Global Term Insurance Market

Market Size in USD Million

CAGR :

%

USD

288.00 Million

USD

379.25 Million

2024

2032

USD

288.00 Million

USD

379.25 Million

2024

2032

| 2025 –2032 | |

| USD 288.00 Million | |

| USD 379.25 Million | |

|

|

|

|

Term Insurance Market Size

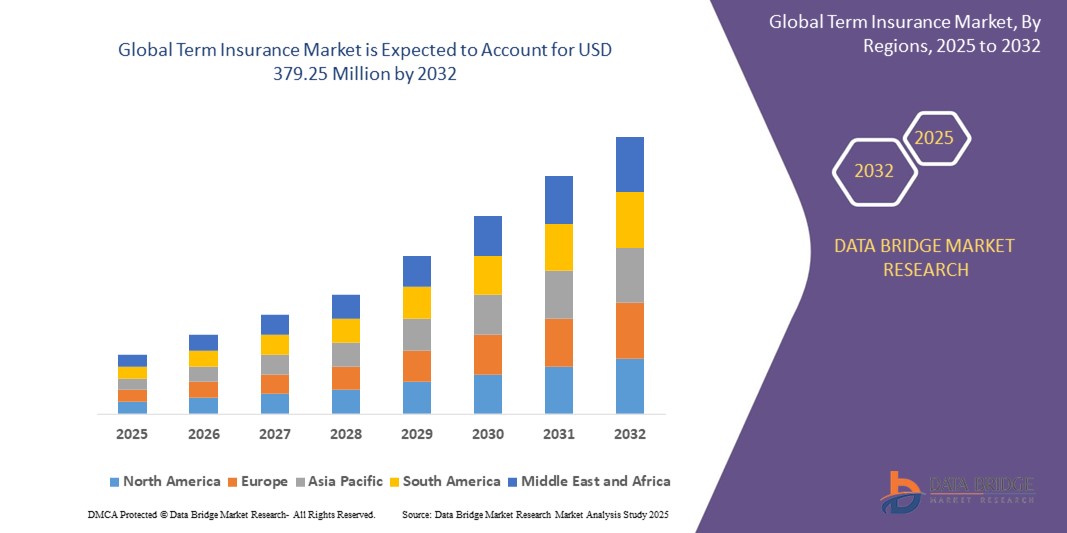

- The global term insurance market size was valued at USD 288.00 million in 2024 and is expected to reach USD 379.25 million by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by increasing financial awareness, rising disposable incomes, and a growing need for income protection, especially among younger and middle-income populations across developing economies. This shift in consumer mindset is encouraging early adoption of term life insurance as a foundational element of personal financial planning

- Furthermore, the integration of digital platforms, AI-driven underwriting, and simplified online policy issuance is transforming customer experience, making term insurance more accessible, transparent, and affordable. These advancements are significantly accelerating policy adoption across urban and semi-urban markets, thereby boosting the industry's overall growth

Term Insurance Market Analysis

- Term insurance is a pure risk life insurance product that provides financial protection to beneficiaries in case of the policyholder’s death during the policy term. It offers high coverage at relatively low premiums, making it an ideal choice for income replacement, debt coverage, and long-term family security

- The rising demand for term insurance is primarily driven by increasing awareness around financial risk management, the emergence of tech-enabled distribution channels, and supportive regulatory frameworks promoting affordable insurance solutions for underserved and digitally connected populations

- Asia-Pacific dominated term insurance market with a share of 31% in 2024, due to a rapidly expanding working population, increasing financial literacy, and growing demand for affordable life coverage across emerging economies

- North America is expected to be the fastest growing region in the term insurance market during the forecast period due to rising awareness of life insurance gaps, increasing penetration of online policy sales, and the growing need for income protection

- Individual level segment dominated the market with a market share of 76.4% in 2024, due to rising awareness around personal financial planning and growing middle-class participation in life insurance schemes. Consumers increasingly opt for individual term plans for tailored coverage, independence in policy management, and customizable features that address personal financial responsibilities, such as family support or debt coverage

Report Scope and Term Insurance Market Segmentation

|

Attributes |

Term Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Term Insurance Market Trends

“Digital Transformation in Term Insurance”

- The term insurance market is evolving quickly as insurers adopt digital tools—such as online policy issuance, automated underwriting, and digital claims processing—to streamline customer experience and expand reach to younger, tech-savvy buyers

- For instance, companies such as AIA Group, MetLife, and Prudential have introduced mobile applications and AI-driven chatbots that empower seamless online purchasing, instant policy quotes, automated document verification, and 24/7 customer service, meeting rising digital expectations and accelerating market penetration

- Digital-only and insurtech players are disrupting traditional distribution by offering simple, jargon-free products, easy onboarding, and transparent pricing, helping demystify term insurance for first-time and underserved customers

- The rise in data analytics and artificial intelligence enables insurers to better identify customer needs, personalize coverage, and target marketing campaigns with greater precision

- Automated underwriting and e-KYC (electronic know-your-customer) tools reduce application turnaround from days to minutes, lowering operational costs and enhancing customer satisfaction

- Collaboration between incumbent insurers and technology startups is driving innovation in risk assessment, fraud detection, and claims management, boosting efficiency and building trust in digital channels

Term Insurance Market Dynamics

Driver

“Increased Awareness of Financial Security”

- Growing awareness about the importance of financial security and future income protection—spurred by pandemic experiences and evolving family structures—is driving strong demand for term insurance, especially among younger professionals and heads of households

- For instance, providers such as Northwestern Mutual, LIC (Life Insurance Corporation of India), and Manulife are rolling out financial literacy programs and educational campaigns to inform consumers about the benefits of term insurance for income replacement, education funding, and debt protection

- Expanding middle-class populations in emerging economies are fueling the need for affordable, straightforward risk protection as incomes rise and long-term financial planning becomes a priority

- Regulatory support and government initiatives to address under-insurance and close protection gaps across various population segments are increasing both accessibility and market penetration

- Advisors and digital platforms now focus on simple, “needs-based” sales conversations, lowering barriers to purchase for previously uninsured or underinsured populations

Restraint/Challenge

“Short-Term Coverage”

- One of the significant challenges limiting term insurance adoption is the short-term, time-bound nature of its coverage, which does not build cash value or investment returns, making products less attractive to customers seeking wealth accumulation alongside protection

- For instance, many consumers compare traditional whole life or endowment products (offered by firms such as MetLife and Prudential) to term policies, becoming hesitant to buy term-only plans when renewal uncertainty, premium increases after maturity, and lack of payout on survival are considered

- The limited perceived value after policy expiration can lead to lapses or reluctance to renew, especially among customers with rising financial obligations as they age

- Complexity in re-qualification for coverage, particularly in the context of changing health conditions or advancing age, poses barriers for long-term retention of policyholders

- Lack of cross-sell or upgrade pathways to more comprehensive products constrains customer lifecycle value for insurers and reduces the term market’s appeal among affluent buyers

Term Insurance Market Scope

The market is segmented on the basis of type, level, and distribution channel.

- By Type

On the basis of type, the term insurance market is segmented into Level Term Policy, Renewable or Convertible, Annual Renewable Term, and Mortgage Life Insurance. The Level Term Policy segment dominated the largest market revenue share in 2024, owing to its fixed premium structure and guaranteed death benefit for a specified term, which appeals to individuals seeking predictable long-term coverage. Its popularity is also reinforced by its affordability compared to whole life policies and its suitability for covering income replacement needs, education costs, or mortgages. Consumers are drawn to the simplicity and transparency of level term plans, making them a go-to choice for financial planning and family protection.

The Renewable or Convertible segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by growing demand for flexible insurance solutions that allow policyholders to adapt their coverage to changing life circumstances. These policies offer the option to renew coverage without undergoing new medical examinations or to convert to permanent insurance, which is particularly attractive for young adults or individuals with evolving financial goals. This adaptability and future-proofing capability are key factors contributing to the segment's rising uptake.

- By Level

On the basis of level, the term insurance market is segmented into Individual Level, Group Level, and Decreasing. The Individual Level segment accounted for the largest market share of 76.4% in 2024, supported by rising awareness around personal financial planning and growing middle-class participation in life insurance schemes. Consumers increasingly opt for individual term plans for tailored coverage, independence in policy management, and customizable features that address personal financial responsibilities, such as family support or debt coverage.

The Decreasing segment is expected to witness the fastest growth rate from 2025 to 2032, as consumers adopt insurance products aligned with declining financial obligations, such as loan repayments or mortgage balances. Decreasing term insurance is gaining traction among homeowners and small business owners who prefer low-cost, purpose-specific protection that reduces over time in sync with liabilities.

- By Distribution Channel

On the basis of distribution channel, the term insurance market is segmented into Direct Channel and Indirect Channel. The Direct Channel segment dominated the market in 2024, propelled by digital transformation and the proliferation of online insurance platforms, aggregators, and mobile apps. Consumers increasingly prefer purchasing policies directly through insurer websites for the convenience, transparency, and control it offers in comparing plans, calculating premiums, and initiating claims.

The Indirect Channel segment is projected to witness the highest CAGR from 2025 to 2032, fueled by the continued importance of insurance agents, brokers, and bancassurance partners in educating and guiding consumers, especially in developing regions. Personal interaction, trust, and the ability to navigate complex policy options with expert help are driving the growth of indirect distribution methods, particularly for first-time buyers and those seeking customized advisory services.

Term Insurance Market Regional Analysis

- Asia-Pacific dominated the term insurance market with the largest revenue share of 31% in 2024, driven by a rapidly expanding working population, increasing financial literacy, and growing demand for affordable life coverage across emerging economies

- The region’s rising middle class, growing awareness of financial protection, and digitalization of insurance services are contributing significantly to market growth

- In addition, government initiatives promoting life insurance inclusion, coupled with the rise of insurtech platforms and mobile-based policy distribution, are accelerating adoption of term insurance across urban and rural areas

Japan Term Insurance Market Insight

The Japan market is witnessing steady growth due to increasing demand for retirement planning and legacy protection amid an aging population. Japanese consumers favor term policies for their simplicity and affordability, especially as part of estate and inheritance planning. Digital channels and bancassurance are playing a pivotal role in expanding policy reach and customer engagement.

China Term Insurance Market Insight

The China term insurance market held the largest share in Asia-Pacific in 2024, supported by a massive insurable population and strong government backing for insurance sector reform. Growing awareness of financial protection, rising middle-income groups, and rapid urbanization are driving demand for term life products. Local insurers are expanding digital offerings and leveraging mobile ecosystems to improve policy penetration and customer experience.

Europe Term Insurance Market Insight

The Europe term insurance market is projected to grow at a steady CAGR over the forecast period, fueled by increasing emphasis on financial planning, tax-saving incentives, and a high level of consumer trust in insurance products. Demand is particularly strong among young professionals and families seeking income protection and mortgage-linked coverage. Regulatory frameworks supporting transparency and consumer protection further support regional market expansion.

U.K. Term Insurance Market Insight

The U.K. market is anticipated to grow steadily, supported by strong demand for level and decreasing term plans linked to mortgage and debt coverage. Rising awareness of the need for financial preparedness among younger demographics and the growth of online insurance platforms are major contributors to market development. Financial advisors and comparison websites are also influencing product uptake through greater policy transparency and education.

Germany Term Insurance Market Insight

The Germany term insurance market is expanding due to high consumer awareness, favorable tax treatment of life policies, and strong demand for long-term financial security. German consumers prefer level term insurance as part of structured family financial planning. The country’s robust distribution network, including tied agents and banks, continues to drive high policy sales.

North America Term Insurance Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising awareness of life insurance gaps, increasing penetration of online policy sales, and the growing need for income protection. A younger population seeking flexible, low-cost coverage and growing demand for digital financial services are fueling market expansion. Advancements in underwriting technologies, simplified issue processes, and data-driven risk assessment are also contributing to regional growth.

U.S. Term Insurance Market Insight

The U.S. term insurance market captured the largest revenue share in 2024 within North America, backed by high awareness levels and strong participation from both individual and employer-sponsored channels. Consumers increasingly prefer customizable and renewable term products as part of family income and mortgage protection plans. The growth of direct-to-consumer platforms and strategic collaborations between insurers and fintechs are reshaping the policy distribution landscape.

Term Insurance Market Share

The term insurance industry is primarily led by well-established companies, including:

- Xero Limited (New Zealand)

- AlfaStrahovanie Group (Russia)

- Brighthouse Financial Inc (U.S.)

- CNP Assurances (France)

- FWD Fuji Life Insurance Company, Limited (Japan)

- Great-West Lifeco Inc (Canada)

- ASSICURAZIONI GENERALI S.P.A (Italy)

- ICICI Prudential Life Insurance Co. Ltd (India)

- IndiaFirst Life Insurance Company Limited (India)

- Industrial Alliance Insurance and Financial Services Inc (Canada)

- John Hancock (U.S.)

- MetLife Services and Solutions, LLC (U.S.)

- OHIO NATIONAL SEGUROS DE VIDA SA (Spain)

- Ping An Insurance (Group) Company of China, Ltd (China)

- RBC Insurance Services Inc (Canada)

- SBI Life Insurance Company Limited (India)

- Sun Life Assurance Company of Canada (Canada)

- Tata AIA Life Insurance Company Ltd (India)

- Tokio Marine Holdings, Inc (Japan)

- Vitality (U.K.)

- Zurich (Switzerland)

Latest Developments in Global Term Insurance Market

- In January 2025, Go Digit Life Insurance Limited (Digit Life) launched its inaugural individual pure term life insurance product, Digit Glow Term Life Insurance. Specifically designed to cater to the distinct financial protection needs of India’s 300 million self-employed individuals, the plan marks Digit Life’s strategic entry into the individual term insurance segment, aiming to expand coverage among an underserved and economically diverse demographic

- In December 2024, ICICI Prudential Life Insurance launched ‘ICICI Pru Wish’, a pioneering health-focused offering in the life insurance sector, designed to address women-specific critical illnesses and surgeries. Developed in collaboration with Reinsurance Group of America (RGA), a leading global life and health reinsurer, the product represents an industry-first initiative aimed at providing tailored health protection for women through comprehensive and specialized coverage

- In December 2023, Max Life Insurance Company Ltd. launched the Smart Total Elite Protection Plan, a next-generation term insurance product tailored to shifting consumer demands for flexible, high-coverage solutions. This non-linked, non-participating pure-risk premium plan includes features such as instant claim payment, cover continuance benefits, and special exit value. The launch reflects Max Life’s strategic move to strengthen its position in the evolving Indian term insurance landscape by offering innovative, customer-centric solutions that enhance financial protection and policyholder experience

- In June 2023, Policygenius partnered with Labyrinth Financial Services (LFS), integrating its proprietary fulfillment platform, Policygenius Pro, into LFS's operations. This collaboration is reshaping the U.S. term life insurance distribution model by simplifying the application process for LFS partners and improving the client experience. By streamlining underwriting and documentation workflows, the partnership enhances market accessibility, making it easier for clients to purchase term life coverage through a more efficient and user-friendly process

- In May 2023, New York Life introduced a diversified suite of competitively priced term life insurance products, including level term, yearly renewable term, and policies with optional living benefits. Targeted at both individuals and small business owners, this product expansion signifies the company’s focus on broadening its market reach while addressing growing consumer concerns around affordability, flexibility, and comprehensive financial protection. The move strengthens New York Life’s value proposition in an increasingly competitive term insurance market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.