Global Thermoformed Plastics In Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

9.61 Billion

USD

14.05 Billion

2025

2033

USD

9.61 Billion

USD

14.05 Billion

2025

2033

| 2026 –2033 | |

| USD 9.61 Billion | |

| USD 14.05 Billion | |

|

|

|

|

Thermoformed Plastics in Healthcare Market Size

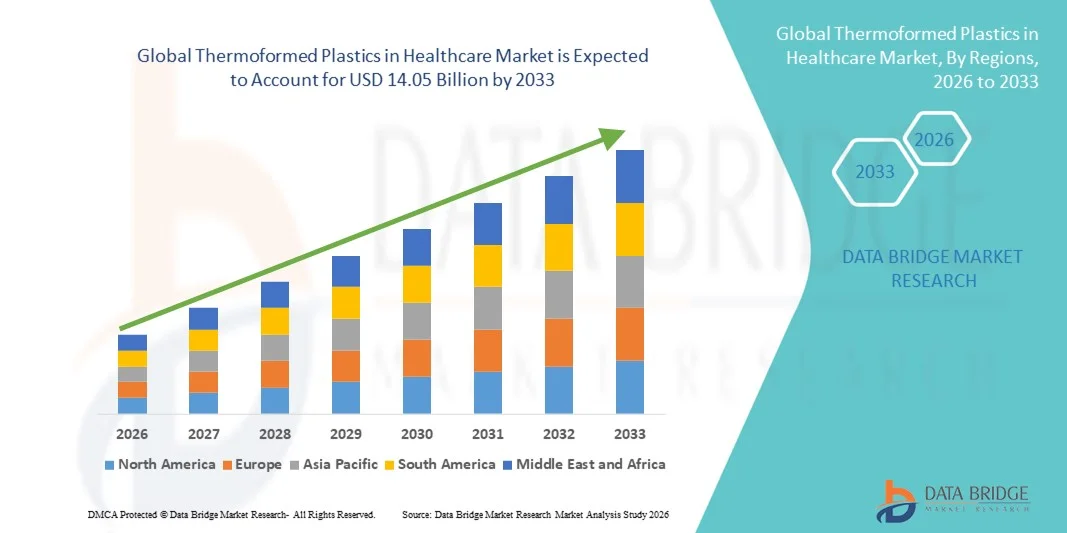

- The global thermoformed plastics in healthcare market size was valued at USD 9.61 billion in 2025 and is expected to reach USD 14.05 billion by 2033, at a CAGR of 4.87% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, durable, and customizable packaging and medical components in the healthcare sector, driven by rising patient care standards and stringent hygiene requirements

- Furthermore, growing adoption of advanced manufacturing techniques, such as thermoforming and vacuum forming, along with the need for cost-effective and efficient production of medical trays, blister packs, and device housings, is accelerating the uptake of Thermoformed Plastics in Healthcare solutions, thereby significantly boosting the industry's growth

Thermoformed Plastics in Healthcare Market Analysis

- Thermoformed plastics in healthcare, used for medical packaging and device components, are increasingly vital in modern healthcare systems due to their enhanced safety, precision, and compatibility with sterile environments

- The escalating demand for thermoformed plastics in healthcare is primarily fueled by rising production of medical devices, increasing regulatory requirements for sterile packaging, and growing adoption of efficient manufacturing technologies

- North America dominated the thermoformed plastics in healthcare market with the largest revenue share of 38.5% in 2025, driven by the strong presence of medical device manufacturers, well-established healthcare infrastructure, and rising demand for high-quality sterile packaging solutions. The U.S. remains the largest contributor within the region, fueled by advanced manufacturing capabilities and innovations in medical packaging and devices

- Asia-Pacific is expected to be the fastest growing region in the thermoformed plastics in healthcare market during the forecast period, with a CAGR of 7.8%, due to rapid healthcare expansion, rising medical device production, and increasing adoption of cost-effective and lightweight thermoformed packaging solutions in countries like China and India

- The Thin Gauge segment held the largest revenue share of 46% in 2025, primarily driven by the high adoption in disposable trays, blister packaging, and laboratory consumables

Report Scope and Thermoformed Plastics in Healthcare Market Segmentation

|

Attributes |

Thermoformed Plastics in Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Thermoformed Plastics in Healthcare Market Trends

Enhanced Convenience Through Advanced Material Applications

- A significant and accelerating trend in the global Thermoformed Plastics in Healthcare market is the increasing adoption of advanced thermoformed solutions for medical devices, surgical trays, and diagnostic packaging

- These materials improve operational efficiency, product safety, and ease of handling

- For instance, thermoformed surgical trays with compartmentalized designs are being widely adopted in hospitals in North America and Europe to organize instruments, reduce contamination risks, and facilitate faster sterilization processes

- Prefilled syringe and infusion packaging in Asia-Pacific are being optimized for sterile transport, ease of handling by medical staff, and minimized waste

- Thermoformed plastics are increasingly used in diagnostic kits and laboratory consumables, offering clear visibility, precision, and reduced risk of contamination

- The trend reflects a growing emphasis on improving patient care, reducing medical errors, and optimizing hospital workflows through specialized thermoformed solutions

Thermoformed Plastics in Healthcare Market Dynamics

Driver

Rising Demand for Medical Devices and Disposable Healthcare Products

- The surge in minimally invasive surgeries, diagnostic testing, and outpatient procedures is driving strong demand for disposable healthcare products manufactured using thermoformed plastics. These products offer superior durability, sterility, and design flexibility compared to traditional packaging methods

- For instance, hospitals in the United States and Germany increasingly rely on thermoformed trays for surgical kits, IV administration sets, and catheter packaging, while emerging markets such as India and China are rapidly adopting cost-effective, sterile thermoformed diagnostic kits to meet rising patient volumes

- Increasing government investments in healthcare infrastructure, particularly in Asia-Pacific and the Middle East, are supporting the widespread adoption of high-quality thermoformed medical devices and packaging solutions

- The industry is witnessing a growing preference for single-use, disposable products to prevent cross-contamination and improve infection control, which further accelerates market growth for thermoformed components

- Manufacturers are leveraging the flexibility of thermoforming to produce highly customized, complex medical components, which allows healthcare providers to meet specific clinical needs and maintain high standards of care

Restraint/Challenge

Regulatory Compliance and Material Costs

- The Thermoformed Plastics in Healthcare market faces significant challenges due to strict regulatory standards imposed by authorities such as the FDA, ISO, and MDR, requiring manufacturers to adhere to rigorous testing, certification, and quality control processes

- For instance, companies in developing regions often face delays in obtaining certifications for medical-grade polymers, while manufacturers in North America and Europe must invest heavily in compliance measures, which can delay product launches and increase costs

- High-quality thermoformed materials and precision molding equipment involve substantial capital investment, making the initial setup expensive, particularly for small- and medium-sized enterprises looking to enter the market

- Inconsistent standards and variations in regulatory requirements across countries create challenges for manufacturers aiming to serve a global customer base, as products may need modifications to meet local compliance guidelines

- In addition, fluctuations in polymer prices and the need for specialized manufacturing expertise can limit adoption in price-sensitive regions, making cost management and supply chain optimization critical for sustained growth

Thermoformed Plastics in Healthcare Market Scope

The market is segmented on the basis of product type, thermoforming type, and parts type.

- By Product

On the basis of product, the Thermoformed Plastics in Healthcare market is segmented into Bio-Degradable Polymers, PE, PVC, and PP. The PE (Polyethylene) segment dominated the market with the largest revenue share of 38.5% in 2025, attributed to its widespread use in medical trays, packaging, and disposable devices due to excellent chemical resistance, biocompatibility, and ease of sterilization. Hospitals, clinics, and diagnostic centers prefer PE-based thermoformed products for high-volume, low-cost applications. Its lightweight nature, combined with durability and flexibility in forming processes, supports adoption across healthcare packaging and medical device components. The segment’s dominance is further reinforced by established supply chains, regulatory approvals, and cost-effectiveness compared to PVC and PP. PE’s ability to maintain product integrity during sterilization and storage ensures high reliability in medical applications. In addition, the material’s compatibility with automated thermoforming lines allows for mass production at lower operational costs. The adoption in disposable surgical trays, biohazard containers, and labware contributes significantly to its revenue share. Its versatility in both thin and thick gauge applications further cements its leading market position.

The Bio-Degradable Polymers segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by increasing environmental concerns and regulatory pressures for sustainable medical packaging solutions. Hospitals and healthcare providers are progressively shifting toward eco-friendly alternatives to reduce plastic waste. Bio-degradable polymers offer comparable strength and chemical resistance to conventional plastics, enabling their use in trays, packaging, and disposable medical devices. The growing emphasis on circular economy models, combined with advancements in polymer blending technologies, supports faster adoption. Furthermore, rising awareness among patients and medical institutions about sustainable healthcare practices is fueling demand. Innovations in compostable polymers and enhanced processability make bio-degradable products more cost-competitive. Adoption is particularly strong in Europe and North America, where sustainability mandates and corporate responsibility initiatives drive procurement policies.

- By Thermoforming Type

On the basis of thermoforming type, the market is segmented into Vacuum Formed, Pressure Formed, and Mechanical Formed. The Vacuum Formed segment dominated with a revenue share of 42% in 2025, due to its ability to produce precise, lightweight, and high-quality parts with consistent thickness. Vacuum forming is widely applied in manufacturing disposable trays, protective medical packaging, and device housings. The process offers excellent flexibility in design, allowing production of complex shapes with minimal tooling costs. Hospitals and device manufacturers favor vacuum-formed products for short production runs and rapid prototyping. Its ease of integration into automated production lines enhances efficiency and reduces labor costs. In addition, the process ensures uniform material distribution, which is critical for sterilizable medical products. The high repeatability and low scrap rates further support its revenue dominance.

The Pressure Formed segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, due to its capacity to produce deeper draws and more intricate geometries suitable for specialized medical device components. Its precision and structural integrity make it ideal for rigid packaging, protective casings, and high-performance trays. The increasing demand for complex medical assemblies and durable packaging drives growth. Pressure forming also allows better material utilization and high-quality surface finishes, appealing to premium medical device manufacturers.

- By Parts Type

On the basis of parts type, the market is segmented into Thin Gauge and Thick Gauge. The Thin Gauge segment held the largest revenue share of 46% in 2025, primarily driven by the high adoption in disposable trays, blister packaging, and laboratory consumables. Thin gauge parts are favored for cost-efficiency, lightweight characteristics, and compatibility with high-speed thermoforming lines. The ability to maintain structural integrity at lower material thicknesses ensures widespread usage in hospitals and diagnostic centers.

The Thick Gauge segment is anticipated to witness the fastest CAGR of 7.9% from 2026 to 2033, fueled by rising demand for durable medical housings, device casings, and reusable trays. Thick gauge parts provide enhanced strength, impact resistance, and heat tolerance, making them suitable for long-term or repeated-use applications. The growing adoption of advanced medical equipment requiring robust polymer components is driving growth globally, especially in North America and Europe. In addition, increasing focus on product safety and regulatory compliance in medical device manufacturing further supports the adoption of thick gauge thermoformed parts.

Thermoformed Plastics in Healthcare Market Regional Analysis

- North America dominated the thermoformed plastics in healthcare market with the largest revenue share of 38.5% in 2025, driven by the strong presence of medical device manufacturers, well-established healthcare infrastructure, and rising demand for high-quality sterile packaging solutions

- The market remains the largest contributor within the region, fueled by advanced manufacturing capabilities, innovations in medical packaging, and the increasing adoption of polymer-based components in medical devices

- Hospitals, clinics, and diagnostic centers prioritize lightweight, durable, and sterilizable thermoformed plastics for trays, device housings, and packaging applications. High R&D investment, strict regulatory compliance standards, and strong partnerships between manufacturers and healthcare providers further strengthen market growth in North America

U.S. Thermoformed Plastics in Healthcare Market Insight

The U.S. thermoformed plastics in healthcare market captured the largest share within North America, accounting for over 80% of the region’s revenue in 2025. The market is driven by continuous innovation in medical device design, high adoption of sterile packaging solutions, and growing healthcare expenditure. Key factors include the development of advanced thermoformed medical trays, reusable housings, and specialized device components that meet FDA and ISO standards. The demand for lightweight, cost-effective, and high-performance polymers in hospitals, surgical centers, and medical device manufacturing is further propelling the market. In addition, the U.S. leads in integrating biodegradable and eco-friendly polymers in healthcare applications, supporting sustainability trends.

Europe Thermoformed Plastics in Healthcare Market Insight

The Europe thermoformed plastics in healthcare market is projected to grow at a substantial CAGR, supported by stringent regulatory frameworks, rising awareness of healthcare hygiene, and increasing adoption of sterile packaging solutions. Germany, France, and the U.K. are key markets, driven by well-developed healthcare systems and a focus on advanced medical devices. Hospitals and specialty clinics are increasingly adopting thermoformed trays, housings, and protective packaging for medical devices. The push toward lightweight, durable, and reusable medical components, along with eco-friendly polymer usage, is creating significant growth opportunities across the region.

U.K. Thermoformed Plastics in Healthcare Market Insight

The U.K. thermoformed plastics in healthcare market is anticipated to grow at a notable CAGR due to the rising demand for sterile packaging solutions and advanced medical device components. Hospitals, surgical centers, and maternity clinics are key end users adopting thermoformed plastics for trays, housings, and protective packaging. The focus on patient safety, product sterilization, and cost-effective manufacturing is encouraging manufacturers to expand their offerings in the U.K. market. In addition, sustainability initiatives and the adoption of recyclable polymers are expected to drive growth during the forecast period.

Germany Thermoformed Plastics in Healthcare Market Insight

Germany thermoformed plastics in healthcare market is a leading market in Europe for thermoformed plastics in healthcare, driven by a combination of high healthcare standards, strong medical device manufacturing, and advanced R&D infrastructure. The demand for durable, sterilizable, and lightweight medical trays, housings, and device components is increasing in hospitals, clinics, and diagnostic laboratories. In addition, Germany’s emphasis on sustainable and recyclable polymers aligns with regional environmental regulations, supporting the adoption of bio-degradable and eco-friendly thermoformed materials in healthcare applications.

Asia-Pacific Thermoformed Plastics in Healthcare Market Insight

The Asia-Pacific thermoformed plastics in healthcare market is expected to be the fastest-growing region with a CAGR of 7.8% from 2026 to 2033, driven by rapid expansion of healthcare infrastructure, increasing medical device production, and rising demand for cost-effective and lightweight thermoformed packaging solutions in countries like China, India, and Japan. The growth is fueled by the region’s emerging medical device manufacturers, rising hospital and clinic expansions, and increased investment in polymer-based packaging for device sterilization. Moreover, government initiatives supporting healthcare modernization and local manufacturing of medical plastics are accelerating market adoption.

Japan Thermoformed Plastics in Healthcare Market Insight

Japan’s thermoformed plastics in healthcare market is gaining traction due to its high-quality healthcare infrastructure, advanced medical device manufacturing, and the growing emphasis on patient safety. The adoption of thermoformed plastics for trays, device housings, and protective packaging is rising, particularly in hospitals and surgical centers. Japan’s aging population and emphasis on reusable and sterilizable medical components further support the demand for durable and reliable thermoformed plastics.

China Thermoformed Plastics in Healthcare Market Insight

China thermoformed plastics in healthcare market accounted for the largest revenue share in Asia-Pacific in 2025, owing to rapid urbanization, expanding middle-class healthcare demand, and growth in domestic medical device manufacturing. Hospitals, specialty clinics, and diagnostic centers are increasingly adopting cost-effective, lightweight, and high-performance thermoformed plastics for trays, housings, and packaging. Government initiatives promoting local medical device production and the push toward standardized sterilizable packaging solutions are key factors driving market growth in China.

Thermoformed Plastics in Healthcare Market Share

The Thermoformed Plastics in Healthcare industry is primarily led by well-established companies, including:

- Plastic Technologies, Inc. (U.S.)

- Campbell Hausfeld (U.S.)

- MedPlast (U.S.)

- Inteplast Group (U.S.)

- Klöckner Pentaplast (Germany)

- Winpak (Canada)

- Tekni-Plex (U.S.)

- Plastipak Holdings (U.S.)

- Sealed Air Corporation (U.S.)

- Coveris (Austria)

- Amcor Limited (Australia)

- Mondi Group (Germany)

- SABIC (Saudi Arabia)

- Shanghai Ruisen Packaging (China)

Latest Developments in Global Thermoformed Plastics in Healthcare Market

- In May 2023, Tegrant Corporation announced the launch of a new line of sustainable thermoformed packaging solutions made from recycled materials designed to reduce environmental impact and meet rising demand for eco‑friendly medical and pharmaceutical packaging

- In November 2023, Coveris introduced Formpeel P, a recyclable and flexible thermoforming film solution tailored for diverse applications including medical packaging, aimed at improving sustainability and performance in healthcare packaging formats

- In August 2024, Tekni‑Plex unveiled a new high‑barrier thermoformed blister packaging specifically engineered for sensitive drug products, combining advanced materials like high‑density polyethylene and aluminum to enhance moisture and oxygen stability

- In June 2024, Sonoco completed the acquisition of Thermoform Engineered Quality (TEQ), strengthening its capabilities in custom thermoformed packaging solutions for medical devices and diagnostics, and expanding its sterile packaging portfolio

- In October 2024, Amcor Flexibles announced that its Oshkosh facility would expand thermoforming capacity with a new Class 7 cleanroom to support thermoformed trays and lids for pharmaceuticals and medical devices — including plans to introduce a recycle‑ready APET material “AmSecure” for healthcare trays in early 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.