Global Tax Management Market

Market Size in USD Billion

CAGR :

%

USD

24.55 Billion

USD

57.40 Billion

2025

2033

USD

24.55 Billion

USD

57.40 Billion

2025

2033

| 2026 –2033 | |

| USD 24.55 Billion | |

| USD 57.40 Billion | |

|

|

|

|

Tax Management Market Size

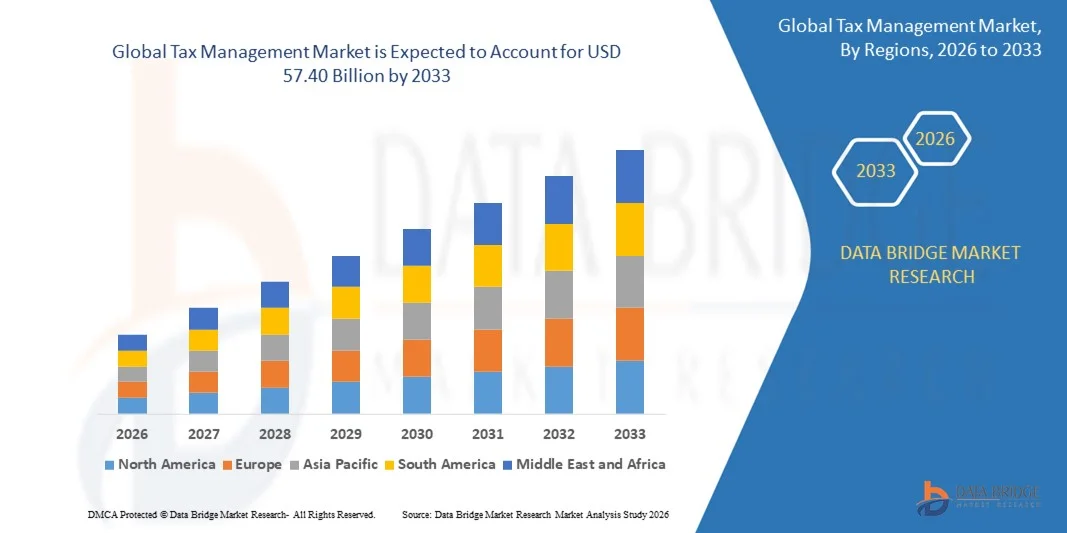

- The global tax management market size was valued at USD 24.55 billion in 2025 and is expected to reach USD 57.40 billion by 2033, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of automated tax solutions and advanced software platforms, which are enabling businesses to streamline compliance, improve accuracy, and reduce manual intervention in both indirect and direct tax processes

- Furthermore, rising demand from enterprises for real-time reporting, cloud-based accessibility, and AI-enabled predictive analytics is establishing tax management solutions as essential tools for financial and operational efficiency. These converging factors are accelerating the adoption of tax management platforms, thereby significantly driving market growth

Tax Management Market Analysis

- Tax management solutions include software and services designed to automate, manage, and optimize indirect and direct tax processes. These platforms support compliance, reporting, filing, and strategic tax planning, integrating with enterprise resource planning (ERP) systems and financial platforms to enhance efficiency across organizations

- The escalating demand for tax management solutions is primarily fueled by growing regulatory complexities, increased cross-border business operations, and the rising need for accurate, real-time tax reporting. Enterprises are also seeking AI-driven and cloud-enabled solutions to reduce errors, ensure compliance, and gain actionable insights for strategic financial planning

- North America dominated the tax management market with a share of 35.2% in 2025, due to widespread adoption of automated tax compliance solutions and cloud-based financial software

- Asia-Pacific is expected to be the fastest growing region in the tax management market during the forecast period due to rapid economic growth, urbanization, and increasing adoption of cloud-based tax solutions in countries such as China, India, and Japan

- Software segment dominated the market with a market share of 68.5% in 2025, due to the growing adoption of automated tax compliance tools and the need for real-time data processing. Organizations increasingly rely on tax management software to reduce human errors, ensure regulatory compliance, and streamline reporting processes

Report Scope and Tax Management Market Segmentation

|

Attributes |

Tax Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Tax Management Market Trends

Growing Adoption of Cloud-Based and AI-Enabled Tax Solutions

- A significant trend in the tax management market is the increasing adoption of cloud-based platforms and AI-enabled solutions, driven by the rising need for real-time compliance, accurate reporting, and operational efficiency across enterprises. These platforms are enabling organizations to automate indirect and direct tax processes, optimize tax planning, and reduce errors, making them central to modern financial management practices

- For instance, Intuit (US) has integrated advanced machine learning algorithms into its tax software to provide predictive insights for proactive tax planning. Similarly, Avalara (US) is leveraging cloud automation to streamline sales tax compliance for businesses of all sizes. These solutions enhance efficiency and accuracy, allowing companies to focus on strategic decision-making rather than manual compliance tasks

- The growing deployment of AI-driven analytics in tax platforms is allowing organizations to forecast liabilities, identify tax-saving opportunities, and ensure compliance across multiple jurisdictions. This trend is particularly evident in multinational corporations seeking scalable and adaptive solutions to manage cross-border tax obligations

- Increasing digitalization and the move toward cloud-native platforms are fostering the adoption of SaaS-based tax management solutions, which offer remote access, integration with ERP systems, and automated updates to reflect changing regulations. These factors are accelerating the adoption of comprehensive tax platforms in both SMEs and large enterprises

- Companies are also integrating tax management solutions with broader financial ecosystems, enabling real-time synchronization of accounting, reporting, and compliance data. This is creating a seamless experience for finance teams, enhancing decision-making speed, and minimizing the risk of errors or penalties

- The market is witnessing heightened demand from sectors such as BFSI, IT, retail, and manufacturing, where regulatory scrutiny and multi-jurisdictional operations necessitate robust tax management systems. The convergence of cloud, AI, and automation is establishing these solutions as critical tools for operational resilience and strategic growth

Tax Management Market Dynamics

Driver

Increasing Regulatory Compliance Requirements and Complexity

- The growing complexity of indirect and direct tax regulations across countries is driving the demand for automated tax management solutions that ensure compliance while reducing manual effort and risk of errors. Companies face evolving rules for VAT, GST, corporate income tax, and cross-border reporting, which require reliable platforms to maintain accurate filings

- For instance, H&R Block (US) launched a mobile application specifically targeting small businesses to simplify compliance with federal and state tax regulations, addressing the growing need for accessible and accurate reporting tools. Similarly, Deloitte (GB) expanded its tax advisory services in Asia to help multinational clients navigate complex local tax laws

- The rising focus on audit readiness and regulatory reporting is compelling organizations to adopt software and service solutions that offer real-time monitoring, error detection, and automated filing capabilities. These solutions are increasingly integrated with ERP and accounting systems to centralize tax data management

- Companies are also leveraging AI and analytics features in tax software to proactively manage tax liabilities and ensure alignment with continuously changing regulations. This reduces financial risk and supports informed strategic decisions

- The combination of regulatory pressure, penalties for non-compliance, and increasing corporate accountability is solidifying automated tax solutions as essential investments for both SMEs and large enterprises, reinforcing sustained market growth

Restraint/Challenge

Integration with Legacy Financial and ERP Systems

- The tax management market faces challenges due to the difficulty of integrating modern cloud-based and AI-enabled solutions with legacy financial and ERP systems. Many organizations still rely on traditional on-premises systems, creating compatibility issues and complicating data migration

- For instance, SAP (Germany) and Vertex Corporate (US) often encounter hurdles when deploying advanced tax solutions in enterprises with multiple legacy systems, requiring extensive customization and implementation time. These integration challenges increase project complexity, deployment costs, and operational disruption

- Legacy systems may lack standardized interfaces, making it difficult to automate tax calculations, reporting, and compliance workflows fully. Organizations must invest in middleware or customized connectors to bridge these gaps, which can slow adoption

- The reliance on legacy IT infrastructure can also restrict scalability, limit access to advanced AI features, and hinder real-time reporting capabilities. These constraints may reduce the overall efficiency gains expected from modern tax management solutions

- Overall, integration challenges with existing financial and ERP systems continue to be a key restraint, requiring vendors and organizations to carefully plan implementation strategies to achieve full functionality while maintaining operational continuity

Tax Management Market Scope

The market is segmented on the basis of component, tax type, deployment mode, organization size, and vertical.

- By Component

On the basis of component, the tax management market is segmented into software and services. The software segment dominated the largest market revenue share of 68.5% in 2025, driven by the growing adoption of automated tax compliance tools and the need for real-time data processing. Organizations increasingly rely on tax management software to reduce human errors, ensure regulatory compliance, and streamline reporting processes. The availability of advanced features such as AI-driven analytics, audit trail maintenance, and integration with enterprise resource planning (ERP) systems further reinforces the demand for software solutions. Tax software also provides scalability for growing organizations, enabling them to adapt to evolving tax regulations efficiently.

The services segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for expert consultation, tax advisory, and outsourcing of complex tax processes. For instance, firms such as Deloitte and PwC offer specialized tax management services that support multinational corporations in navigating global tax regulations. Services are particularly valued by SMEs and large enterprises seeking risk mitigation, regulatory adherence, and strategic tax planning. The growth is also supported by rising complexity in indirect and direct tax frameworks across countries, making professional services an essential complement to software tools.

- By Tax Type

On the basis of tax type, the market is segmented into indirect tax and direct tax. The indirect tax segment held the largest market revenue share in 2025, driven by increasing adoption of automated GST, VAT, and sales tax solutions. Companies face growing pressure to comply with constantly evolving indirect tax regulations, and automation helps reduce errors, optimize filings, and prevent penalties. Indirect tax solutions also provide real-time reporting and analytics, enabling businesses to track tax liabilities across multiple jurisdictions efficiently. The segment’s leadership is reinforced by integration capabilities with accounting and ERP systems, which enhance operational efficiency and reduce manual workload.

The direct tax segment is expected to register the fastest growth from 2026 to 2033, fueled by rising corporate income tax compliance requirements and individual tax planning solutions. For instance, Thomson Reuters provides direct tax solutions that help enterprises automate calculations, maintain audit trails, and comply with country-specific regulations. Direct tax management software and services are increasingly adopted to improve accuracy, reduce compliance costs, and support strategic financial planning. The increasing adoption of cloud-based direct tax solutions across large enterprises further accelerates market expansion.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into cloud-based and on-premises solutions. The cloud-based segment dominated the largest revenue share in 2025, driven by its scalability, lower upfront investment, and ease of remote access. Cloud deployment enables organizations to update tax rules automatically, integrate with financial systems seamlessly, and access real-time analytics. The rising adoption of Software-as-a-Service (SaaS) models and the demand for collaborative platforms across geographically dispersed teams further enhance cloud-based solutions’ appeal. Cloud platforms also allow organizations to maintain compliance with minimal IT infrastructure management.

The on-premises segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by organizations’ preference for enhanced data security and customized deployment. For instance, SAP offers on-premises tax management solutions that allow large enterprises to maintain control over sensitive financial and tax data. On-premises solutions are particularly adopted by highly regulated sectors such as banking, energy, and healthcare, where compliance and confidentiality are critical. The growth is further driven by organizations requiring deep integration with legacy ERP systems and tailored reporting capabilities.

- By Organization Size

On the basis of organization size, the market is segmented into SMEs and large enterprises. Large enterprises dominated the largest revenue share in 2025, driven by their complex tax structures, global operations, and higher compliance requirements. Large organizations increasingly adopt advanced tax management solutions to automate filing processes, monitor cross-border tax obligations, and minimize risks of audits and penalties. The demand is reinforced by integration capabilities with enterprise-wide financial systems, enabling seamless data flow and real-time analytics for informed decision-making. Large enterprises also benefit from professional services and consultancy packages to ensure regulatory adherence in multiple jurisdictions.

The SME segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing digital adoption and the need for cost-effective tax solutions. For instance, Intuit QuickBooks provides SME-focused tax management tools that simplify indirect and direct tax compliance. SMEs are adopting cloud-based and subscription models to reduce upfront costs while ensuring accuracy and regulatory compliance. The growth is also driven by government incentives and simplified tax frameworks supporting SMEs’ automation of accounting and tax reporting processes.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, IT and telecom, manufacturing, energy and utilities, retail, healthcare and life sciences, media and entertainment, and others. The BFSI vertical dominated the largest revenue share in 2025, driven by high regulatory scrutiny, complex financial transactions, and stringent compliance requirements. Banks, insurance firms, and financial institutions rely on tax management solutions to automate indirect and direct tax calculations, manage audits, and generate real-time reporting. The segment’s dominance is further supported by integration capabilities with financial platforms and ERP systems, enabling risk mitigation and operational efficiency. BFSI players also prioritize solutions offering multi-jurisdictional compliance and advanced analytics for tax planning and forecasting.

The IT and telecom vertical is expected to witness the fastest growth from 2026 to 2033, fueled by rapid digital transformation and globalization of services. For instance, Infosys and Wipro provide specialized tax management solutions tailored to IT and telecom clients to manage indirect tax obligations across multiple regions. The sector increasingly adopts cloud-based solutions for real-time reporting, cross-border compliance, and automated tax calculation. Rising regulatory changes, expanding service footprints, and the need for seamless integration with enterprise systems further accelerate the adoption of tax management solutions in this vertical.

Tax Management Market Regional Analysis

- North America dominated the tax management market with the largest revenue share of 35.2% in 2025, driven by widespread adoption of automated tax compliance solutions and cloud-based financial software

- Organizations in the region increasingly prioritize efficiency, accuracy, and real-time reporting in both indirect and direct tax processes

- The region’s technologically advanced infrastructure, high digital literacy, and strong presence of global corporations foster the integration of tax management solutions across SMEs and large enterprises

U.S. Tax Management Market Insight

The U.S. tax management market captured the largest revenue share in North America in 2025, fueled by the growing adoption of cloud-based solutions and automated tax software. Businesses are increasingly focusing on reducing compliance costs, ensuring accuracy in filings, and managing multi-state and federal tax obligations efficiently. The rising demand for integration with ERP and financial systems, along with support for mobile and web-based platforms, is accelerating adoption. In addition, U.S. organizations are leveraging advanced analytics, AI, and machine learning to predict tax liabilities, optimize planning, and support decision-making.

Europe Tax Management Market Insight

The Europe tax management market is projected to expand at a substantial CAGR during the forecast period, driven by stringent tax regulations, cross-border compliance requirements, and digital reporting mandates. Enterprises across the region are adopting automated solutions to manage VAT, GST, and corporate income tax efficiently. The market growth is further supported by increased demand for cloud-based platforms and integrated services across SMEs and large enterprises. European organizations are also motivated by cost optimization and risk mitigation, with tax management solutions offering real-time monitoring, reporting, and regulatory adherence.

U.K. Tax Management Market Insight

The U.K. tax management market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by a focus on digitalization, automation, and compliance with HMRC regulations. Businesses are increasingly leveraging tax management solutions for indirect and direct tax reporting, audit readiness, and strategic tax planning. The U.K.’s robust financial services sector, high adoption of cloud-based software, and supportive regulatory environment drive the uptake of automated tax solutions. Moreover, the growing need for efficiency, accuracy, and integration with enterprise financial systems is expected to further stimulate market growth.

Germany Tax Management Market Insight

The Germany tax management market is expected to expand at a considerable CAGR during the forecast period, driven by complex tax regulations, high corporate compliance requirements, and rising digitalization initiatives. German enterprises are increasingly adopting tax management software and services to ensure accurate indirect and direct tax calculations and timely reporting. The country’s emphasis on technological innovation, efficiency, and integration with ERP systems supports the demand for automated solutions. Furthermore, German organizations are focusing on sustainability and compliance, which is enhancing the adoption of advanced tax management platforms.

Asia-Pacific Tax Management Market Insight

The Asia-Pacific tax management market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid economic growth, urbanization, and increasing adoption of cloud-based tax solutions in countries such as China, India, and Japan. Enterprises in the region are seeking efficient, scalable, and automated platforms to handle indirect and direct tax compliance across multiple jurisdictions. Government initiatives promoting digitalization, combined with the rise of SMEs and large multinational corporations, are accelerating demand. In addition, the emergence of domestic software providers offering affordable and integrated tax solutions is further supporting market expansion.

Japan Tax Management Market Insight

The Japan tax management market is gaining momentum due to increasing automation in corporate finance functions and growing demand for accurate and efficient tax reporting. Japanese enterprises are adopting software and service solutions to comply with national tax regulations and streamline indirect and direct tax processes. Integration with ERP and cloud platforms, alongside the rise of digital transformation initiatives, is further enhancing adoption. The market is also supported by a focus on risk reduction, audit readiness, and real-time tax analytics for both SMEs and large enterprises.

China Tax Management Market Insight

The China tax management market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid economic growth, digital adoption, and stringent tax compliance requirements. Chinese enterprises are increasingly relying on automated tax software and advisory services to manage indirect and direct taxes efficiently. The push for digital transformation, cloud adoption, and integration with enterprise financial systems is accelerating market demand. Domestic solution providers are offering cost-effective, scalable platforms, enabling businesses across manufacturing, IT, retail, and BFSI sectors to ensure accurate, timely, and compliant tax reporting.

Tax Management Market Share

The tax management industry is primarily led by well-established companies, including:

- Avalara, Inc. (U.S.)

- ADP, Inc. (U.S.)

- Wolters Kluwer N.V. (Netherlands)

- Thomson Reuters (Canada)

- Intuit Inc. (U.S.)

- H&R Block, Inc. (U.S.)

- SAP (Germany)

- Blucora, Inc. (U.S.)

- Sovos Compliance, LLC. (U.S.)

- Vertex Corporate (U.S.)

- Shoeboxed, Inc. (U.S.)

- Sailotech (India)

- SAXTAX Software (U.S.)

- Paychex Inc. (U.S.)

- CrowdReason, LLC. (U.S.)

- Defmacro Software Private Limited (India)

- OUTRIGHT MARKETING PRIVATE LIMITED (India)

- DAVO Technologies (U.S.)

- Xero Limited (New Zealand)

- TaxSlayer LLC (U.S.)

- Taxback International (Ireland)

- TaxCloud (U.S.)

- Drake Enterprises (U.S.)

- Canopy Tax, Inc. (Canada)

- TaxJar (U.S.)

Latest Developments in Global Tax Management Market

- In October 2025, Vertex (US) completed a strategic investment in AI‑native startup Kintsugi, aiming to advance automated sales tax compliance solutions tailored for small and midsize businesses. This strategic investment strengthens Vertex’s tax technology portfolio by leveraging AI to enhance automation accuracy and support scalable compliance workflows. The move enables SMBs to manage complex tax filings more efficiently, reduces manual intervention, and positions Vertex as a leading provider of intelligent tax solutions

- In August 2025, Tax Star (UAE) announced a strategic partnership with Wafeq, a UAE‑based accounting software company, to simplify corporate tax compliance for businesses in the region. This collaboration expands Tax Star’s solution ecosystem and drives adoption of cloud‑native, AI‑enabled tax compliance tools among SMEs. The partnership supports the broader digital transformation of tax processes in emerging markets, enhancing operational efficiency and compliance accuracy

- In September 2025, H&R Block (US) launched a new mobile application designed to simplify tax filing for small businesses, enhancing digital accessibility and engagement. This initiative allows small business owners to manage tax obligations more efficiently, reduces filing errors, and strengthens H&R Block’s market presence while building brand loyalty among a critical segment of users

- In August 2025, Intuit (US) announced a partnership with a leading AI firm to integrate advanced machine learning algorithms into its tax software, aiming to enhance predictive analytics capabilities. The integration provides users with insights to optimize tax strategies proactively, strengthens Intuit’s competitive positioning, and accelerates the adoption of AI-driven tax management solutions across the U.S. market

- In July 2025, Deloitte (GB) expanded its global tax services by acquiring a regional tax consultancy firm in Asia, enhancing its geographic footprint and diversifying service offerings. This acquisition allows Deloitte to integrate local expertise, navigate complex tax regulations in emerging markets more effectively, and reinforce its competitive position in the global tax management landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.