Global Telecom Analytics Market

Market Size in USD Billion

CAGR :

%

USD

7.57 Billion

USD

23.31 Billion

2024

2032

USD

7.57 Billion

USD

23.31 Billion

2024

2032

| 2025 –2032 | |

| USD 7.57 Billion | |

| USD 23.31 Billion | |

|

|

|

|

Telecom Analytics Market Size

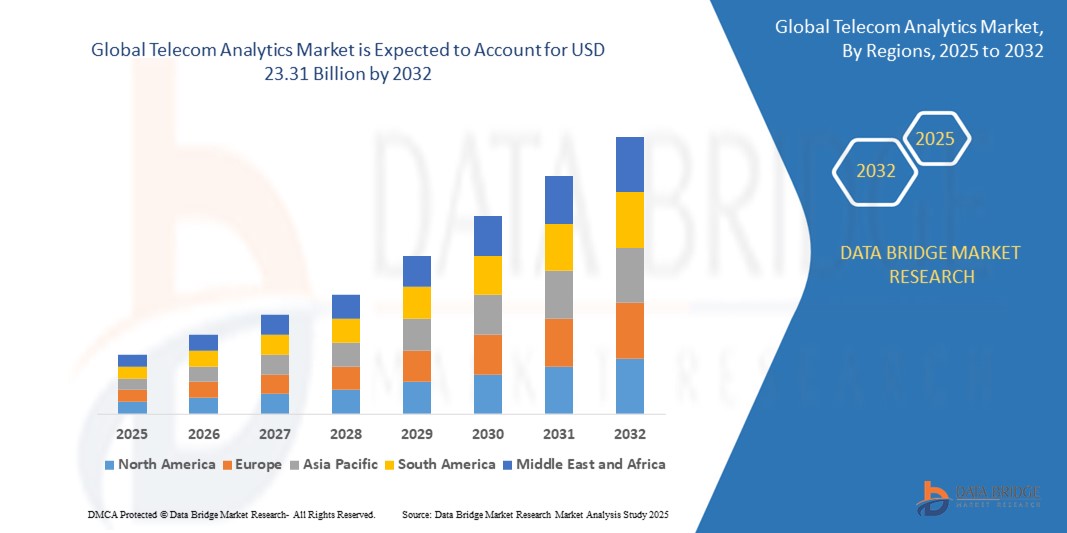

- The global telecom analytics market size was valued at USD 7.57 billion in 2024 and is expected to reach USD 23.31 billion by 2032, at a CAGR of 15.1% during the forecast period

- The market growth is largely fueled by the increasing demand for real-time data insights, network optimization, and customer experience enhancement

- With the exponential growth in mobile data usage, IoT adoption, and 5G deployment, telecom operators are leveraging analytics to manage network congestion, optimize performance, and reduce operational costs through predictive maintenance and intelligent routing

- Telecom companies are increasingly using analytics to gain deeper insights into customer behavior, personalize offerings, and reduce churn. Real-time sentiment analysis and customer journey mapping help deliver more engaging and responsive services

Telecom Analytics Market Analysis

- A significant factor contributing to this growth is the integration of artificial intelligence and machine learning into telecom analytics solutions, amplifying data analysis capabilities and enabling operators to anticipate network failures, predict customer churn, and proactively address potential issues

- Dell Technologies introduced new solutions, including the Telecom Infrastructure Automation Suite and Telecom Infrastructure Blocks for Red Hat, aimed at simplifying cloud deployments and enhancing efficiency in telecom networks

- North America dominated the telecom analytics market with the largest revenue share of 39.07% in 2024, driven by a mature telecom industry and early adoption of advanced analytics technologies

- Asia-Pacific is expected to be the fastest growing region in the telecom analytics market during the forecast period due to increasing urbanization and rising disposable incomes

- The customer analytics segment dominated the telecom analytics market with the largest market revenue share of approximately 35% in 2024, driven by telecom operators’ focus on understanding customer behavior, improving retention, and personalizing services

Report Scope and Telecom Analytics Market Segmentation

|

Attributes |

Telecom Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Telecom Analytics Market Trends

“AI and Machine Learning Reshape Telecom Analytics”

- The telecom analytics market is evolving rapidly with the growing integration of artificial intelligence and machine learning into analytics platforms

- Companies are using intelligent tools to predict customer behavior and enhance service delivery based on real-time data patterns

- Machine learning algorithms are helping telecom operators to detect anomalies, reduce manual intervention, and increase network reliability

- Personalization of services through artificial intelligence is helping service providers reduce churn and improve customer loyalty

- Cloud-based artificial intelligence systems are enabling telecom companies to scale their analytics capabilities with more flexibility and speed

- For instance, a major telecom operator recently introduced an artificial intelligence-based analytics engine that analyzes millions of call records daily to identify service gaps and resolve them before users report issues

- In conclusion, this strong shift towards artificial intelligence-powered analytics demonstrates how the telecom industry is prioritizing data intelligence to drive automation, improve customer experiences, and maintain competitive advantage in a dynamic environment

Telecom Analytics Market Dynamics

Driver

“Increasing Demand for Enhanced Customer Experience”

- The rising demand for enhanced customer experience is driving telecom analytics growth as operators prioritize retaining customers, which costs significantly less than acquiring new ones

- Advanced analytics help telecom companies gain deeper insights into customer behavior, preferences, and pain points by analyzing vast data from interactions, usage patterns, and network performance

- For instance, Vodafone uses predictive analytics to identify customers likely to churn and offers personalized plans and support, improving loyalty and reducing revenue loss

- Analytics also improves network quality by detecting congestion points and optimizing resources, helping meet customer expectations for seamless connectivity and fast problem resolution

- With growing smartphone adoption, companies like AT&T automate support processes through real-time data insights, ensuring quick issue resolution and better customer satisfaction

- In conclusion, this focus on customer-centric analytics is essential for telecom operators to differentiate and expand their market presence, fueling ongoing investments in AI-driven analytics platforms

Restraint/Challenge

“Data Privacy and Regulatory Compliance”

- Increasing concerns over data privacy and strict regulatory compliance are significant challenges limiting the growth of telecom analytics solutions

- Telecom companies handle vast amounts of sensitive data, including personal identifiers, location details, and communication records, raising privacy issues among users and regulators

- Regulations like the General Data Protection Regulation and California Consumer Privacy Act require telecom operators to follow stringent rules on data storage, processing, and sharing, demanding costly investments in encryption, anonymization, and audit mechanisms

- For instance, in 2023, a leading telecom provider faced fines due to inadequate compliance with data protection laws, highlighting the financial and reputational risks of non-compliance

- Balancing comprehensive data analytics with privacy preservation involves implementing privacy-by-design, securing customer consent, and ensuring transparency, which can limit data availability and delay analytics projects

- Growing consumer awareness and demand for data security further push telecom companies to enhance governance practices, adding complexity and operational cost

- In conclusion, the combined impact of privacy concerns and regulatory demands complicates analytics efforts, increases expenses, and slows innovation in the telecom analytics market

Telecom Analytics Market Scope

The market is segmented on the basis of analytics type, application, component, deployment model, and organization size.

• By Analytics Type

On the basis of analytics type, the global telecom analytics market is segmented into customer analytics, network analytics, subscriber analytics, location analytics, price analytics and service analytics, and others. The customer analytics segment dominated the largest market revenue share of approximately 35% in 2024, driven by telecom operators’ focus on understanding customer behavior, improving retention, and personalizing services. Customer analytics helps companies analyze usage patterns, preferences, and churn risks, leading to improved customer engagement and revenue growth.

The network analytics segment is expected to witness the fastest growth rate of 22% from 2025 to 2032, fueled by increasing demand to optimize network performance and predict faults using real-time data analytics. Network analytics enables operators to monitor network health, reduce downtime, and enhance service quality, which is critical as networks become more complex with 5G and IoT proliferation.

• By Application

On the basis of application, the market is segmented into customer management, network management, marketing management, sales and distribution, risk and compliance management, workforce management, and others. The customer management segment held the largest market share of around 40% in 2024, reflecting the high priority given to customer experience enhancement and churn reduction through targeted campaigns and personalized offers.

The risk and compliance management segment is projected to grow at the fastest CAGR of 20% from 2025 to 2032, driven by the growing need for fraud detection, regulatory compliance, and security analytics in telecom networks.

• By Component

On the basis of component, the telecom analytics market is segmented into solution and services. The solution segment accounted for the largest share in 2024 due to the rising deployment of advanced analytics platforms and software tools by telecom companies to enable data-driven decision-making.

Meanwhile, the services segment is expected to record steady growth as companies increasingly outsource analytics operations and seek consulting services for effective implementation.

- By Deployment Model

On the basis of deployment model, the market is segmented into on-premises and cloud-based. The cloud-based segment is anticipated to witness the fastest growth rate of 24% during the forecast period, driven by scalability, cost-effectiveness, and real-time data processing advantages offered by cloud infrastructure.

The on-premises segment holds a significant share due to the preference of large telecom enterprises for greater control and data security.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium enterprises. Large enterprises dominate the market with a share exceeding 60% in 2024, as they invest heavily in advanced analytics to optimize operations, reduce churn, and innovate service offerings.

Small and medium enterprises are expected to grow rapidly with increasing adoption of affordable analytics-as-a-service models and cloud-based platforms facilitating their entry into analytics-driven decision-making.

Telecom Analytics Market Regional Analysis

- North America dominated the telecom analytics market with the largest revenue share of 39.07% in 2024, driven by a mature telecom industry and early adoption of advanced analytics technologies

- Major telecom operators invest heavily in AI and machine learning to optimize network performance, enhance customer experience, and reduce churn, fueling market growth

- The rapid rollout of 5G infrastructure creates a demand for real-time analytics to manage increased data traffic and ensure seamless connectivity

U.S. Telecom Analytics Market Insight

The U.S. telecom analytics market captured the largest revenue share in north America in 2024, owing to early adoption of advanced analytics tools and the presence of major telecom players such as AT&T and verizon. the growing use of ai and ml in customer segmentation, churn prediction, and fraud detection is a key driver. additionally, the expansion of 5g infrastructure and high mobile data traffic necessitate real-time analytics for network optimization. the U.S. also leads in integrating cloud-based analytics platforms, enhancing operational agility and scalability. regulatory focus on data security and customer privacy further encourages investments in robust analytics systems.

Europe Telecom Analytics Market Insight

The Europe telecom analytics market is projected to grow at a substantial CAGR over the forecast period, fueled by increasing regulatory compliance demands such as GDPR, and the region’s emphasis on digital transformation. Telecom operators across the U.K., Germany, France, and the Nordics are leveraging analytics to improve service personalization, reduce churn, and manage complex multi-channel customer journeys. Additionally, the rise of connected devices and growing iot adoption in sectors like manufacturing and smart cities are contributing to demand for telecom data insights. Government support for 5g rollouts and infrastructure upgrades further boosts the analytics ecosystem across the region.

U.K. Telecom Analytics Market Insight

The U.K. telecom analytics market is set to grow at a healthy Cagr, driven by rising competition in the telecom space and the growing need to reduce customer churn and optimize marketing strategies. the adoption of analytics platforms is being accelerated by the country's strong digital infrastructure and a high penetration of smartphones and connected devices. U.K. telecom companies are also focusing on improving fraud detection and optimizing pricing models using predictive analytics. additionally, the shift toward remote working and increased data usage are reinforcing the demand for real-time and network performance analytics.

Germany Telecom Analytics Market Insight

Germany’s telecom analytics market is expanding rapidly, supported by the country’s leadership in industrial digitalization and a strong emphasis on data-driven decision-making. German telecom operators are utilizing analytics to enhance network efficiency, manage complex user demands, and provide personalized service offerings. The push toward industry 4.0 and smart manufacturing is also contributing to the demand for robust telecom data analytics to support seamless connectivity and iot integration. Data privacy laws and security concerns are shaping the deployment of compliant, localized analytics solutions, further strengthening the market outlook.

Asia-Pacific Telecom Analytics Market Insight

The Asia-Pacific telecom analytics market is projected to grow at the fastest Cagr of 22% from 2025 to 2032, fueled by rapid digitalization, expanding mobile subscriber base, and increasing 5g investments across China, India, Japan, and southeast Asia. telecom operators in the region are leveraging analytics to gain competitive advantage in pricing, customer retention, and network planning. government-led initiatives for smart cities and digital economies are further increasing the demand for telecom data insights. additionally, local telecom firms are investing in ai-powered analytics platforms to manage the exponential data growth and support efficient service delivery.

Japan Telecom Analytics Market Insight

The Japan Telecom Analytics market is gaining traction due to the country’s advanced telecommunications infrastructure and its leadership in 5G and IoT adoption. Japanese operators are prioritizing analytics for network optimization, predictive maintenance, and service personalization. With a high-tech consumer base, there is growing interest in real-time customer behavior insights and enhanced digital service delivery. Furthermore, the aging population and increasing demand for automated service delivery are prompting telcos to utilize AI-driven analytics for customer support and digital engagement.

China Telecom Analytics Market Insight

China accounted for the largest market revenue share in the Asia-Pacific Telecom Analytics market in 2024, supported by massive mobile and internet user bases and rapid advancements in 5G deployment. Chinese telecom giants such as China Mobile and China Telecom are heavily investing in big data analytics to drive network efficiency, reduce fraud, and enhance ARPU (average revenue per user). The country’s focus on smart cities, AI, and domestic innovation is further encouraging the adoption of telecom analytics solutions. Strategic government policies and large-scale infrastructure projects are also fostering a strong environment for analytics-driven telecom growth.

Telecom Analytics Market Share

The Telecom Analytics industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Adobe Inc. (U.S.)

- SAP SE (Germany)

- Cisco Systems, Inc. (U.S.)

- Teradata (U.S.)

- Wipro Limited (India)

- Open Text Corporation (Canada)

- Dell Inc. (U.S.)

- Open Text (U.K.)

- Cloud Software Group, Inc. (U.S.)

- Sisense Ltd (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Salesforce, Inc. (U.S.)

- Accenture (Ireland)

- Alteryx (U.S.)

- Couchbase, Inc. (U.S.)

- Amdocs (U.S.)

- Huawei Technologies Co., Ltd. (China)

- MicroStrategy Incorporated (U.S.)

- Nokia (Finland)

Latest Developments in Global Telecom Analytics Market

- In February 2023, Nokia Corporation unveiled AVA Customer and Mobile Network Insights, a cloud-native analytics software. This solution leverages AI and machine learning to streamline 5G network data analysis, offering cost-effective insights. It aids communications service providers in making informed, automated decisions through correlated reports from 5G networks

- In July 2022, Oracle launched Oracle Construction Intelligence Cloud Analytics to integrate data from diverse applications. This tool helps engineering and construction firms diagnose issues, foresee risks, and guide future actions. By consolidating data from Oracle Smart Construction Platform, it provides a comprehensive performance overview, enabling quick problem resolution and strategic improvements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.