Global Thawing System Market

Market Size in USD Million

CAGR :

%

USD

97.51 Million

USD

260.16 Million

2024

2032

USD

97.51 Million

USD

260.16 Million

2024

2032

| 2025 –2032 | |

| USD 97.51 Million | |

| USD 260.16 Million | |

|

|

|

|

Thawing System Market Size

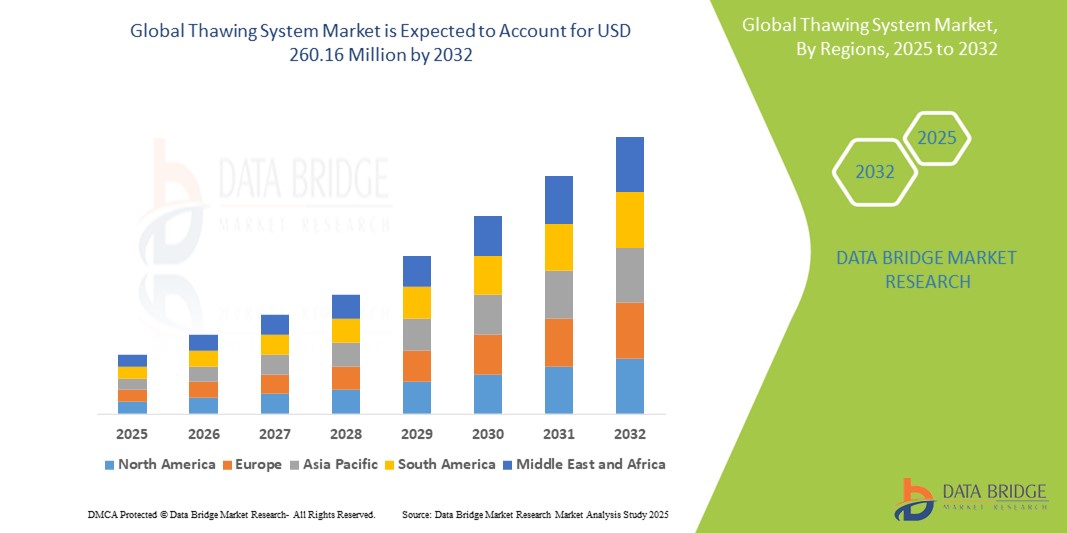

- The global thawing system market size was valued at USD 97.51 million in 2024 and is expected to reach USD 260.16 million by 2032, at a CAGR of 13.05 % during the forecast period

- This growth is driven by factors such as the increasing demand for thawing systems in the food industry, advancements in thawing technology, and the growing need for efficient food processing and preservation methods.

Thawing System Market Analysis

- The thawing system market is experiencing steady growth as food safety regulations and demand for efficient thawing solutions increase. This trend is especially evident in the foodservice and retail sectors, where time-efficient thawing methods are crucial for product quality

- The market is witnessing a shift towards automation and advanced technologies that improve thawing accuracy and reduce human error. Companies are integrating smart features into thawing systems to cater to the rising demand for consistency and operational efficiency

- North America is expected to dominate the thawing system market due to its well-established healthcare infrastructure, advanced food processing industries, and high adoption of automated thawing technologies across various sectors

- Asia-Pacific is expected to be the fastest-growing region in the thawing system market during the forecast period due to rapid industrialization, increasing demand for thawing solutions in healthcare and food sectors, and expanding pharmaceutical and biotechnology industries

- The automated systems segment is expected to dominate the thawing system market with the largest share of 43.9% in 2025 due to its ability to provide rapid, consistent, and reliable thawing with minimal human intervention. The growing need for precision and efficiency in medical and research applications, such as in organ transplantation and blood banking, is driving the adoption of automated thawing systems

Report Scope and Thawing System Market Segmentation

|

Attributes |

Thawing System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Thawing System Market Trends

“Automation and Integration of Smart Features in Thawing Systems”

- Automation in thawing systems is becoming increasingly common as businesses seek greater efficiency and reduced labor costs. Automated thawing systems allow for hands-free operation, minimizing human error and ensuring uniform thawing

- The integration of smart features, such as temperature sensors and real-time monitoring, is improving the accuracy and consistency of thawing processes. This trend helps maintain product quality and reduces waste

- Smart thawing systems are capable of adjusting temperature settings automatically based on the product type, optimizing thawing speed and efficiency. This ensures that the food remains at optimal quality

- Companies are increasingly incorporating cloud-based systems into thawing units to enable remote monitoring and management

- For instance, a foodservice chain can track thawing progress from a central hub across multiple locations

- Manufacturers are also focusing on energy efficiency by incorporating energy-saving technologies, making these smart thawing systems more cost-effective and environmentally friendly

Thawing System Market Dynamics

Driver

“Increasing Demand for Time-Efficient Thawing Solutions”

- The growing demand for time-efficient thawing solutions is a key driver in the thawing system market, particularly in the foodservice and retail industries. Businesses need faster methods to optimize operations and ensure quicker turnaround for perishable products

- Traditional thawing methods, such as room temperature thawing or water thawing, are inefficient and time-consuming, often leading to inconsistent results. This has led to a shift towards more advanced, faster, and reliable thawing technologies

- Automated thawing systems with smart features such as temperature control and real-time monitoring are becoming crucial in the foodservice industry. These systems ensure consistent thawing results and help businesses meet food safety regulations

- For instance, a major restaurant chain has adopted automated thawing systems to quickly and uniformly thaw frozen meats, reducing waste and improving operational efficiency

- As a result of increased demand for reliable thawing systems, manufacturers are innovating by introducing more energy-efficient, user-friendly, and scalable thawing solutions, helping businesses adapt to varying food types and production volumes

Opportunity

“Growth in the Food and Beverage Industry”

- The rapid growth of the food and beverage industry offers significant opportunities for the thawing system market, driven by changing consumer preferences and the increased demand for frozen and convenience foods

- With supermarkets, quick-service restaurants, and institutional food service providers relying heavily on frozen products, there is a growing need for thawing systems that can handle large volumes and deliver consistent results

- For instance, quick-service restaurants (QSRs) benefit from fast and efficient thawing systems, allowing them to prepare meals quickly and minimize food waste, making automated high-volume thawing solutions essential

- As global supply chains expand and more food is transported and stored frozen, the demand for reliable and efficient thawing systems intensifies to ensure timely food preparation across industries

- In addition, the increasing consumer focus on sustainability is prompting foodservice providers to adopt energy-efficient thawing systems, helping businesses reduce costs and meet their sustainability goals while maintaining high-quality food standards

Restraint/Challenge

“High Initial Investment Costs”

- A key challenge in the thawing system market is the high initial investment costs of advanced thawing technologies, which can be a significant barrier for many businesses, especially small and medium-sized enterprises (SMEs)

- For instance, automated thawing systems with smart features such as temperature control and real-time monitoring often come with a premium price, making them difficult for businesses with tight budgets, such as small grocery chains, to justify

- This high upfront cost can deter businesses from investing in advanced thawing systems, especially when traditional thawing methods appear more affordable in the short term

- In addition, maintenance and operational costs for advanced systems are an ongoing concern, as they require periodic maintenance and upgrades that may be out of reach for smaller businesses with limited resources

- As a result, the high capital expenditure and ongoing costs hinder the widespread adoption of advanced thawing systems, particularly among businesses focused on cost control and operational efficiency

Thawing System Market Scope

The market is segmented on the basis of type, sample type, and end users.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Sample Type |

|

|

By End Users |

|

In 2025, the automated systems is projected to dominate the market with a largest share in type segment

The automated systems segment is expected to dominate the thawing system market with the largest share of 43.9% in 2025 due to its ability to provide rapid, consistent, and reliable thawing with minimal human intervention. The growing need for precision and efficiency in medical and research applications, such as in organ transplantation and blood banking, is driving the adoption of automated thawing systems.

The blood is expected to account for the largest share during the forecast period in sample segment

In 2025, the blood segment is expected to dominate the market with the largest market share of 53.1% due to its critical role in emergency and surgical settings. As the demand for blood transfusions and other blood-related medical procedures continues to rise, thawing systems that ensure quick, safe, and consistent thawing of blood samples are becoming essential in healthcare facilities globally.

Thawing System Market Regional Analysis

“North America Holds the Largest Share in the Thawing System Market”

- North America dominates the thawing system market, accounting for over 47.8% of the global market share. This is largely driven by the region’s robust healthcare infrastructure and high demand for advanced thawing technologies

- The increasing number of healthcare facilities, blood banks, and research centers across the U.S. significantly contribute to the dominance, as these institutions require reliable thawing systems for critical medical applications

- Technological advancements, such as automated thawing systems with smart features, are widely adopted in North America to improve efficiency and ensure regulatory compliance in medical and food industries

- The region’s large-scale investment in biopharmaceutical research and cell therapy has increased the need for high-quality thawing systems, further solidifying North America's leading position in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Thawing System Market”

- Asia-Pacific is the fastest-growing region in the thawing system market, with rapidly expanding adoption of thawing technologies across various sectors. The market share is growing significantly due to the region's rising healthcare and research infrastructure

- Government investments in medical research, regenerative medicine, and biotechnology have led to an increasing demand for thawing systems, particularly in emerging economies such as China and India

- The region is experiencing rapid urbanization, leading to higher consumption of frozen food and creating demand for efficient thawing solutions in the food industry

- The growing number of pharmaceutical and biotechnology companies in Asia-Pacific is driving the demand for thawing systems in clinical and research settings, further enhancing the region's market share expansion

Thawing System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Helmer Scientific Inc. (U.S.)

- Boekel Scientific (U.S.)

- SARSTEDT AG & Co. KG (Germany)

- Cardinal Health (U.S.)

- General Electric Company (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

- Bioline India (India)

- LABCOLD (U.K.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Brainlab AG (Germany)

- Varian Medical Systems, Inc. (U.S.)

- Olympus Corporation (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Karl Kaps GmbH & Co. KG (Germany)

- Seiler Instrument Inc. (U.S.)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

Latest Developments in Global Thawing System Market

- In September 2022, Entegris formed a strategic partnership with Farrar Scientific, a division of Trane Technologies renowned for its climate innovations. Farrar specializes in ultra-cold temperature storage systems and controlled rate freeze/thaw chambers for pharmaceutical, biotech, and biorepository applications. Entegris contributes its Aramus bag, enhancing cold storage and transport capabilities. This collaboration aims to expedite the freeze/thaw process, offering a comprehensive solution to the industry

- In September 2022, Entegris established a partnership with HOF Sonderanlagenbau GmbH, an international provider of freeze/thaw equipment and tailored solutions for the pharmaceutical and biotechnology sectors. Entegris offers its Aramus bag for robust cold storage and transport. This collaboration enables Entegris to provide a combined solution that accelerates the freeze/thaw process and showcases its new Life Sciences Technology Center, designed to offer customers the opportunity to leverage cold-chain supply expertise to optimize processes, reduce costs, and increase speed to market

- In June 2023, Helmer Scientific introduced an advanced thawing system specifically designed for the food and beverage sector. This innovative system is engineered to deliver quick and reliable thawing of frozen food products, ensuring that their quality is preserved throughout the process. It addresses the growing need within the industry for more efficient thawing solutions that can reduce food waste and improve operational efficiency. The system’s capabilities are particularly valuable in foodservice operations and retail, where speed and consistency are critical

- In May 2023, Sarstedt introduced a groundbreaking defrosting apparatus tailored for medical applications. This innovative device is designed to provide rapid thawing of frozen blood products and other critical medical supplies, ensuring their safety and efficacy are maintained. It addresses the growing need for efficient thawing in healthcare settings, where preserving the quality of medical products is vital. The system promises to enhance medical procedures by reducing thawing time while ensuring consistency and reliability in thawed products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.