Thermoform Trays Market Analysis and Size

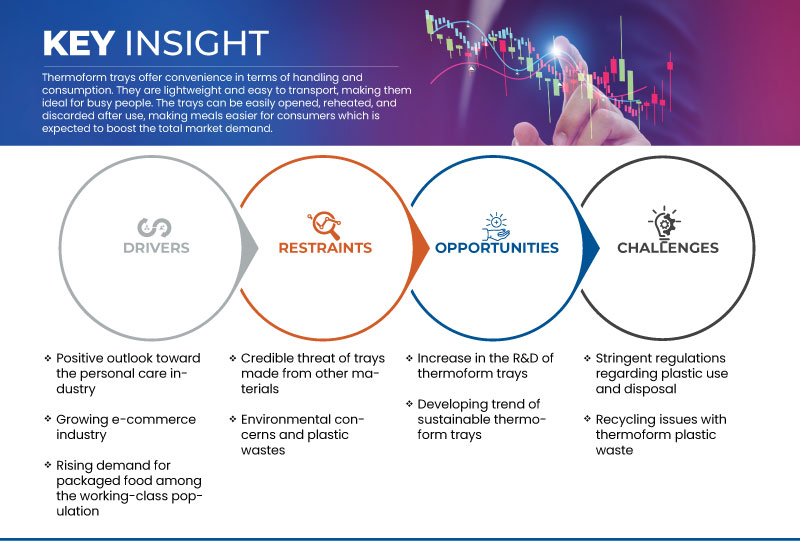

Thermoforming is a manufacturing process where an extruded plastic sheet is heated to a point where it is able to stretch. The rising demand for packaged food among the working-class population and the growing e-commerce industry are major factors expected to drive market growth. In addition, the rising trend of sustainable thermoform trays is expected to provide an opportunity for market growth. However, environmental concerns and the production of plastic waste due to the use of thermoform trays are expected to pose a challenge to market growth.

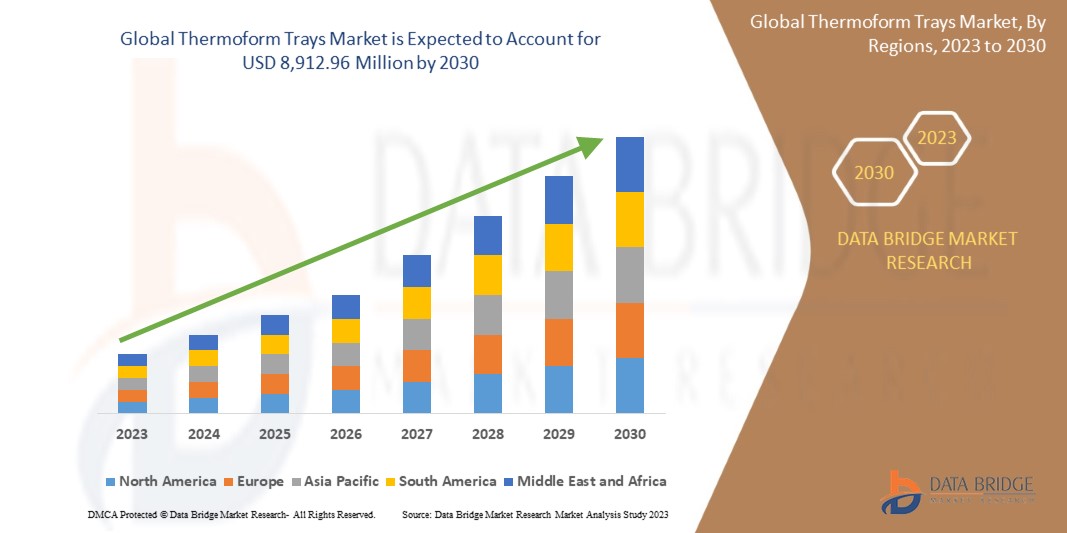

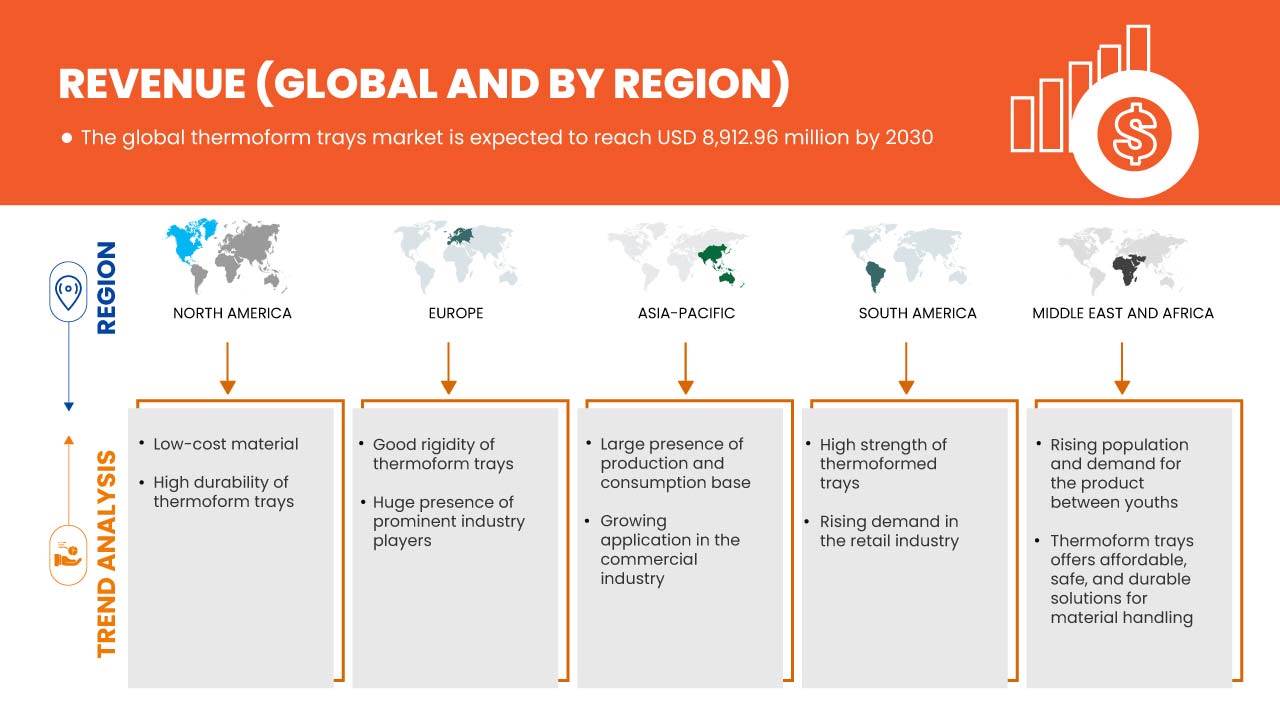

Data Bridge Market Research analyzes that the global thermoform trays market is expected to reach a value of USD 8,912.96 million by 2030, at a CAGR of 4.5% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units |

|

Segments Covered |

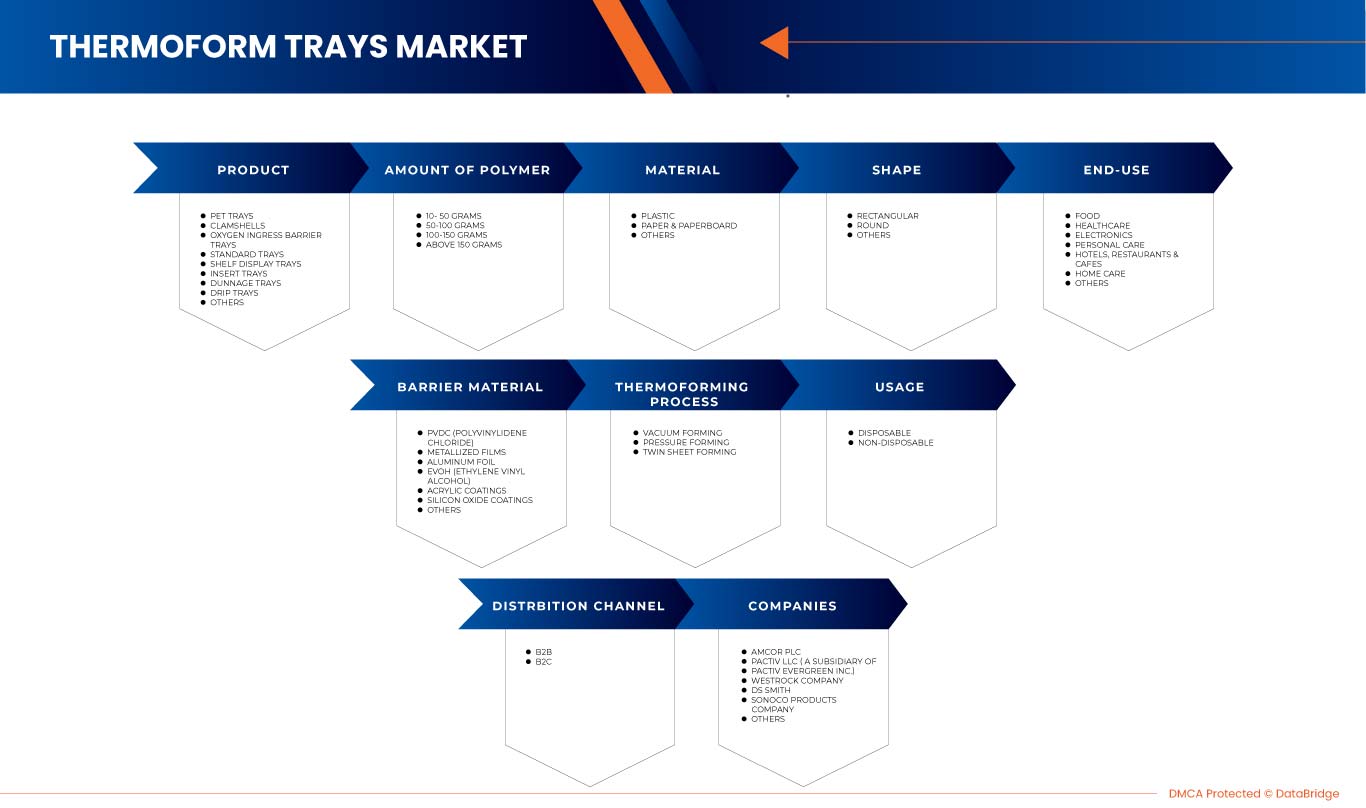

By Product (PET Trays, Clamshells, Oxygen Ingress Barrier Trays, Standard Trays, Shelf Display Trays, Insert Trays, Dunnage Trays, Drip Trays, and Others), Barrier Material (PVDC (Polyvinylidene Chloride), Metallized Films, Aluminium Foil, EVOH (Ethylene Vinyl Alcohol), Acrylic Coatings, Silicon Oxide Coatings, and Others), Amount of Polymer (10-50 Grams, 50-100 Grams, 100-150 Grams, and Above 150 Grams), Material (Plastic, Paper & Paperboard, and Others), Thermoforming Process (Vacuum Forming, Pressure Forming, and Twin Sheet Forming), Shape (Rectangular, Round, and Others), Usage (Disposable and Non-Disposable), Distribution Channel (B2B and B2C), End-Use (Food, Healthcare, Electronics, Personal Care, Hotels, Restaurants & Cafes, Home Care, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Saudi Arabia, U.A.E., Kuwait, and rest of Middle East and Africa |

|

Market Players Covered |

Amcor plc, Pactiv LLC (A subsidiary of Pactiv Evergreen Inc.), WestRock Company, DS Smith, Sonoco Products Company, Prent Corporation, Huhtamaki, Placon, Nelipak Healthcare Packaging, Lacerta Group LLC, EasyPak, Dordan Manufacturing Company, HLP Klearfold, Engineered Components & Packaging, LLC, and Universal Plastics Group, Inc. among others |

Market Definition

Thermoform trays are developed to help farmers to meet increased agricultural demand on a sustainable basis. Thermoform trays boost crop yield and its value, which positively affects farm productivity. Agricultural biostimulant comprises of multiple amalgamations of chemicals, substances, and micro-organisms that are added to the plants or soils to boost crop vigor, production, sensitivity to abiotic pressure, and quality. They support the growth and production of crops throughout the entire crop life cycle, from seed germination to plant maturity, in a variety of demonstrated ways, such as regulating plant metabolism. They are developed for farmers to meet the demand for sustainable agriculture, including quality and improved crop yield, and even for the consumers to meet the demand for organic products so as to cope with health and safety standards. Thus, due to this, investors are increasingly interested in the biostimulant category with respect to the significant growth potential.

Global Thermoform Trays Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing E-Commerce Industry

Thermoform packaging products involve several plastic packaging products used in industries for finished packaging goods. They have high strength and are available in different shapes and sizes, increasing their demand in the market. They are easily sealable, which prevents damage to items in trays that are made from thermoform material, giving protection to finished goods in transit.

In the e-commerce industry, high-quality packaging is essential so that the goods should reach the customers' hands without any distortion in their quality. E-commerce and courier service have also increased with the increase in online shopping apps, medical stores, and online retail stores, leading to increased use of different types of thermoform packaging products for pharmaceutical and personal care electronic items. In addition, several electronic stores have shifted to the digital platform, due to which the packaging in consumer electronics has increased. Several manufacturers of packaging products analyze the demand for finished goods on digital media and produce accordingly. Moreover, the increasing trend of online food delivery sites is expected to boost market growth.

For instance,

- In June 2019, according to Forbes, the online food delivery market was estimated to reach USD 34.31 billion in 2017, and by 2030 it is estimated that the market will reach USD 90.95 billion due to rapid urbanization and fast-paced lifestyle

Therefore, increasing e-commerce services and growth in the e-commerce industry will increase the demand for thermoform trays in several sectors, which is expected to drive market growth.

- Increasing Demand for Packaged Food among Working Class Population

The rising demand for packaged food among the working-class population is a significant factor expected to drive market growth. Thermoform trays have become an essential part of food product packaging. Convenient and time-saving meal options are becoming more and more necessary as more people lead busy lives. Packaged food offers a practical alternative by providing ready-to-eat or easy-to-prepare meals that need minimal effort and time. Thermoform trays are critical in preserving the safety, freshness, and mobility of these packaged foods.

Thermoform trays are highly secured packaging products as lids do not distort goods during transit. In addition, the covers are tightly sealed, which does not allow any material to pass into food products, which ensures food products' safety. In the food and packaging industry, the use of thermoform trays is increasing as it helps to increase the shelf life of the products and is also used for storage.

Furthermore, thermoform trays offer convenience in terms of handling and consumption. They are lightweight and easy to transport, making them ideal for busy people. The trays can be easily opened, reheated, and discarded after use, making meals easier for consumers.

For instance,

- In August 2018, according to SouthPack Packaging article, thermoform packaging is a strong, resilient, and tamper-resistant packaging alternative. This provides protection not just during shipping and transportation but also a variety of sealing solutions that can help to extend the shelf life of the goods

Thus, the increasing demand for packaged food in the food and beverage industry will increase the demand for thermoform trays, which is expected to drive market growth.

Restraint

- Environmental Concerns and Plastic Wastes

The growing environmental concerns regarding plastic waste are one of the major restraints for market growth. Thermoform trays are made of plastic, which adds to the increasing issue of plastic pollution. Plastic trays wind up in landfills, oceans, and other natural areas due to improper disposal and a lack of recycling options, harming wildlife and ecosystems. The slow decomposition rate of plastic exacerbates the issue, as it can take several years for thermoform trays to break down. Furthermore, the large production volume of single-use thermoform trays limits resources and increases energy usage.

Therefore, consumers are becoming increasingly aware of plastic and various plastic materials that have harmful effects on the environment. This has made consumers' now more concerned about the environmental implications of plastic. The used plastic and its waste is critically harming the environment as the recycling rates for plastics are very low compared to other counterpart materials.

For instance,

- In October 2022, according to the NPR, the percentage of recycled plastic that is actually used to create new products has reached new lows of only 5%, which is expected to drop further. The Ellen MacArthur Foundation's New Plastic Economy Project has set goals for the recycling rate of plastic, which must be at least 30%

Challenge

- Stringent Regulations Regarding Plastic Use and Disposal

The rising concern about the use of plastic in the manufacturing process of thermoform trays has led to strict rules and regulations. As consumer demand for safe and sustainable products increases, governments have implemented stringent rules and regulations to ensure environmental safety, quality, and protection. This imposition of various stringent regulations on the use of thermoform trays, with rising environmental concerns related to toxicity issues, is expected to pose a major challenge to market growth.

These guidelines and laws cover the use of specific raw materials in the manufacturing of thermoform trays. In addition, the rules and regulations made for the use of polyurethanes, such as polyurethane foams, are expected to restrain market growth.

For instance,

- In June 2020, according to Medical Plant News, packaging solutions should include ISO 11607 for the packaging of medical products. It is designed to improve protection and preserve tough sterilization conditions

Opportunity

- Increase in the R&D of Thermoform Trays

There has been a rise in the R&D of thermoform trays in recent years. The increased demand for trays for packaging in different industries, including medicines, food & beverage, and electronics, has increased the demand for R&D of thermoform trays. The demand for improved product protection, shelf life, and cost-effective packaging solutions is increasing. The industrial shift towards sustainable and eco-friendly packaging encourages investment in R&D activities. In addition, researchers are finding ways to develop new sustainable materials for thermoform trays, improve recyclability, and reduce waste of thermoform trays materials.

For instance,

- In November 2022, Amcor plc created a material that combines the benefits of trays, foams, and liners into a single product known as Amcor HealthCare Ortho Secure Thermoform trays that avoids the risk of abrasion and keeps the medical devices intact. Such trays also lower the packaging's carbon footprint as it does not consist of materials such as sleeves, liners, and foams

Global Thermoform Trays Market Scope

The global thermoform trays market is segmented into nine notable segments based on product, barrier material, amount of polymer, material, thermoforming process, shape, usage, distribution channel, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- PET Trays

- Standard Trays

- Insert Trays

- Dunnage Trays

- Shelf Display Trays

- Drip Trays

- Others

On the basis of product, the market is segmented into PET trays, clamshells, oxygen ingress barrier trays, standard trays, shelf display trays, insert trays, dunnage trays, drip trays, and others.

Barrier Material

- EVOH (Ethylene Vinyl Alcohol)

- PVDC (Polyvinylidene Chloride)

- Aluminum Foil

- Metallized Films

- Acrylic Coatings

- Silicon Oxide Coatings

- Others

On the basis of barrier material, the market is segmented into PVDC (Polyvinylidene Chloride), metallized films, aluminium foil, EVOH (Ethylene Vinyl Alcohol), acrylic coatings, silicon oxide coatings, and others.

Amount of Polymer

- 10-50 Grams

- 50-100 Grams

- 100-150 Grams

- Above 150 Grams

On the basis of amount of polymer, the market is segmented into 50-100 grams, 10-50 grams, 100-150 grams, and above 150 grams.

Material

- Plastic

- Paper & Paperboard

- Others

On the basis of material, the market is segmented into plastic, paper & paperboard, and others.

Thermoforming Process

- Vacuum Forming

- Pressure Forming

- Twin Sheet Forming

On the basis of thermoforming process, the market is segmented into vacuum forming, pressure forming, and twin sheet forming.

Shape

- Round

- Rectangular

- Others

On the basis of shape, the market is segmented into rectangular, round, and others.

Usage

- Disposable

- Non-Disposable

On the basis of usage, the market is segmented into disposable and non-disposable.

Distribution Channel

- B2B

- B2C

On the basis of distribution channel, the market is segmented into B2B and B2C.

End-Use

- Food

- Personal Care

- Healthcare

- Electronics

- Hotels, Restaurants & Cafes

- Home Care

- Others

On the basis of end-use, the market is segmented into food, healthcare, electronics, personal care, hotels, restaurants & cafes, home care, and others.

Global Thermoform Trays Market Regional Analysis/Insights

The global thermoform trays market is analyzed, and market size insights and trends are provided by country, product, barrier material, amount of polymer, material, thermoforming process, shape, usage, distribution channel, and end-use as referenced above.

The countries covered in the global thermoform trays market report are U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Saudi Arabia, U.A.E., Kuwait, and rest of Middle East and Africa.

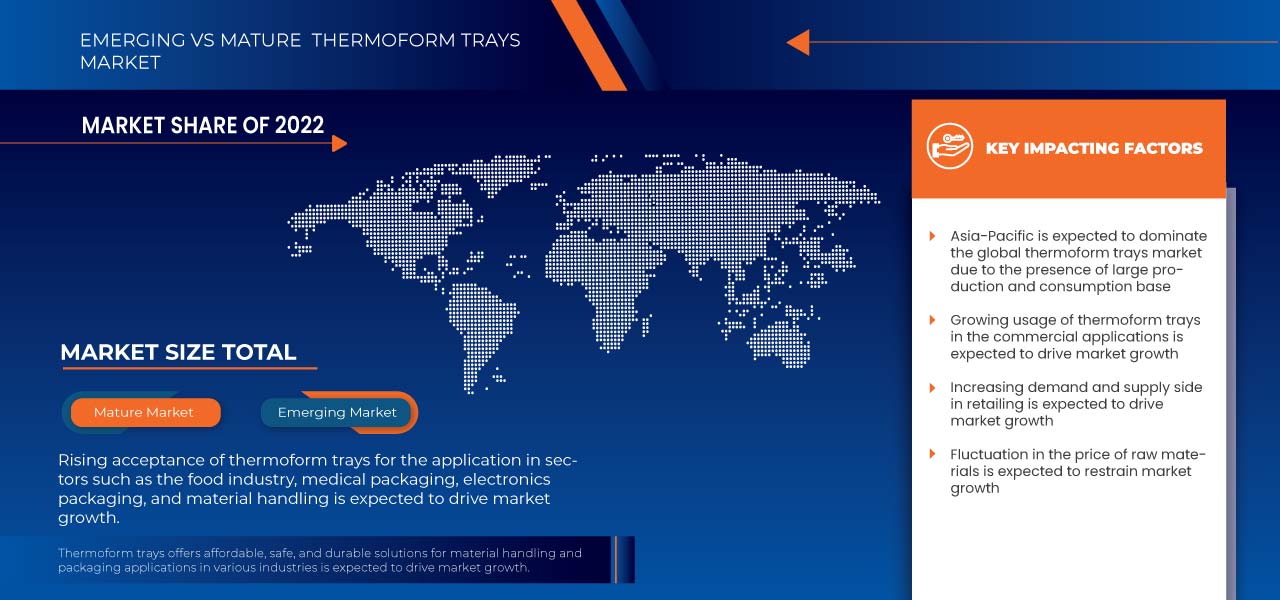

Asia-Pacific is expected to dominate the global thermoform trays market with a CAGR of around 5.3% due to large production, easy availability of products, and an increase in customer base. The U.S. is expected to dominate the North America thermoform trays market due to the rising acceptance of thermoform trays, such as containers and pallets in material handling and packaging applications. China is expected to dominate the Asia-Pacific thermoform trays market due to the expansion in the food and construction industry on a global level. Germany is expected to dominate the Europe thermoform trays market due to the growth in the food and medical industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Thermoform Trays Market Share Analysis

The global thermoform trays market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the global thermoform trays market are Amcor plc, Pactiv LLC (A subsidiary of Pactiv Evergreen Inc.), WestRock Company, DS Smith, Sonoco Products Company, Prent Corporation, Huhtamaki, Placon, Nelipak Healthcare Packaging, Lacerta Group LLC, EasyPak, Dordan Manufacturing Company, HLP Klearfold, Engineered Components & Packaging, LLC, and Universal Plastics Group, Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.3 BRAND OUTLOOK

4.3.1 BRAND COMPARATIVE ANALYSIS ON THE GLOBAL THERMOFORM TRAYS MARKET

4.3.2 PRODUCT VS BRAND OVERVIEW

4.4 CONSUMER BUYING BEHAVIOR

4.5 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET– GLOBAL THERMOFORM TRAYS MARKET

4.5.1 IMPACT ON PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON DEMAND

4.5.5 IMPACT ON STRATEGIC DECISIONS

4.5.6 CONCLUSION

4.6 TRADE ANALYSIS

4.6.1 IMPORT DATA OF TRAYS, DISHES, PLATES, CUPS AND THE LIKE, OF PAPER OR PAPERBOARD (EXCLUDING OF BAMBOO PAPERBOARD)

4.6.2 EXPORT DATA OF TRAYS, DISHES, PLATES, CUPS AND THE LIKE, OF PAPER OR PAPERBOARD (EXCLUDING OF BAMBOO PAPERBOARD)

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 GLOBAL THERMOFORM TRAYS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.8.1 PVC (POLYVINYL CHLORIDE)

4.8.2 PET (POLYETHYLENE TEREPHTHALATE)

4.8.3 PP (POLYPROPYLENE)

4.8.4 ACRYLONITRILE BUTADIENE STYRENE (ABS)

4.8.5 POLYSTYRENE (PS)

4.8.6 POLYETHYLENE (PE)

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS

4.11 VENDOR SELECTION CRITERIA

5 REGULATORY CHANGES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING E-COMMERCE INDUSTRY

6.1.2 INCREASING DEMAND FOR PACKAGED FOOD AMONG WORKING CLASS POPULATION

6.1.3 POSITIVE OUTLOOK TOWARDS PERSONAL CARE INDUSTRY

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL CONCERNS AND PLASTIC WASTES

6.2.2 CREDIBLE THREAT OF TRAYS MADE FROM OTHER MATERIALS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN THE R&D OF THERMOFORM TRAYS

6.3.2 DEVELOPING TREND OF SUSTAINABLE THERMOFORM TRAYS

6.4 CHALLENGES

6.4.1 STRINGENT REGULATIONS REGARDING PLASTIC USE AND DISPOSAL

6.4.2 RECYCLING ISSUES WITH THERMOFORM PLASTIC WASTE

7 GLOBAL THERMOFORM TRAYS MARKET : BY REGION

7.1 OVERVIEW

7.2 NORTH AMERICA

7.3 EUROPE

7.4 ASIA-PACIFIC

7.5 SOUTH AMERICA

7.6 MIDDLE EAST & AFRICA

8 COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: EUROPE

8.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 AMCOR PLC (2022)

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENT

10.2 PACTIV LLC (A SUBSIDIARY OF PACTIV EVERGREEN INC.) (2022)

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 WESTROCK COMPANY

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENT

10.4 DS SMITH

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT DEVELOPMENT

10.5 SONOCO PRODUCTS COMPANY

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 DORDAN MANUFACTURING COMPANY

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 EASYPAK

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 ENGINEERED COMPONENTS & PACKAGING, LLC

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 HLP KLEARFOLD

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENT

10.1 HUHTAMAKI

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 LACERTA GROUP LLC

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 NELIPAK HEALTHCARE PACKAGING

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 PLACON

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 PRENT CORPORATION

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 UNIVERSAL PLASTICS GROUP, INC.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Figure

FIGURE 1 GLOBAL THERMOFORM TRAYS MARKET: SEGMENTATION

FIGURE 2 GLOBAL THERMOFORM TRAYS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL THERMOFORM TRAYS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL THERMOFORM TRAYS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GLOBAL THERMOFORM TRAYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL THERMOFORM TRAYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL THERMOFORM TRAYS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL THERMOFORM TRAYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL THERMOFORM TRAYS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL THERMOFORM TRAYS MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 POSITIVE OUTLOOK TOWARDS PERSONAL CARE INDUSTRY IS THE KEY DRIVER FOR THE GLOBAL THERMOFORM TRAYS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 THE PET TRAYS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL THERMOFORM TRAYS MARKET IN 2023 AND 2030

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR THERMOFORM TRAYS MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 VENDOR SELECTION CRITERIA

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL THERMOFORM TRAYS MARKET

FIGURE 16 GLOBAL THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 17 GLOBAL THERMOFORM TRAYS MARKET: BY REGION (2022)

FIGURE 18 GLOBAL THERMOFORM TRAYS MARKET: BY REGION (2023 & 2030)

FIGURE 19 GLOBAL THERMOFORM TRAYS MARKET: BY REGION (2022 & 2030)

FIGURE 20 GLOBAL THERMOFORM TRAYS MARKET: BY PRODUCT (2023-2030)

FIGURE 21 NORTH AMERICA THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA THERMOFORM TRAYS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 26 EUROPE THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 27 EUROPE THERMOFORM TRAYS MARKET: BY COUNTRY (2022)

FIGURE 28 EUROPE THERMOFORM TRAYS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 EUROPE THERMOFORM TRAYS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 EUROPE THERMOFORM TRAYS MARKET: BY PRODUCT (2023 & 2030)

FIGURE 31 ASIA-PACIFIC THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 32 ASIA-PACIFIC THERMOFORM TRAYS MARKET: BY COUNTRY (2022)

FIGURE 33 ASIA-PACIFIC THERMOFORM TRAYS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 ASIA-PACIFIC THERMOFORM TRAYS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 ASIA-PACIFIC THERMOFORM TRAYS MARKET: BY PRODUCT (2023 & 2030)

FIGURE 36 SOUTH AMERICA THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 37 SOUTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022)

FIGURE 38 SOUTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 SOUTH AMERICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 40 SOUTH AMERICA THERMOFORM TRAYS MARKET: BY PRODUCT (2023 & 2030)

FIGURE 41 MIDDLE EAST AND AFRICA THERMOFORM TRAYS MARKET: SNAPSHOT (2022)

FIGURE 42 MIDDLE EAST AND AFRICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022)

FIGURE 43 MIDDLE EAST AND AFRICA THERMOFORM TRAYS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 44 MIDDLE EAST AND AFRICA THERMOFORM TRAYS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 MIDDLE EAST AND AFRICA THERMOFORM TRAYS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 46 GLOBAL THERMOFORM TRAYS MARKET: COMPANY SHARE 2022 (%)

FIGURE 47 NORTH AMERICA THERMOFORM TRAYS MARKET: COMPANY SHARE 2022 (%)

FIGURE 48 EUROPE THERMOFORM TRAYS MARKET: COMPANY SHARE 2022 (%)

FIGURE 49 ASIA-PACIFIC THERMOFORM TRAYS MARKET: COMPANY SHARE 2022 (%)

Global Thermoform Trays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoform Trays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoform Trays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.