Global Telecom Application Programming Interface (API) Market Segmentation, By Type (Messaging API, WebRTC API, Payment API, IVR API, Location API, Content Delivery API, Others), Deployment Mode (Hybrid, Multi-Cloud, On-Premise), User Type (Enterprise Developer, Internal Telecom Developer, Partner Developer, Long Tail Developer), Industry Vertical (BFSI, Healthcare, IT and Telecom, Retail, Government, Manufacturing, Transportation, Others) - Industry Trends and Forecast to 2032

Telecom Application Programming Interface (API) Market Size

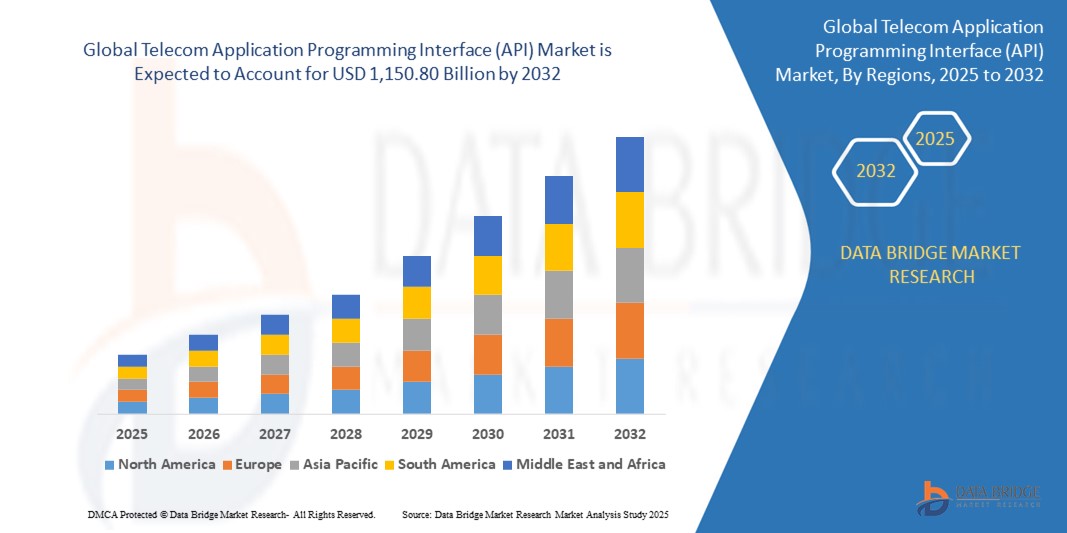

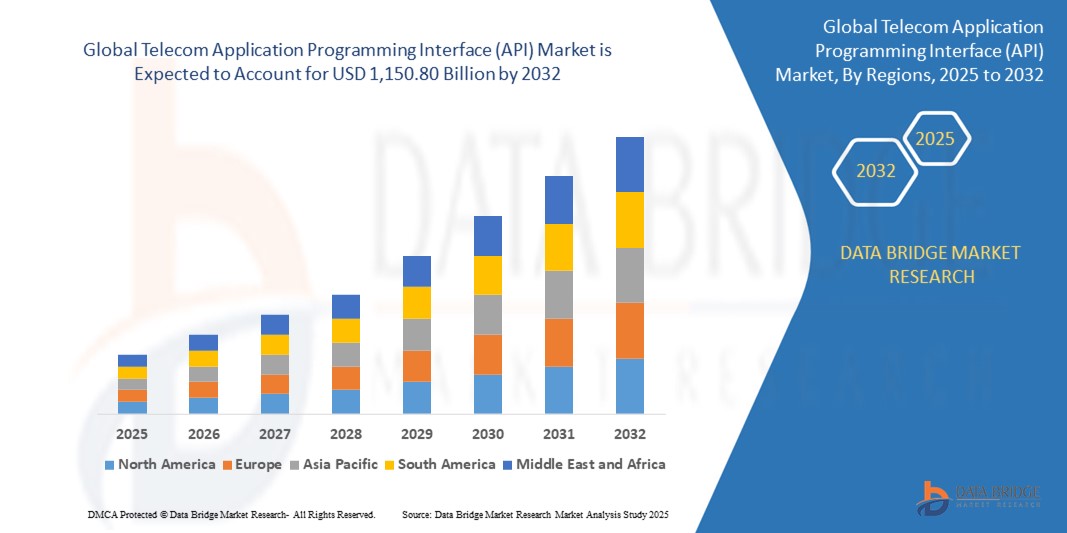

- The global Telecom Application Programming Interface (API) market size was valued at USD 369.50 billion in 2024 and is expected to reach USD 1,150.80 billion by 2032, at a CAGR of 15.2% during the forecast period

- This growth is driven by factors such as the increasing adoption of 5G networks, the proliferation of IoT devices, and the rising demand for seamless integration of mobile and cloud-based services.

Telecom Application Programming Interface (API) Market Analysis

- Telecom APIs are sets of protocols and tools that enable developers to integrate telecommunication functionalities, such as messaging, voice, and location services, into applications, enhancing connectivity and user experiences.

- The demand for telecom APIs is significantly driven by the global surge in mobile subscribers, projected to reach 5.7 billion by 2025, and the growing adoption of IoT, with 25.2 billion connections expected by 2025.

- North America is expected to dominate the Telecom API market due to its mature telecommunications infrastructure and the presence of key players like AT&T and Verizon.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid 5G deployment and digital transformation in countries like China and India.

Report Scope and Telecom Application Programming Interface (API) Market Segmentation

|

Attributes

|

Telecom Application Programming Interface (API) Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Telecom Application Programming Interface (API) Market Trends

“Advancements in 5G and AI-Driven API Solutions”

- One prominent trend in the Telecom API market is the increasing integration of 5G networks and AI-driven APIs to support high-speed, low-latency applications and real-time data processing.

- These advancements enable telecom operators to offer innovative services, such as IoT connectivity and personalized customer experiences, improving operational efficiency by up to 30%.

- For instance. AI-driven APIs can enhance A2P messaging accuracy by 25%, boosting customer engagement in retail and BFSI sectors.

- These innovations are transforming telecom services, driving demand for next-generation API platforms with advanced capabilities.

Telecom Application Programming Interface (API) Market Dynamics

Driver

“Proliferation of IoT and 5G Adoption”

- The rapid growth of IoT, with 25.2 billion connections projected by 2025, and the global rollout of 5G networks, expected to reach 1.8 billion connections by 2025, are significantly contributing to the demand for telecom APIs.

- APIs enable seamless integration of IoT devices and high-speed 5G services, supporting applications like smart cities and autonomous vehicles.

- For instance, GSMA reported in 2024 that 46 operators in 24 markets offer 5G mobile services, driving API adoption for real-time connectivity.

- As IoT and 5G adoption accelerates, the demand for telecom APIs rises, ensuring scalable and secure connectivity solutions.

Opportunity

“Growing Demand for Cloud-Based API Platforms”

- Cloud-based API platforms offer scalability, flexibility, and cost efficiency, enabling telecom operators to deploy APIs rapidly and support digital transformation.

- These platforms can reduce deployment costs by up to 20% compared to on-premise systems, making them attractive for enterprises and SMEs.

- For instance, in February 2024, AWS collaborated with operators like Verizon and Telefonica to offer cloud-based network APIs, enhancing developer access.

- This opportunity drives market growth by addressing the need for agile and scalable API solutions in a digital-first world.

Restraint/Challenge

“Competition from Over-the-Top (OTT) Service Providers”

- The rise of OTT providers, such as Netflix and WhatsApp, which deliver services over mobile internet without relying on telecom infrastructure, poses a significant challenge to the Telecom API market.

- OTT services neutralize telecom infrastructure costs, charging consumers only for data usage, which impacts API monetization.

- For instance, in 2024, Cisco reported that OTT media services accounted for 40% of mobile data traffic, limiting traditional telecom API revenue streams.

- This competition can hinder market growth, requiring telecom operators to innovate and diversify API offerings.

Telecom Application Programming Interface (API) Market Scope

The market is segmented on the basis of type, deployment mode, user type, and industry vertical.

|

Segmentation

|

Sub-Segmentation

|

|

By Type

|

|

|

By Deployment Mode

|

|

|

By User Type

|

|

|

By Industry Vertical

|

|

In 2025, the Messaging API type is projected to dominate the market with the largest share in the type segment.

The Messaging API segment is expected to dominate the Telecom API market with the largest share of 37.8% in 2025 due to its critical role in A2P messaging, customer engagement, and personalized marketing across industries like retail and BFSI.

Telecom Application Programming Interface (API) Market Regional Analysis

“North America Holds the Largest Share in the Telecom Application Programming Interface (API) Market”

- North America dominates the Telecom API market, driven by its mature telecommunications infrastructure, high 5G adoption, and the presence of key players like AT&T and Twilio.

- The U.S. holds a significant share, with a market valuation of USD 117.5 billion in 2024, due to early adoption of APIs and a vibrant developer ecosystem.

- The availability of advanced cloud infrastructure and growing demand for IoT-driven APIs further strengthen the market.

- In addition, the high rate of adoption of 5G, with 48% penetration projected by 2025, fuels market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Telecom Application Programming Interface (API) Market”

- The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid 5G deployment, increasing mobile subscribers, and government-led digital transformation initiatives.

- Countries such as China and India are emerging as key markets, with India projected to grow at a CAGR of 22.5% due to its expanding mobile user base.

- India, with 1.5 billion mobile internet users projected by 2025, remains a crucial market for telecom APIs.

- The expanding presence of global API providers and improving technological infrastructure further contribute to market growth.

Telecom Application Programming Interface (API) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AT&T Inc. (U.S.)

- Twilio Inc. (U.S.)

- Telefonica S.A. (Spain)

- Verizon Communications Inc. (U.S.)

- Vodafone Group PLC (U.K.)

- Orange S.A. (France)

- Cisco Systems, Inc. (U.S.)

- Nokia Corporation (Finland)

- Alcatel-Lucent S.A. (France)

- Apigee Corp. (U.S.)

Latest Developments in Global Telecom Application Programming Interface (API) Market

- March 2024: China Mobile, China Telecom, and China Unicom launched the GSMA Open Gateway’s OTP API to combat mobile fraud, enhancing API-driven security solutions.

- February 2024: AWS partnered with Verizon, T-Mobile, and Telefonica to offer developers access to network APIs, boosting cloud-based API adoption.

- September 2023: Deutsche Telekom launched the MagentaBusiness API platform, powered by Vonage, to provide developers with communication and network APIs.

SKU-