. The growing preference for DIY smart home setups, combined with robust demand for voice-controlled systems and mobile application integration, further propels the Thin Film Coatings industry. Moreover, the increasing integration of smart home technologies, such as Alexa, Google Assistant, and Apple HomeKit, is significantly contributing to the market's expansion.

Europe Thin Film Coatings Market Insight

The Europe Thin Film Coatings market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of Thin Film Coatings. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with Thin Film Coatings being incorporated into both new constructions and renovation projects.

U.K. Thin Film Coatings Market Insight

The U.K. Thin Film Coatings market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. Additionally, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The UK’s embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Thin Film Coatings Market Insight

The Germany Thin Film Coatings market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. Germany’s well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of Thin Film Coatings, particularly in residential and commercial buildings. The integration of Thin Film Coatings with home automation systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Asia-Pacific Thin Film Coatings Market Insight

The Asia-Pacific Thin Film Coatings market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of Thin Film Coatings. Furthermore, as APAC emerges as a manufacturing hub for Thin Film Coatings components and systems, the affordability and accessibility of Thin Film Coatings are expanding to a wider consumer base.

Japan Thin Film Coatings Market Insight

The Japan Thin Film Coatings market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of Thin Film Coatings is driven by the increasing number of smart homes and connected buildings. The integration of Thin Film Coatings with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

China Thin Film Coatings Market Insight

The China Thin Film Coatings market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and Thin Film Coatings are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable Thin Film Coatings options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Thin Film Coatings Market Share

The thin film coatings industry is primarily led by well-established companies, including:

- MATERION CORPORATION (U.S.)

- IDEX Optical Technologies (U.S.)

- Reynard Corporation (U.S.)

- OC Oerlikon Management AG (Switzerland)

- ULVAC-PHI, INCORPORATED (Japan)

- EP LABORATORIES, INC. (U.S.)

- THINFILMS, INC. (U.S.)

- MPP Micro Point Pro (U.S.)

- IHI HAUZER TECHNO COATING B.V. (Netherlands)

- CVD Equipment Corporation (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- LAM RESEARCH CORPORATION (U.S.)

- DuPont (U.S.)

- ZEISS (Germany)

- PPG Industries, Inc. (U.S.)

- Nippon Sheet Glass Co., Ltd (Japan)

Latest Developments in Global Thin Film Coatings Market

-

In April 2022, JX Nippon Mining & Metals' USD 29 million land acquisition in Mesa, Arizona aims to establish a strategic foothold in the U.S., enhancing its presence and operational capabilities in the region

- In January 2022, Umicore consolidated its thin film and electroplating businesses into a unified unit, focusing on advanced vacuum deposition and electroplating technologies to deliver high-quality solutions

- In January 2022, Umicore repositioned its electroplating and thin film offerings under its metal deposition portfolio, targeting expanded applications across diverse industries to attract new customer segments

- In November 2020, Edmund Optics acquired Quality Thin Films Inc., augmenting its portfolio with advanced optical components featuring robust laser crystal coatings, spanning from ultraviolet to far-infrared wavelengths

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thin Film Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thin Film Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thin Film Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.