Global Testing Inspection And Certification Market

Market Size in USD Billion

CAGR :

%

USD

235.85 Billion

USD

397.42 Billion

2024

2032

USD

235.85 Billion

USD

397.42 Billion

2024

2032

| 2025 –2032 | |

| USD 235.85 Billion | |

| USD 397.42 Billion | |

|

|

|

|

Testing Inspection and Certification Market Size

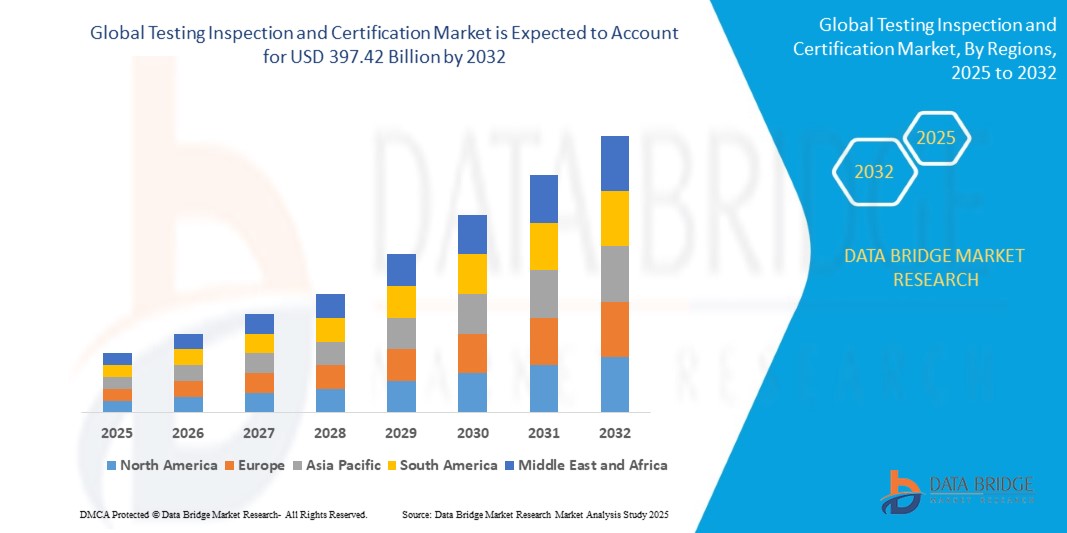

- The Global Testing Inspection and Certification Market size was valued at USD 235.85 billion in 2024 and is expected to reach USD 397.42 billion by 2032, at a CAGR of 6.74% during the forecast period

- The market expansion is driven by the accelerating pace of industrialization, globalization of trade, and stricter regulatory frameworks across various industries, including manufacturing, healthcare, energy, and consumer goods. As businesses strive to meet increasingly complex compliance standards and ensure product reliability, TIC services are becoming an essential component of supply chains worldwide.

- Additionally, the rising integration of advanced technologies such as AI, IoT, and blockchain into TIC processes is improving efficiency, traceability, and transparency. These digital advancements are particularly crucial in sectors like automotive, aerospace, and electronics, where precision and safety are paramount, thereby enhancing the market appeal of third-party and in-house TIC service providers.

Testing Inspection and Certification Market Analysis

- Testing, Inspection, and Certification (TIC) services are playing an increasingly critical role across various industries as organizations strive to comply with regulatory standards, ensure product quality, and enhance operational efficiency. These services verify that products, systems, and processes meet defined safety, quality, and environmental standards, making TIC an integral component of modern quality assurance and risk management strategies in sectors such as manufacturing, healthcare, energy, automotive, and food & beverage.

- The surging demand for TIC services is primarily driven by several key factors, including globalization of trade, stringent government regulations, rising consumer awareness regarding product quality and safety, and the growth of end-use industries. As international trade expands, companies must adhere to a diverse range of regional compliance requirements, increasing the need for standardized testing, inspection, and certification processes that ensure market access and reduce the risk of recalls or penalties.

- Asia-Pacific dominates the Testing Inspection and Certification Market with the highest growth rate, registering a CAGR of 32.16% during the forecast period (2025–2032). The growth is driven by accelerating urbanization, rising disposable incomes, and increased technological advancements in countries like China, Japan, and India.

- North America holds the Significant share of the Testing Inspection and Certification Market, accounting for 27.44% in 2024. The region's growth is led by high smart home adoption rates, demand for connected security solutions, and a tech-savvy population.

- The Testing segment accounted for the largest market revenue share in 2024, attributed to its critical role in quality assurance, safety verification, and regulatory compliance across various industries.

Report Scope and Testing Inspection and Certification Market Segmentation

|

Attributes |

Testing Inspection and Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Testing Inspection and Certification Market Trends

“Rising Demand for Regulatory Compliance Across Industries”

- The growing stringency of international and domestic regulations across sectors like pharmaceuticals, automotive, and food is significantly driving the TIC market. Industries must comply with ISO, FDA, and other local standards to access global markets.

- For Instance: In February 2024, SGS SA expanded its pharmaceutical testing capabilities in Singapore to support international clients in meeting regulatory standards such as the U.S. FDA, EU GMP, and WHO guidelines.

- This need for compliance drives companies to adopt third-party TIC services to ensure product safety, quality, and performance across manufacturing and distribution processes.

- For Instance: In 2023, TÜV Rheinland provided compliance inspection for European manufacturers to meet new EU Medical Device Regulations (MDR), ensuring continued market access.

Testing Inspection and Certification Market Dynamics

Driver

“Integration of Digital Technologies and Industry 4.0”

- The adoption of AI, IoT, and automation in manufacturing processes has increased the demand for real-time inspection, predictive maintenance, and remote testing solutions.

- For Instance: In March 2024, TÜV SÜD launched its digital inspection platform integrating AI for visual defect detection and blockchain-based audit trails, supporting smart factory operations.

- Digitalization enhances efficiency, reduces human error, and allows for scalable TIC operations, particularly in high-tech and fast-moving sectors.

- For instance: DEKRA introduced remote vehicle inspections using drones and AI-based software in Germany, reducing inspection time and enhancing operational transparency.

Restraint/Challenge

“High Cost of Certification for SMEs”

- TIC services often come with high upfront and recurring costs, which small and medium enterprises (SMEs) struggle to afford—especially in developing nations.

- For Instance: A 2023 survey by UL LLC revealed that over 60% of SMEs in Southeast Asia cited certification costs as a major barrier to exporting to the EU and U.S. markets.

- The burden of compliance, audits, and re-certification creates entry barriers, discouraging SMEs from entering global supply chains despite meeting quality standards.

- For Instance: In 2024, Kiwa launched a subsidy initiative in Africa to help SMEs access ISO certification, highlighting the need for more cost-effective TIC models.

Testing Inspection and Certification Market Scope

The market is segmented on the basis of service type, sourcing type, and application.

- By Service Type

On the basis of service type, the Testing Inspection and Certification Market is segmented into Testing, Inspection, Certification, and Others. The Testing segment accounted for the largest market revenue share in 2024, attributed to its critical role in quality assurance, safety verification, and regulatory compliance across various industries. Organizations prioritize testing to ensure that products and processes meet technical standards and minimize risk exposure. This segment is widely adopted in sectors such as consumer goods, pharmaceuticals, construction, and electronics.

The Certification segment is projected to register the fastest CAGR from 2025 to 2032, driven by increasing international trade, regulatory requirements, and a global focus on product quality and safety. Certification assures market acceptance, consumer trust, and regulatory compliance, particularly in heavily regulated industries such as food, life sciences, and energy.

- By Sourcing Type

On the basis of sourcing type, the market is segmented into In-House Services and Outsourced Services. The Outsourced Services segment dominates the market in 2024, with organizations increasingly seeking third-party expertise to meet compliance standards, reduce operational costs, and access state-of-the-art facilities. Third-party TIC providers are particularly in demand in sectors like oil & gas, manufacturing, and transportation, where complex testing and inspection are required.

The In-House Services segment is expected to witness moderate growth during the forecast period, as large organizations with the infrastructure and skilled personnel prefer managing compliance and quality internally for better control and integration with production workflows.

- By Application

On the basis of application, the Testing Inspection and Certification Market is segmented into Agriculture and Food, Construction, Life Science, Consumer Products, Transportation, Energy, Oil, Gas and Chemical, Mining, Industrial Machinery, and Others.

Agriculture and Food: This segment is further sub-segmented into Seed and Crop, Fertilizers, Food, Pest Control and Fumigation, and Others. The Food sub-segment leads the application due to rising consumer awareness about food safety, hygiene regulations, and traceability. Demand is driven by both regulatory compliance and brand protection across domestic and export markets.

Testing Inspection and Certification Market Regional Analysis

- Asia-Pacific dominates the Testing Inspection and Certification Market with the highest growth rate, registering a CAGR of 32.16% during the forecast period (2025–2032).

- The growth is driven by accelerating urbanization, rising disposable incomes, and increased technological advancements in countries like China, Japan, and India.

- Government initiatives encouraging smart city development and digitalization are promoting the use of advanced TIC services across residential and industrial sectors.

- The region is also a key manufacturing hub, contributing to affordable access and local production of TIC equipment and systems.

China Testing Inspection and Certification Market Insight

The China Testing Inspection and Certification Market held the largest revenue share in Asia-Pacific in 2024, supported by the rapid adoption of smart home systems, a booming middle class, and high urbanization rates. As one of the world’s largest markets for connected home devices, China is witnessing widespread use of TIC services in residential and commercial properties. The government's push for smart infrastructure, coupled with robust domestic production capabilities, further accelerates market expansion..

Japan Testing Inspection and Certification Market Insight

The Japan TIC Market is experiencing significant growth, fueled by the country’s strong technology adoption, urban density, and focus on secure, automated living environments. Japan’s aging population and increasing demand for convenience are driving the adoption of intelligent TIC solutions across homes and offices. Additionally, the integration of TIC systems with IoT devices, such as surveillance cameras and lighting controls, is enhancing user experience and security.

North America Testing Inspection and Certification Market Insight

North America holds the Significant share of the Testing Inspection and Certification Market, accounting for 27.44% in 2024. The region's growth is led by high smart home adoption rates, demand for connected security solutions, and a tech-savvy population. Consumers favor smart access control systems for their seamless integration, remote accessibility, and compatibility with devices like thermostats and security cameras..

U.S. Testing Inspection and Certification Market Insight

The U.S. Testing Inspection and Certification Market captured 81% of North America’s revenue share in 2024, driven by the rapid penetration of connected devices and the growing trend toward home automation. Rising concerns about security, alongside consumer preference for keyless and mobile-integrated solutions, are key growth drivers. Additionally, the popularity of virtual assistants like Alexa, Google Assistant, and Apple HomeKit is fostering the integration of TIC systems with broader smart home ecosystems.

Europe Testing Inspection and Certification Market Insight

Europe is projected to grow steadily in the Testing Inspection and Certification Market over the forecast period, propelled by strict regulatory compliance requirements, increasing urbanization, and heightened awareness of building safety standards. The demand for energy-efficient and secure access control systems is promoting TIC adoption across residential and commercial developments.

Germany Testing Inspection and Certification Market Insight

The Germany TIC Market is poised for robust growth, supported by the country's commitment to sustainability, technological innovation, and security. German consumers show a high preference for data-secure, eco-friendly TIC systems, which are being integrated into both modern and retrofitted buildings. A strong regulatory framework further compels adoption across industries.

U.K. Testing Inspection and Certification Market Insight

The U.K. TIC Market is expected to grow at a notable CAGR, influenced by increasing concerns over property security and a rising interest in smart living solutions. The growing trend of home automation, coupled with support from the retail and e-commerce sectors, is fueling demand for intelligent, connected TIC devices, especially in urban and suburban households.

Testing Inspection and Certification Market Share

The Testing Inspection and Certification industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Intertek Group plc(United Kingdom)

- DEKRA (Germany)

- Eurofins Scientific(Luxembourg)

- TÜV SÜD(Germany)

- Applus+(Spain)

- ALS Limited(Australia)

- Kiwa(Netherlands)

- RINA S.p.A.(Italy)

- TÜV NORD GROUP(Germany)

- TÜV Rheinland (Germany)

- Lloyd's Register Group Services Limited (United Kingdom)

- MISTRAS Group, Inc.(United States)

- Element Materials Technology (United Kingdom)

- UL LLC (United States)

- VDE Testing and Certification Institute GmbH(Germany)

- Keystone Compliance(United States)

- FORCE TECHNOLOGY(Denmark)

- HV Technologies, Inc.(United States)

Latest Developments in Global Testing Inspection and Certification Market

- In May 2024, Bureau Veritas inaugurated a new Electrical and Electronics Testing Laboratory in Vietnam to strengthen its footprint in Southeast Asia. This facility enhances the company's capacity to test consumer electronics and ensure compliance with both local and international regulatory standards. The move reflects Bureau Veritas’s strategic focus on expanding its TIC services in fast-growing emerging markets, particularly where electronics exports are surging.

- In April 2024, SGS SA launched a state-of-the-art biopharmaceutical testing laboratory in the U.S., aimed at supporting the growing demand for quality control and regulatory compliance in advanced therapeutics. The new facility enhances SGS’s capabilities in analytical development, GMP testing, and biosafety—aligning with the global shift toward biotech innovation and the rising complexity of pharmaceutical regulations.

- In March 2024, Intertek Group plc introduced its new “Sustainability Assurance Program” targeting manufacturers seeking Environmental, Social, and Governance (ESG) compliance certifications. The initiative is designed to help global brands meet stakeholder expectations and adhere to ESG reporting mandates. By integrating ESG metrics into traditional TIC services, Intertek is positioning itself as a leader in the evolving landscape of responsible business practices.

- In February 2024, TÜV SÜD launched its first fully digital remote inspection platform for industrial equipment across Europe. This platform enables real-time remote visual inspections, live streaming from manufacturing sites, and digital documentation, significantly reducing travel costs and inspection timelines. The launch emphasizes TÜV SÜD’s commitment to Industry 4.0 and digital transformation in the TIC sector.

- In January 2024, Eurofins Scientific announced the expansion of its food safety and agricultural testing facilities in Brazil, aiming to support Latin American agribusiness exporters. This expansion enhances Eurofins’ capacity to perform microbiological, chemical, and GMO testing for food and feed products, reinforcing global food safety compliance and tapping into the growing demand for traceability in agricultural exports.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Testing Inspection And Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Testing Inspection And Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Testing Inspection And Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.