Global Termite Bait Systems Market

Market Size in USD Million

CAGR :

%

USD

361.68 Million

USD

559.29 Million

2024

2032

USD

361.68 Million

USD

559.29 Million

2024

2032

| 2025 –2032 | |

| USD 361.68 Million | |

| USD 559.29 Million | |

|

|

|

|

Termite Bait System Market Size

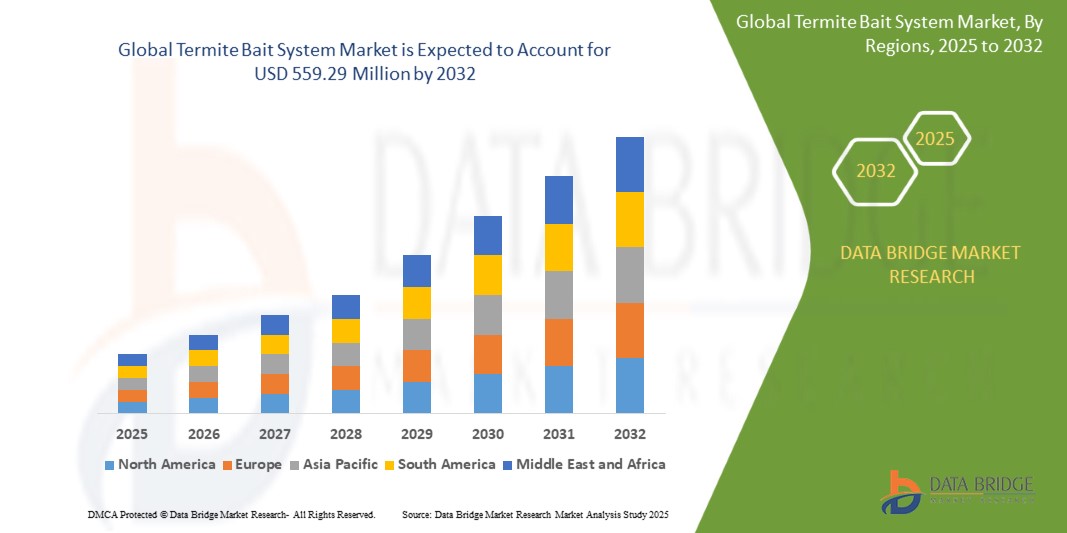

- The Global Termite Bait System Market size was valued at USD 361.68 Million in 2024 and is expected to reach USD 559.29 Million by 2032, at a CAGR of5.6% during the forecast period

- This growth is driven by factors such as increasing demand for eco-friendly pest control solutions, rising awareness, and advancements in bait system technologies

Termite Bait System Market Analysis

- Termite Bait Systems are essential tools used for controlling termite infestations, offering a sustainable and efficient solution for pest management in residential and commercial properties

- The demand for Termite Bait Systems is significantly driven by increasing concerns over property damage caused by termites, along with the rising preference for eco-friendly, non-toxic pest control methods

- North America is expected to dominate the Termite Bait System market due to a high incidence of termite infestations, advanced pest control technologies, and a strong regulatory environment favoring sustainable pest management solutions

- Asia-Pacific is expected to be the fastest growing region in the Termite Bait System market during the forecast period, driven by rapid urbanization, growing awareness of termite damage, and increasing adoption of integrated pest management practices

- The Subterranean segment is expected to dominate the market, with a market share of 60.12% due to its effectiveness in termite control and widespread availability of various formulations for different termite species

Report Scope and Termite Bait System Market Segmentation

|

Attributes |

Termite Bait System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Termite Bait System Market Trends

Eco-Friendly and Smart Pest Control Innovations in Termite Bait Systems

- One prominent trend in the Termite Bait System market is the increasing demand for eco-friendly and sustainable pest control solutions, driven by growing environmental concerns and consumer preferences for non-toxic alternatives

- Manufacturers are focusing on developing termite bait systems that utilize environmentally safe ingredients, such as plant-based and biodegradable materials, to reduce the environmental footprint of traditional chemical pest control methods

- For instance, the introduction of bait systems with natural active ingredients, such as borates or silica, is gaining traction as these solutions provide effective termite control without harming the ecosystem.

- The integration of smart technologies in termite bait systems, such as remote monitoring and data analytics, is also becoming a key trend. These innovations enable homeowners and pest control professionals to track and optimize the effectiveness of the bait systems in real-time, improving efficiency and user convenience

- Additionally, the rise of integrated pest management (IPM) strategies, which combine different pest control methods, is contributing to the growing adoption of termite bait systems as a proactive solution for long-term termite prevention

Termite Bait System Market Dynamics

Driver

Rising Awareness of Termite Infestation Risks and Sustainable Pest Control Solutions

- The growing awareness of termite infestations and the potential damage to residential and commercial properties is significantly contributing to the increased demand for Termite Bait Systems in global markets

- With increasing concerns over the long-term structural damage caused by termites, property owners are seeking effective and sustainable solutions for termite control that do not rely on harmful chemicals

- Eco-friendly termite bait systems, which offer a non-toxic and environmentally safe alternative, are gaining popularity as part of a broader shift toward sustainable pest management practices

For instance

- According to the National Pest Management Association (2023), termite damage costs U.S. homeowners approximately $5 billion annually, prompting greater demand for proactive and long-term pest control solutions like termite bait systems.

- As a result, the increasing focus on preventing termite damage, combined with the rising demand for eco-conscious solutions, is expected to drive the market for advanced and sustainable termite bait systems in both developed and emerging markets

Opportunity

Advancements in Smart Termite Bait Systems with Remote Monitoring

- The growing trend of integrating smart technologies in pest control is driving opportunities in the global Termite Bait System market

- With the rise of IoT and data analytics, manufacturers have the opportunity to develop termite bait systems equipped with remote monitoring capabilities, allowing users to track and manage termite control in real time

- These smart systems enable better monitoring of bait stations, ensuring optimal performance and faster detection of infestations, providing a more efficient and user-friendly solution

For instance

- In 2023, BASF launched a smart termite bait system with remote monitoring features, allowing pest control professionals to track bait usage and termite activity via a mobile app, improving service efficiency.

- The adoption of remote monitoring technology in termite bait systems offers a competitive edge for manufacturers, creating new market opportunities in both residential and commercial pest control sectors.

Restraint/Challenge

High Production Costs and Lack of Consumer Awareness

- The Termite Bait System market faces challenges related to high production costs, particularly for eco-friendly and advanced bait formulations that utilize sustainable and non-toxic materials, impacting pricing and profitability

- Additionally, the market is hindered by a lack of widespread consumer awareness regarding the benefits and effectiveness of termite bait systems compared to traditional chemical treatments, limiting market penetration

- These factors create obstacles for manufacturers seeking to educate the public, justify higher prices for eco-friendly options, and encourage broader adoption of these systems in both residential and commercial applications

For instance

- According to the National Pest Management Association (NPMA), many homeowners remain unaware of the long-term advantages of termite bait systems, preferring conventional pest control methods due to familiarity.

- These challenges may delay the growth of the market, making it harder for companies to expand and establish a strong consumer base while dealing with higher costs and limited market education

Termite Bait System Market Scope

The market is segmented on the basis of termite type, station type, type, distribution channel, and application.

|

Segmentation |

Sub-Segmentation |

|

By Termite Type |

|

|

By Station Type |

|

|

By Type |

|

|

By Distribution Channel |

|

|

By Application |

|

In 2025, the Subterranean is projected to dominate the market with a largest share in termite type segment

The Subterranean segment is expected to dominate the Termite Bait System market with the largest share of 60.12% in 2025 due to its critical role in effectively controlling subterranean termite infestations. Subterranean termites cause significant structural damage, making their control a priority. Bait systems designed for these termites offer a long-term solution by attracting termites to the bait and eliminating entire colonies, ensuring lasting protection for residential and commercial properties.

The Bait Devices is expected to account for the largest share during the forecast period in type market

In 2025, the Bait Devices segment is expected to dominate the Termite Bait System market with the largest market share of 53.21% due to their effectiveness in providing targeted termite control. Bait devices offer a non-toxic, eco-friendly solution for long-term termite management, attracting termites to the bait and eliminating entire colonies. Their ease of use and minimal environmental impact make them a preferred choice for homeowners and pest control professionals.

Termite Bait System Market Regional Analysis

North America Holds the Largest Share in the Termite Bait System Market

-

North America dominates the Termite Bait System market with a share of 40.12%, driven by the region’s advanced pest control infrastructure, high awareness of termite damage risks, and the widespread use of eco-friendly solutions

- The U.S. accounts for the largest share due to its strong residential and commercial construction industries, which are highly susceptible to termite infestations, making termite control a priority

- Rising consumer awareness regarding non-toxic and sustainable pest control methods is further boosting the demand for termite bait systems in the region

- The presence of major pest control companies, strong research and development efforts, and increased focus on integrated pest management (IPM) contribute to market growth

Asia-Pacific is Projected to Register the Highest CAGR in the Termite Bait System Market

-

The Asia-Pacific region is expected to experience the fastest growth in the Termite Bait System market, driven by rapid urbanization, rising disposable incomes, and an increasing awareness of termite-related property damage

- Countries like China, India, and Australia are witnessing significant investments in real estate and infrastructure development, leading to an increased demand for effective termite control solutions

- Japan and South Korea are seeing higher adoption of advanced termite bait systems due to their growing focus on sustainable and environmentally friendly pest control options.

- The expanding middle class, rising concern over environmental impact, and growing awareness of the importance of long-term termite prevention contribute to the accelerated demand for termite bait systems across the region

Termite Bait System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Syngenta AG (Switzerland)

- Sumitomo Chemical Co. Ltd. (Japan)

- Spectrum Brands Holdings Inc. (U.S.)

- Rollins Inc. (U.S.)

- Arrow Exterminators Inc. (U.S.)

- BASF SE (Germany)

- Bayer AG (Germany)

- DuPont (U.S.)

- Ensystex (U.S.)

- PCT International Inc. (U.S.)

- Rentokil Initial PLC (United Kingdom)

- SBM Life Science Corp. (U.S.)

- Corteva (U.S.)

- Hulett Environmental Services (U.S.)

- Eco-Safe (U.S.)

- Terminix (U.S.)

- Oldham Chemical Company (U.S.)

- Cowleys Pest Services (U.S.)

- Petri Pest Control (U.S.)

- Blue Chip Exterminating (U.S.)

Latest Developments in Global Termite Bait System Market

- In January 2018, Arrow Exterminators acquired Moore’s Premium Termite and Pest Control LLC (US). This acquisition enhanced Arrow's capacity to expand and provide a comprehensive range of services to residential and commercial customers in Georgetown, South Carolina

- In January 2018, Orkin, a subsidiary of Rollins, launched six new franchises in Northeast Brazil, Brasilia, Argentina, Kenya, the Netherlands, and Azerbaijan. This expansion broadened Rollins' footprint in South America, Europe, and Africa

- In November 2017, BASF launched Termidor HE, a non-repellent termite control product, in Japan. When applied to the foundation soil of homes and commercial buildings, it effectively prevents termite infestations in structural materials like wood

- In April 2017, DowDuPont's Dow AgroSciences (US) launched Recruit AG FlexPack termite bait, designed for use in food manufacturing and food service areas. This introduction enhanced Dow AgroSciences' market position in several states across the U.S.

- In April 2016, Sumitomo Chemical opened a new R&D facility in North America, focusing on delivering innovative solutions in health and crop science, specifically in crop protection chemicals and biorationals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.